- in Asia

- in Asia

- in Asia

- within Antitrust/Competition Law and Intellectual Property topic(s)

- with readers working within the Retail & Leisure industries

This is the third article of our enterprise software industry series, "The End of a Software Era." You can read the other articles in the series here.

It is time to acknowledge a hard truth— enterprise software companies need a new growth formula.

AI is transforming product strategies, tariffs are shaking global markets, and customer acquisition costs are ballooning. As a result, existing growth playbooks—reliant on expansive product portfolios and hiring more salespeople to chase new customers—are now obsolete. Instead, companies must build sustainable, value-driven growth models centered on impactful core products, retaining current customers, and continuously expanding revenue through cross-selling and upselling.

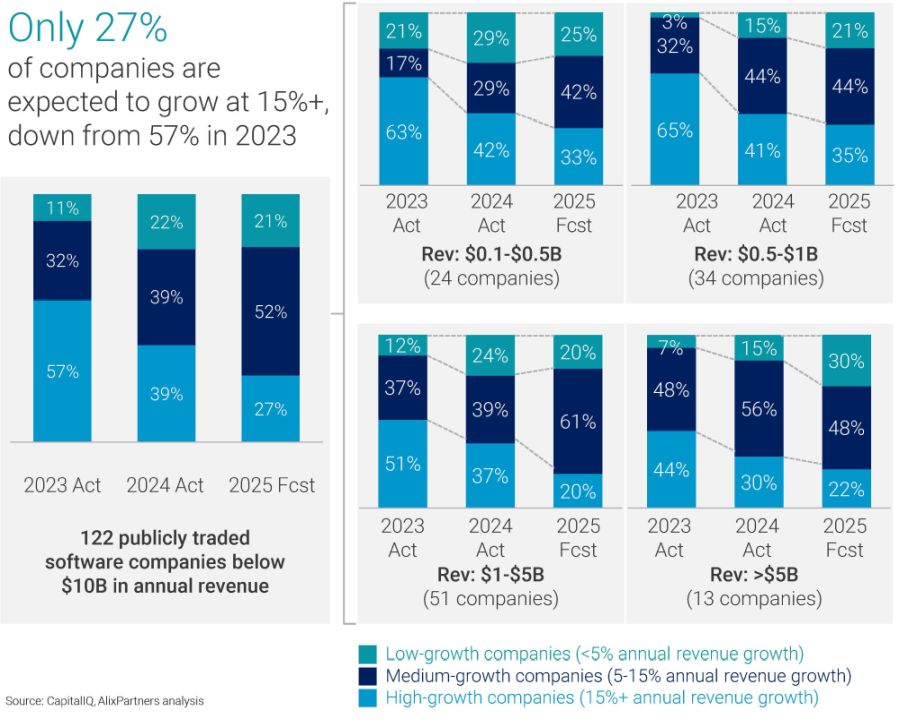

As discussed in the first article of the current series, "The End of a Software Era," analysts are projecting further decline in the percentage of "high growth" (15%+ annual revenue growth) enterprise software companies in 2025 due to the disruptions listed above. We found this trend to be consistent across companies of different sizes. The rise of AI agents is expected to further accelerate the disruption of mid-size enterprise software companies.

On top of this, it's become increasingly challenging and expensive to acquire new customers as competition intensifies across every subsector of the industry. Customers are also continuing to reevaluate their software spend leading to increased churn rates.

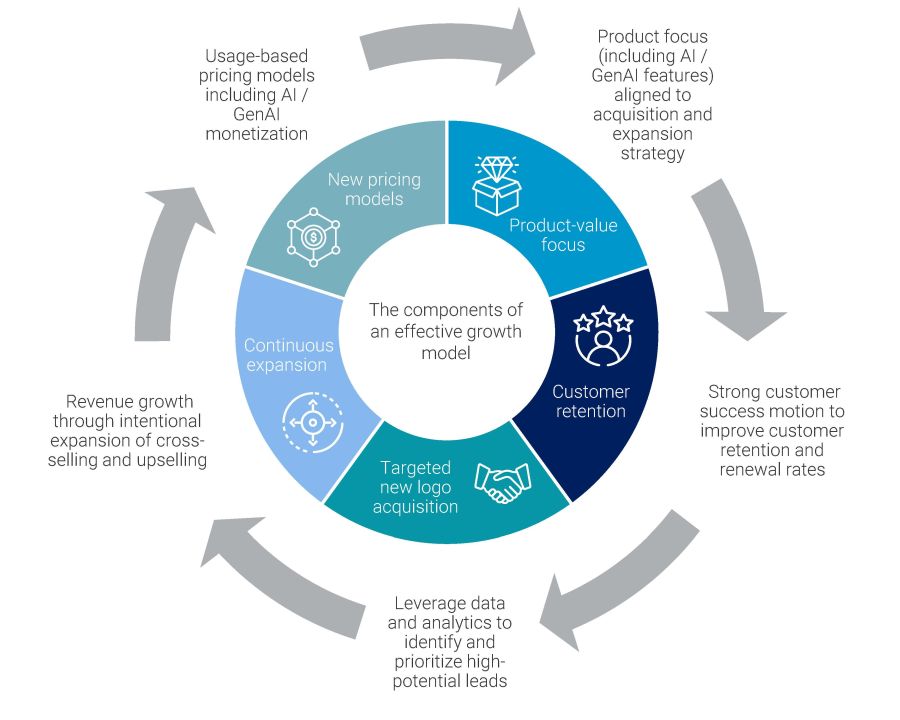

How do enterprise software companies successfully navigate these shifts and weather the storm? We believe they need to build a new growth model designed around product value and laser-focused on customer retention, targeted acquisition, and continuous expansion. This growth model needs to support innovative and flexible models including usage- and outcome-based pricing for AI-embedded products.

Product-value focus

Building a growth model in this environment begins by focusing on the value customers derive from products. Enterprise software companies must prioritize delivering clear value by addressing evolving customer needs such as new AI capabilities, advanced data analytics, and seamless API integrations. Additionally, software companies need to develop complementary solutions and create customizable options without the cost of launching new product lines. A product-value focus increases retention and attracts new customers, while complementary offerings provide opportunities for cross-selling and upselling.

The practice of frequently introducing new products, often at the minimum viable product (MVP) level, to quickly grab market share is mostly behind us. Instead, companies must double down on product quality and targeted product expansion, including the use of net-new technologies such as AI agents to improve value propositions. For example, Adobe has narrowed its focus to core creative and cloud products, augmenting quality while integrating AI with its Sensei platform. Similarly, Salesforce has boosted its cloud-based CRM solutions, first with Einstein AI and now with Agentforce.

Customer retention

Customer retention is essential to predictable growth. Enterprise software companies must build partnerships with their customers to deliver continuous value—through personalized onboarding, frequent engagement, and proactive support—to reduce churn and drive satisfaction. To ensure long-term success, companies need to prioritize and invest in their most profitable customers, where retention yields the highest return.

Traditionally, software companies have implemented dedicated customer success teams, but many are struggling to effectively collaborate between sales and customer success. This has led to a renewed emphasis on operating model and incentive structure improvements. Some have added customer success metrics such as consumption and adoption to sales team incentives. In a market with elevated competition and shrinking growth, limiting churn needs to be a priority.

Targeted new logo acquisition

Instead of casting wide nets, leading software companies use data analytics and AI models to identify high-potential leads and increase conversion rates. Verticalized go-to-market approaches and strategic collaborations with other software providers have been key focus areas to target specific customers and segments.

By driving metrics like lead conversion rate and customer lifetime value, enterprise software companies improve their marketing efficiency, lower acquisition costs, and better align offerings with target customer needs. The name of the game is efficiency over number of sellers.

Continuous expansion

In the current environment, growth cannot primarily hinge on new customers. Enterprise software companies are realizing that existing customers can be a great source of sustainable, and often predictable, revenue growth.

Accordingly, companies are refining their sales motions to proactively engage with existing customers by offering carefully planned complementary solutions and cross-selling additional services to solve problems in adjacent areas. An increasing number are also implementing product-led growth tactics such as free trials, feature unlocks, and in-app nudges to drive continuous expansion.

New pricing models

Traditional seat-based subscription models can be restrictive, especially in the world of AI where a single subscription can accomplish more than ever before. As AI technologies rapidly evolve, many companies are rethinking their pricing structures to better capture value. Meanwhile, customers are also demanding more flexible pricing models that align with their usage and needs. In response, software companies must accelerate the shift to consumption-based pricing and offer greater flexibility. This pricing approach allows companies to better monetize high-usage customers while creating entry-level tiers for smaller customers. We recently published an article on how consumption-based pricing can unlock the next level of growth.

In addition to consumption-based models, a few software companies are experimenting with outcome-based pricing for AI agents, where fees are tied to business impacts. For example, Salesforce is pricing Agentforce per successfully handled customer interaction. Similarly, ServiceNow is experimenting with pricing per automated resolution of IT service requests.

Setting the growth model in motion

We are increasingly seeing examples where clients are incorporating multiple elements of this new growth model into their strategy. Recently, this approach helped an enterprise software client that had seen its growth decline from 30%+ CAGR to below 20% within one year due to rising churn and a slowdown in new customer acquisition.

To mitigate the slowdown in growth, we worked with the client to transform its operating model. The company rebalanced its R&D portfolio with an emphasis on stabilizing core products and addressing customer issues. The company also refreshed its overall go-to-market strategy to focus on existing customer relationships and reduce churn. To realize this sweeping transformation, they changed several executives in favor of new hires with a track record of not just growth but also of operational excellence. This plan aims to hold the line on growth in the near term, while improving margins by 10+ points and positioning the company to win in the future.

In today's disruptive market, enterprise software companies must embrace a new growth playbook focused on product value, customer retention, targeted new logo acquisition, and continuous expansion to achieve predictable growth. Success will require strengthening core products while strategically investing in innovations such as AI agents. At the same time, companies must optimize their pricing models to meet customer needs and to fully capture the value of their solutions. The question is no longer whether to adapt, but how quickly to embrace this new concept and outpace the competition.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.