- within Compliance and Immigration topic(s)

The Trusts (Regulation of Trust Business) Act 2001 (the "Act") has been in operation in Bermuda since 25 January 2002.

The Act introduces a framework for the way trusts are managed in Bermuda and makes provision for licensing and regulating persons carrying on trust business. It provides that a company, partnership or individual (a "trustee") shall not carry on trust business in or from within Bermuda without the appropriate licence. Trust business is defined in the Act as the provision of the services of a trustee as a business, trade, profession or vocation.

Improving Regulation

The Act replaced the Trust Companies Act 1991 which was considered by the Bermuda Government to be out-of-date as it did not afford sufficient powers of intervention to the regulators of the trust industry, the Bermuda Monetary Authority ("BMA") and the Ministry of Finance. Instead, the Act now ensures that sufficient records of trust business are maintained to demonstrate internationally that participants in Bermuda’s trust industry are legitimate whilst respecting the need to ensure privacy for the settlers and beneficiaries of trusts. The overall policy of the Act requires

that significant trust business should be managed by a licensed company (rather than by individuals) and that this company should be regulated by the BMA. The Government has committed to keeping information concerning trust business confidential, except in the event of a criminal investigation.

The Act provides that no person carrying on business in or from within Bermuda shall use any name which indicates within that it is carrying on trust business, unless it is a licensed trustee or has received an exemption. This means that a private trust company, which seeks to use "trust" or "trustee" in its name, can only do so if it is licensed or if it can certify to the BMA that it qualifies for an exemption. Most private trust companies will be covered by an exemption order. The policy is to allow blue chip exempt companies to receive licences provided they have a physical presence with their own staff, or staff supplied by another company under a management agreement

Trust Regulators

The BMA now has the responsibility for granting and revoking trust company licences, which was formerly the responsibility of the Ministry of Finance. With this change comes the added responsibility of publishing annual reports and a statement of principles pertaining to its licensing and supervisory functions. The BMA now has more comprehensive intervention powers but is also required to issue codes of conduct to be observed by persons carrying on trust business. The BMA also must comply with the general policy directions issued by the Ministry of Finance.

When Is A Licence Required?

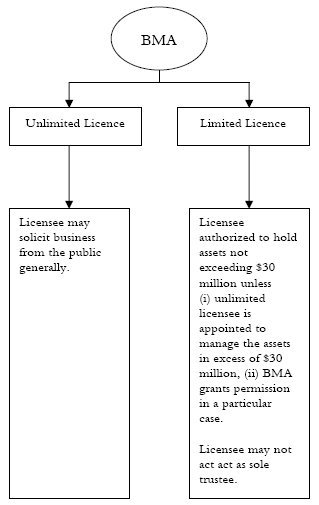

All trustees must be licensed unless they fall within a Government exemption order, which will be discussed in more detail later. The BMA can issue an unlimited trust licence to a company or a limited trust licence to a partnership or an individual. The differences between an unlimited and a limited licence can be seen in the diagram below.

An initial application to the BMA for a licence must be accompanied by the following:

- a business plan

- particulars of applicant’s arrangements

- an application fee (to be prescribed under the Government Fees Act 1965)

- such other information or documents as the BMA may require.

The applicant must fulfill minimum criteria established by the BMA and set out in the First Schedule to the Act. The minimum criteria include the following:

- the controllers and officers of a corporate trustee must be fit and proper persons

- the business of a company must be directed by at least two individuals, unless otherwise approved by the BMA

- the composition of the board of directors must conform to that considered appropriate by the BMA

- the trustee must conduct business in a prudent manner by maintaining adequate accounting and insurance and conforming with the provisions of the Act

- the trustee is to maintain minimum net assets of $250,000 in the case of a corporate trustee or $25,000 in any other case

- the business of a trustee must be carried out with integrity and professional skill

All licences must be displayed in the offices of the trustees and a notice of each licence published in the Royal Gazette. A register of licences will be available for inspection by the general public at the BMA.

Exempt Trustees

Certain persons falling within a specified class will be exempt from the requirement to hold a licence under an exemption order made by the Ministry of Finance. An exemption order means that the persons covered by it do not have to be licensed trustees when they execute and administer trusts as part of their business, trade, profession or vocation.

Persons currently covered by an exemption order include private trust companies, provided that they fulfil the criteria set out in the order. For more information, please see our Brief entitled "The Private Trust Company". In the commercial context, exemptions are also available for registered pension plans, as well as collective investment schemes approved by the Bermuda Monetary Authority.

Exemptions are also available for bare trustees or nominees and persons who are members of a recognised professional body, who appoint a specified trust company to maintain the trust records or who have a co-trustee who is a licensed trustee.

Regulating Undertakings

The BMA may restrict or even revoke a licence when a trustee fails to satisfy the minimum criteria, contravenes a provision of the Act, or fails to meet an obligation imposed by or under the Act.

The nature and extent of restriction or revocation is a matter of degree and can be illustrated as follows:

|

Restriction of Licence |

Revocation of Licence |

|

Result of minor breach |

Result of more serious breach |

|

BMA notifies trustee in question of the grounds for, and nature of, the proposed action, unless a restriction should be imposed or varied as a matter of urgency. |

BMA notifies trustee of grounds for proposed action. |

|

Opportunity given to trustee to put forward proposals to remedy any breach or comply with any licensing criteria unless restriction is imposed as a matter of urgency. |

Opportunity given to trustee to put forward proposals to remedy any breach or comply with any licensing criteria. |

|

BMA sets conditions or directions to protect the interest of clients or potential clients of a trustee. |

No conditions or directions. |

|

Failure to comply with any condition of direction could result in a $25,000 fine on summary conviction or $75,000 on conviction on indictment. |

Ultimate sanction could be a court order to wind up a trustee which is a company where it is just and equitable to do so. |

|

Trustee has right to appeal decision of BMA to a tribunal. |

Trustee has right to appeal decision of BMA to a tribunal. |

It is always open for a trustee to irrevocably surrender its licence by written notice to the BMA. In addition, the BMA is empowered to

petition the Supreme Court for an order to transfer a trust to new trustees, when it is satisfied that it is necessary to do so in the interest of the settlor and beneficiaries.

Majority Shareholders And Controllers

Approval of the BMA must first be obtained where a person becomes a 10% or majority shareholder controller of a corporate trustee. The BMA may object to the appointment unless it is satisfied that the person is a responsible and fit shareholder. It may also object to an existing controller who it considers is no longer a fit and proper person and could impose restrictions on the shares of a controller or ultimately apply to the court for an order for the sale of specified shares.

Disclosure Of Information

A trustee which is a company must notify the BMA of any change in its controllers or officers. It must also provide the BMA with a certificate of compliance certifying that the trustee has complied with the provisions of the Act, the minimum criteria and codes of conduct. A certificate of compliance must be provided to the BMA within four months from the end of the corporate trustee's financial year. Failure to do so could result in a fine of $10,000.

The Act also provides that the BMA may request information and reports from a trustee. An auditor, accountant or other person engaged by the trustee is required to report to the BMA any facts which indicate to him that the minimum criteria have not been or may not be fulfilled by a trustee, which are likely to be of material significance for the exercise of the BMA's functions. The BMA has the further authority to request the production of documents for examination and has the right of entry into premises occupied by a trustee to obtain information and documents when the circumstances warrant.

The Act provides for all licensed trustees to produce annual accounts, but only licensed trustees which are companies are required to produce audited accounts.

Disclosure To Overseas Regulators

The Act authorises a person to disclose information to the Minister of Finance and to other authorities in Bermuda for the purpose of enabling or assisting them to discharge their regulatory functions. Discretion is also given to make disclosures to overseas regulators provided that they are subject to similar restrictions on further disclosure as is applicable in Bermuda. It is important to note that, generally, information on settlors and beneficiaries may not be disclosed to overseas regulators. However, any information may be disclosed for the purposes of prosecuting criminal proceedings under the Criminal Justice (International Cooperation) Act 1994.

Investigations And Penalties

Investigations of trustees may be conducted by third parties on behalf of the BMA and can concern the nature, conduct or state of a trustee's business or any particular aspect of it, or the ownership and control of the trustee. Investigations may also be performed where a trustee is suspected of carrying on trust business without a licence, or contravening an exemption order. Failure to comply with the requirement to obtain a licence where one is required could result in a fine of $25,000 and/or imprisonment for one year, on summary conviction, or a fine of $100,000 and/or imprisonment for five years on conviction on indictment.

It is an offence to obstruct investigations and a magistrate can issue a search warrant where a person is suspected of removing, tampering with or destroying documents required by the BMA or refuses to provide the documents or information requested.

This publication is intended only to provide a summary of the subject mattered covered. It does not purport to be comprehensive or to provide legal advice. No person should act in reliance on any statement contained in this publication without first obtaining specific professional advice. May 2005

© Appleby Spurling Hunter