- within Litigation, Mediation & Arbitration, Corporate/Commercial Law and Real Estate and Construction topic(s)

- with readers working within the Media & Information, Property and Transport industries

Introduction

Climate change is one of the biggest problems humanity faces in today's day and age. This issue's urgency and importance have led nations to tackle it. The heavy reliance and over-exploitation of fossil fuels have led to irreversible changes across the globe, and it is the need of the hour to, at the very least, stop further exploitation of these resources. Given that entities across the globe are so heavily dependent on fossil fuels, a blanket ban on greenhouse gas emissions by these entities shall be detrimental to the economic growth and progress of nations. Additionally, the progress made in the Renewable Energy sector is far from replacing the existing fossil fuel structures. Thus, the concept of carbon markets evolved, incentivising entities to switch to greener energy sources by selling the credits obtained to entities looking to offset their excess emissions.

This Article shall briefly discuss the evolution of carbon markets under the Kyoto Protocol and Paris Agreement before discussing the framework laid down in India to achieve the Nationally Determined Contributions ('NDCs') committed by India under the Paris Agreement. The Article shall then look at the obstacles in governing and regulating the Indian carbon market and discuss the potential solutions that can be employed in the near future to address this.

The Emergence of Carbon Markets

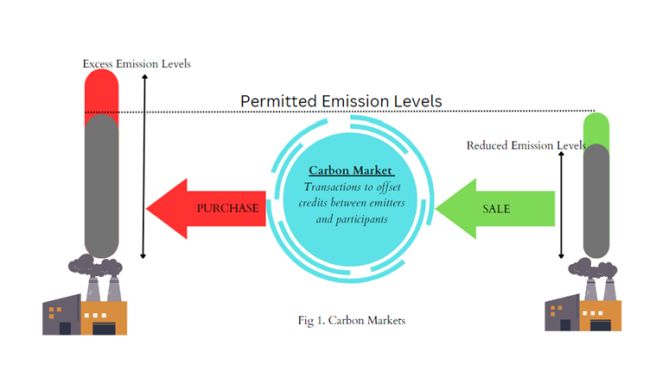

In the simplest of terms, carbon markets are systems or platforms where carbon credits are bought and sold. Companies or individuals can use such carbon credits to compensate for greenhouse gas emissions by purchasing them from entities that have contributed towards the removal or reduction of greenhouse gas emissions. Upon using a carbon credit to reduce or avoid emissions, it shall be no longer tradeable. Therefore, a price is being put on greenhouse gas emissions by making it a tradable commodity. The rationale for such carbon markets is simple; if polluters pay for their carbon emissions, it shall provide them with a good enough reason to reduce emissions.

Under the Kyoto Protocol, the Clean Development Mechanism ('CDM') sets emission reduction targets for countries while incentivising developing countries to develop emission-reduction projects to earn certified emission reduction credits equalling one tonne of CO2.1 These certified emission reduction credits have also provided flexibility to industrialised countries to meet their emission reduction targets through trade.

Over the years, two kinds of carbon markets have evolved – compulsory and voluntary. Compulsory markets are constituted according to legislation(s) and regulated as specified. Voluntary carbon markets are private initiatives not necessarily regulated by a specific legal regime. Typically, third-party agents verify the credits obtained through voluntary carbon markets.

More recently, Article 6 of the Paris Agreement has enabled countries to cooperate voluntarily to achieve the emission reduction targets they set out in their NDCs.2Under this provision, a country can transfer the credits earned by reducing GHG emissions to help other countries meet their targets. While governments may transfer such emission reductions through authorisation, only one country may count them towards its NDC to avoid double counting and overestimating global emission reductions. As a party to the Paris Agreement, India has also made legislative efforts to achieve its NDC. Therefore, it is essential to understand the legislative foundation and framework for the carbon market in India.

Legal Framework in India

The Energy Conservation Act, 2001 ('Energy Conservation Act')

The Energy Conservation Act aims to promote energy efficiency and conservation and provides a framework for regulating energy consumption. The Bureau of Energy Efficiency has been constituted under the Energy Conservation Act to recommend standards and regulations for energy consumption.

The Central Government, under Section 14A of the Energy Conservation Act, has the power to issue energy savings certificates to designated consumers whose energy consumption is less than the prescribed norms and standards. The designated consumers can buy energy-saving certificates to compensate for exceeding these consumption norms and standards.

During the COP-26 summit in 2021, specific commitments were made by India, including commitments such as reducing carbon emissions by one billion tonnes by 2030. In addition, India also committed to building 500 GW of non-fossil energy capacity.3 As a step towards fulfilling India's NDCs, in December 2022, The Energy Conservation (Amendment) Act, 2022 ('Amendment Act') was passed by the Parliament. The Amendment Act empowers the Central Government to establish carbon credit trading markets in India. The Amendment Act also amends the Energy Conservation Act to facilitate achieving the COP-26 goals mentioned above by introducing concepts such as carbon credit trading and mandatory use of non-fossil sources.

The Amendment Act empowers the Central Government to specify a 'carbon credit trading scheme'.4 Under the exercise of such powers, the Central Government has specified the Carbon Credit Trading Scheme, 2023, as discussed under the heading 'Carbon Credits Scheme: Features' below. While the registered entities (i.e., any entity, including designated consumers, registered for the carbon credit trading scheme specified under clause (w) of section 14) shall be entitled to trade in such certificates, a carbon credit certificate can also be purchased by any other individual voluntarily. The Amendment Act empowers the Government to require specifically designated consumers to meet their energy consumption requirements; a share of such requirements has to be through non-fossil sources. Such designated consumers may include commercial buildings, transport sectors such as Railways and cement, mining, chemicals, and steel industries.

The Amendment Act replaces the 'Energy Conservation Code' with the 'Energy Conservation and Sustainable Building Code'. This Code provides norms and standards for energy efficiency and its conservation, the use of renewable energy and other green building requirements. It also extends the applicability of energy consumption standards to vehicles and vessels. The said Code shall apply to buildings (office and residential) that meet the specified thresholds. The Energy Conservation Act permits the state governments to lower such threshold requirements to bring more buildings within the ambit of the Code.

The Electricity Act, 2003 ('Electricity Act')

The Electricity Act provides a comprehensive framework for developing and generating power and the preparation of a National Electricity Policy and Plan for developing a power system based on optimal utilisation of resources such as coal, natural gas, nuclear substances or materials, and hydro and renewable energy sources.

The Central Electricity Regulatory Commission ('CERC'), constituted under the Electricity Act, regulates the Electricity market and, among other things, undertakes the function of tariff determination.

The Electricity Act also mandates the State Electricity Regulatory Commissions to specify terms and conditions to determine tariffs per the provisions of the Electricity Act. Concerning renewable energy, the terms and conditions set by these State Electricity Commissions have to be guided by the following:5

(i) the factors which would encourage competition, efficiency, economical use of the resources, good performance and optimum investments;

(ii) the promotion of co-generation and generation of electricity from renewable sources of energy;

(iii) the National Electricity Policy and tariff policy.

The CERC regulates Renewable Energy Certificates ('RECs') under the Electricity Act. The concept of RECs has been dealt with in greater detail here. The RECs aim to promote renewable energy sources and develop an electricity market. The RECs are also used by bulk purchasers such as discoms, open access consumers and other entities as specified by the concerned State Electricity Regulatory Commissions to fulfil their Renewable Purchase Obligation ('RPO') further to Section 86 of the Electricity Act. The RPO requires entities, as specified by the concerned State Electricity Regulatory Commissions to purchase a portion of their electricity from Renewable Energy sources.

A carbon credit certificate obtained under the 'carbon credit trading scheme' shall be issued to obligated entities who comply with the greenhouse gas emission norms as prescribed by the Central Government under the Energy Conservation Act. A carbon credit certificate, therefore, may meet the categorisation norms and standards applicable to renewable energy certificates and or energy savings certificates.

Clarity would be required to ascertain the interplay among the certificates mentioned above. There is also a need to avoid the problem of double counting.

The Ministerial Dilemma

The Government of India (Allocation of Business) Rules, 1961, framed under Article 77(3) of The Constitution of India, 1950, among other matters, sets forth the role and responsibility of the Ministry of Power. Under the said Rules, the Ministry of Power is responsible for::

(i) general policy in the power sector, and issues related to energy policy and coordination, and

(ii) energy conservation and energy efficiency pertaining to the power sector.

Under the Government of India (Allocation of Business) Rules, 1961, the Ministry of Environment, Forest, and Climate Change, regulates the following matters:

(i) 'climate change and related matters,

(ii) environmental norms, and

(iii) forestry.

In foreign jurisdictions such as the US, Switzerland and the UK, the Environment Regulator or Ministry is responsible for schemes on carbon credits and carbon markets.

It may be noted that the Ministry of Environment, Forest, and Climate Change has introduced the draft Green Credit Programme, 2023, to encourage farmers, local bodies, industries, and individuals, among others, to promote environmental actions across sectors voluntarily. The environmentally friendly initiatives under this Programme would make these individuals and organisations eligible to earn credits. However, for the determination and calculation of the status of NDCs, the relationship between carbon credits and green credits may cause the problem of duplicity, defeating the entire purpose of both these schemes. The definition of a 'green credit' under the draft Green Credit Programme, 2023, does not deal with converting green credit into carbon credit or vice versa.

Carbon Credit Scheme: Features

The Central Government notified the Carbon Credit Trading Scheme, 2023 ('Carbon Credit Scheme') in the gazette on June 28, 2023, under Section 14(w) of the Energy Conservation Act. The Carbon Credit Scheme defines a 'power exchange' as "an electronic trading platform under Regulation 2(1)(as) of the Central Electricity Regulatory Commission (Power Market) Regulations, 2021."

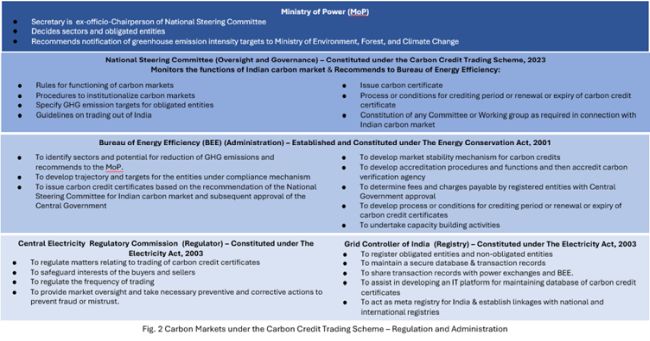

The Carbon Credit Scheme constitutes a National Steering Committee which shall include members from various ministries such as the Ministry of Power, Ministry of Environment, Forest and Climate Change, Ministry of Finance, etc.6 The functions of the National Steering Committee involve recommending to the Bureau of Energy Efficiency in respect of carbon credit certificates, Indian carbon market rules, regulations and procedures for the trading of carbon certificates and other related functions.

Per the Carbon Credit Scheme, the Central Electricity Regulatory Commission ('CERC') shall act as the regulator for the Indian Carbon Markets.7 The Bureau of Energy Efficiency shall act as the administrator of the Indian Carbon Markets.8

There shall be accredited carbon verification agencies for verification activities under the Carbon Credit Scheme. These agencies shall be provided accreditation by the Bureau of Energy Efficiency with prior approval of the Central Government and on the recommendations of the National Steering Committee.9The Carbon Credit Scheme must specify the context under which verification activities shall be carried out., given that such agencies have no role in issuing carbon credit certificates. The Grid Controller of India Limited shall discharge the role of the registry for the Indian Carbon market in compliance with the directions issued by the Bureau of Energy Efficiency from time to time.10

The Carbon Credit Scheme applies to 'registered entities' as defined under the Energy Conservation Act, "any entity, including designated consumers, registered for carbon credit trading scheme specified under clause (w) of section 14;". The Carbon Credit Scheme classifies these registered entities into obligated and non-obligated entities. Obligated entities shall be notified under the compliance mechanism, and the non-obligated entities shall be entitled to purchase the carbon credit certificates voluntarily.11

The Bureau of Energy Efficiency recommends to the Ministry of Power the sectors and obligated entities that shall come under the compliance mechanism. Under the compliance mechanism, the Central Government shall notify greenhouse gas emission norms under the Carbon Credit Scheme, which shall be complied with by the obligated entities.

Under the Carbon Credit Scheme, detailed procedures and functions under the Indian carbon market are yet to be laid down. Therefore, there are specific measures that the Central Government shall undertake to lay a proper foundation for the Indian carbon market to achieve the goals and targets set out under the Paris Agreement and combating climate change.

Governance

Governance in the context of carbon markets means incorporating mechanisms and processes for issuing, verifying and trading carbon credits. It is important because the credibility and effectiveness of these markets shall be impacted significantly by the manner of governance of these carbon markets. Good governance of carbon markets is essential for achieving the objective of reducing greenhouse gas emissions and attaining the goals of sustainable development.

For effective governance, the carbon markets should be inclusive and transparent. They should promote diversity in participation while also having flexible and scalable processes. To achieve this, the entities and bodies involved in the functioning and regulating the Indian carbon market are synchronised and observe the highest standards of transparency and accountability.

While the transition to greener energy has its benefits, 'greenwashing' can cause significant harm to this transition. 'Greenwashing' occurs when the true impact of the actions of an entity is not reflected transparently in the contributions they claim to have made. The concept of carbon markets has also received criticism for enabling such practices.12 The Bureau of Energy Efficiency, in particular, needs to ensure that the appointment of carbon verification considers the authenticity of its carbon certificate, which shall ensure that greenhouse gas reductions occur in the true sense and not just on paper.

A healthy human system is equally essential for a healthy environmental system. In order to address the challenges faced due to climate change through well-informed decisions, governance of such carbon markets shall be inclusive, multidimensional and flexible at every level of engagement. The law shall incorporate provisions promoting equitable participation, sanctions for punishing malicious actors and safeguarding whistle-blowers.

To ensure equitable decision-making and benefit distribution, vulnerable populations and women shall be empowered to participate and participate in the carbon market governance.13 This shall enhance the viability and credibility while also addressing the flawed design of the market and industry players acting in an isolated system.

An effective market shall create conditions conducive to developing products that are dynamic and adaptable to the diverse issues and challenges the stakeholders face. Ensuring the participation of a distributed, diverse and decentralised group of players shall build faith and trust in the efficiency and validity of these carbon markets while also helping scale them up.

Viewpoint

At present, the greatest existential threat that humanity faces is climate change. Much action on the part of countries is required to respond to this threat. There has to be a transition from fossil fuels to non-fossil fuels in a very comprehensive manner to ensure that countries meet the goals and commitments set by them.

The main issues that the carbon markets in India shall address are:

- i) reducing emissions at the earliest

- ii) protect and develop carbon sinks for removing carbon dioxide from the atmosphere.

It is argued that priority must be given to reducing greenhouse gas emissions, and the Government should use carbon offsets as a last resort only. The Carbon Credit Scheme is the beginning of establishing the Indian carbon market. As discussed above, the problem of greenwashing may be a challenge to the transition to greener energy and reduced emissions. The consequences of greenwashing can be far-reaching. It might lead to confusion among consumers and make them sceptical about whether there is an actual contribution to environmental efforts. Such increased scepticism may also harm the legitimate attempts that companies are undertaking towards becoming more environmentally friendly. In the end, such inaccurate environmental practices will not just hurt the consumers and the firms but, most importantly, harm our environment.

Given that the Indian carbon market is still nascent, the foundations for such a market should be based on transparency that involves complete and accurate reporting of greenhouse gas emissions and carbon credits, providing reliable information to investors to enable them to make informed decisions. The accreditation agencies shall also ensure the credibility and accuracy of the certificates obtained by projects under the Carbon Credit Scheme, providing investors with confidence in their investment and creating a positive environmental impact.

These steps shall help achieve the true objective of the Carbon Credit Scheme rather than just creating an industry that permits emissions in exchange for money, thereby never contributing towards climate change positively. The manner in which we implement and plan these potential solutions shall determine the future of our planet.

Footnotes

1. What are carbon markets, and why are they important? UNDP GLOBAL CLIMATE PROMISE, May 18, 2022. available at: https://climatepromise.undp.org/news-and-stories/what-are-carbon-markets-and-why-are-they-importan

2. id.

3. "India's Stand at COP-26", Press Information Bureau, Ministry of Environment, Forest, and Climate Change, February 3, 2022.

4. Section 2(db), The Energy Conservation Act, 2001.

5. Section 61, The Electricity Act, 2003.

6. Section 3, Carbon Credit Trading Scheme, 2023.

7. Section 7, Carbon Credit Trading Scheme, 2023.

8. Section 5, Carbon Credit Trading Scheme, 2023.

9. Section 9, Carbon Credit Trading Scheme, 2023.

10. Section 6, Carbon Credit Trading Scheme, 2023.

11. Section 11, Carbon Credit Trading Scheme, 2023.

12. Jennifer L, Inside Carbon Markets: Problems, Causes, and Potential Solutions, CARBON CREDITS, (March 2, 2023). available at: https://carboncredits.com/inside-carbon-markets-problems-causes-and-potential-solutions/ .

13. Recommendations for the Digital Voluntary and Regulated Carbon Markets, WORLD ECONOMIC FORUM, 5, (March 2023).

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.