- within Insolvency/Bankruptcy/Re-Structuring, Criminal Law, Litigation and Mediation & Arbitration topic(s)

Companies with excess cash often engage in various lending and funding activities to enhance their returns. In Vietnam, while such financial activities are widespread, the Value Added Tax (VAT) treatment of related income, particularly interest income, has been inconsistent. According to Vietnam's VAT guidelines (Circular 219/2013/TT-BTC, Articles 4 and 5)1, income from lending activities is exempt from VAT, whereas other financial income does not require VAT declaration or payment. "VAT exempted" income and "not-subject-to VAT declaration" income have different implications with respect to the corresponding input VAT and invoice requirement. Traditionally, interest income was considered part of lending activities and thus exempt from VAT. However, recent tax audits and guidance from tax authorities show differing approaches to VAT treatment for interest income from non-bank lending versus bank deposits.

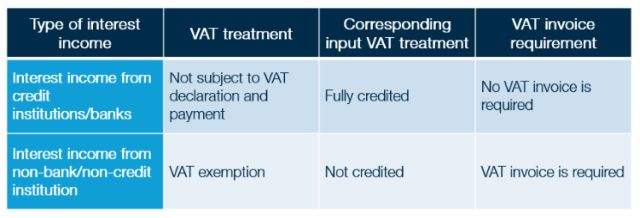

We observed that the local tax authorities have adopted the following positions:

This evolving interpretation has led to confusion among enterprises regarding these categories and treatments. In practice, many enterprises are unaware of the need to issue VAT invoices for interest income from lending to other non-bank borrowers, which could be related or unrelated parties. In recent tax inspections, tax auditors have successfully imposed significant penalties for noncompliance with invoicing requirements, with fines ranging from USD 120 to USD 800 per invoice, leading to collections of up to USD 40,000 in some cases.

IMPLICATIONS FOR YOUR COMPANY

Companies generating interest income or financial income from various sources should review their current VAT treatments to ensure compliance with the correct VAT treatment and invoicing requirements, to optimize the VAT position as well as income tax position and, more importantly, to prevent unexpected surprises with additional financial burden during the possible tax audits at the companies.

HOW CAN A&M HELP?

We are available to provide further information and to discuss the implications of these evolving tax treatments in Vietnam.

Our A&M Tax team based in Vietnam can support enterprises dealing with the evolving VAT treatments on interest income and other financial income via the following offerings:

- VAT Compliance Review: Conduct a thorough review of the company's current VAT practices related to multiple types of financial income to ensure compliance with the latest regulations and interpretations by tax authorities.

- Advisory Services: Provide expert advice on the correct VAT treatment for different types of financial income, including invoicing requirements and defense paper setup.

- Training and Workshops: Offer training sessions and workshops for finance and accounting teams to keep them current on the latest VAT regulations and the importance of proper invoicing practices.

- Custom Solutions: Develop tailored solutions for specific business needs, such as handling complex transactions or financial activities that may have unique VAT implications.

Footnote

1. Finance Ministry of Vietnam, Circular No. 219/2013/TT-BTC dated 31 December 2013 guiding on VAT

Originally published 29 October 2024

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.