Environmental, social, and governance (ESG) performance is an increasingly important principle for investors, customers, and employees in the chemicals sector. In this Insights, we focus primarily on the environmental aspects given the importance of reducing carbon emissions, and the growing urgency for the sector to develop sustainability-focused strategies and strengthen net-zero commitments, delivery capabilities, and climate risk management.

Developing a robust sustainability-led strategy is becoming imperative across sectors. In particular, the chemical sector has been under pressure given its inherently high level of emissions and energy intensity. As a result, chemical companies are looking to integrate sustainability into their overall strategies to better adapt to a rapidly changing market environment, and address growing pressure from key stakeholders including investors, customers, suppliers, employees, and local communities. Additionally, as central players in often complex value chains, chemical companies need to find ways to effectively collaborate with both raw material suppliers and end users to achieve targeted sustainability goals,

To provide some perspective on these issues, CRA reviewed ESG commitments from 20 large global1 chemicals companies, with a particular focus on environmental aspects of ESG. We also examined their stated strategies and key initiatives to explore how the companies are addressing the following key issues:

- How are they positioning sustainability in the context of their overall strategies?

- What specific ESG targets and timelines have they set?

- How directly have they embedded sustainability into their strategies and investment plans?

- What are the expected benefits of their near-term and long-term commitments? How grounded are the benefits in terms of specific initiatives or programs?

- What can we learn in terms of best practices?

In general, the chemical companies reviewed exhibited a broad range of targets regarding the extent of emissions reduction and timing. They also differ in terms of how well defined the specific strategies are to achieve the goals. For example, some of the companies with more ambitious targets appear to have well-defined strategies to achieve momentum within the next five years while starting to pursue the structural changes in their portfolio or operations necessary to meet the more ambitious longer-term sustainability goals.

ESG commitments, reporting, and performance

ESG reporting has become standard across the chemical sector—nearly all companies in our sample have published ESG or sustainability reports. However, there is a wide range in the depth of the analysis communicated as well as in the stretch of aspirations e.g., varying levels of decarbonization goals, differences in the scope of emissions included (see scope emissions defined below), timing to achieve targets, and concreteness of the improvement initiatives described.

Scope emissions defined

Scope 1 covers direct emissions from owned or controlled sources. Scope 2 covers indirect emissions from purchased electricity, steam, heating, and cooling consumed by the reporting company. Scope 3 includes all other indirect emissions that occur across a company's value chain.

The imperative to reduce emissions

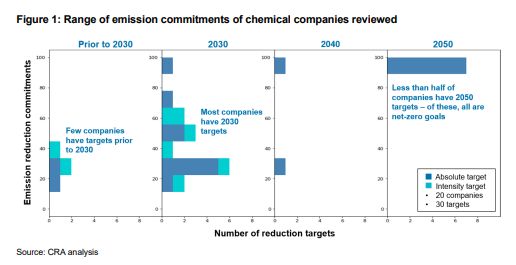

While 95% of the companies in our sample have communicated greenhouse gas (GHG) emission targets for 2030, only 37% have communicated targets beyond 2030. Additionally, all emission targets are focused on Scope 1 and 2 emissions (i.e., no targets set for Scope 3 emissions). This is driven by the inherent difficulties in accurately, and consistently, measuring upstream and downstream emissions—we saw significant differences in how Scope 3 emissions were reported for the companies in our sample.

GHG reduction targets for 2030 vary widely from 20% to 100%, reflecting, in part, the differing starting points, carbon emission intensities,2 and levels of sustainability embedded into strategies of the companies in our sample. In some cases, targets seem to be designed to spur organizational action, while others appear to be the output of rigorous planning with detailed goals and well described initiatives. As for companies that report emission targets beyond 2040, all companies have set 100% reduction goals (or net zero) as seen in Figure 1.

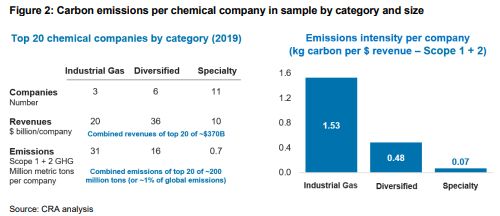

The magnitude of emissions, both on an absolute basis as well as per dollar of revenue, is a direct representation of the business portfolio of the company. This is especially noteworthy when considering emissions relative to company size. As shown in Figure 2, emission intensity by type of company varies significantly. Industrial gas companies have the highest Scope 1 + 2 emissions intensity driven by their high energy usage and scope and scale of manufacturing operations. Diversified and petrochemical companies have the second highest intensity reflecting relatively high energy requirements and the scale and scope of their operations. Specialty chemical companies, in general, have much lower Scope 1 + 2 emissions intensity given their product mix, value chain participation, and smaller-scale manufacturing (i.e., lower volume/higher value specialty or formulated products).

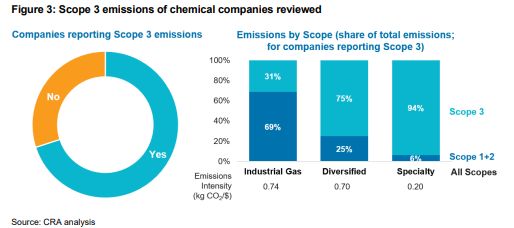

Despite the current lack of clear standards for measuring Scope 3 emissions, the importance of considering all company emissions should not be ignored. According to the limited reporting of Scope 3 in the sample, typically ~50% of Scope 3 emissions result from purchased goods and services (upstream), ~20% from end-of-life treatment of products (downstream), and ~10% from direct use of sold products (downstream).

Given that Scope 3 emissions represent the largest portion of total emissions (approximately two-thirds of total emissions of companies in our sample), chemical companies must consider how to tackle these emissions in their strategies. When considering all three emission categories, the differences in emission intensities between chemical subsectors are significantly reduced (see Figure 3).

The ratio of Scope 3 to Scope 1 + 2 emissions implies ample opportunity for chemical companies to "punch above their weight" in terms of global emission reductions. To reduce Scope 3 emissions, chemical companies will need to develop strategies to lower their own downstream emissions through investments in technologies (e.g., new processes and/or feedstocks) to lower the carbon content of their products. Perhaps more importantly, chemical companies will need to collaborate with partners across the value chain to better evaluate carbon emissions, prioritize investments, and support implementation of decarbonization initiatives. However, the lack of consistency in reporting will need to be resolved to improve the credibility attached to any Scope 3 goals.

Tackling waste and circularity

Approximately 80% of the companies have communicated waste reduction, recycling, and circularity targets. These, by their nature, tend to be largely within the control of the company. Prominent examples include moving to 100% reusable or recyclable packaging for products by 2035 or achieving zero waste to landfill for all manufacturing by 2025. We believe that these targets should largely be achievable with existing technology, but there will be a steep cost curve as enabling technology rapidly matures. This dynamic has the potential to offer advantage for those with compelling circularity strategies that enable waste reduction while improving cost positioning.

Water conservation and supply risk

Nearly three-quarters of the chemical companies analyzed have communicated detailed water usage targets. Examples include reduction of freshwater usage intensity by 25% and using recycled water for more than 50% of non-product operation by 2025. Given shifting weather patterns and increasing drought conditions in many parts of the world, water access risks in certain regions will be much higher than in others—water supply risk should be a key factor in developing strategies. It is not apparent from the review the extent to which companies have accounted for local water access risks in their strategic and investment plans, but this clearly is an issue to be addressed.

Strategic priorities and best practices

Our assessment revealed several common themes in terms of priorities and approaches to achieving stated sustainability goals—these can help guide the design of a well-structured program.

Active portfolio management to improve business/product and market mix

Reshaping the market and product portfolio can be the most impactful piece of an emissions-reduction strategy. Portfolio repositioning can also have material effects (both positive and negative) on short- and long-term business performance and value creation. We already see chemical companies looking to divest or limit their positioning in businesses focused on serving less attractive sectors while more aggressively growing or acquiring businesses that are positioned well for sustainable businesses or offerings. For example, companies are moving away from at-risk markets (or those that are perceived to be in long-term decline) including O&G3 E&P or the ICE-based4 automotive sector to those that are more aligned with meeting demand for the future (e.g., performance coatings, circular packaging, health and wellness, or electric vehicles). Managing these portfolio shifts in a manner that is also consistent with maintaining or establishing a coherent and distinctive portfolio is key to drive value creation.

Rethinking supply chains

Chemical companies typically sit at the center of complex value chains consisting of feedstock suppliers, formulators and converters, and end users. Achieving sustainability goals requires the coordination of a multi-party value chain from raw materials through to the final end user.

Continuous collaboration with suppliers and customers is critical to achieving the goals. Some key strategies include:

- Entering power purchase agreements (PPAs) covering up to 100% of power needs with renewables,

- Reformulating products to utilize more sustainable raw materials,

- Actively engaging with customers to facilitate better and more efficient use of chemical products e.g., the agricultural chemical segment offers numerous examples of how education can reduce environmental impact in the use of chemical products, and

- Converting distribution vehicle fleets to electric or other low-carbon fuels over time.

Technology innovation

Technological innovations both at the product and application level will be important contributors to driving greater sustainability. Companies are actively working on new products aligned to the shift to renewable energy and the drive to enhanced energy efficiency. Examples include adhesives and coatings to improve solar panel efficiency, energy-reducing paints for buildings, coatings to increase lifetime of machinery, and packaging based on recycled products.

The aspiration of achieving net-carbon neutrality by 2050 or earlier will require deployment of technologies that are not yet fully commercial or new breakthrough technologies. Measured bets and early access to potential breakthrough technologies should be an important component of a differentiating, sustainabilityfocused strategy. Examples of such breakthrough programs might include:

- Using residue waste as a key energy source in company operations,

- Nature-based solutions such as reforestation and ecosystem restoration,

- Research in process technology such as in steam cracker design, desalination, and low-carbon hydrogen production (e.g., water electrolysis supplied by renewables), and

- Determining how hydrogen can fit into company operations through research and pilots.

Manufacturing and operational excellence

Improving the effectiveness of operations continues to be the most dependable and measurable avenue to near-term ESG performance improvement. These largely incremental measures to enhance existing manufacturing operations will have a positive impact on sustainability but are unlikely to offer step-change performance toward net-carbon neutrality.

Companies in our sample are implementing a range of important operational initiatives to improve sustainability performance, including:

- Classic energy reduction programs such as capacity utilization management and improved control systems, as well as applying machine learning into manufacturing operations,

- Advanced gas turbine projects to improve energy efficiency and emissions,

- Modification of maintenance practices to reduce methane emissions across operations., and

- Reduction of refrigerant (powerful greenhouse gas) leaks and deployment of alternatives with lower climate impact.

These measures are consistent with the need to improve legacy manufacturing systems. Clearly, there will be new and more innovative technologies put in place to achieve sustainability goals. The recent investments in blue and green hydrogen by the industrial gas industry are examples of such breakthrough measures.

Culture, management practices, and incentives

Embedding ESG-performance measurement into standard management practices is a critical driver for improved performance and differentiation. Management must balance moving forward with typically incremental steps (i.e., grounded on implementable programs) with more ambitious and most-often capital intensive fundamental changes (i.e., breakthrough technologies not yet fully developed).

Success will require developing a sustainability-driven culture that is actively engaged in both achieving the short-term goals and rallying around economic means to achieve the desired future state. Some noteworthy practices include:

- Instituting an internal carbon price on investments. While only 30% of companies in our sample utilize a carbon price in their investment decisions, it could be one of the most substantial levers for long-term improvement of a company's carbon footprint. Those currently in implementation in the chemicals industry range from a "variable shadow price" to US$11/t of CO2e to upwards of US$120/t of CO2e.

- Incorporating ESG performance as a key component into executive compensation plans.

- Limiting exposure to carbon offsets, or at minimum, having contingency plans in place for offset-dependent emission reductions. Offsets are under scrutiny as to their ultimate sustainability contribution and could prove to be a risky strategy in some future scenarios.

Changing priorities to succeed in the transition

While sustainability has been a long-standing priority in the chemical sector, its strategic importance has risen to new levels over the past several years. It is imperative that management teams create and execute robust sustainability-focused strategies to better compete in a rapidly changing market, satisfy growing consumer pressures, meet increasingly stringent regulatory requirements, attract skilled employees, and deliver superior value to shareholders. Chemical companies are finding themselves being pushed by investors, customers, and employees to be more proactive sooner.

As a way of building momentum towards a more sustainable company, placing sustainability high on the C suite agenda is the starting point. Companies will need to navigate the range of short- and medium-term options to deliver on their commitments including operational measures, rethinking supply chains, optimizing the portfolio mix, technology innovation, and other more transformational measures.There will undoubtedly be tough choices ahead to make these changes while delivering superior value to shareholders and meeting other stakeholder commitments.

Our findings and deep sector expertise can offer insights to company management in looking to make these tough choices and achieve ambitious sustainability goals.

Footnotes

1 Sample of chemical companies with revenues ranging from $4 to $70 Billion USD

2 Carbon emission per unit of annual revenue

3 Oil and Gas Exploration and Production

4 Internal Combustion Engine Vehicle Manufacturing

First published December 3, 2021.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.