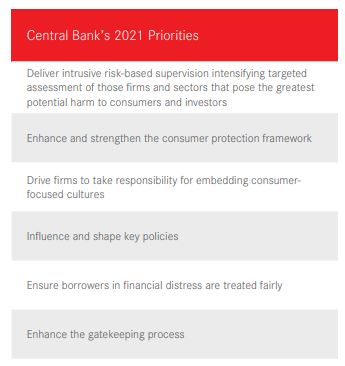

On 29 March 2021, the Central Bank published the ;Consumer Protection Outlook Report ("Outlook Report") for 2021 which sets out the priority areas that the Central Bank will be focusing on in 2021.

The Outlook Report also outlines the main risks, across all financial sectors that the Central Bank believes pose the greatest potential for consumer and investor harm, and its expectation of firms to address the risks identified.

Kieran O'Sullivan, senior associate: "On the publication of the Outlook Report, Director of Consumer Protection, Gráinne McEvoy noted that the Central Bank publishes the Outlook Report to ensure firms are clear on the Central Bank's expectations on the issues and areas that need close attention, something which the Report certainly achieves. The Central Bank's expectations are clear and detailed, which is of huge assistance to impacted firms. Firms need to review these details and carry out a gap analysis to assist them in identifying what needs to be addressed. The Outlook Report states clearly that the Central Bank expects firms to act on the contents of the Outlook Report and that it will "continue to supervise firms to ensure they are fully compliant with their obligations."

Of broader interest are the comments made by the Central Bank in respect of some of its ongoing consumer protection initiatives; including the review of the Consumer Protection Code, the Business Interruption Framework, the Differential Pricing Review and the IAF.

In respect of the Consumer Protection Code review, the Report provides some much awaited clarity on the parameters of the review. The Report outlines that the work aims to "substantially update" the Consumer Protection Code to address emerging trends and risks across the rapidly changing financial services landscape and to ensure that it continues to deliver strong protections for consumers and investors into the future. It explains how it will look to the impacts which technology and digitalisation is having on financial services, and how consumer protections should adapt accordingly. The review will make proposals to ensure information made available to consumers and investors is as clear and useful as possible, both in terms of content and delivery. The Outlook Report also details that it intends to develop further requirements on how firms can better ensure vulnerability among consumers and investors is recognised and catered for. Finally the Central Bank explained that it intends to consult publicly on these proposals in 2021. Matheson will continue to follow this closely and will update clients when the consultation is launched."

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.