The main tax legislation in Gibraltar is the Income Tax Act 2010. Gibraltar has tax incentives for certain high-net-worth individuals or senior executives which cap the amount of tax payable in Gibraltar. The rules for these tax incentives are set out in the following instruments:

- the High Executive Possessing Specialist Skills (HEPSS) Rules 2008; and

- the Qualifying (Category 2) Individuals Rules 2004.

Gibraltar has tax incentives for certain high-net-worth individuals or senior executives which cap the amount of tax payable in Gibraltar as follows.

HEPSS: A special employment tax status (HEPSS) is available for employees who meet certain criteria as an incentive for companies recruiting senior executives.

Individuals who have been granted HEPSS status will pay tax only on the first £160,000 of income per annum (tax charge of £39,940).

This status is available to individuals who:

- will be employed in a high executive or senior management position in Gibraltar;

- possess skills not available in Gibraltar and which, in the government’s opinion, will bring economic value to Gibraltar; and

- will earn more than £160,000 per annum of income in Gibraltar.

Applications for HEPSS status must be submitted to and approved by the Finance Centre.

Category 2 status: Individuals with a minimum of £2 million in net assets may qualify for Category 2 status and be taxed only on their first £105,000 of worldwide taxable income, regardless of total earnings. The annual tax liability for Category 2 individuals currently ranges from £32,000 to £37,310. This tax shelter does not extend to any income from a trade, business, profession or vocation in Gibraltar.

Applications for Category 2 status must be submitted to and approved by the Finance Centre.

Detached worker: There is a specific status (detached worker) for employees who are sent by their employer to carry out a specific task in Gibraltar from another country. Typically, detached workers continue paying social contributions in their country of origin. However, tax in the form of pay as you earn will be deducted on any income earned during their period in Gibraltar. If the detached workers are not present in Gibraltar for more than 30 days in aggregate in a tax year (1 July to 30 June), any income earned will be exempt from income tax in Gibraltar.

Gibraltar has tax treaties in place with the United Kingdom and Spain. The UK-Gibraltar Double Taxation Agreement entered into force on 24 March 2020. This agreement is based on the Organisation for Economic Co-operation and Development (OECD) Model Tax Convention and sets out ‘tie-breaker’ rules in relation to which jurisdiction has the right to tax in circumstances where individuals are resident in both the United Kingdom and Gibraltar.

The International Agreement on Taxation and the Protection of Financial Interests Between the United Kingdom of Great Britain and Northern Ireland and the Kingdom of Spain regarding Gibraltar was agreed in 2019 and entered into force on the 4 March 2021. The agreement is not a traditional double taxation agreement based on the OECD model. The purpose of the agreement is to regularise relations and to provide certainty on tax status to residents of both Gibraltar and Spain.

Article 2 states that individuals will be classified as tax resident in either Gibraltar or Spain in accordance with the applicable domestic legislation. If an individual is potentially tax resident in both Gibraltar and Spain, he or she will be treated as tax resident in Spain only if any of the following applies:

- He or she spends over 183 overnight stays of the calendar year in Spain. In applying this test, any sporadic absences from either Spain or Gibraltar are attributed to the place where that individual spends most of his or her time;

- His or her spouse or civil partner habitually resides in Spain;

- The only permanent home at his or her disposal is in Spain; or

- Two-thirds of his or her net assets are located in Spain.

If none of these tests is conclusively met, there is a presumption that the individual is tax resident in Spain unless he or she:

- spends over 183 days in Gibraltar; and

- has a permanent home in Gibraltar.

A Joint Coordination Committee will assist in resolving tax residency conflicts involving difficulties or doubts.

Category 2 status or HEPSS status in Gibraltar does not in itself constitute tax residency in Gibraltar.

Individuals are subject to tax in Gibraltar based on residency. Individuals who are ordinarily resident in Gibraltar are taxed on their worldwide income. Non-resident individuals are taxed on income accruing in or derived from Gibraltar. An individual will be ordinarily resident in Gibraltar if he or she is present in Gibraltar for:

- at least 183 days in the year of assessment; and/or

- over 300 days in aggregate over three consecutive years of assessment.

The personal tax year runs from 1 July to 30 June.

(a) What taxes are levied and what are the applicable rates?

Individuals are subject to income tax only; there is no capital gains tax in Gibraltar. In relation to income tax, individuals have the choice of being taxed under either the Allowance-Based System or the Gross Income-Based System, and will be assessed under the system that results in the lower tax.

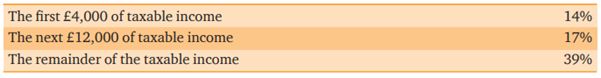

Allowance-Based System: Under the Allowances-Based System, the individual will be taxed on his or her income less available allowances. For the 2021/222 tax year, the applicable tax rates are as follows:

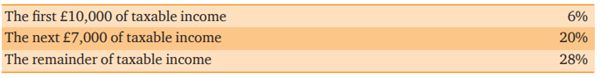

Gross Income-Based System: The applicable income bands and tax rates under the Gross Income-Based System for the 2021/22 tax year are as follows (for income up to £25,000):

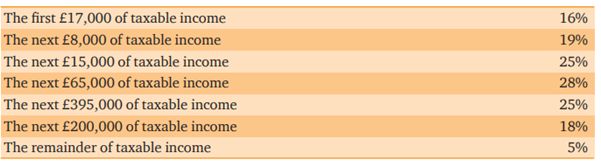

The income bands and tax rates for income above GBP £25,000 are as follows:

(b) How is the taxable base determined?

Individuals are subject to tax in Gibraltar based on residency. Individuals who are ordinarily resident in Gibraltar are taxed on their worldwide income. Non-resident individuals are taxed on income accruing in or derived from Gibraltar. An individual will be ordinarily resident in Gibraltar if he or she is present in Gibraltar for:

- at least 183 days in the year of assessment; and/or

- over 300 days in aggregate over three consecutive years of assessment.

There is no capital gains tax or inheritance tax in Gibraltar. Additionally, individuals are not taxed on the following:

- interest income;

- royalty income;

- dividends (except where the dividend is a distribution of a company’s profits that were assessable to tax in Gibraltar); or

- rental income from property located outside of Gibraltar.

(c) What are the relevant tax return requirements?

Individuals liable to tax or having assessable income for a year of assessment must make a full and complete return of their income for that year by 30 November immediately following the end of that year of assessment.

(d) What exemptions, deductions and other forms of relief are available?

There is no capital gains tax or inheritance tax in Gibraltar. Additionally, individuals are not taxed on the following:

- interest income;

- royalty income;

- dividends (except where the dividend is a distribution of a company’s profits that were assessable to tax in Gibraltar); or

- rental income from property located outside of Gibraltar.

For the tax year 2021/22, individuals whose taxable income does not exceed £11,450 per annum are exempt from paying income tax. Taper relief is available for individuals whose taxable income is between £11,451 and £19,712 per annum.

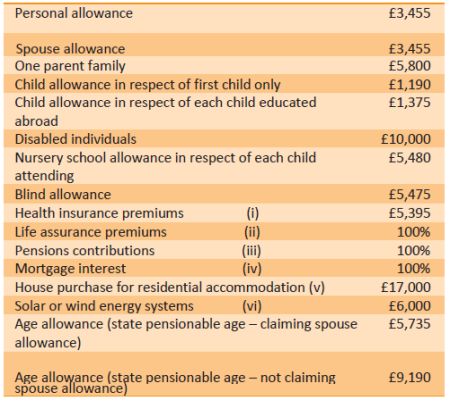

Tax allowances are also available to all individuals; the amounts depend on whether the person is being taxed under the Allowance-Based System or under the Gross Income-Based System.

Allowance-Based System: For the 2021/22 tax year, individuals can potentially claim the following allowances (subject to satisfying the requirements of each allowance):

The minimum total allowances amount to £4,343.

- Maximum relief.

- Allowable premiums up to one-seventh of assessable income or 7% of capital sum assured.

- Maximum relief will be equal to the lessor of 20% of the earned assessable income and £35,000 on contributions to a personal pension scheme or retirement annuity contract and one-sixth of the total assessable income in respect of contributions to an occupational pension scheme.

- Interest payable on a loan to acquire a Gibraltar property to be used as a taxpayer’s principal residence is allowable on loans up to a value of £350,000. Loan arrangements entered into before 1 July 2008 are eligible for relief on 100% of the loan as long as the loan continues to be secured on the current property and is in the name of the current borrower. The interest on these loans is subject to ‘tapered grandfathering’, whereby the relief on the amount of the loan in excess of £350,000 is reduced by one-tenth per annum.

- One-off allowance of £13,000 spread over a number of years and additional allowance of £4,000 restricted to a maximum of £1,000 per year.

- One-off allowance of £6,000 spread over two years.

A tax credit equal to the higher of £300 or 2% of the tax payable for the year is available.

A tax credit of up to £4,000 is also available for individuals aged 60 and over who are not in receipt of pension or annuity income in excess of £6,000

Gross Income-Based System: Persons under the Gross Income-Based System may also benefit from a deduction from their assessable income of:

- up to £1,500 per annum in respect of mortgage interest payments;

- up to £1,500 per annum in respect of pension contributions to an approved scheme;

- up to £5,000 per annum in respect of approved expenditure incurred on the enhancement of the frontage of their property;

- up to £7,500 per annum in respect of approved expenditure incurred towards the purchase of their home (this benefit is available to first-time home buyers only and if the purchase occurs on or after 1 July 2015);

- up to £3,000 per annum in respect of expenditure incurred towards private medical insurance premiums; and

- up to £6,000 over two years in respect of expenditure incurred towards the installation of solar energy systems.

(a) What taxes are levied and what are the applicable rates?

There is no capital gains tax in Gibraltar.

(b) How is the taxable base determined?

N/A

(c) What are the relevant tax return requirements?

N/A

(d) What exemptions, deductions and other forms of relief are available?

N/A

(a) What taxes are levied and what are the applicable rates?

There is no inheritance tax in Gibraltar.

(b) How is the taxable base determined?

N/A

(c) What are the relevant tax return requirements?

N/A

(d) What exemptions, deductions and other forms of relief are available?

N/A

(a) What taxes are levied and what are the applicable rates?

Generally, investment income received by individuals is not subject to tax in Gibraltar. There is no capital gains tax or withholding tax in Gibraltar. Additionally, interest income received by an individual is not taxable. In relation to dividends, only dividends which are distributions of profits from the taxable income of a Gibraltar company and received by individuals who are ordinarily resident in Gibraltar are subject to tax in Gibraltar.

(b) How is the taxable base determined?

N/A

(c) What are the relevant tax return requirements?

Taxable dividends should be declared on the tax return which is due by 30 November following the end of the year of assessment.

(d) What exemptions, deductions and other forms of relief are available?

Most investment income is exempt from tax in Gibraltar. In relation to taxable dividends, a tax credit will be available to the individual receiving the dividend to reflect the tax already paid by the company making the dividend distribution.

(a) What taxes are levied and what are the applicable rates?

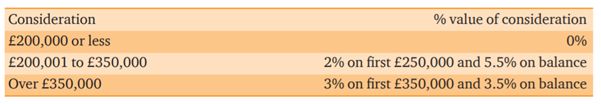

Stamp duty is payable on the transfer or sale of any Gibraltar real estate or shares in a company owning Gibraltar real estate (on an amount based on the market value of said real estate) at the following rates:

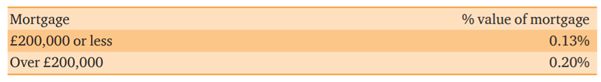

Stamp duty is also payable on mortgages secured on Gibraltar real estate at the following rates:

(b) How is the taxable base determined?

The taxable base is based on the consideration (price) paid for the property.

(c) What are the relevant tax return requirements?

In practice, the lawyer acting for the purchase will ensure that the relevant amount of stamp duty is calculated and paid.

(d) What exemptions, deductions and other forms of relief are available?

For first and second-time buyers, there is no stamp duty to pay on properties valued at less than £260,000.

Stamp duty on transfer of properties between spouses is nil.

On affordable housing estates developed by the government, the following applies:

- There is no stamp duty on the initial purchase price of the property; and

- A special rate of stamp duty of 7.5% is payable on the sale of affordable housing developed by the government within the first 10 years of the original purchase. The duty is not payable in circumstances of a forced sale, including in case of divorce or where a family moves to a larger property as a meritorious upgrade to another, newer government affordable housing estate.

Property investment incentive: Owners of property constructed in Gibraltar between 1 July 2016 and 31 December 2018 that is rented for residential purposes will receive a tax credit equal to the tax payable on the profits earned on the first 24 months of rent occurring in the first five years after the completion of that property.

(a) What are they and what are the applicable rates?

Social insurance contributions are payable by all employees and self-employed persons in any week in which they work. The rates of social insurance contributions increased with effect from 1 July 2021 as follows:

- Employees’ contributions are calculated as 10% of gross earnings, subject to a minimum of £12.10 per week (£52.44 per month) and a maximum of £36.30 per week (£157.30 per month).

- Employers’ contributions are calculated as 20% of gross earnings, subject to a minimum of £28 per week (£121.34 per month) and a maximum of £50 per week (£216.66 per month).

- Self-employed contributions are calculated as 20% of gross earnings, subject to a minimum of £25 per week (£108.34 per month) and a maximum of £50 per week (£216.66 per month).

(b) How is the taxable base determined?

It is based on a percentage of gross earnings subject to minimum and maximum contributions (see question 2.8(a)).

(c) What are the relevant tax return requirements?

Employers must complete and submit Form P8 detailing employer and employee contributions to the Income Tax Office by 31 July following the tax year in question.

(d) What exemptions, deductions and other forms of relief are available?

Individuals aged 60 and over and those whose statutory occupational retirement age is earlier than 60 – as in the case of a fire officer, police officer, prison officer or a member of the Royal Gibraltar Regiment – and are in insurable employment are exempt from paying the employee’s share of social insurance contributions. Employers will continue to be required to pay their share of the contribution.

There is an exemption from employers’ and employees’ social insurance contributions in respect of an employee’s secondary employment. This is subject to the full contribution having been paid in Gibraltar. There is also an exemption from social insurance for students’ income from employment or vocation which is followed by full-time employment.

A credit in respect of employers’ social insurance contributions of £100 per employee is available to businesses with 10 employees or fewer. This is increased to 20 employees for new businesses within the first year of operation.

There is also an exemption from the payment of both employer and employee social insurance contributions in the case of payments received while on maternity leave.

(a) What are they and what are the applicable rates?

Currently, there is no value added tax or equivalent sales tax in Gibraltar. However, goods imported into Gibraltar are subject to import duty at varying rates.

(b) How is the taxable base determined?

N/A

(c) What are the relevant tax return requirements?

N/A

(d) What exemptions, deductions and other forms of relief are available?

N/A

Gibraltar succession law is similar to English law and is set out in the Wills Act 2009 and the Administration of Estates Act 1933.

Contentious issues may be referred to the Supreme Court of Gibraltar for resolution.

There is no forced heirship in Gibraltar.

Where a person dies intestate, the distribution of assets to a surviving spouse and/or children will be undertaken in accordance with the rules set out in the Administration of Estates Act 1933.

A claim may be made under the Inheritance (Provision for Family Dependants) Act 1977 for reasonable financial provision by a spouse, child or dependant if the deceased was domiciled in Gibraltar at the time of death.

The Wills Act 2009 is the principal law governing wills in Gibraltar.

Specialist legal advice should be obtained in relation to conflicts of law issues.

Gibraltar recognises validly executed foreign wills. Section 5 of the Wills Act 2009 states: “A will shall be treated as properly executed if its execution conformed to the internal law in force in the territory or State where it was executed, or in the territory or State where, at the time of its execution or of the testator’s death, he was domiciled or had his habitual residence, or in a state of which, at either of those times, he was a national.”

Specialist legal advice should be obtained in relation to limitations to testamentary freedom. One point to note is that when a person marries, any will created prior to the marriage will be void unless the will was created in contemplation of marriage and a statement to that effect is contained in the will.

Similarly, where a testator divorces or has his or her marriage or civil partnership annulled, any interest of the spouse in a will created during the marriage will lapse; as will any appointment of the spouse as an executor unless a contrary intent was contained within the will.

The Wills Act 2009 sets out the formal requirements for the signing and attestation of wills. No will is valid unless:

- it is in writing and signed by the testator, or by some other person in his or her presence and by his or her direction;

- it appears that the testator intended by his or her signature to give effect to the will;

- the signature is made or acknowledged by the testator in the presence of two or more witnesses present at the same time; and

- each witness either:

-

- attests and signs the will; or

- acknowledges his signature in the presence of the testator (but not necessarily in the presence of any other witness).

However, no form of attestation is necessary.

It is recommended that formal advice be obtained from a Gibraltar lawyer to ensure that wills are validly drafted and executed in accordance with Gibraltar law.

In May 2021, the Central Register of Wills was established in Gibraltar and it is now possible to register all wills and codicils (those created in the past plus any new wills and codicils).

Specialist legal advice should be obtained in relation to challenging or amending a will in Gibraltar.

Specialist legal advice should be obtained in relation to challenging a will in Gibraltar. The Civil Procedure Rules under the Civil Procedures Act in England and Wales also apply in Gibraltar. These rules set out the procedures for challenging a will. Rulings on such challenges are made by the Supreme Court of Gibraltar.

A claim may be made under the Inheritance (Provision for Family Dependants) Act 1977 for reasonable financial provision by a spouse, child or dependant if the deceased was domiciled in Gibraltar at the time of death.

Where a person dies intestate, the distribution of assets to a surviving spouse and/or children and/or other relatives will be undertaken in accordance with the rules set out in the Administration of Estates Act.

A claim can be made to challenge the intestacy rules under the Inheritance (Provision for Family Dependants) Act by a dependant or family member of the deceased if the deceased was domiciled in Gibraltar at death.

The main laws governing trusts in Gibraltar are as follows:

- the Trustees Act 1895;

- the Registered Trust Act 1999;

- the Trusts (Private International Law) Act 2015; and

- the Trusts (Recognition) Act 1989.

Gibraltar recognises the Hague Convention on the Law Applicable to Trusts and on their Recognition by virtue of the Trusts (Recognition) Act 1989.

Specialist legal advice should be obtained in relation to conflict of laws issues.

A variety of trusts are available in Gibraltar, including purpose trusts, life interest trusts, accumulation trusts and discretionary trusts. Discretionary trusts are commonly used in practice to hold assets and can be administered and distributed confidentially if required.

The Hague Trusts Convention has the force of law in Gibraltar by virtue of the Trusts (Recognition) Act 1989.

The Trusts (Private International Law) Act 2015 states that a foreign trust will be regarded as being governed by and will be interpreted in accordance with its proper law as determined by Articles 6 and 7 of the Hague Trusts Convention. Without prejudice to Articles 15, 16 and 18 of the Hague Trusts Convention, a foreign trust will be unenforceable in Gibraltar to the extent that:

- the trust purports:

-

- to do anything which is contrary to the law of Gibraltar;

- to confer any right or power or impose any obligation which is contrary to the law of Gibraltar; or

- to apply directly to immovable property situated in Gibraltar; and

- the trust, or any disposition thereto or right, claim or interest asserted in respect of such a trust, is contrary to the public policy of Gibraltar.

A trust is created through a written trust deed. A trust deed may (but need not) be registered with the registrar of registered trusts, who keeps an index under the Registered Trust Act 1999.

Broadly speaking, trustees are appointed to administer the assets of a trust for the benefit of the beneficiaries named in the trust deed. Trustees act as the legal owner of trust assets and are responsible for administering and distributing the assets of the trust in accordance with the trust deed, as well as being responsible for the trust’s tax obligations.

Specific provisions relating to the powers and duties of trustees in Gibraltar are set out in the Trustees Act.

A trust is considered resident in Gibraltar for tax purposes where it has one or more beneficiaries who are ordinarily resident for tax purposes in Gibraltar (excluding Category 2 individuals). A trust is not a separate legal entity for tax purposes and any charge to tax is levied on the trustees in their capacity as trustees. A Gibraltar resident trust is subject to taxation in Gibraltar at the rate of 12.5% (from 1 August 2021; previously 10%) on taxable income.

Beneficiaries who are ordinarily resident in Gibraltar may also be liable to tax on income received from a trust. A beneficiary who is assessed to tax on income received from a trust will be entitled to offset against his or her liability any tax paid by or credited to the trust in Gibraltar in respect of the matched income. If the tax paid by the trust on the income received by a beneficiary is greater than the tax payable by the beneficiary, the excess will be refunded to the beneficiary.

A Gibraltar trust which has non-resident beneficiaries is not subject to taxation in Gibraltar and all of its income (with the exception of Gibraltar rental income and income from a trade, business, profession or vocation which has accrued in and derived from Gibraltar) may be accumulated free of tax in Gibraltar.

Trust tax returns must be submitted by 30 November following the tax year in question. The format of the return will depend on:

- whether the trustee is a professional trustee; and/or

- whether any distributions have been made.

Specialist legal advice should be obtained in relation to the creation and administration of trusts.

The 2021 budget introduced the first significant tax changes in Gibraltar in a number of years, including increasing the corporate tax rate to 12.5% and the minimum annual tax amount paid by High Executive Possessing Specialist Skills (HEPSS) and Category 2 individuals. However, from a private client perspective, Gibraltar remains an attractive jurisdiction, with comparatively low personal income tax rates and no capital gains tax, inheritance tax or value added tax.

The special HEPSS and Category 2 tax regimes continue to be beneficial for executives and high-net-worth individuals. From a tax perspective, it is likely that the corporate tax rate in Gibraltar will increase to 15% over the next few years in line with global developments for a minimum corporate tax rate.

Negotiations are ongoing regarding Gibraltar’s future relationship with the European Union with a view to a formal treaty being concluded in this respect. From a private client perspective, it will be important to follow developments in relation to any resulting tax changes in Gibraltar and/or changes in relation to the movement of people, goods and capital between Gibraltar and the European Union.

Individuals should obtain professional advice in advance of undertaking any transactions or implementing any proposed structures relating to private wealth management, to ensure that all relevant tax, legal and other factors are taken into account.

Gibraltar is an attractive jurisdiction from a tax perspective for private clients and offers an excellent overall quality of life. However, with a land area of just 2.6 square miles, property is in high demand and it is therefore important for anyone considering a move to Gibraltar to visit in advance and ensure that a property will be available to meet his or her needs.

Given its close proximity, many private clients based in Gibraltar own assets and/or spend time in Spain. The recently enacted Gibraltar-Spain tax treaty contains a number of provisions around when individuals and corporate entities are treated as tax resident in Spain rather than Gibraltar. It is therefore important to consider the potential impact of this treaty for any private client proposing to spend time in both Gibraltar and Spain and/or to own assets in both jurisdictions.

This publication is based on taxation law and practice in Gibraltar as of 8 February 2022. This publication has been prepared for general guidance and does not constitute professional advice. You should not act upon the information contained in this publication without obtaining specific professional advice. No representation or warranty (express or implied) is given as to the accuracy or completeness of the information contained in this publication, and, to the extent permitted by law, PricewaterhouseCoopers Limited does not accept or assume any liability, responsibility or duty of care for any consequences of you or anyone else acting, or refraining to act, in reliance on the information contained in this publication or for any decision based on it.