- in United States

- in United States

- within Technology topic(s)

A Letter of Undertaking (LUT) plays a significant role for all companies in India engaged in the export of services. It is a document filed under the provisions of the Goods and Services Tax (GST) law that allows exporters to supply goods or services without paying Integrated Goods and Services Tax (IGST).

The Purpose:

- The LUT enables companies to export services without the burden of paying IGST upfront.

- It assures the government that the exporter will fulfill all GST compliance requirements.

Lets understand the benifit with an Example of Export of Services Worth $10,000

Scenario 1: With a Letter of Undertaking (LUT)

- Service Export Details:

- Value of exported services: $10,000 (approx. ₹8,20,000 at an exchange rate of ₹82 per USD).

- IGST rate applicable on services: 18%.

- Impact:

- Since the company has filed an LUT, it is not required to pay IGST at the time of exporting services.

- The company delivers services and receives $10,000 in foreign exchange.

- No cash flow impact as no upfront tax is paid, and no refund needs to be claimed.

Scenario 2: Without a Letter of Undertaking (LUT)

- Service Export Details:

- Value of exported services: $10,000 (approx. ₹8,20,000).

- IGST rate applicable on services: 18%.

- Impact:

- The company must pay IGST of ₹1,47,600 (18% of ₹8,20,000) at the time of export.

- Although GST law allows for a refund of this tax (as exports

are zero-rated), the process involves:

- Filing refund applications.

- Waiting for government approval and disbursal, which can take weeks or months.

- This results in a significant cash flow impact, as ₹1,47,600 is blocked until the refund is processed.

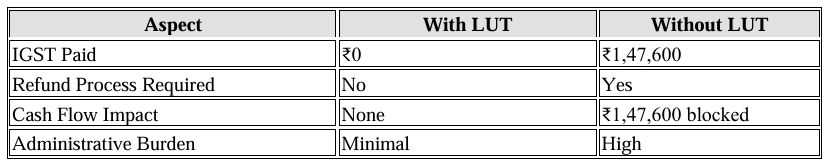

Comparison of Scenarios:

With an LUT, the company avoids upfront IGST payments, ensuring smooth cash flow and minimal administrative effort. Without an LUT, the company must pay IGST, claim a refund, and endure delays, which can hinder operations and liquidity. This demonstrates the critical importance of an LUT for service exporters.

Some Key Points About LUT:

- Eligibility:

- Any exporter of goods or services, including companies engaged in exporting services, is eligible to file an LUT.

- Validity:

- The LUT is valid for one financial year, after which it needs to be renewed.

- Benefits:

- Cost Efficiency: By avoiding IGST payment, exporters save on working capital that might otherwise be tied up.

- Simplified Process: Exporters don't need to claim a refund for taxes paid, which simplifies cash flow management and reduces paperwork.

- Faster Operations: Since taxes aren't paid upfront, service exporters can focus on delivering services efficiently.

- Requirements:

- The LUT must be filed in Form GST RFD-11 through the GST portal.

- The exporter must provide details such as the GST registration, bank account, and a declaration to fulfill all conditions for exports under GST.

- Obligations:

- Exporters must ensure that the export proceeds (in convertible foreign exchange or otherwise as per RBI guidelines) are received within the prescribed time frame.

- Failure to comply with LUT conditions can result in penalties or the need to pay IGST along with interest.

- Impact for Service Exporters:

- Service exporters can maintain competitive pricing by avoiding the additional cost of IGST.

- It supports cash flow management and enhances their ability to scale operations.

Eligibility for Foreign Subsidiaries:

Foreign subsidiaries can apply for LUT if:

- GST Registration:

- The subsidiary is registered under GST in India.

- Export Activities:

- They are exporting goods, services, or both, or making supplies to Special Economic Zones (SEZs).

- No Tax Evasion Record:

- The company has not been prosecuted for any offense involving tax evasion exceeding ₹250 lakh under GST or any previous law.

- Fulfillment of Conditions:

- The subsidiary complies with the conditions of exports as laid down under the GST laws, such as realization of export proceeds in convertible foreign exchange (or INR where permissible under RBI guidelines).

Additional Benefits for Foreign Subsidiaries Using LUT:

- Simplified Compliance:

- LUT eliminates the need to claim refunds for IGST paid, making operations more efficient.

- Competitive Cost Advantage:

- Cost savings from avoiding IGST upfront can help foreign subsidiaries maintain competitive pricing in global markets.

Example:

A U.S.-based parent company has a subsidiary in India that provides IT services to clients worldwide. The Indian subsidiary can file an LUT and export services to global clients without paying IGST. This avoids tax outflow and the need for refunds, streamlining the subsidiary's operations in India.

Key Considerations for Foreign Subsidiaries:

- Export Revenue in Convertible Foreign Exchange:

- As per GST and RBI guidelines, export proceeds must generally be received in convertible foreign exchange (or INR in specified cases like trade with Nepal or Bhutan).

- Annual Filing:

- The LUT is valid for one financial year and needs to be renewed annually.

- Compliance with Indian Laws:

- As Indian entities, foreign subsidiaries must adhere to all GST-related requirements, including timely filing of GST returns and declarations.

Conclusion:

For companies in India engaged in the export of services, filing a Letter of Undertaking is a strategic and compliance-focused approach to optimize their tax obligations. The foreign subsidiaries in India engaged in export of goods or services can leverage LUT to simplify their tax compliance, avoid IGST payments, and optimize cash flow, provided they meet the eligibility requirements.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.