- within Corporate/Commercial Law topic(s)

- in United States

- with readers working within the Business & Consumer Services, Media & Information and Retail & Leisure industries

- within Corporate/Commercial Law topic(s)

- in United States

- with readers working within the Media & Information and Telecomms industries

- within Corporate/Commercial Law, Employment and HR, Media, Telecoms, IT and Entertainment topic(s)

Updated: 21.01.2025

Advantages of Investing in Poland

Registration of companies in Poland remains very popular amongst foreign investor for last two decades. There are number of advantages why entrepreneurs choose Poland for their investment localization:

- Easy and fast company registration process that takes couple of days,

- No restrictions for foreigners (who may be shareholders and directors),

- Polish companies have access EU labor, consumer market, etc.

- Political and economic stability,

- Low corporate taxation (0% tax on profit retention, low taxes for holding companies),

- Incentives for investors (investment zones),

- New foreign investment landscape from 2025.

Company Incorporation in Poland - Key Facts for 2025

| Minimum share capital | 5.000 zł for LLC and 100.000 zł for JSC |

| Foreigners can be Shareholders? | Yes |

| Separate legal personality of LLC? | Yes |

| Fast track registration available | Yes |

| Online registration available | Yes |

| Time required to register the company | 1 - 5 days |

| Foreigners can be Directors? | Yes |

| Tax number - NIP | Assigned automatically during registration of the company |

| Statistical number - REGON | Assigned automatically during registration of the company |

| Company registration number (KRS) | Assigned automatically during registration of the company |

| Company name reservation? | Not required |

| Basic corporate tax rate | 9 % and 19% for revenues above 2 MLN EUR |

| Availability of 0 % tax rate (Estonian CIT) | Yes – in case of profit retention |

| Shareholder liability | Shareholders bear no liability for company debts |

| Incorporation tax / stamp tax | 0,5% on initial contributed capital |

| Usual financing methods | Shareholder loan, Share Capital Increase, Reserve Capital Injection. |

| Virtual Office | Company may be registered at virtual address, however for VAT registration regular premises are required. |

| Bank account | Bank account in Poland may be opened via local bank at your jurisdiction or at visit in Polish bank (upon completion of KYC) |

| E-signature | Mandatory for each Director of Polish company |

| Beneficial Owner (CRBR) | UBO shall be reported to Polish UBO register: CRBR |

Company registration flow-chart

- Sign Articles of Association

- Appoint corporate bodies (incl. Directors)

- Deposit share capital

- File for court registration

- Open a bank account

- Apply for license (if required) and start doing business

Registering the company with a provider

Most usually investors register companies with provides like, e.g. Dudkowiak Kopeć Putyra – Law Firm Warsaw. Using a provider facilitates the process as the provider will furnish you with relevant forms, advise and make sure that company is registered within couple of days.

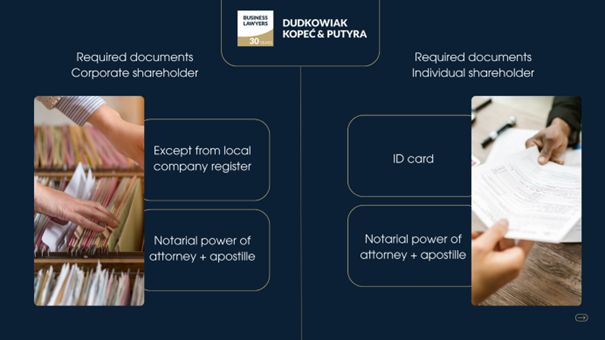

Documents required for company registration in Poland

List of required documents depend on whether the shareholder of Polish company will be an individual person of corporate entity.

Individual shareholder will need to present:

- ID

- Notarial power of attorney (for company registration without visiting Poland) + Apostille (or legalization)

Corporate shareholder will need to present:

- Excerpt from local company register + Apostille (or legalization)

- Notarial power of attorney (for company registration without visiting Poland) + Apostille (or legalization)

Company registration fees and costs

| Official registration fee (court fee) | 350 zł |

| Official translations | depending on the number of documents and language from 20 - 80 zl per page |

| Stamp fee (for power of attorney) | 17 zl per each granted registration power of attorney |

| Notary - only for classic registration (offline) | depending on the share capital amount |

| Registration agent / attorney fee | as agreed with registration expert |

Company registration tax

| Company registration tax rate | 0,5 % |

| Tax calculation base | initial share capital of the newly registered company |

| Who is obliged to pay the registration tax? | newly registered company |

| Who remits the registration tax? |

|

Company registration vs. shelve company purchase

In most cases company registration is recommended option as it is:

- equally fast

- safer - you get brand new company within couple of days

- tailor made - the company has features designated by you

Company registration by the foreigner or foreign corporation

There are no restrictions in Poland as to registration of companies by foreign individuals or corporations. Some restrictions may be related to companies owning real estate and in particular agricultural lands.

Available legal form of company in Poland

Polish corporate law provides wide variety of legal forms of the

companies.

Most popular form, in which approx. 95 % of investments are perform

is:

- LLC - Limited Liability Company - Spółka z ograniczoną odpowiedzialnością.

Far behind there are other alternative legal form of companies:

- JSC - Joint Stock Company - Spółka Akcyjna

- SJCS - Simple Joint Stock Company - Prosta Spółka Akcyjna

- LLP - Limited Liability Partnership - Spółka Komandytowa

- JSP - Joint Stock Partnership - Spółka Komandytowo-Akcyjna

- PP - Professional Partnership - Spółka Partnerska

- SP - Simple Partnership - Spółka Jawna

Almost all foreign investments are performed in LLC form, small percentage of capital rising investments are executed in JSC form. Other forms are in minority. Should you have any questions about alternative registration forms - please feel free to contact our company registration experts.

Limited Liability Company in Poland

LLC is an independent legal entity with a separate legal personality from its shareholders. LLC can trade with goods and provide services, hold credits and debts on its own name. In can be easily incorporated within couple of days.

Corporate structure of LLC consists of:

- Management Board – that manages the company, represents it, signs contracts and performs day to day operations;

- Shareholders Meeting – that (in accordance with Articles of Associations) undertakes key decisions regarding the company and approves annual accounts

- Supervisory Board – non-mandatory corporate body that supervisees operations of the company and performs other functions designated by the Articles of Association.

Polish LLC is most usually represented by:

- Directors – i.e. members of the Management Board

- Registered Proxies – i.e. authorized signatories who are not members of the Board but have wide signing powers

Minimum allowed capital level of Polish Limited Liability Company is 5.000 zł. Capital contribution may be provided in monetary or non-monetary contributions (assets). Contribution cannot be provided in the form of services towards the company.

Company incorporation or branch registration?

There is no definite answer for such question. Most common choice of the investors in Poland is the brand-new company, rather than branch. However, depending on the business type, or investment plans branch may turn out to be more reasonable or tax efficient solution.

LLC company provides liability limitation, while branch does not, in consequence exposing your foreign entity to legal risks sourcing from Poland. On the other hand, new company may require obtaining new licenses, while in case of branch extension or passporting of licenses may be possible. Other potential benefit of the branch is the ability to inject capital with no tax on capital, as opposed to LLC when you might be required to cover 0,5% of transaction tax.

The decision whether to incorporate a company or register a branch shall be consulted with corporate attorney and tax advisor.

Usual benefits and incentives of company registration in Poland

SEZ – Special Economic Zones

Special Economic Zones (SEZs) are designated areas in Poland, in which if the company is incorporate and located (i.e. by establishing production plant) it may benefit from tax preferences or exemptions: e.g. property tax, corporate income tax, personal income tax. Launch of operations and particular benefits for the company are determined in special permits that are issued for opening a company is SEZ.

Low corporate income tax – 9 %

Companies with status of small taxpayers in Poland pay 9 % of corporate income tax. The rate is applicable to taxpayers with revenues that did not exceed the revenue of EUR 2 million. Above that threshold the rate of 19% applies.

0 % of corporate income tax

Companies meeting certain criteria may benefit from 0% corporate income tax in case of profits retention and reinvestment.

IP Box

Companies that are creating Intellectual Property as a part of their business (incl. IT companies and software development companies) may benefit from 5 % corporate income tax rate, if the meet certain additional criteria and keep proper record of income from "qualified IP rights".

Research and Development Tax Relief (R&D)

R&D relief is a complex tax solution for companies that are investing in research and development. Beneficiaries of R&D reliefs are allowed to deduct the R&D related expenses in increased amounts (e.g. 200%) – which, in consequence, decreases the tax payable in Poland significantly.

Holding company

Since 2022 there is new tax incentive introduced for holding companies in Poland. If the company is designed as a holding company (not operating) and it is seated in Poland it may benefit from 0% on dividend payments and 0% tax on sale of shares in subsidiary.

E-signatures – are they mandatory?

Yes – obtaining ePUAP or e-signatures for Directors of Polish company is mandatory. Each Management Board Member of Polish company needs to be able to sign annual accounts and financial statements. E-signatures are also useful in day to day operations, issuing authorizations, powers of attorney or correspondence with public authorities.

Most of the e-signature providers offer:

- USB e-signature kit - this e-signature kit is being issued with a cryptographic card, which shall be put into a USB stick reader. The costs of such e-signature are of:

-

- approx. 100 EUR - valid for 2 years or

- approx. 150 EUR – valid for 3 years

- Mobile e-signature - to sign documents via mobile app, where users get generated tokens to confirm the signature. The costs of such e-signature are of:

-

- approx. 150 EUR - valid for 2 years or

- approx. 200 EUR – valid for 3 years

Depending on the provider there are four usual ways of setting up the e-signature:

- Certified provides, e.g. selected law firm may take care of the process, i.e. purchase the device, create your account and generate mandatory statements. E-signature applicant will only need to notary public in their place of residence to sign the documents, which are then delivered to the e-signature provider.

- Meeting in person with the e-signature agent. The agent will take care of the whole procedure of setting up the e-signature, and it may be issued during the meeting.

- Online set up with an e-signature agent in cooperation with the bank. If the applicant has a bank account in one of the cooperating banks it is possible to obtain e-signature via online meeting.

- Online identify verification and e-signature set up.

Content of the Articles of Association:

The articles of association of new limited liability company in Poland shall provide at least the below listed stipulations:

- the business name and seat of the company;

- the object of the company's activity;

- the amount of share capital;

- whether a shareholder may have more than one share;

- the number and nominal value of the shares taken up by each individual shareholders;

- duration of the company, if it is limited

Application for company incorporation

Application for company incorporation in Poland should contain at least:

- the business name, registered office and address of the company;

- the object of the company's activity;

- the amount of share capital;

- specifying whether a shareholder may have more than one share;

- surnames, first names and addresses or addresses for electronic delivery of members of the management board and the manner of representing the company;

- surnames and first names of the members of the supervisory board or audit committee,

- if the shareholders make in-kind contributions to the company, an indication of this circumstance;

- duration of the company, if limited.

FAQ – Company Registration in Poland

How much time do I need to register company in Poland?

The company can be registered in Poland within 1-5 days in online mode.

Can I start employing right away after company registration?

Yes – you can start employing right away after company registration, just make sure you comply with Polish Employment and Labor Law. Please note that Employee Benefits and Employment Termination rules might be different in Poland compared to your jurisdiction.

What is the minimum share capital of the company in Poland?

Minimum share capital amounts to 5.000 zł

What is the company registration authority in Poland?

Companies in Poland are registered in the Courts - special corporate departments - called KRS"

Do I need an agent to register company in Poland?

No - you do not need an agent to register company in Poland but using service of registration attorney may significantly simplify and speed up the process.

Can the company be registered at virtual address?

Yes, the company may be registered at virtual address.

Can I buy a property with my Polish company?

Most usually you can buy a property in Poland with your Polish company, unless certain restrictions are imposed on particular property.

Can I register a trademark with my Polish company?

Yes – you can register a trademark in Poland with your Polish company.

Does it make a difference in which city of Poland I register the company?

Not really, the only difference, will be in competent authorities that will keep the files of your company and collect taxes.

What are prerequisites for company de-registration in Poland?

Company de-registration is not as easy as removal of the company from the register. Prior to that the company must undergo liquidation or insolvency procedure.

Is there a difference between company registration and incorporation?

Technically, firstly the company needs to be incorporated (created), and once this is accomplished it has to be registered in competent court register (KRS). In practice, the term company registration is often used in reference to the complete process, i.e. creation and registration.

Do I need to come to Poland to register a company?

No, you do not need to come to Poland to register the company, the process can be executed remotely based on the power of attorney issued in the country of your residence.

Is online company registration available in Poland?

Yes, but it may not be available to all foreigners and foreign corporations. We recommend contacting registration expert to verify your options.

Do I need to reserve a name for the company before starting registration process in Poland?

No, there is no name reservation process in Poland that proceeds registration.

Is there a company registration tax in Poland?

Yes, there is a 0,5 % tax on the initial share capital that is contributed to the newly registered company in Poland.

What are the taxes in Poland?

Polish Tax Law provides Corporate Income Tax at rate of 19% or 9%.

What is e-Delivery?

E-Delivery is new governmental service, mandatory from 2025 that will allow each company to send and receive secure communication. e-Delivery is the electronic equivalent of a registered letter with acknowledgment of receipt. This service allows public entities, citizens, and businesses to benefit from convenient and secure electronic deliveries. These are legally equivalent to traditional registered mail with acknowledgment of receipt.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.