NOTICE PUBLISHED BY THE MINISTRY OF FINANCE AND PUBLIC CREDIT IN REFERENCE TO THE FILING OF NOTICES AND REPORTS IN ZEROS (NOTHING TO REPORT) REGARDING THE COMPANIES' OPERATIONS FOR 2013 AND 2014 IN RELATION TO THE FEDERAL LAW FOR THE PREVENTION AND IDENTIFICATION OF OPERATIONS WITH ILLEGAL PROCEEDS (ANTIMONEY LAUNDERING LAW).

On January 17, 2014, the Ministry of Finance and Public Credit (Secretaría de Hacienda y Crédito Público) through its prevention of money laundering website established certain administrative breaks for the filing of notices and reports in zeros regarding companies' operations for 2013 and 2014.

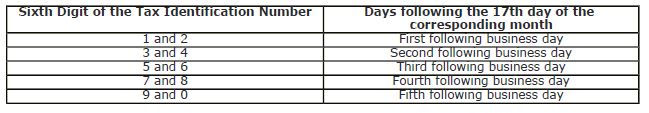

Any person that is obligated to file notices for having performed sensitive activities (actividades vulnerables) during the year 2014, or reports in zeros if no sensitive activities subject to reporting were performed during such period, shall have, as of February 17, 2014 and onward, additional days to file said notices and reports depending on the sixth digit of such person's or company's tax identification number (RFC), in accordance to the following agenda:

Likewise, the Ministry of Finance and Public Credit informed that the notices and reports in zeros corresponding to sensitive activities carried out during the year 2013 that are filed after January 17, 2014 would not be considered as late filings for purposes of the Anti-Money Laundering law.

The above-mentioned will only be applicable to those who properly comply with the filing of notices and reports in zeros the year 2014.

Originally published on January 20, 2014

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.