I. INTRODUCTION

Greenhouse Gases ("GHGs") emissions as a result of human activity have had a most catastrophic impact on climate change and global warming since the mid – 20th century.1 As per an analysis conducted by the International Energy Agency ("IEA"), carbon dioxide emissions rose by 6% in 2021 to 36.3 billion tonnes, marking the highest peak point, as the world economy rebounded from the Covid-19 crisis.2

Countries worldwide have been discussing ways to combat climate change since the early 1990s3. These discussions have led to the implementation of various important accords, including the Kyoto Protocol and the Paris Agreement. One of the major concerns faced by several countries, more specifically developing countries, while committing to sustainability goals is the impact it might have on their overall economy owing to the adoption of expensive cleaner technologies in every industry. To address this problem, both Kyoto Protocol and Paris Agreement developed and regulated the concept of carbon pricing.

II. CARBON PRICING

Carbon pricing is an increasingly popular mechanism that captures the external costs of emitting carbon. It effectively shifts the responsibility of paying for the destruction of the environment from the public to the GHG emitters. This gives emitters the option of either reducing their emissions or continue emitting by paying for their emissions. It creates a price signal that reduces or regulates GHG emissions and at the same time provides a strong financial case for shifting investments away from high-emission fossil-fuels based technology towards cleaner technology.4

III. CARBON CREDITS

For carbon pricing to work successfully, the emissions are reduced to a measurable unit that can be tradeable. Carbon credits are such measurable and verifiable emission reductions from certified climate action projects. A carbon credit is a tradable permit or a certificate that provides the holder of the credit, the right to emit one ton of carbon dioxide or an equivalent of another GHG, acting as an offset for producers of GHGs.

IV. INTERNATIONAL TREATIES

i. Kyoto Protocol:

The Kyoto Protocol was adopted in 1997 in Japan and entered into force in 2005. More than 170 countries adopted the Kyoto Protocol which set legally binding targets for some industrialised countries requiring them to reduce their emissions by an average of 5% below the levels emitted during the year 1990 over a period of five years i.e., 2008 to 2012 and established a system to monitor countries' progress. But the treaty did not compel developing countries, including major carbon emitters China and India.5

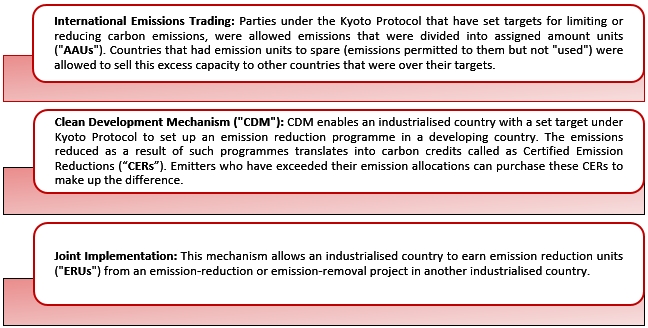

Under the Kyoto Protocol, countries were to meet their targets primarily through national measures. It also offered additional means to meet their targets by way of three market-based mechanisms:

ii. Paris Agreement:

In 2015, at the COP 21 Sustainable Development Summit held in Paris, all participants of United Nations Framework Convention on Climate Change ("UNFCCC") signed a legally binding international treaty on climate change. While the Kyoto Protocol required only developed countries to reduce emissions, the Paris Agreement recognised that climate change is a shared problem and called on all countries to set emissions targets through 'nationally determined contributions' ("NDCs").6

Article 6 of the Paris Agreement allows countries to voluntarily cooperate to achieve emission reduction targets set out in their NDCs. Article 6.4 of the Paris Agreement is similar to the CDM and establishes a mechanism for trading GHG emission reductions between countries.

Paris Agreement also counters for the prevention of double counting of emission reductions. Double counting refers to two countries separately accounting for the same GHG reductions resulting from an emission-reduction project. The international transfer of emission reductions should not lead to higher total emissions than if the participating countries or entities had met their targets individually. Article 6.2 of the Paris Agreement establishes such an accounting framework. It avoids double counting through a form of double-entry bookkeeping, referred to as "corresponding adjustments." The country selling emission reductions makes an addition to its emission level, and the country acquiring the emission reductions makes a subtraction. Both countries prepare an emissions balance in which the country's target level is compared with its emissions, adjusted for any international transfers of emission reductions.

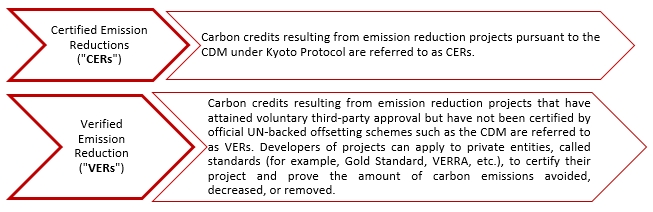

Kyoto Protocol was extended until December 2020 through Doha Amendment and has not been extended further. While Kyoto Protocol was never withdrawn, Paris Agreement in effect has superseded the Kyoto Protocol as the principal regulatory instrument. At COP 26, it was notified that the CDM would cease in relation to emission reductions occurring after 31 December 2020. No further registration of projects or renewal of crediting periods for CDM projects or further CERs can take place under the CDM for emission reductions after such date. Instead, those requests will need to be made under Article 6.4 of the Paris Agreement which provides for a new international carbon market mechanism to contribute to the mitigation of GHG emissions and support sustainable development. CDM projects that transition to the mechanism under Article 6.4 will be deregistered from the CDM with effect from the date of the transition. There are temporary measures in place to allow the CDM Executive Board to take certain decisions until the transition can take place.7

V. INTERNATIONAL TREATIES

A carbon market is a trading system where you can buy and sell carbon credits and make the reduction in emissions a tradable asset. There are two types of carbon markets as given below:

- Compulsory market: They are compulsory and regulated by governments and companies to account for their emissions. Designated entities are required to comply with mandatory and legally binding caps on the total amount of carbon dioxide they are allowed to emit per year. Failure to comply with these mandatory caps results in fines or legal penalties.

- Voluntary market: Emissions reductions in the voluntary market are verified by independent third-party agents (like Gold Standard, VERRA, etc.) and are not certified by a regulatory authority.

VI. INDIAN REGULATORY FRAMEWORK

While there are various energy saving schemes like the "Perform Achieve Trade" scheme ("PAT Scheme") and "Renewable Energy Saving Certificates" scheme ("REC Scheme") that govern the trade of energy savings by some of the designated entities, there is no established regulatory framework for the domestic carbon market in India. Both PAT scheme and REC scheme work on similar principles of energy savings.

Under PAT scheme, designated consumers who overachieve the energy consumption norms and standards allocated to them are issued Energy Savings Certificates ("ESCerts") by the Bureau of Energy Efficiency (BEE). These designated consumers then trade these ESCerts on energy exchanges with other designated consumers who underachieve their consumption norms.

Under REC Scheme, the aim is to promote renewable energy and facilitate the compliance of renewable purchase obligations ("RPO") (A mechanism under the Electricity Act, 2003 according to which the obligated entities have to purchase a certain percentage of electricity from renewable energy sources, as a percentage of the total consumption of electricity). Renewable Energy Certificates ("RECs") are regulated by the Central Electricity Regulatory Commission (Terms and Conditions for Renewable Energy Certificates for Renewable Energy Generation) Regulations, 2022. The eligible entities as per these regulations are issued RECs which can be traded on energy exchanges or through electricity traders and purchased by obligated entities to meet their RPO compliance.

The Indian government has recently taken the following steps towards the introduction of a domestic carbon market:

- In October 2021, India's Bureau of Energy Efficiency (BEE) presented a draft blueprint for the phased introduction of a national cap-and-trade system in India, providing for the introduction of a voluntary market in the first phase.

- On 8 August 2022, the Lok Sabha passed an amendment ("Bill") to the Energy Conservation Act, 2001.8 Section 14 of the bill grants the Indian central government or any authorized agency the power to issue "carbon credit certificates" for the reduction of carbon emissions to registered entities. These credits can then be sold in the market. The amendment bill will be presented to the Upper House of Parliament (Rajya Sabha) in December 2022. If adopted and assented to by the President of India, it will become an act of Parliament and come into force on such date as may be notified by the central government.

India is a party to both the Kyoto Protocol and the Paris Agreement. In pursuance of the Kyoto Protocol, it established the National CDM Authority (NCDMA) under the Ministry of Environment, Forest, and Climate Change ("MoEFCC") to provide a single window clearance for CDM projects in the country. Now, for implementing its commitment under the Paris Agreement, MoEFCC has constituted a high-level inter-ministerial Apex Committee for Implementation of the Paris Agreement ("AIPA") under the chairmanship of the Secretary, MoEFCC. One of the key functions of AIPA would be to operate as a national authority to regulate carbon markets in India under Article 6 of the Paris Agreement, formulate guidelines for the consideration of projects or activities under Article 6 of the Paris Agreement, issue guidelines on carbon pricing, market mechanism, etc.9

VII. CONCLUSION

As per India's updated NDC under the Paris Agreement, it now stands committed to reducing the emissions intensity of its GDP by 45 percent by 2030, from the 2005 level and achieving about 50 percent cumulative electric power installed capacity from non-fossil fuel-based energy resources by 2030.10

While India has taken a step forward in building its carbon market, there is a need for setting up a regulatory framework and issuing policy guidelines that provide clear mandates on emission reductions. There are multiple gaps that need to be addressed, including timelines for implementation, the nature of the registered entities, how the credits will be generated and certified, and what agencies will be involved.

Carbon markets will open up new horizons for businesses involved in developing, consulting, and trading carbon credits and can be highly beneficial for developing nations like India as it will make sure that economic activities are carried out while taking carbon-related targets into consideration.

There appears to be a regulatory intent to impose a ban on the export of carbon credits. The government before implementing such a ban on the export of carbon credits must evaluate the demand for carbon credits in the domestic market, the effect on the existing renewable energy projects in India, international relations, and the effect on foreign investments for the generation of carbon credits. Shying away from a global market for carbon credits may well be inappropriate for an economy poised to evolve multiple sustainable solutions to this problem, unless the intent is to artificially deflate the price – which will benefit only the domestic polluters.

Watch out for curve balls!

Footnotes

1. IPCC (Intergovernmental Panel on Climate Change). 2021. Climate change 2021: The physical science basis. Working Group I contribution to the IPCC Sixth Assessment Report. Cambridge, United Kingdom: Cambridge University Press.

2. Available at https://www.iea.org/news/global-co2-emissions-rebounded-to-their-highest-level-in-history-in-2021

3. Global Climate Agreements: Successes And Failures

4. Available at https://unfccc.int/about-us/regional-collaboration-centres/the-ciaca/about-carbon-pricing

5. Available at https://unfccc.int/kyoto_protocol

6. Available at https://uk.practicallaw.thomsonreuters.com/4-205-2962

7. Available at https://uk.practicallaw.thomsonreuters.com/4-205-2962

8. Available at https://icapcarbonaction.com/en/news/india-establishes-framework-voluntary-carbon-market-and-outlines-pathway-towards-cap-and-trade

9. Available at https://pib.gov.in/PressReleaseIframePage.aspx?PRID=1677630

10. Available at https://pib.gov.in/PressReleaseIframePage.aspx?PRID=1847812

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.