- within Corporate/Commercial Law topic(s)

- with Inhouse Counsel

- in Ireland

- with readers working within the Retail & Leisure and Law Firm industries

1. INTRODUCTION

ESG reporting is a form of corporate disclosure that outlines an organization's commitments, endeavours, and advancements concerning environmental, social, and governance (ESG) aspects. While businesses have historically focused on reporting financial and operational metrics, ESG reporting emerged as a newer practice in the early 2000's.1 The acronym ESG encompasses an organization's sustainable and ethical impacts on the environment, society, and governance. These ESG considerations are now pivotal in shaping corporate strategies and performance.

A globally unified approach to establishing sustainability reporting standards is imperative for several reasons. Since, climate change and the Sustainable Development Goals (SDGs) necessitate a worldwide perspective, the Businesses operate within intricate global value chains, confront global risks, and secure funding from international investors including adoption of a shared language for sustainability reporting standards, which benefits investors, companies, and various stakeholders by streamlining comparisons.

Traditionally, financial data has been documented in corporate reports, while sustainability information has been presented separately in sustainability reports. However, the recognition of how sustainability issues can profoundly impact a company's long-term value creation has led to an increasing demand for the disclosure of ESG information within mainstream corporate reporting.

In recent years, substantial advancements have been made in the realm of ESG reporting. Corporations, investors, and regulators now acknowledge the significance of sustainability and responsible business practices. Nevertheless, organizations must ensure that their ESG reporting is meaningful and actionable for their stakeholders to maintain credibility.

2. HISTORICAL EVOLUTION OF ESG REPORTING

In the 1960s, the rise of socially responsible investing (SRI) was driven by increasing environmental degradation and growing awareness of social rights issues. However, it wasn't until 1992, during the first Earth Summit hosted by the United Nations in Rio de Janeiro, that ESG (Environmental, Social, and Governance) frameworks were developed. The United Nations Framework Convention on Climate Change (UNFCCC), a binding international environmental treaty, was signed by 154 nations during this summit. This incident was a turning point that sparked the development of ESG frameworks.

ESG issues gained prominence in 2015 as the Sustainable Development Goals (SDGs) were formed by the UN. These objectives seek to fulfill fundamental requirements in developing nations, such as nutrition and affordable housing, empower individuals with decent jobs and education, and ensure long-term environmental safety.

The UN Framework Convention included the Paris Agreement as of the same year. Its main goal was to keep global warming far below 2 degrees Celsius, ideally 1.5 degrees Celsius, in comparison to pre-industrial levels. This underscored the necessity of combating climate change and reaffirmed the significance of ESG factors in corporate decision-making.2

These recent achievements in environmental and sustainability reporting signal a significant change in the direction of more accountability and transparency in solving urgent global concerns. The Task Force on Climate-Related Financial Disclosures (TCFD), established in 2017 with the goal of improving the disclosure of climate-related financial information, started the momentum, which carried over to projects like the OECD's analysis on the transition to a net-zero economy in 2020. The commitment to fight climate change globally was further cemented at the COP26 meeting of the United Nations in 2021. A strong intention to standardize sustainability reporting techniques was made evident by the founding of the International Sustainability Standards Board (ISSB) and the launch of the European Sustainability Reporting Standards (ESRS) in 2022. With the official release of the ISSB Standards in 2023 and the implementation of the Corporate Sustainability Reporting Directive (CSRD) of the European Union, there is now a more comprehensive and cogent framework for businesses all over the world to report their environmental and social impacts.

ESG Framework have become an important aspect these days, since there is an increasing need for companies to adopt an ESG reporting method nowadays to prioritise the welfare of the world's population. These reporting methods helps in maintaining transparency and accountability to stakeholders and holds values that align with the community and their clients.

3. SIGNIFICANCE OF ESG REPORTING IN THE GLOBAL BUSINESS ENVIRONMENT

Environmental, Social, and Governance (ESG) reporting has significantly increased over the past few years, which has prompted the creation of numerous norms and frameworks to help businesses disclose their sustainability practices and accomplishments. ESG data is essential for providing firms with a thorough understanding of their governance processes, social responsibilities, and environmental effect. Companies can identify areas where they can improve and put measures into place to improve their sustainability performance through the gathering and analysis of ESG data. Companies can use this information to set relevant goals, monitor their progress, and inform stakeholders about their sustainability initiatives.

The importance of ESG reporting lies in the transformation it brings to how companies disclose information and in its broader goals for the company and its internal and external surroundings. For businesses, ESG reporting signifies a shift in how they perceive and measure 'value.' Companies are now required to consider creating value not only for their shareholders but for all stakeholders, including customers, employees, the environment, society, lenders, and credit rating agencies, particularly those focusing on ESG performance. Stakeholders, such as investors, customers, employees, and regulators, are increasingly seeking transparency and accountability from companies concerning their ESG practices. ESG data equips organizations to meet these expectations by providing trustworthy and standardized information on their sustainability performance.3

As the reporting of material ESG topics becomes more widespread, the need for data curation and standardization is also increasing. There is a growing recognition that for companies to succeed in the long term, they must prioritize environmental & social issues and monitor their ESG data closely.

4. EVOLUTION OF ESG IN THE MIDDLE EAST COUNTRIES (MENA)

The Middle East has been increasingly focusing on climate and sustainability efforts, with Egypt hosting COP27 and the UAE set to host COP28. The region's engagement with Environmental, Social, and Governance (ESG) principles predates these COP events and traces back to the signing and adoption of the Paris Agreement during COP21 in December 2015. This landmark agreement signaled the Middle East's commitment to achieving the Sustainable Development Goals (SDGs) and laid the foundation for their ongoing efforts in the areas of environmental responsibility and sustainability. Since then, the region has been actively evolving and strengthening its focus on ESG initiatives. In the Middle East and North Africa (MENA) region, countries are taking proactive steps to contribute to the advancement of ESG principles. This period marked a turning point as solar electricity and wind power became economically competitive with fossil fuels in some areas. Several countries, including Qatar and Bahrain, released ESG guidelines, while Egypt issued its first green sovereign bond. Notably, Saudi Arabia and the UAE launched ambitious sustainability initiatives, aiming to address climate change and reduce emissions.4

COP27 was held, bringing national pledges to combat climate change to the forefront. The Middle East Green Initiative and the Arab Coordination Group, which committed significant funding to promote an energy transition in line with long-term Net Zero pledges, were two examples of the large financing commitments made at COP27. This was especially remarkable in the context of Gulf States, whose economies have historically been dependent on the production of hydrocarbons. Significant green investments were announced by Saudi Arabia, Oman, and Saudi Aramco. The UAE also teamed up with the US for a $100 billion clean energy program. They stressed the significance of a practical transition that takes into account the need to supply global economies with inexpensive energy and guarantee global energy security.

The stock exchange(s) of each nation in the Middle East are principally in charge of leading activities relating to Environmental, Social, and Governance (ESG) disclosure and advice. Notably, many stock exchange in the region is a participant in the SSE Initiative of the United Nations. This shows a shared commitment to advancing sustainable and ethical investing methods in the financial markets of the Middle East. The Middle East will play a larger role in global climate action as a result of MENA Climate Week, which will take place in October 2023, and hosting COP28 in November 2023 in Dubai.5

5. GROWTH OF ESG REPORTING IN THE UAE

ESG (Environmental, Social, and Governance) developments in the Arab region, including the United Arab Emirates (UAE), have been influenced by several factors. These include the imperative to broaden energy resources, global demands for action due to the climate emergency, and the region's emphasis on sustainable financial practices and investments.6

As early as 2020, the UAE had taken proactive steps to encourage companies to invest in sustainability. One notable initiative was the requirement for listed companies to report on ESG matters.

In 2020, the UAE Securities and Commodities Authority (SCA) introduced the 'Corporate Governance Code for Public Joint Stock Companies,' which mandated that Public Joint Stock Companies listed on the Abu Dhabi Securities Exchange or the Dubai Financial Market publish an annual sustainability report. Article 76 of the Governance Code specified that these reports should comprehensively address how a company's operations impact the environment, society, and governance, particularly focusing on their positive contributions to society and the local economy. Furthermore, Listed Public Joint Stock Companies were instructed to adhere to the Global Reporting Initiative standards and sustainability guidelines issued by the Abu Dhabi Securities Exchange or the Dubai Financial Market, as applicable. It's important to note that, at this stage, this reporting requirement only applied to Listed Public Joint Stock Companies, while private and state-owned enterprises had the option to voluntarily adopt sustainability reporting.7

In more recent times, The Abu Dhabi Global Market (ADGM) through its Financial Services Regulatory Authority (FSRA), launched a pioneering sustainable finance framework, effective from July 4, 2023. In 2021, it has prioritized Sustainable Finance (SusFin) and achieved the distinction of being the first International Financial Centre worldwide to achieve carbon neutrality. Additionally, the Middle East and North Africa region saw significant progress in ESG with the issuance of sustainable bonds amounting to USD $8 billion in 2021. These developments underscore the significant strides that the Middle East has taken in advancing ESG initiatives.8

The United Arab Emirates (UAE) has been chosen as the host for the COP28 international climate conference in 2023, marking the third time a member of the Organization of the Petroleum Exporting Countries (OPEC) has hosted these talks.9 Dubai's ruler, Sheikh Mohammed bin Rashid al-Maktoum, who also serves as the UAE's prime minister, has reaffirmed the UAE's dedication to global climate action and the protection of the planet.

During COP27, hosted by Egypt in 2022, significant financial commitments were made by the Middle East Green Initiative and the Arab Coordination Group to support an energy transition aligned with long-term Net Zero goals. COP28 is expected to generate momentum for the Gulf States to advance their climate action goals and implement climate policies.10 The UAE has unveiled a strategic initiative to achieve carbon neutrality by 2050, with a particular focus on reducing carbon emissions from the oil and gas sector.11 Both the COP27 Presidency and the upcoming COP28 Presidency are committed to ensuring a transparent and inclusive process in the lead-up to the conference.

6. MANDATORY ESG REPORTING GUIDELINES BY ARAB EXCHANGES

A key focus of the UAE's Vision 2031 is the establishment of a sustainable green economy. This objective aims to foster sustainable development and infrastructure.

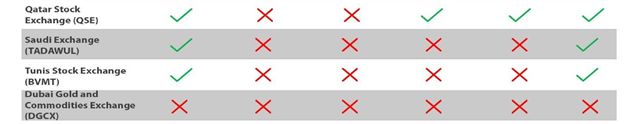

There are seventeen members in the Arab Federation of Exchanges (AFE), Out of which 10 exchanges are actively involved as partners in the SSE initiative. Additionally twelve exchanges are part of the world federation of exchanges (WFE). Among these eight, Arab stock exchanges have provided written guidance for ESG Reporting, with two of them having mandatory reporting regulations. Furthermore, four exchanges release annual sustainability reports, while six offer training programs related to ESG matters.12

Notably, the UAE has made significant progress in implementing its sustainable development strategy, particularly within the Dubai Financial Market (DFM) and the Abu Dhabi Securities Exchange (ADX).

The DFM, which lists 63 companies with a domestic market capitalization of $111 billion, and the ADX, listing 75 companies with a domestic market capitalization of $433 billion, have both been mandated to annually publish sustainability reports following the Global Reporting Initiative (GRI) standards. Moreover, these exchanges have played a proactive role in offering guidance and training on ESG reporting.13

Furthermore, with the approval and support of the Securities and Commodities Authority (SCA), the DFM has introduced an ESG stock index exclusively for UAE companies. This index is designed to monitor and assess the performance of businesses in the country that adhere to sustainability best practices. Additionally, the SCA has been instrumental in promoting ESG reporting by encouraging listed companies to disclose a comprehensive set of 32 ESG metrics and indicators.

ADX guidelines promote 31 ESG metrics and The Dubai Financial Market (DFM) includes a total of 32 metrics, which consist of 31 metrics similar to those found in the ADX, plus an additional metric i.e., (Collective Bargaining), aligning with the recommendations of the Sustainable Stock Exchanges (SSE) initiative and the World Federation of Exchanges (WFE). The aim is to foster sustainability within financial markets, in accordance with the UAE National Vision 2031 and the Abu Dhabi Economic Vision 2030.

7. ESG DISCLOSURE REQUIREMENTS INTRODUCED BY ADGM

Abu Dhabi Global Market (ADGM), through its Financial Services Regulatory Authority (FSRA), launched a pioneering sustainable finance framework, effective from July 4, 2023. This framework covers sustainability guidelines for investment funds, portfolios, bonds, and sukuks, and mandates ESG reporting for ADGM-based companies. This ESG Disclosures Framework, will be obligatory for companies based in ADGM (Abu Dhabi Global Market) meeting specific criteria14:

- Companies with an annual turnover exceeding $68 million.

- Companies holding a Financial Services Permission under FSMR (Financial Services and Markets Regulations) for regulated activities, such as managing collective investment funds or assets, provided their assets under management exceed $6 billion during any financial year.

ADGM-based entities not meeting these criteria have the option to voluntarily adopt the ESG Disclosures Framework.

Under the ESG Disclosures Framework, companies falling within its scope must incorporate in their annual accounts information that offers insights into the growth, performance, and status of the assets they manage or supervise. This information should align with an international framework pertaining to environmental, social, and governance (ESG) aspects, as specified in Section 399B(2) of Chapter 4A of the Companies Regulations 2020.15

It's important to note that companies do have the choice to exclude this information from their reports. However, they can do so only if they provide a well-justified, written explanation to the ADGM Registrar, elucidating why they have opted not to include it. This follows the "comply or explain" principle.

8. STRATEGIES FOR ENSURING ESG COMPLIANCE16

8.1 ESG Due Diligence:

ESG due diligence is the process of identifying and remedying environmental, social, and governance (ESG) risks. It helps to give insights into current practices of a company and examines operations of the company in-depth. This analysis helps in evaluating the gaps between the Company's actual performance and the desired performance in different areas of ESG. After analysing the gaps, recommendations are provided in order to outline the actions required to address these gaps.

8.2 Materiality Assessment:

The next step after analysing gaps and corrective measures is materiality assessment. It is a crucial for identifying and prioritising the main aspects of ESG issues faced by a company and implementing an effective roadmap and ESG Strategy for further improvement. During Materiality assessment certain objectives and goals are set which varies in accordance with the sector the company is in, since the risks assessed during materiality assessment are sector-specific.

8.3 Risk Matrix:

ESG Risk matrix categorizes risks and issues on the basis of its relevance and significance in a company and in accordance with its operations. The matrix helps in assessing the risks and assist a company in its decision making. These strategies are important for investors seeking transparency and accountability regarding internal processes of a company. With the help of a Risk Matrix the strategies and reporting standards adopted by a company facilitates effective goal setting and data driven ESG improvement.

8.4 ESG Reporting:

The disclosure of sustainability information is a pivotal step these days, where companies tend to communicate its non-financial and sustainability annual performance to its stakeholders and the public at large through the medium of ESG Reporting by using various reporting formats to report their contributions such as:

Annual Reports: Inform shareholders and stakeholders about activities and finances, briefly covering key ESG topics.

Sustainability Reports: Standalone reports following GRI standards, consolidating ESG information for investors and stakeholders.

Integrated Reports: Offer a concise view of strategy, governance, and performance, aligning with the International Integrated Reporting Council's framework and encouraging alignment with national strategies like UAE Vision 2021.

ESG reporting encompasses both qualitative and quantitative data and may include sustainability reporting. While annual integrated reporting is mandatory for listed companies in many parts of the world, the landscape is evolving, with several companies voluntarily reporting ESG parameters. The primary aim of reporting is to evaluate and identify risk-adjusted returns and ensure transparency and accountability in the company's journey towards sustainable growth.

8.5 Consequences of Non-Compliance:

Non-compliance with ESG reporting requirements in the UAE government's stringent timeline can lead to substantial financial penalties. According to the initial guidelines set by the SCA, public corporations that do not submit their ESG reports punctually may be subject to fines that can reach AED 50,000 (approximately USD 13,500), with the possibility of additional charges and accruing interest. In contrast, public companies that do not adhere to the GRI standards may encounter fines of up to AED 20,000 (around USD 5,500).17

9. CONCLUSION

The significance of ESG (Environmental, Social, and Governance) is on an upward trajectory, and it is poised to remain a pivotal aspect of business, investment, and regulatory landscapes.

The evolution of ESG has been driven by the recognition that businesses have a crucial role to play in addressing issues and challenges related to ESG which leads to long term sustainability and profits. It also is a means to evaluate the Company's performance and its commitment to sustainable practices which in turn holds greater transparency and accountability. Anticipated trends indicate that governments worldwide will intensify their efforts to bolster ESG regulations, while companies will increasingly adopt proactive measures to emerge as leaders in implementing robust ESG reforms. From a financial and investment perspective, the assessment of assets will involve a holistic consideration of ESG factors alongside traditional financial metrics. It is imperative for companies to recognize that ESG is not solely about ethical conduct; it also holds substantial implications for long-term returns on investment.

ESG represents a dynamic and expanding framework that is gaining prominence among investors on a global scale. Significant advancements are anticipated in this arena in the coming years, both within the UAE and internationally. The growth of ESG Reporting in UAE mirrors the global trend, with the Country's Financial Markets including DFM and the ADX, taking proactive steps to mandate ESG Disclosures. The introduction of Reporting guidelines by ADGM further reinforces the commitment of UAE to align with the International Standards. While regulators and public bodies play a pivotal role in shaping the ESG landscape, companies themselves bear the responsibility of ensuring that their ESG strategies are comprehensive and effective. In some instances, innovative business practices offering new environmentally sustainable services and products in the green finance market may take the lead in further evolving the regulatory framework. Companies in the Middle East are increasingly responding to the growing emphasis on climate-related concerns with greater determination. They are becoming more transparent in their reporting, sharing information about how their operations impact the environment with the public. Additionally, organizations are restructuring to establish a more systematic approach to managing sustainability efforts. This includes appointing senior executives with specific responsibilities focused on sustainability matters. These actions collectively reflect the region's commitment to ESG principles and its dedication to addressing environmental and social challenges.

ESG is a multifaceted paradigm that is not only here to stay but is poised to evolve, making it essential for all stakeholders to embrace and adapt to this transformative shift in the corporate and financial world.

Footnotes

1. https://www.techtarget.com/sustainability/definition/ESG-reporting

2. https://www.esggo.com/blog/a-brief-history-of-esg

3. https://illuminem.com/illuminemvoices/importance-of-esg-data-in-modern-business

4. https://www.pwc.com/m1/en/esg/survey.html

7. https://cms-lawnow.com/en/ealerts/2023/06/the-esg-journey-in-the-united-arab-emirates

8. https://cms-lawnow.com/en/ealerts/2023/06/the-esg-journey-in-the-united-arab-emirates

11. https://www.arabnews.com/node/2195436/middle-east

12. https://arab-exchanges.org/upload/4749websiteESG%20Report%202021%20English.pdf

14. https://www.morganlewis.com/pubs/2023/07/sustainable-finance-a-strategic-priority-for-the-uae

15. https://cms-lawnow.com/en/ealerts/2023/06/the-esg-journey-in-the-united-arab-emirates

16. https://www.centurymaxim.com/blogs/rise-of-esg-compliance-in-the-uae/

This article is for information purpose only. It is not intended to constitute, and should not be taken as legal advice, or a communication intended to solicit or establish commercial motives with any. The firm shall not have any obligations or liabilities towards any acts or omission of any reader(s) consequent to any information contained herein. The readers are advised to consult competent professionals in their own judgment before acting on the basis of any information provided hereby.