In 2014, mixed funds attracted the largest net inflows with almost €122 million, followed by bond funds and diversified funds at €105 million and €101 million respectively. Net assets in equity funds went up by 3.5 percent, or €76 million, when com-pared to the previous year despite the uncertain economic environment throughout the year.

In contrast, hedge funds and money market funds suffered net outflows of €118.5 million and €23.8 million respectively in 2014.

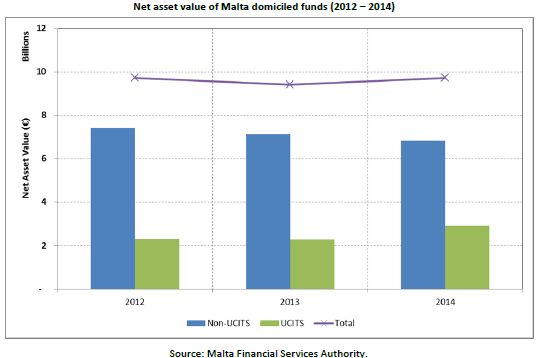

Net assets in Non-UCITS funds totalled €6.8 billion at the end of 2014, 4.2 percent less when compared with the previous end year. In contrast, the net asset value of UCITS funds expanded by 26.6 percent over the period 2013 – 2014, to stand at €2.9 billion at the end of 2014.

The MFSA NAV Report for December 2014 may be accessed through the following link: http://goo.gl/fdxVb9

MFSA Newsletter - February 2015

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.