- within International Law topic(s)

- in United States

- with readers working within the Accounting & Consultancy and Law Firm industries

- within International Law topic(s)

- in United States

- with readers working within the Accounting & Consultancy and Law Firm industries

- within International Law, Energy and Natural Resources, Food, Drugs, Healthcare and Life Sciences topic(s)

For the last five years, Press Note 3 (or PN3, as it is more commonly known) introduced by the Government of India in April 2020 to regulate investments from land bordering nations has been at the center of a large majority of Indian deal making. The expansive scope of the press note – which requires that investments from and acquisitions by an entity based in a country which shares a land border with India, or where the "beneficial owner" of the investment is situated in a country which shares a land border with India, will be subject to prior Government approval – meant than both direct investments into India as well as global transactions with an India element, controlling as well as minority investments, and fresh investments as well as secondary acquisitions, were subject to the PN3 test (please refer to our earlier note, Press Note 3 of 2020: A First Anniversary Edition, which analyses the regime in detail).

This note discusses the evolution of the regime since its introduction and examines certain recent trends in relation to the press note.

Developments (or lack thereof!) in the regime

Although issued against the backdrop of the Covid-19 pandemic, the press note has managed to exist almost "as-is" in the Indian statute books. Press reports have from time to time raised hopes of a potential relaxation of the requirement at several points in the past, but nothing as such found its way through. Quite to the contrary, other regulations have been amended progressively to further tighten the PN3 framework as follows:

Touchstone take: The Government seems inclined to continue with the PN3 regime as-is at least for now.

PN3 approvals

The larger issue over and above relaxation of the PN3 regime has historically been that the Government was not forthcoming in approving investment proposals that were submitted for approval under the press note. Until April 2024, it was reported that the Government had received around 526 proposals from PN3 impacted investors, of which around 201 proposals were rejected and only around 124 proposals were approved. The remaining around 201 proposals were either withdrawn or were still held up. The initial couple of years of the press note saw a flurry of activity with a number of applications filed, but there was very little interaction with the Government and long periods of silence.

There has, however, been a slight softening of the Government's stance since early 2023, with applications now being considered on merit on a case-to-case basis. There is also now active engagement from the relevant departments and ministries almost immediately upon filing the application. Along with the traditional follow-on requests from the Government, this is being done by way of prompt outreach to the senior officials and directors of the investor, physical inspections of, and inquiries regarding the project site and offices and understanding the antecedents of the investor.

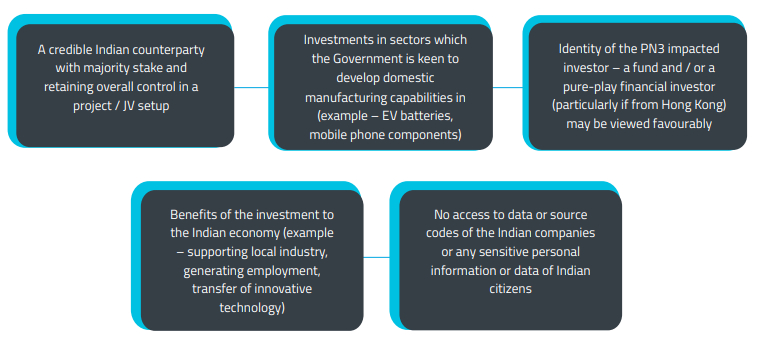

Although nothing has been disclosed officially by the Government, based on some recent precedents, it seems that there are certain relevant factors which could play a role in increasing the possibility of a positive outcome. These include:

Whilst the typical timelines for a PN3 application continue to be between eight to nine months from the time of filing the application, we have seen approvals coming through within a significantly shorter timeframe of five months in cases where one or more of the abovementioned factors were present

Touchstone take: Whilst the overall uncertainty around the fate of applications continues to subsist, there now seems to be an intent to process the applications, follow the timelines in all earnestness and to consider granting an approval where the fact pattern supports such an outcome.

Way Forward

Whilst on one hand, perhaps because of the stand-off with the United States, the Chinese Government has extended an olive branch to India both in terms of trade and travel of Indian personnel. On the other hand, however, the bonhomie between Pakistan and China shows no signs of abating even with the recent tensions on the Indo-Pak border. Leaving aside the geo-politics, press reports suggest that certain prominent Chinese entities, which have historically been keen to retain control over their projects in India, are now reconciling to retaining just a minority stake in order to be able to continue to operate in, and access, the Indian market.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.