Income tax is a direct tax that a government levies on the income of its residents or the non-residents if the source of income is in India.

To calculate the amount of income tax payable to the Government, you will first need to compute your total income for the financial year. Should this income be real income? Or some receipt which prima facie are not in the nature of income may also be 'deemed' to be your income for the year? There are numerous instances in which you may be required to pay income tax on the receipts which are not necessarily in the nature of income but is regarded as your 'deemed income' by virtue of the deeming provisions of the Income Tax Act. One must be alert and cautious with regards to these kinds of receipts or deemed income instances.

Income is defined under Section 2(24) of the Income Tax Act which is an inclusive defination of income. This means that the Act specifically defines certain nature of receipts which are regarded as income of the assessee and there could be certain other nature of receipts which, though may or may not be in the nature of income, may also be regarded as or deemed as the income of the assessee.

There are certain receipts which are not real income but with this deeming fiction in the Act, are regarded as income and these kinds of income too are subject to income tax.

Therefore, it is extremely important to understand which are the nature of these kind of receipts which are not in the nature of income but which will be deemed as income and tax liability arises on such deemed income. Let us examine a few of them:

Section 2(22)(e ) – deemed dividend:

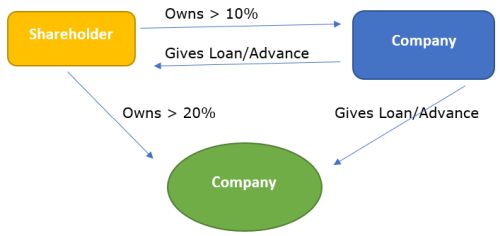

If a Company (which is not a company in which public are substantially interested) makes any payment by way of loan or advance to a shareholder, who holds not less than 10% of the voting power in the company, such receipt will be deemed to be dividend income for the receiving shareholder.

This section also covers instances where, if such company gives loans or advance to any concern in which such shareholder is a member/partner beneficially holding at least 20% of its income, such receipt will also be deemed to be dividend income for the receiving shareholder.

Albeit, the amount of such deemed dividend will be restricted to the accumulated profits in the company.

So, if a Pvt. Ltd. Company gives a temporary loan to one of its shareholders (say ABC) holding more than 10% of voting power, the said amount will be regarded as dividend income for such shareholder ABC.

Further, if a Pvt. Ltd. Company gives temporary loan to another company in which ABC owns more than 20% shares, the amount shall also re deemed as dividend income for ABC.

Therefore, even if such shareholder has received temporary money from the company which he has returned to the company after a certain period of time, the receipt will be deemed to be his dividend and he will be required to pay tax on such 'deemed income'.

Section 50C – Transfer of Immovable Property (IP) – deemed sale consideration:

Where an assessee transfers/sells an IP and the sale proceeds received as a result of this transfer is less than the "stamp duty market value" of the property, the stamp duty market value of the IP will be deemed to be the full value of consideration received on transfer of IP. It has however been provided that if the stamp duty market value is more by 5% of the sale consideration then the deeming fiction will not apply.

This can be illustrated by following table:

| Description | Actual deal | Deemed deal |

| Sale value of IP | 50,00,000 | |

| Stamp duty market value of the IP | 70,00,000 | |

| Indexed cost of the IP | 20,00,000 | 20,00,000 |

| Long Term Capital Gain | 30,00,000 | 40,00,000 |

| Tax payable @ 20% | 6,00,000 | 8,00,000 |

As can be seen from above, even if the assessee has actually sold the property for Rs. 50 Lakhs and received only Rs. 50 Lakhs on sale of the IP, the transaction value and the sale consideration is deemed to have been at Rs. 70 Lakhs since the stamp duty market value of that property is Rs. 70 Lakhs. Accordingly, the assessee's tax liability went up by Rs. 2 Lakhs.

Certainly, this section is inserted to curb black money transactions in property deals, but this has led to a lot of hardship and much higher effective rate of taxation for even some genuine transactions.

The assessee, in such cases, has an option to dispute/appeal the value adopted by the stamp valuation authority before the appellate authority or apply to the Assessing Officer to refer the valuation of the property to a Valuation Officer as prescribed under the Act. Accordingly, the value derived at by the appellate authority or the valuation officer will be considered as the final sale consideration for this transaction.

Section 50CA – Transfer of Shares – deemed sale consideration:

Where an assessee transfers Shares (other than shares quoted on recognised stock exchange), for a consideration which is less than Fair Market Value (FMV) of the share, such FMV shall be deemed to be full value of consideration received as a result of such transfer. The FMV of the shares shall be determined in accordance with Rule 11UA of the Income Tax Rules. The FMV in normal circumstances be calculated at "Net Worth" or "book value" of the company.

Again, in such a case, a shareholder is required to pay tax on the amount which he has neither actually received nor is he going to receive in future but on the amount which he is deemed to have received based on certain valuation principals.

Section 56(2(viib) – Issue of shares by Company – deemed income

When a Company (in which public are not substantially interested) receives any consideration, from a resident, for issue of shares exceeding the fair market value (FMV) of the share, the excess amount so received will be regarded as income of the company.

The Company can arrive at the FMV of the shares of the company by calculating the same at Networth or Book value of the company.

If the shares are issues at a price which is higher than the Net worth of the company, the same needs to be justified and supported by a valuation report as valued and certified by a certified valuer. The method of valuation is prescribed under Rule 11UA of the Income Tax Rules.

In such case, the company has actually received money against issue of its own shares at a premium, which essentially is a 'Capital Account transaction'. The company does not earn any income when it issues share at a premium. However, by virtue of deeming fiction, the premium which is received in excess of the FMV of the shares of the company so determined will be deemed to be income of the company and tax will be payable on the same by the company. Therefore, it is important for the company to get their shares valued from a registered valuer whenever it issues share at a premium, higher than the FMV of the shares. It is worthwhile to mention here that this deeming fiction does not apply when the shares are issued to a non-resident.

Section 56(2)(ix) – Forfeiture up on failed negotiation

If an assessee has received any sum of money during the course of negotiation for transfer of an capital asset, which is in the nature of advance and if the negotiation does not result into a deal of transfer of the capital asset and if the assessee forfeits the advance money so received, the money so received will be deemed to be the income of the assessee. Earlier, this advance receipt would go on to reduce the cost of the capital asset but now the section is amended to state that the advance so received and forfeited will be regarded as the income of the assessee.

In addition to the above, there are various instances where even though a receipt of money that prima facie does not represent income, is treated as income under a deeming fiction on which tax is payable.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.