- within Environment topic(s)

- in European Union

- in European Union

- in European Union

- in European Union

- in European Union

- in European Union

- within Corporate/Commercial Law, Litigation, Mediation & Arbitration and Privacy topic(s)

- with readers working within the Law Firm industries

BACKGROUND

- https://www.mca.gov.in/Ministry/latestnews/National_Voluntary_Guidelines_2011_12jul2011.pdf

- https://www.sebi.gov.in/legal/circulars/aug-2012/business-responsibility-reports_23245.html

- https://www.sebi.gov.in/legal/circulars/nov-2015/format-for-business-responsibility-report-brr-_30954.html

- https://www.sebi.gov.in/media/press-releases/nov-2019/sebi-board-meeting_45022.html

- https://pib.gov.in/PressReleasePage.aspx?PRID=1645169

- https://www.sebi.gov.in/reports-and-statistics/reports/aug-2020/consultation-paper-on-the-format-for-business-responsibility-and-sustainability-reporting_47345.html

- https://www.sebi.gov.in/media/press-releases/mar-2021/sebi-board-meeting_49648.html

- https://www.sebi.gov.in/legal/circulars/may-2021/business-responsibility-and-sustainability-reporting-by-listed-entities_50096.html

INTRODUCTION

It is no secret that business operations across industries have a significant impact on various environmental, social and governance aspects. As employers/ members of the Board, it falls within their purview of responsibility to not only safeguard the interest of all the stakeholders but also hold them accountable for their contribution towards sustainable use of resources and further adhering to the requisite legal and statutory compliances.

With the primary objective of inculcating and bring business responsibility to the forefront, the Ministry of Corporate Affairs (MCA) issued 'Voluntary Guidelines on Corporate Social Responsibility' back in 20091. Thereafter, to establish a designated framework around responsible reporting, the MCA introduced the 'National Voluntary Guidelines' (NVGs) in 20112. The applicability of NVGs extended to business enterprises irrespective of the size or business of the organization. It was put forth to encourage transparency, integrity and accountability, while maintaining ethical business standards. The guidelines were framed keeping in mind various elements of environment, social and governance. Pursuantly, in 2019, the NVGs were revised and structured as the National Guidelines on Responsible Business Conduct (NGRBC)3. Comprising of nine pillars of business conduct and responsibility, these guidelines assist companies to adhere to the required compliance requirements in line with the applicable governing laws. The objective of the NGRBC is to promote inclusive growth and development of businesses, while ensuring that all aspects within the ambit of the ESG components are adequately covered.

CORPORATE SOCIAL RESPONSIBILITY

In 2013, the MCA made it mandatory for companies to carry out projects on Corporate Social Responsibility (CSR), thereby promoting social and economic welfare. This move by the Government made India the first country to have regulated and made it mandatory for certain categories of companies to carry out CSR activities. This mandate is provided for under Section 1354 read with Schedule VII5 of the Companies Act, 2013, Companies (Corporate Social Responsibility Policy) Rules, 20146 and Companies (Corporate Social Responsibility Policy) Amendment Rules, 20217, which outline the categories of companies to which the aforementioned is applicable and also lays down supporting rules & guidelines on the conduct, reporting and prescribed limit of minimum contributions pertaining to CSR activities. The Indian CSR regime has been integrated to promote social, economic and environmental well-being through responsible contribution by corporations.

BUSINESS RESPONSIBILITY REPORTING

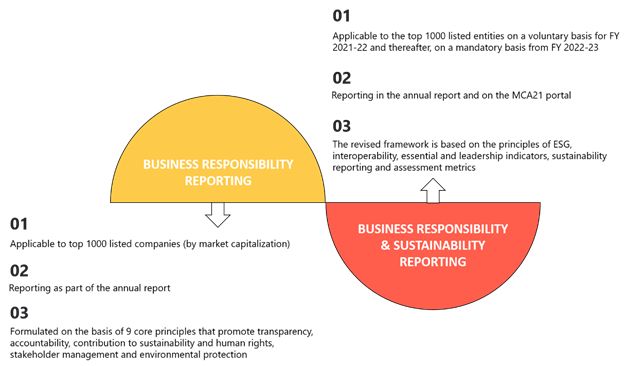

Business Responsibility Reporting (BRR) for top 100 listed companies (by market capitalization) was made mandatory by SEBI vide a circular dated 13th August, 20128. The reporting requirement was established on the framework of NVGs. Thereafter, in 20159, SEBI approved the extension of the BRR applicability to top 500 listed companies (by market capitalization); which was further revised to top 1000 listed companies (by market capitalization) vide SEBI circular issued in November 201910.

The Bombay Stock Exchange (BSE) made a pioneering move in 2017,11 by joining forces with the Sustainable Stock Exchange Initiative. It therefore, became the first exchange in Asia to undertake sustainability as a vital element of reporting. Subsequently, BSE benchmarked its reporting standards in line with the Global Reporting Initiative (GRI) principles. To enhance visibility, BSE encourages sustainability reports by companies to be featured on public domains, which assists companies to demonstrate leadership in sustainability with institutional investors.

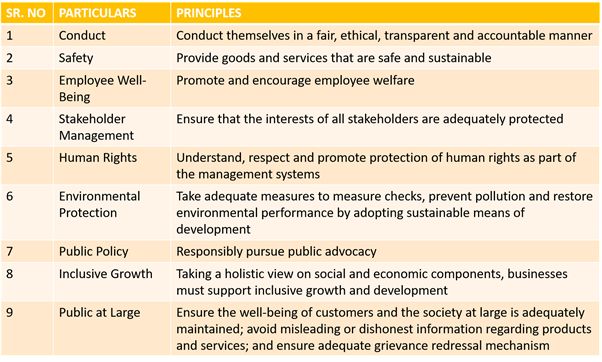

The core principles of BRR that help structure the report include integrity and ethics as an integral part of the business operations. The 9 core principles of the BRR guidelines include -

BUSINESS RESPONSIBILITY & SUSTAINABILITY REPORTING

In August 202012, the MCA released a Committee Report on BRR, which highlighted the need to revise the existing framework and incorporate a new reporting standard called the Business Responsibility & Sustainability Reporting (BRSR). As per the report, the Committee recommended a two-fold disclosure mechanism viz. a 'comprehensive format' and a 'lite version'. Bringing ESG Principles to the mainstream, the BRSR outline significant elements of all three components viz.

- Interoperability - This enables cross-mapping and reporting in line with global standards such as Global Reporting Initiative (GRI), Task Force on Climate-related Financial Disclosures (TCFD), Sustainability Accounting Standards Board (SASB) and so on, which may thus facilitate a smoother listing process at a global level.

- Essential (mandatory) and Leadership (voluntary) Indicators - The revised framework encourages the adaptation of the Key Performance Indicators (KPIs) model.

- Sustainability Reporting - The BRSR mechanism is expected to bring about greater levels of transparency and accountability amongst companies at the time of making disclosures. Furthermore, the disclosures are expected to provide substantial quantitative data demonstrating the efforts made by companies towards climate change and other social & regulator aspects.

- Assessment Metrics - Emphasizing on quantifiable metrics, the BRSR is likely to enable smoother measurement and comparability across industries.

In order to facilitate a smooth transition, in a Board meeting held on 25th March, 202113, SEBI observed the voluntary applicability of BRSR on the top 1000 listed entities (by market capitalization)for FY 2021-22, wherein, the same companies would mandatorily be obliged to such reporting from FY 2022-23.

Already having significant global presence, the Environmental, Social and Governance (ESG) regime has gained a remarkable traction in the Indian market as well. Especially the last few years have seen a surge in impact investments and monitoring sustainable risks and opportunities. SEBI and the MCA have played a vital role in addressing the demand for non-financial reporting in India. The BRSR framework is expected to meet global reporting standards that lay major emphasis on ESG related disclosures and also enhance contribution towards sustainable growth and development.

In continuation of its circular on BRSR applicability, the Regulatory Authority vide Circular14 dated 10th May, 2021 released the BRSR format15 detailing out the disclosures focused on different ESG parameters. The reformed framework includes additional requirements on sustainability reporting by listed entities and is expected to bring about greater transparency and accountability w.r.t. ESG components.

Some of the key elements enlisted under the new BRSR format include -

- Impact Investments - With the primary objective to create awareness around sustainability, the new disclosure requirements will enable companies to connect with the stakeholders and promote impact investments;

- Benchmark Industry Best Practices - The listed companies while preparing sustainability reports, can now cross-reference such reporting with internationally accepted disclosure parameters as set out under GRI, SASB, TCFD, etc. Furthermore, in case the data sought under BRSR format is already available under the annual report; the Regulatory Authority to avoid dual reporting, allows entities to cross reference such disclosure data either in the annual report or the sustainability report by categorically mentioning the page numbers for relevant information as per the BRSR format;

- Training and Awareness - The new format lays emphasis on the important of imparting adequate awareness and training sessions on aspects such as employee health & safety measures, anti-corruption issues and upskilling the workforce. Accordingly, the companies are required to disclose details of such training initiatives.

- Assessment Disclosures - With a key focus on environmental and social aspects, the new format seeks disclosures w.r.t. any Environmental or Social Impact Assessments carried out by the listed entities in compliance with relevant laws.

- Indicators - The revised framework promotes the adaptation of the Key Performance Indicators (KPIs) model and although voluntary, the Regulatory Authority encourages listed companies to report on leadership indicators as well.

KEY DIFFERENCES BETWEEN BRR AND BRSR

UNIVERSE OF GLOBAL LAWS

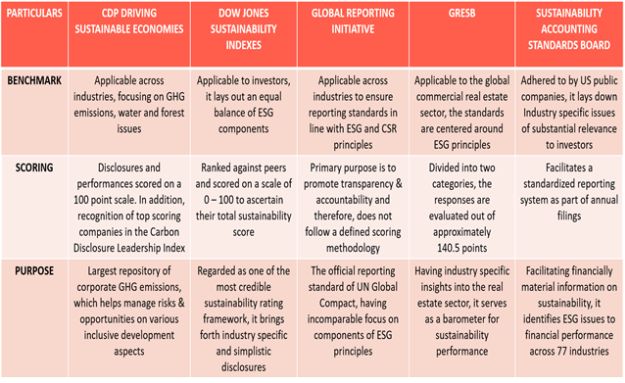

Emerged as a mainstream concept, sustainability is the talk of the town. At a global level, one will find numerous voluntary and mandatory disclosure frameworks that have been formulated to help businesses benchmark industry best practices. With ESG principles being a key trend and an underlying factor in most, if not all, of the existing frameworks; the following 5 are the reporting standards/ initiatives that are globally accepted and structured to provide adequate guidance and disclosure recommendations w.r.t. ESG components.

Introduced in 2015 by the Financial Stability Board (FSB), the Task Force on Climate related Disclosures (TCFD)16, the recommendations were put together realizing the financial risk to the economy on account of climate change. The TCFD recommendations encourage regular and consistent disclosures, which could be used across industries to provide essential information and help demonstrate to the stakeholders - responsibility, foresight and commitment to climate change. The final TCFD reporting recommendations are established on the pillars of governance, risk management, strategic approach, assessment metrics and targets. This enables increased investors' and lenders' confidence along with creating increased awareness around climate-change within the company, thereby resulting in better risk management.

In today's business scenario, before any investment decision, investors must gain insights into the company's financial and operational aspects alongside its governance and risk management approach. Integrating TCFD recommendations in financial reports are seen as a necessary step to encourage and promote informed investing and lending decision making. Another essential element of TCFD is that the reporting recommendations set therein are formulated after duly taking into consideration and in alignment with the standards set out under various other climate related reporting initiatives such as CDP, Climate Disclosure Standards Board (CDSB), Global Reporting Initiative (GRI), International Integrated Reporting Council (IIRC) and Sustainability Accounting Standards Board (SASB).

RECOMMENDATIONS ON SUSTAINABILITY REPORTING IN ANNUAL REPORTS

While preparing a sustainability report as part of the annual records, it is crucial to remember that this report is different from a CSR report and with the ever-increasing awareness and practices towards reducing climate change, it is imperative for companies to adopt a holistic approach w.r.t. sustainability reporting.

| Sr. No. | Particulars | Explanation |

| 1 | Overview |

Providing essential details pertaining to the business operations -

|

| 2 | Strategy |

Elaborate the strategy formulated to ensure sustainable development based on short and long-term parameters. Report whether or not, sustainability forms an integral part of the business culture. |

| 3 | Identification |

Step 1: Listing out the Key Performance Indicators (KPIs) Step 2: Applicability of the established KPIs in line with sustainability requirements. Step 3: Setting out targets, measuring outcomes and targets achieved periodically. |

| 4 | Highlight Impact of ESG of Finances |

Step 1: Drawing a parallel between ESG and its positive impact on enhanced financial outcomes. Step 2: Highlighting activities that contribute to the financial and reputational standing of the business. Step 3: Elaborate on concepts such as impact investments, reduced operational costs, commitment to climate change, and alignment with SDGs, etc. |

| 5 | Reporting framework |

Reporting initiatives such as the UN Sustainable Development Goals (SDGs), International Finance Corporation (IFC), Global Reporting Initiative (GRI), ISO 26000 Guidance on Social Responsibility, Task Force on Climate-related Financial Disclosures (TCFD), etc. In order to benchmark best practices and policies, it is imperative to gain industry insights and therefore, the sustainable report of a company should be put together in line with the principles as set out in the above disclosure initiatives and the parameters set therein. |

| 6 | Key components |

Any disclosure made under the sustainability report much follow the practice of transparency and accountability. While being engaging, the report must demonstrate the following -

|

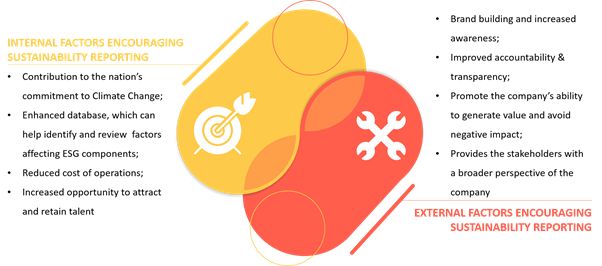

SOME OF THE KEY BENEFITS OF SUSTAINABILITY REPORTING

ALIGNMENT TO PARIS AGREEMENT

A legally binding international treaty on climate change which was adopted by 196 signatories in 2015, the Paris Agreement17 came into effect in November 2016. The underlying objective of the Agreement is to curb/ reduce the effects of global warming by bringing down the impact levels below 2 degrees Celsius as compared to pre-industrial levels. The signatories to the Agreement have pledged to make substantial efforts to monitor and control greenhouse gas emissions and achieve their respective targets of a climate-neutral world. Functioning on a 5-year model of evaluating progress, the signatory countries are required to submit their plan of actions and efforts, made so far, in achieving the Nationally Determined Contributions (NDCs) as part of their commitment to climate change action.

ALIGNMENT TO CLIMATE CHANGE

While climate change is an infamous concept that continues to have an alarming effect worldwide; the Paris Agreement on climate change also ignited a spark around topics such as low-carbon solutions, carbon neutrality and zero carbon emissions. In addition to this, issues like Diversity Equality & Inclusion (DEI) and drawing a balance between shareholders and other stakeholders are also noticeably being considered as part of the global sustainable growth and development process.

INDIA'S COMMITMENT TO INCLUSIVE DEVELOPMENT

India has been an active participant when it comes to commitment to inclusive development viz. safeguard human rights, environmental protection and sustainable growth. One of its significant global moves includes becoming a part of the United Nations Human Rights Council (UNHRC); pursuant to which India was also seen to have made substantial contributions in shaping the 17 UN Sustainable Development Goals (SDGs) that are established on the foundation of protecting human rights.

Businesses worldwide play a substantial role in terms of impact on the society and environment based on the business operations. It is globally recognized and understood that there is an urgent need to monitor social responsibility of businesses. Being in line with its commitment, India introduced the practice of Corporate Social Responsibility (CSR) and became a pioneer by becoming the first country to mandate the CSR regime.

While delivering a speech at the World Sustainable Development Summit 2021, the Prime Minister of India, Narendra Modi mentioned how the nation has already managed to drop off its emission intensity by 24% as against its target emission intensity of 33-35% by 2030. Additionally, India's Environment Minister, Prakash Javadekar also mentioned India's stance w.r.t. the Paris Agreement, who stated that India is one of the few countries that is on track with its commitment to successfully contribute and achieve its goals under the Agreement.

Some of the efforts undertaken by India over the past few years that demonstrate the nation's alignment and commitment to climate change include the following:

- India was recently facilitated with the CERAWeek Global Energy and Environment Leadership Award for its significant contribution towards environmental protection and upliftment;

- Substantial efforts are being made to increase its contribution to natural gas from 6% to 15% by 2030;

- The launch of the National Hydrogen Mission to encourage the use of hydrogen as a fuel;

- India is merely 2% short of its 2030 goal of achieving 40% of the electricity capacity of non-fossil fuels;

- India's commitment to human rights can be seen enshrined under Part III of the Constitution of India, which guarantees various socio-economic rights to the citizens of India. Moreover, in a landmark judgement the Supreme Court of India recognized the right to a clean environment as part of an individual's right to life under the Constitution;

- Collaboration with the Apex Committee for Implementation of Paris Agreement (AIPA) to increase the coordination among 14 key ministries and to further engage businesses, stakeholders and the U.N. on the successful delivery of the Paris Agreement;

- The India CEO Forum on Climate Change was held virtually on 5th November, 2020. With the participation of key industry leaders from across industries, in order to achieve the goals under the Paris Agreement, the 'Declaration of Private Sector on Climate Change' was signed by 24 leading private industries;

- As part of one of the flagship programs under the Swachh Bharat Abhiyaan, the 'Namami Gange' initiative facilitates corporates to either make monetary contribution to the Clean Ganga Fund or undertake activities such as adopting ghats, collecting or disposing of solid waste and so on.

CONCLUSION

The revised reporting mechanism is aimed at creating awareness and encourage better investment decisions. It is expected to align with global reporting standards and contribute to sustainable and inclusive development in the country. With SEBI enforcing ESG disclosures, the revamped reporting mechanism will enable more transparency and accountability; and also better demonstrate the sustainability awareness and performance standards of companies.

Footnotes

1. https://www.mca.gov.in/Ministry/pdf/CSR_Voluntary_Guidelines_24dec2009.pdf

2. https://www.mca.gov.in/Ministry/latestnews/National_Voluntary_Guidelines_2011_12jul2011.pdf

3. https://www.mca.gov.in/Ministry/pdf/NationalGuildeline_15032019.pdf

4. https://www.mca.gov.in/SearchableActs/Section135.htm

5. https://www.mca.gov.in/SearchableActs/Schedule7.htm

7. http://www.mca.gov.in/Ministry/pdf/CSRAmendmentRules_22012021.pdf

8. https://www.sebi.gov.in/legal/circulars/aug-2012/business-responsibility-reports_23245.html

10. https://www.sebi.gov.in/media/press-releases/nov-2019/sebi-board-meeting_45022.html

11. https://www.bseindia.com/static/about/sustainability.html#!#1

12. https://pib.gov.in/PressReleaseIframePage.aspx?PRID=1645169

13. https://www.sebi.gov.in/media/press-releases/mar-2021/sebi-board-meeting_49648.html

16. https://www.fsb-tcfd.org/recommendations/

With an expertise of over 14 years, Sonal is a partner with the firm spearheading ESG practice. He is well acclaimed for his work in regulatory & compliance programs and with his crossroad working with business & laws – he offers advice & technology driven solutions for effective change management in the journey of ESG. He advises clients on the intricate detailing of different laws, their impact, pre-emptive measures, and ways to de-risk the organization.

Fauzia Khan is an associate with the firm working in the ESG domain. With the emerging change in the business landscape and awareness around sustainability, she contributes her expertise to help clients understand and adapt responsible and sustainable strategies with respect to compliance and ethics in the ESG realm.

This article is for information purpose only. It is not intended to constitute, and should not be taken as legal advice, or a communication intended to solicit or establish commercial motives with any. The firm shall not have any obligations or liabilities towards any acts or omission of any reader(s) consequent to any information contained herein. The readers are advised to consult competent professionals in their own judgment before acting on the basis of any information provided hereby.