Proposed changes to VCT and EIS schemes could see them becoming more widely available.

As a brief recap, both venture capital trusts (VCTs) and enterprise investment schemes (EISs) seek to provide capital to small and expanding companies with the aim of growing the business and generating a profit. The main difference between the two schemes is that while a VCT invests in a series of companies, the EIS only invests in a single company, which increases the element of risk to the investor.

The Treasury has proposed a relaxation of the legislation governing both VCTs and EISs, which could shift a previously esoteric area of investment into the mainstream for many individuals.

VCTs

Individuals can invest up to £200,000 per tax year and benefit from 30% income tax relief, which is claimed via their self-assessment tax return. Dividends are tax-free and there is no CGT should the VCT be sold. There is, however, a minimum holding period of five years to continue to benefit from the 30% tax relief.

EISs

Following a change in legislation in April 2011, the EIS now provides the same level of income tax relief upon investment as a VCT at 30% (increased from the previous level of 20%) for investments up to £500,000. There is a minimum holding period of three years and the EIS also provides CGT deferral.

Any capital gain realised on sale is not taxable, provided income tax relief has been received and not withdrawn. Losses may also be allowable for income tax purposes. After two years the EIS investment is exempt from IHT.

It is now possible to carry back all of the income tax relief to the previous tax year. For example, relief for investments made in 2012/13 can be set back to 2011/12.

Proposed changes

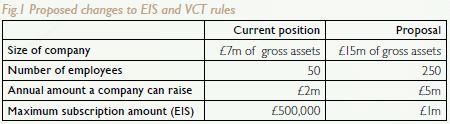

While the changes noted in the table below came into force for EIS on 6 April 2012 the Treasury recently announced that the proposed new rule for VCTs which disqualifies their VCT status if they invest in companies breaching the investment limit (the maximum funds raised from EIS, VCT and SEIS sources, which is £2m prior to EU state aid approval and £5m if the new proposals are approved), will take effect on or after the Finance Bill 2012 receives Royal Assent. This means that before that date, provided VCTs meet the test of at least 70% of their investments meeting the current £2m funding limit, they can invest in companies raising more than that without disqualification in the event the higher £5m limit does not receive EU state aid approval.

The proposed changes will provide VCT and EIS managers with much greater flexibility to invest in larger and, ultimately, more established companies, which should reduce the level of risk to which the investor is exposed.

As these VCT and EIS tax reliefs constitute EU State Aid, any rule changes require EU approval, and this has still to be secured.

With many small businesses continuing to have difficulty in raising finance through the traditional bank route, VCTs and EISs are ideally placed to strike attractive deals with these businesses. In many cases, the manager will take a seat on the board to provide expertise in decision-making and help guide the business forward and represent investors' interests.

Previous opportunities

There are a variety of offers in the VCT and EIS markets each year and Smith & Williamson meets with each manager to assess their investment strategy and the track record of previous offerings.

VCTs

Dealing first with VCTs, our buy list for the last tax year included those providers who were offering 'limited life' VCTs. This means they aim to maintain capital and intend to return around 110p against an initial cost of 70p after the minimum holding period of five years. Typically this will occur around year six. Generally speaking, these are normally lower risk VCTs as the investments they make may include a minimum return to the VCT of 70p, i.e. the net subscription of investors.

The more traditional VCTs are those in the 'generalist' sector, which should be seen as a longer-term private equity play with investor return coming by way of tax-free dividends as the VCT makes profitable realisations. One of the offerings for the last tax year was effectively a fund of VCTs, which divides the investment between seven existing VCTs, all with differing investment strategies. The advantage of such a structure is that investors are immediately accessing mature VCTs and will receive tax-free dividends from day one, and on a monthly basis going forward.

EISs

With EISs it is much more difficult to track performance, so we concentrated on two very different structures – both of which have demonstrated their ability to produce investor returns.

The first offer was centred on mitigating risk as much as possible and invested in various television productions with the aim of producing a return of 105p after the minimum holding period of three years. The other EIS was a very exciting opportunity involving principals with an enviable track record in the pub freehold sector who were also committing personal funds. This opportunity benefited from the backing of pub freeholds, but EIS investment is not without risk so would not suit the low or lower-risk investor. VCTs tend to be more tax year-end driven while EISs will continue to be available throughout the year. We anticipate the launch of a number of offerings once the Finance Bill receives Royal Assent.

Seek advice

These types of investments are not suitable or appropriate for everyone. Investments of this nature, while aiming to mitigate tax, can carry a significant risk to capital. Specialist advice is therefore essential.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.