- within Employment and HR and Insurance topic(s)

Key Point to Note:

The Report (i) identifies key conduct risks for 2022, (ii) outlines actions to be taken to in order to identify, mitigate and manage such risks and (iii) outlines the Central Bank's supervisory priorities for 2022.

Background

On 8 February, 2022 the Central Bank of Ireland (Central Bank) published its second Securities Markets Risk Outlook Report (Report) in which it identifies the key conduct risks1 it sees facing securities markets in 2022 and sets down its expectations of what financial service providers and market participants should do to effectively identify, mitigate and manage these risks. The Report also details the supervisory priorities of the Central Bank for the year ahead.

In the foreword to the Report, Director of Securities and Markets Supervision, Patricia Dunne, highlights that the Central Bank "will take appropriate supervisory action" against securities markets participants who do not appropriately consider the risks outlined in the Report or whose behaviour is identified by the Central Bank as falling short of its expectations.

Key conduct risks for 2022

While the Report identifies conduct risks applicable to regulated financial service providers more generally, for the purposes of this briefing, we focus on the key conduct risks most relevant to fund management companies (FMCs) and the funds that they manage and actions which the Central Bank has identified that should be taken to manage such risks.

Sustainable Finance |

Suggested Action to be taken |

Greenwashing2The growth in demand for sustainable finance products which place environmental, social and governance objectives and considerations at the core of the investment process is acknowledged by the Central Bank. As a result of this strong investor demand, the Report outlines that risks have been identified by the Central Bank where investors are misled to into buying products that do not meet their sustainable expectations.Sustainable Finance Disclosure Regulation (SFDR) ImplementationThe Central Bank recaps on the introduction of Level 1 SFDR requirements in the Report and warns FMCs that sufficient resources and focus from management will be key in order to successfully implement the more detailed Level 2 SFDR obligations which are due to apply from January 2023.3 |

Ensure investors are fully informed of a financial

product's sustainability characteristics in a manner that is

measurable and quantifiable, using transparent parameters.

Allocate sufficient resources and focus from management in good time prior to the January 2023 application date for Level 2 SFDR measures to ensure successful implementation of these obligations. Implement an action plan to address the supervisory expectations of the Central Bank on management of climate risk as detailed in its letter dated 3 November 2021. |

Market Dynamics |

Suggested Action to be taken |

Fund LiquidityThe Report outlines that instruments such as high yield fixed income instruments can be difficult to manage in periods of increased market volatility as a result of being less liquid and of lower credit quality.According to the Central Bank, this risk has driven a number of supervisory engagements and letters addressed to FMCs including the recent CSA on Liquidity Risk Management.4 |

Critically review existing risk management framework in place to identify, manage and mitigate the potential risks arising from the use of liquidity risk within a fund's portfolio and ensure that this framework meets all supervisory expectations set down by ESMA and the Central Bank in recent publications. |

Fund LeverageAs noted by the Central Bank in the Report, the use of leverage can result in amplified shocks to institutions and markets. The Central Bank cites that as a result of the sometimes opaque nature of derivatives contracts used to achieve leverage, the channels for transmissions of these shocks are not always clear. The ECB Financial Stability Review is highlighted by the Central Bank, which examined euro area funds' ability to meet variation margin calls and found that a large share of euro area funds with derivative exposures faced a liquidity squeeze from high margin calls during market turmoil that occurred in early 2020. |

Have an appropriate risk management framework in place to identify, manage and mitigate the potential risks arising from the use of leverage risk within a fund's portfolio, including conducting regular stress testing against plausible shock scenarios. |

Governance |

Suggested Action to be taken |

Board Oversight, Governance Structures and Due DiligenceRisks arising from failure on the part of FMCs to; (i) carry out appropriate due diligence; (ii) oversee delegates and third party intermediaries; and (iii) implement a clear documented governance structure have been identified by the Central Bank in the Report. Ineffective FMC oversight is singled out by the Central Bank as being a major factor in regulatory deficiencies arising across its mandate. The Report highlights that the Central Bank's Cross-Industry Guidance on Outsourcing, together with its Feedback Statement on Consultation Paper 138 were published to support and supplement existing sectoral legislation, guidelines and regulations on outsourcing and assist regulated financial service providers to develop a framework which effectively identifies, measures, monitors and manages outsourcing risk. |

Review and have regard to the Cross-Industry Guidance on

Outsourcing and ensure adherence to legislative requirements

relating to outsourcing.5

Ensure relevant reports are received from delegates and challenge information received, so as to effect good governance. |

Fund Management Companies Guidance (FMC Guidance)The Central Bank found in its thematic review that a significant number of FMC have not implemented governance frameworks to the standard set by the FMC Guidance.Deficiencies identified by the thematic review outlined by the Central Bank include failure by FMCs to have appropriate resources, including a lack of skilled experienced staff, to enable them to properly carry out their functions. FMCs are reminded of the Central Bank's expectation that designated persons be clearly identified, local individuals possessing relevant skills and experience with adequate time to commit to the role in order to effectively carry out the managerial function assigned to them. |

Review governance framework to ensure the standards of the FMC

Guidance are met which should identify who within the FMC is

responsible for making key decisions.

Ensure designated persons are sufficiently senior, appropriately skilled and can allocate sufficient time commitments to their role. |

Self-Managed Investment Funds converting to Externally Managed FundsIn the Report, the Central Bank stresses the importance of a critical assessment being carried out by FMCs of the impact of proposed new business and ensuring that they are sufficiently resourced with requisite skillsets and have adequate operational capacity in order to meet their obligations.This is against a backdrop of a significant increase in the number of self-managed investments funds appointing third party FMCs, as observed by the Central Bank, in order to meet the requirements of the FMC Guidance. |

Assess possible changes required to how resources and operational capacity will need to change to take account of any increase in the nature, scale and complexity of funds under management; |

Investment Advisors acting as Investment ManagersThe Central Bank acknowledges the delegated model of funds and FMCs, noting that an investment manager appointed by the fund or FMC may in turn appoint investment advisor(s) to advise on portfolio management. The Central Bank sets out its clear expectation that the role performed by any investment advisor is non-discretionary in nature and an "adjunct to the role performed by the Investment Manager". The Central Bank outlines its concern regarding cases where the investment advisor is acting as a de facto manager, with an inappropriate and imbalanced level of control over the fund in its relationship with the FMC and investment manager which is not consistent with the relevant fund's prospectus disclosures. |

Ensure that detailed rationale is minuted for the appointment

of any investment advisor to a fund and details on the role that

they will fulfil;6

Receive and scrutinise at regular intervals reports received from investment managers, in particular with regard to portfolio management and interaction with investment advisors during the period of the report. |

Conflicts of Interest7 |

Suggested Action to be taken |

Connected Party TransactionsShortcomings have been identified by the Central Bank by a minority of designated persons and depositaries with regard to the thoroughness to which they fulfil their obligations around the identification, disclosure, valuation and execution of transactions between the FMC and connected parties.Other areas of concern noted by the Central Bank are where; (i) connected parties do not inform relevant parties of connected transactions; (ii) entities do not identify themselves as being a connected party; and (iii) entitles are deliberately structured in a particular way in order to circumvent the Connected Party Transaction Rules. |

Ensure regulatory requirements regarding conflicts of interest

(identifying such conflicts, mitigating and managing them) are

being met.

Have robust processes and procedures in place to identify any connected or potentially connected transactions and ensure that all relevant parties understand their obligations and duties with respect to such transactions. Engage rigorously with fund depositaries and designated persons prior to a contemplated transaction to ensure all obligations are fulfilled with regard to the Central Bank's rules and that investor interests are protected. |

Influence of Third PartiesThe Central Bank has observed a move away from active stock selection to index-based strategies and notes that fund managers must maintain autonomy over product design and oversight on the selection of the index provider, including seeking evidence of initial and ongoing due diligence by the investment manager and understanding the method and nature of index methodologies.The Central Bank comments that the selling of funds through distributors and/or platforms may influence dealing and settlement timelines that are not appropriate when considered in conjunction with the relevant fund's liquidity profile and portfolio. The Central Bank states that this area of concern became apparent as part of their work on the Common Supervisory Action (CSA) relating to UCITS liquidity management. |

Ensure that an adequate level of oversight and due diligence is

maintained over the selection of index providers.

Ensure the consistency of dealing and settlement times for funds under management with the liquidity profile of the portfolio. |

Financial Innovation |

Suggested Action to be taken |

Special Purpose Acquisition Companies (SPACs)The Central Bank states that it has limited investments in SPACs to 10% of the net asset value for retail investment funds. The Central Bank cites its consideration of concerns raised by ESMA and other Regulators in this decision, with regard to the appropriateness of SPAC transactions for all investors due to their complexity and fees charged, among other factors. |

Have regard to ESMA's Public Statement on 15 July 2021 to address prospectus disclosure and investor protection considerations when investment in SPACs is considered. |

Crypto AssetsThe Central Bank reconfirms its position, that it is highly unlikely to approve a UCITS or Retail Investor AIF proposing any direct or indirect exposure to crypto assets. The Central Bank notes the likelihood of crypto assets being highly risky and speculative and comments that "the possibility that appropriate risk assessment could be difficult for a retail investor without a high degree of expertise." |

Have regard to the Central Bank's comments and position, as outlined in its most recent UCITS Q&A and AIFMD Q&A, when considering investment in crypto assets. |

Cyber Security |

Suggested Action to be taken |

Operational ResilienceThe Report points to the Central Banks's Financial Stability Review 2021:II, noting that operational and cyber resilience of the financial sector (including securities markets) remains a key strategic objective of the Central Bank and reminds FMC of its Cross Industry Guidance on Operational Resilience which was published in December 2021.The Central Bank stresses that FMC need to take steps, among other factors, to ensure that; (i) appropriate procedures and controls are in place to identify and minimise sources of information security risk; and (ii) critical business services are identified and made more resilient to possible disruption from cyber and operational risks. The Central Bank further states that it is "essential that all firms operating in securities markets have appropriate operational resilience in place to mitigate against the threat of cyberattacks". FMC are reminded of the Central Bank's expectation, as outlined in its Cross Industry Guidance in respect of Information Technology and Cybersecurity Risks, for boards and senior management to understand and recognise their responsibility relating to IT, cybersecurity governance and risk management and to maintain oversight of these responsibilities as a priority. |

Identify and understand specific IT related risks and critical

business services and ensure such services are more resilient to

disruption from operational and cyber risk.

Have in place a programme of risk analysis and oversight to identify and minimise sources of cybersecurity risk and prepare emergency procedures and backup plans.8 |

Data |

Suggested Action to be taken |

| The Report highlights that data quality remains a focus for the

Central Bank in 2022 and that FMC "can expect increased

engagement with the Central Bank in respect of data quality

issues" which may be in the form of supervisory action in the

case of FMC which do not have sufficient frameworks in place to

meet their reporting obligations.

The Central Bank cites the level of new legislation in recent years as being a driver of the increased level of data required from FMC. Data driven reviews by the Central Bank are expected to increase particularly in the areas of Securities Financing Transactions (SFTR), European Market Infrastructure Regulation (EMIR), SFDR and the Taxonomy Regulation. |

Consider and address any data quality issues identified in a

reasonable timeframe.

Consider whether data meets the purpose for which it is collected and is accurate, complete and timely. |

Supervisory Priorities for 2022

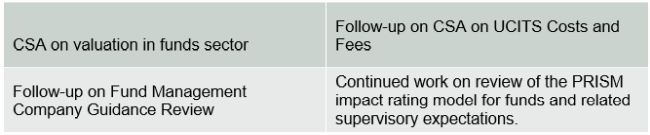

The Report also outlines the Central Bank's supervisory priorities for securities markets in 2022.

Those which are of particular relevance to FMC are set out in the table below.

Next Steps

As a next step, we would encourage all FMC to scrutinise the risks, expectations and supervisory priorities outlined by the Central Bank in the Report and review same against their current business activities, practice, procedures and systems. Where required, FMC should consider. putting an action plan in place to address any identified gaps in their existing arrangements when assessed against the Central Bank's supervisory expectations outlined in the Report.

Footnotes

1 The Central Bank's 'key conduct risks' for 2022 are; Misconduct Risk; Sustainable Finance; Governance; Conflicts of Interest; Financial Innovation; Data; Cyber Security and Market Dynamics. Misconduct Risk is not covered in this briefing.

2 Recital (9) of the draft Taxonomy Regulation describes greenwashing as "the practice of gaining an unfair competitive advantage by marketing a financial product as environmentally friendly, when in fact it does not meet basic environmental standards".

3 Informative and timely ESG related briefings are published on our website here

4 Our commentary on the Central Bank's letter dated 10 March 2021 to FMC relating to liquidity risk management is available here

5 Our detailed analysis of the implications of the Cross-Industry Guidance on Outsourcing for FMCs is available here

6 The Central Bank's most recent AIFMD Q&A sets out its expectations regarding investment advisors in the context of qualifying investor alternative investment funds (QIAIFS) investing in less liquid assets.

7 The Report also considers Payment for Order Flow (PFOF) under this heading.

8 Our webinar which covers practical advice when considering cybersecurity risks is available here

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.