- within Antitrust/Competition Law topic(s)

- in Middle East

- in Middle East

- in Middle East

- in Middle East

- with readers working within the Oil & Gas industries

- within Intellectual Property, International Law and Tax topic(s)

On 4 March 2025, the Turkish Competition Authority ("TCA") issued a press release regarding its ongoing investigations into the cinema and TV industries. In its press release, the TCA emphasized that enforcing competition rules within the media and entertainment sector is vital for upholding pluralism and democracy. According to the TCA, these objectives extend beyond the traditional economic definition of consumer welfare and include the protection of competitive processes, efficiency, and innovation.

The TCA asserted that the ability of consumers to choose freely serves as a fundamental guarantee of pluralism in a democratic society. While highlighting that significant market power carries a high degree of responsibility, the TCA noted that recent industry developments have raised concerns regarding potential anti-competitive practices. Consequently, the TCA is conducting four simultaneous investigations covering the following areas:

- Cinema exhibition and distribution1,

- Production of films and TV series, including their international distribution and YouTube broadcasting2,

- Casting direction and casting/talent agencies/management3,

- Subscription-based Video-on-Demand (SVoD) platforms4.

These investigations specifically target the creation, distribution, exhibition, domestic and international sales, and marketing of film and TV content. In accordance with these considerations, the TCA has now published the reasoned decision for the relevant investigation into the movie theaters distribution and exhibition market.

Background

The relevant investigation involved two major undertakings within the Turkish movie theaters market: Mars Entertainment Group A.Ş. ("Mars") and CJ ENM Medya Film Yapım ve Dağıtım A.Ş. ("CJ ENM"). Mars operates in the distribution stage through CGV Mars and in the exhibition stage under the "Paribu Cineverse" brand. CJ ENM, established in 2017, focuses on the production and distribution of content such as films and TV series. Although these are separate legal entities, the TCA determined that they belong to the same economic unity, as both are ultimately controlled by the South Korea-based CJ Group through its holding company, CJ Corporation.

The core of the case involved allegations that Mars violated Article 6 of Law No. 4054 on the Protection of Competition (akin to Art. 102 of the TFEU) by abusing its dominant position in the cinema exhibition market. The investigation was triggered by complaints suggesting that Mars utilized its significant market power in screenings to unfairly favor its own distribution arms, CGV Mars and CJ ENM. Specific allegations included discriminatory practices where films distributed by group companies were reportedly granted more screens, better time slots, and longer exhibition periods compared to films from independent producers or competing distributors.

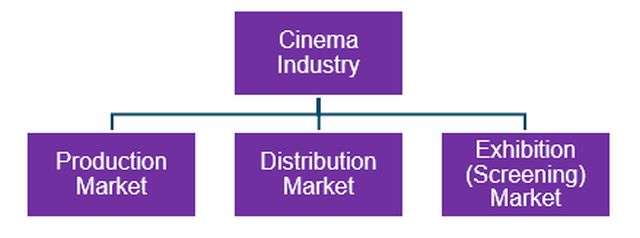

In its market analysis, the TCA identified three distinct levels of the cinema industry value chain:

- The production market,

- The distribution market, and

- The exhibition market.

The TCA concluded that Mars holds a dominant position in the Turkish cinema exhibition market. This finding was supported by Mars' high market share in ticket revenue, audience numbers, and seating capacity, as well as its strong presence in major shopping malls and high brand recognition.

The TCA emphasized that based on on-site inspections and analyses, it could not be determined that Mars and CJ ENM acted as single undertaking in their daily operational activities. Therefore, to isolate and identify potential competition issues, the TCA assessed the data of Mars and CJ ENM separately throughout its analysis.

Relevant Industry and Markets

In the decision, the TCA divides the cinema industry value chain into three main functional stages: production, distribution, and exhibition.

Production Market: This is the creative stage where a film is conceptualized, scripted, and filmed. Producers are responsible for the intellectual property and the financing of the project. In the context of this case, CJ ENM is highlighted as a significant player that operates in this market through various production partnerships.

Distribution Market: This stage acts as a bridge between the producer and the movie theaters. Distributors are responsible for the marketing, promotion, and physical or digital delivery of films to theaters. They determine release dates and the scale of the release, including the number of screens and regional allocation. The Mars Group operates in this market through its brands CGV Mars and CJ ENM.

Exhibition (Screening) Market: This is the retail level of the industry where films are shown to consumers. It involves the management of cinema halls, ticket sales, concession stands, and on-screen advertising. Mars is the market leader in Turkey in this segment, operating under the Paribu Cineverse brand.

The TCA treats these three stages as separate product markets because, according to the TCA, they serve different customer bases, such as producers, distributors, and moviegoers, and are not substitutes for one another.

The primary competition concern, according to the TCA, arises from the vertically integrated nature of the Mars Group. Since Mars is active in all three stages (producing films, distributing them, and owning the theaters where they are shown) the investigation focused on whether Mars abused its dominant position in the exhibition market to favor its own distribution activities while excluding or disadvantaging independent competitors.

The TCA concluded that alternative platforms, such as digital streaming, are not substitutes for movie theaters. For producers, cinema remains a critical steppingstone for prestige and box office success. For audiences, cinema offers a unique social and technical experience, characterized by large screens and advanced sound that cannot be replicated at home. Since the allegations involve Mars leveraging its power in exhibition to favor its own distribution arm, the relevant markets are specifically defined as the market for cinema film exhibition services and the market for the distribution of cinema films for exhibition. Regarding the geographic market definition, the TCA identified the entire territory of Turkey as the relevant geographic market.

Dominant Position Assessment

The TCA conducted a detailed analysis to determine whether Mars holds a dominant position, particularly in the cinema film exhibition services market. While the TCA examined both the exhibition and distribution markets, the legal finding of dominance specifically applies to the exhibition market. This assessment focused on market shares, barriers to entry, and the advantages gained through vertical integration.

The TCA evaluated Mars's position using various metrics such as box office revenues and seating capacity. The data revealed that Mars is the market leader in Turkey by a significant margin. Its market share has remained high and stable over time.

The investigation identified several structural and strategic barriers that prevent new competitors from entering or expanding in the market. Regarding investment costs, the TCA noted that establishing modern cinema complexes requires substantial initial capital. Furthermore, since most cinema traffic in Turkey occurs in shopping malls, the TCA observed that Mars holds long-term, exclusive, or highly favorable lease agreements in the most prestigious and high-traffic locations. This makes it difficult for competitors to secure viable sites. Additionally, the Paribu Cineverse brand enjoys immense recognition. According to the TCA, this creates a loyalty effect that new entrants struggle to replicate.

In this regard, the TCA concluded that the Mars Group holds a dominant position in the Turkish cinema film exhibition services market. While the TCA also analyzed the distribution market, it did not need to establish a separate dominant position there to proceed. Instead, the focus remained on how Mars's power in exhibition affected the distribution market.

TCA's Concerns in the Case

The TCA focused on several competitive concerns arising from the vertically integrated structure and dominant market position of the Mars Group. The primary concern involved self-preferencing, where the TCA suspected that Mars used its dominance in the cinema exhibition market to grant unfair advantages to its own distribution arms, CGV Mars and CJ ENM. According to the TCA, this behavior could manifest in allocating more screens, superior time slots, and longer exhibition periods to group-distributed films compared to those from independent producers or competing distributors.

The TCA also identified risks associated with leveraging market power across different stages of the value chain. According to the TCA, by dominating the exhibition level, Mars could theoretically distort competition in the upstream distribution and production markets. The TCA also noted that even though Mars and CJ ENM operated as separate legal entities, their status as a single economic unit under the CJ Group allowed for a coordinated strategy that could stifle competition and limit consumer choice. All in all, these concerns centered on the TCA's assessment that Mars's integrated operations could undermine the diversity of content available to moviegoers and reduce the overall efficiency and innovation within the Turkish film industry.

Summary of the Parties' Commitments

To resolve the competition concerns identified by the TCA, Mars proposed a set of commitments. These commitments aim to limit the advantages of their integrated business model and keep the market open for independent distributors. Instead of making subjective choices about which movies to show, the parties agreed to follow data driven rules. The table below outlines the main pillars of these commitments, which focus on fair screen allocation and theater management

|

Relevant Commitment5 |

Mars's Commitments |

|---|---|

|

Capacity Limitation (%20-%80 Rule) |

A maximum of 20% of total seat capacity is allocated to films distributed by group companies (CGV Mars), while at least 80% is reserved for independent or third-party distributors. |

|

Objective Screening Criteria |

Decisions on keeping films in theaters are based on objective metrics: Occupancy rate (min. 10% in high season), Ranking (top 4 in first weekend), and Attendance decline (max. 40-50% drop). |

|

Functional Separation |

The decision requires a "Chinese Wall" between Mars's theater management and its distribution units. The staff deciding which movies to show must be independent and cannot share sensitive information with the distribution side of the business. |

|

Data Transparency |

Upon request, detailed performance data (ticket sales, occupancy, revenue) of their own films will be shared with the respective distributors. |

|

Reporting & Monitoring |

An annual compliance report (in Excel format) detailing theater programming and capacity usage must be submitted to the TCA. |

|

Duration of Commitments |

Valid and binding for a period of 3 years6 (one month after the official TCA approval). |

The TCA's assessment concludes that these commitments are proportionate to the identified competition problems, capable of resolving the concerns, and can be implemented effectively in a short timeframe. Consequently, the TCA has decided to terminate the ongoing investigation against Mars by these commitments.

Since Mars holds a dominant position in the exhibition market, there was a structural concern that it could potentially manipulate screening programs to favor CJ ENM films over those of independent distributor. To eliminate these concerns, CJ ENM submitted a commitment text, which focuses primarily on maintaining strict operational and organizational independence from Mars. CJ ENM's commitments revolve around prevention of information exchange. Specifically, it pledged to maintain a separate management, personnel, and organizational structure from Mars. That is to say, they committed that no director or manager serves both entities simultaneously. Also, CJ ENM committed that communication between the two companies will be strictly limited to the standard commercial interactions typical between any third-party distributor and exhibitor, such as theater allocation and performance evaluations. Furthermore, CJ ENM guaranteed that neither company will have access to the other's confidential commercial data, sensitive competitive information, or private databases. These measures are designed to ensure that CJ ENM operates as a truly independent competitor in the distribution market. The TCA's assessment found that these commitments are proportionate to the potential competition issues and are capable of effectively preventing any future exclusionary practices. The TCA noted that Mars and CJ ENM already operate as separate legal entities with different management teams, and these commitments solidify and formalize that separation. In this regard, the TCA concluded that the commitment text should be accepted and made legally binding, leading to the termination of the investigation regarding CJ ENM.

Why This Decision Matters & Conclusion

In August 2025, the TCA concluded its investigation into the Mars Entertainment Group and CJ ENM by accepting a series of commitments to resolve vertical foreclosure concerns. The TCA found that Mars held a dominant position in the Turkish cinema exhibition market, which it allegedly leveraged to unfairly favor its own distribution arms, CGV Mars and CJ ENM, through preferential screen allocation and screening durations. To address these risks, the parties mainly agreed to a strict "20-80 Rule," capping the seat capacity for group-distributed films at 20% while reserving at least 80% for independent distributors.

This landmark decision is the TCA's first reasoned ruling in an industry facing four concurrent investigations. It will likely create a ripple effect across related markets, signaling that the TCA is becoming more demanding during commitment negotiations. At a time when non-compliance investigations are rising in Turkey, this decision stands out because the resulting monitoring burden presents significant new challenges for both the TCA and the undertakings.

Footnotes

1. Please see. https://www.rekabet.gov.tr/en/Guncel/investigation-launched-on-mars-entertain-bbdeafd81b74ef1193cf0050568585c9 (Last Access Date: 25.12.2025)

2. Please see. https://www.rekabet.gov.tr/en/Guncel/investigation-launched-on-med-yapim-tele-01b870fcf591ef1193d20050568585c9 (Last Access Date: 25.12.2025)

3. Please see. https://www.rekabet.gov.tr/en/Guncel/investigation-about-casting-agencies-ass-3622b01cb0cdef1193df0050568585c9 (Last Access Date: 25.12.2025)

4. Please see. https://www.rekabet.gov.tr/en/Guncel/investigation-launched-on-netflix-disney-3491913a0b03f01193e30050568585c9 (Last Access Date: 25.12.2025)

5. Please note that this is a summary. Mars' commitment text is longer and includes many exceptions. For instance, art films or those supported by the Ministry of Culture and Tourism are excluded from the commitments.

6. Generally, TCA commitments are binding indefinitely until a market reassessment occurs. The current case is an exception to this precedent. Similar instances are rare, though the Çiçek Sepeti case (Decision No. 25-09/210-108, dated 06.03.2025) serves as a recent example.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.