What is a "Sales-and-Leaseback" Arrangement?

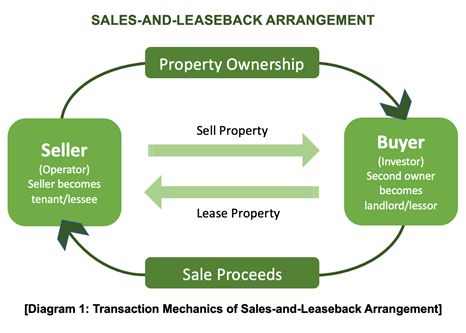

One of the ways for a company to unlock funds, increase profits and enhance cash flow by freeing capital is through a "sales-and-leaseback" arrangement. Through this arrangement a company could sell one or more of its assets to a third-party investor. Simultaneously, the selling party would enter into a lease agreement to lease the assets back from the investor for a long-term lease at a premium rate in order to continue occupying the asset. This arrangement can be understood through Diagram 1.

Sales-and-leaseback arrangement are commonly used by investors and large manufacturing firms to unlock the value of real estate holdings and provide the much-needed liquidity while allowing them to retain the use of such asset. For instance, Club Med Cherating announced that it intends to enter into a sales-and-leaseback arrangement of its assets in October 2021.1

This was part of the group's strategy to sell its assets at a reasonable price and focus on being asset-light while running the companies' business through a long-term lease. Similarly, Sime Darby via Hastings Deering (Australia) Limited opted for a sales-and-leaseback arrangement to unlock their business portfolio for reinvestment elsewhere in the Hastings Deering business while maintaining their day-to-day operations and protecting their future use of its sites.2 The selling party who enters into a sales-and-leaseback arrangement is able to offload existing costly assets for cash while still using the property for their operations.3 Through this method, a company retains the use of a critical asset but no longer holding ownership rights to it.

Company owners would be able to obtain an immediate infusion of cash which may ease funding of operations, repay debts or invest in growth and expansion opportunities. The buyer, on the other hand, may benefit from deriving income generated from the long-term rental of the property.4 Whilst it is beneficial for the seller and buyer of the real estate asset to improve earnings through a sales-and-leaseback arrangement, both parties must still assess the benefits and risks of such a transaction.

Benefits of Sales-and-Leaseback Arrangement

There are various advantages of a sales-and-leaseback arrangement depending upon whether a party is a seller-tenant or a buyer-landlord, which includes5:-

- Operational flexibility

It provides access to funds that can be utilised for various purposes such as business expansion or reinvestment in a more attractive and high yielding business.

- Restore finances

As the real estate asset is now recognized as an operating lease, the seller-tenant may eliminate any outstanding debt associated with the property and converting its equity into cash. This enables them to clear their balance sheet and utilize the funds for other business needs which will enable them to improve their financial position.

- Freedom to set and secure attractive lease terms

A company that has occupied a property for an extended period may opt to secure their tenancy by entering into a long-term lease while also realizing any capital gains by selling the property. The lessee and the lessor can set their own lease period and lower interest rates.

- Unlocking the maximum value of the asset

A company would be able to utilise the value of the asset without having to sell the asset and face issues such as needing to find another asset at a different location, negotiate a favourable purchase price and not to forget the liabilities that may come with it. Here, the value of the asset is preserved by being able to use the same asset without disrupting operations of the business. This would be essential for businesses that requires specific equipment, specialised machinery, or product sensitive environment.

Legal Risks of Sales-and-Leaseback Arrangement

In a sales-and-leaseback arrangement, the seller's risk is the investor's profit. It shifts the risks and benefits of ownership to a third party and generates immediate profit from the sale. Among the legal risks of sales-and-leaseback arrangement are as follows:-

- Ownership and title risks

One of the key legal risks in a sales-and-leaseback of facilities arrangement are title issues. The buyer needs to conduct a thorough title search to ensure that there are no undisclosed liens, encumbrances, or other legal claims on the property that could impact the value of the property or the buyer's ability to obtain financing. If title issues arise after the transaction, it can lead to legal disputes and financial losses.

- Default and termination risks6

As the leaseback period would generally takes around 10 to 20 years, the seller-tenant may become unable to fulfil the entire lease term and ceases operations midway through the tenure of the lease. Therefore, it is crucial for the buyer to conduct a comprehensive investigation of the seller-tenant to confirm their authenticity and longevity in the business, ensuring they will continue to operate at least until the end of the lease. Moreover, the buyer should verify that there are no break clauses in the leaseback agreement that could allow the vendor to terminate the lease prematurely.7

- Regulatory compliance

The property may not comply with applicable laws and regulations which can lead to fines, legal liabilities, or other legal issues for the buyer and seller. It is important to ensure that the property is in compliance with all applicable laws and regulations before finalising a sales-and-leaseback agreement.

- Lease disputes

The terms of the lease agreement may not be clear or may be subject to interpretation, leading to disputes over rent, maintenance responsibilities, or other issues. These disputes can lead to costly legal battles and impact the relationship between the buyer and seller. The tenant should ensure that the leaseback terms are favourable and that they retain sufficient control over the use of the assets.

- Tax and accounting risks

The sales-and-leaseback transaction could have significant tax and accounting implications, and any errors or oversights could result in penalties, fines, and legal disputes.

How to Manage Legal Risks in a Sales-and-Leaseback Arrangement?

Once the legal risks have been identified, companies may want to start thinking the best strategy to manage the legal risks in a sales-and-leaseback arrangement. The following points are amongst the steps to be taken in approaching legal risks in a sales-and-leaseback arrangement:-

- Engage a legal counsel

The first step in managing legal risks in sales-and-leaseback arrangements is to engage a legal counsel with experience in real estate transactions. A legal counsel can review the terms of the agreements to ensure that it protects a party's interests and complies with applicable laws and regulations. A legal counsel can also help to negotiate the terms of the agreements and advise on potential legal risks. Before entering into a sales-and-leaseback arrangement, it is essential to conduct due diligence on both the seller and the asset to ensure that there are no legal issues or liabilities that could impact the value or future use of the asset.

- Conduct due diligence

This can include reviewing the seller's financial statements, credit history, reputation in the industry, title document and any existing leases or contracts. The seller's experience with similar transactions and their track record in managing real estate assets should also be considered to clarify the creditworthiness of the seller.8

- Review lease agreement terms

The lease agreement is a critical component of a sales-and-leaseback arrangement. It is essential to review and carefully draft the terms of the lease agreement to ensure that it protects our interests and minimizes legal risks. Some key terms to consider include the length of the lease, rent payments, maintenance and repair obligations, termination provisions, restrictions on the use of property and the provisions for handling disputes and defaults. Besides, a sales-and-leaseback arrangement is very much dependent on the market value and quality of the asset. Buyers, who are predominantly investors in this arrangement should look for a stable investment return during the lease period, particularly the future cash flow potential and the cost of leasing back the property he already owns in the first place. The quality, location and lease structure should also be taken into account as these will affect the lease rate of the property. Although the term of the lease can be predetermined, for example, a period of 20 years, the lease rate should be revisited at an appropriate window (i.e. every 3 years) in order to protect the lessee and this should be factored in the agreement.

- Consider tax implications

Sales-and-leaseback arrangements can have significant tax implications for businesses. It is essential to consult with a tax professional to understand the tax consequences of the transaction and to structure the transaction in a tax-efficient manner. Some tax considerations to keep in mind include the treatment of the sale proceeds, depreciation of the property, and potential recapture of depreciation upon termination of the lease.

- Anticipate potential disputes

Finally, it is important to anticipate potential disputes that may arise in connection with the sales-and-leaseback arrangement. This can include disputes over the lease agreement terms, issues with the property's condition, and disagreements over rent payments. A plan should be developed for resolving disputes and include provisions in the lease agreement that address potential disputes.

Conclusion

Ultimately, a sales-and-leaseback arrangement provides companies with a valuable source of capital. However, these arrangements can also pose legal risks if not managed properly. Both parties would have to carefully consider the benefits before proceeding with the arrangement. While the sales-and-leaseback arrangement may appear to be a secured long-term investment with low risk, investors would have to calculate the long-term effect of the transaction and whether the secured lease amount is sufficient to maximise their investment capacity in proportion to the purchase price that they are investing. In order to ensure a successful transaction, a carefully curated agreement should be able to mitigate risks in this arrangement and a due diligence on the asset should be essential before considering entering into such an arrangement. By engaging a legal counsel, conducting due diligence, reviewing the terms of the lease agreement, considering tax implications, and anticipating potential disputes, companies can manage legal risks in a sales-and-leaseback arrangement and ensure a successful transaction.

Footnotes

1. Sharen Kaur, 'Club Med Cherating is up for sale, with a leaseback arrangement' New Straits Times (Malaysia, 13 October 2021)(https://www.nst.com.my/property/2021/10/736198/club-med-cherating-sale-leaseback-arrangement) accessed 20 April 2023.

2. 'Sime Darby unit to acquire Australian equipment rental company' The Sun Daily (Malaysia, 2 March 2023) (https://www.thesundaily.my/business/sime-darby-unitto-acquire-australian-equipment-rental-company-GG10701564) accessed 20 April 2023.

3. Darren Best, 'What are The Advantages and Disadvantages of A Sale and Leaseback?' (Savoy Stewart, 4 October 2019) (https://www.savoystewart.co.uk/blog/advantages-and-disadvantages-of-sale-andleaseback) accessed 20 April 2023.

4. Wu Min Aun, 'Credit and Security' [1996] 3 MLJ i, 19

5. Simon Felton, 'Advantages & Disadvantages of a Sale and Leaseback transaction' (Jasper, 3 Jan 2021) (https://www.jasper.io/news/advantages-and-disadvantagesof-a-sale-and-leaseback-transaction) accessed 20 April 2023.

6. Renee Shprecher, 'Risk vs Reward' (CCIM Institute) (https://www.ccim.com/cire-magazine/articles/risk-vsreward/#:~:text=In%20a%20sale%2Dleaseback%2C%20the,its%20investment%20at%20a%20premium.) accessed 20 April 2023.

7. Herald Butcher Malaysia, 'Sale & Leaseback Sale Structure' (Henry Butcher Malaysia Awards Edition, 2020) 7

8. Renee Shprecher, 'Risk vs Reward' (CCIM Institute) (https://www.ccim.com/cire-magazine/articles/risk-vsreward/#:~:text=In%20a%20sale%2Dleaseback%2C%20the,its%20investment%20at%20a%20premium.) accessed 20 April 2023.

Originally published 5 July 2023

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.