- within Law Department Performance, Family and Matrimonial and Antitrust/Competition Law topic(s)

On 1 October 2013, the European Securities and Markets Authority ("ESMA") published its guidelines on reporting obligations under the Alternative Investment Fund Managers Directive ("AIFMD") (the "Guidelines"). The purpose of this briefing is to provide an overview of the detailed reporting requirements for AIFMs preparing to comply with this burdensome regime.

The Guidelines provide further clarification on the information that alternative investment fund managers ("AIFMs") should report to national competent authorities ("NCAs") and the timing of such reporting. The Guidelines provide detailed examples of the types of reporting required of AIFMs under Article 24 of AIFMD and sub-threshold AIFMS under Article 3(3) (d) of AIFMD. AIFMs are required to provide their NCAs with "identification", "portfolio concentration" and "risk profile" reporting as detailed below. Sub-threshold AIFMs need only provide their NCAs with "identification" and "portfolio concentration" (with the exception of information on instruments traded and individual exposures) reporting as detailed below. The level of reporting required under these headings will differ depending on whether the AIFM is an EU AIFM, a sub-threshold AIFM or a non-EU AIFM.

Annex I of the Guidelines sets out a decision tree diagram which summarises the reporting obligations of authorised AIFMs, non-EU AIFMs and registered AIFMs as determined by the total value of assets under management and the nature of the AIFs managed or marketed. This diagram provides a useful step-by-step analysis of the frequency and type of reporting needed.

Key elements of reporting

AIFMs will need to include a considerable amount of information in their reports to NCAs on the matters listed below:

Identification

- identification of the AIFM; and

- identification of AIFs (including, in the case of umbrella funds, the names and ISINs (if available) of all sub-funds).

Identification of AIFMs and AIFs will be achieved by way of a national identification code (code used by NCAs), legal entity identifier codes or, if not available, interim entity identifier codes.

Portfolio concentration

- the breakdown of investment strategies of AIFs (including the percentage of NAV represented by all strategies of the AIFM); »» the principal markets and instruments in which an AIF trades;

- the total value of assets under management of each AIF managed;

- the turnover of AIFs;

- the principal exposures and most important portfolio concentrations of AIFs including information on:(i) the main instruments the AIF trades; (ii) geographical focus; (iii) 10 principal exposures of the AIF; (iv) 5 most important portfolio concentrations; (vi) typical deal/ position size for private equity AIFs; (vii) principal markets in which the AIF trades and investor concentration; and

- the instruments traded and individual exposures including information on: (i) individual exposures in which the AIF is trading; (ii) the main categories of asset in which the AIF is invested; (iii) the value of turnover in each asset class over the reporting period; and (iv) currency exposure.

Risk profile

- risk profile of the AIFs including market, counterparty and borrowing risks;

- liquidity profile of the AIFs; and

- leverage of the AIFs.

Additional reporting

ESMA also published an opinion to accompany the Guidelines which provides details on a set of additional information that, in its view, NCAs could require AIFMs to report on a periodic basis pursuant to Article 24(5), first sub-paragraph of AIFMD. Such information includes:

- information on the total number of transactions carried out using a high frequency algorithmic trading technique, as defined in the forthcoming revised Markets in Financial Instruments Directive (MiFID II), together with the corresponding market value of buys and sells in the base currency of the AIF;

- information on the geographical focus to be expressed as a percentage of total value of assets under management;

- information on the extent of hedging expressed as a percentage where a short position is used to hedge a position with similar exposure;

- information on the Value at Risk approach which is particularly relevant for AIFs pursuing hedge fund strategies; and

- where relevant according to the investment strategy of the AIF, further information such as the portfolio's sensitivity to a change in FX rates or commodity prices.

It is not clear whether all NCAs in the Member States will adopt a consistent approach in applying the additional reporting suggested by ESMA.

Form of reporting

Interestingly, ESMA has also published detailed IT guidance and a consolidated reporting template which is intended to facilitate the reporting by AIFMs to NCAs. Annex II of the Guidelines sets out reporting fields' values, i.e., codes and asset type typology for the various types of reporting.

Timeline for implementation

The Guidelines will be translated into the official EU languages and published on the ESMA website. The publication of the translations will trigger a twomonth period during which the NCAs must notify ESMA whether they comply or intend to comply with the Guidelines. The Central Bank has not yet issued a statement in relation to its implementation of the Guidelines.

In relation to the first reporting date for existing AIFMs, ESMA had initially proposed that existing AIFMs (both authorised and registered AIFMs) should start reporting to NCAs for the first time by 31 January 2014, or by 15 February 2014 for fund of funds, for the period covering 23 July 2013 to 31 December 2013. However, ESMA decided to adopt a more principles-based approach for existing AIFMs. The Guidelines recommend that in order to determine the nature and timing of their reporting obligations for the period starting 22 July 2013, existing AIFMs should take account of: (i) transitional provisions of Article 61(1) of AIFMD; (ii) the European Commission interpretation of Article 61(1) as set out in its Q&A; and (iii) their authorisation status.

This language suggests, at least for an EU AIFM, that the reporting obligation would commence at the latest by the time that EU AIFM was authorised by the relevant NCA and so EU AIFMs should have a transitional period available to them until 22 July 2014. Arguably, the same should apply to subthreshold EU AIFMs which are subject to the lighter touch "registration" regime. However, it is not entirely clear what this means for non-EU AIFMs as these will not be capable of being authorised as AIFMs until in or around 2015. Pending such authorisation, non-EU AIFMs are permitted to privately place AIFs, but it is not clear whether they will be required by the target Member States to report for the first time by 31 January 2014 or a later date, (22 July 2014, for instance). It is hoped that a consistent approach will be adopted by Member States in this regard and we will issue further updates on this as information becomes available.

Reporting periods

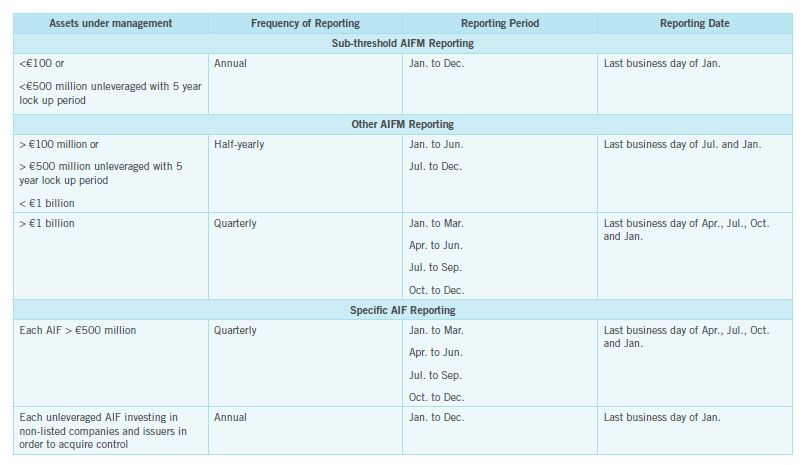

The European Commission's Level 2 Regulation provides for the frequency of reporting by AIFMs and whether this needs to be done on a quarterly, semiannual or annual basis. This is dependent on the AIFs' assets under management calculated in accordance with Article 2 of the Level 2 Regulation. The Guidelines recommend that the reporting periods be aligned with the calendar year. This means that after the first reporting period AIFMs will be required to report, quarterly, semi-annually or annually as set out in the table across

An additional 15 days is provided for reporting with respect to fund of funds. In respect of the first reporting period, the Guidelines state that AIFMs should start reporting as from the first day of the following quarter after they have information to report (i.e., the AIF has been launched) until the end of the first reporting period. For example, an AIFM subject to half yearly reporting obligations that has information to report as from 15 February would start reporting information as from 1 April to 30 June.

Next steps

Although the date of the first reporting period is not yet clear, proposed AIFMs should familiarise themselves with these extensive reporting requirements. We suggest that AIFMs consider whether the reporting obligations will be managed internally or outsourced to service providers. AIFMs need to understand the additional costs and processes involved in order to prepare for this additional reporting workload.

This article contains a general summary of developments and is not a complete or definitive statement of the law. Specific legal advice should be obtained where appropriate.