- in Europe

- in Europe

- within International Law, Antitrust/Competition Law, Litigation and Mediation & Arbitration topic(s)

- with readers working within the Aerospace & Defence, Banking & Credit and Pharmaceuticals & BioTech industries

This brochure focuses on the impact of the Alternative Investment Fund Managers Directive ("AIFMD" or the "Directive") on third country funds and managers.

The first part illustrates through practical case studies, the implications of the Directive on managers established in non-European Union Member States which distribute alternative investment funds ("AIF") both inside and outside the European Union ("EU").

A note on the key features of the AIFMD is incorporated as the second part of the brochure.

FOCUS ON THIRD COUNTRIES

The AIFMD will have an impact on investment managers based in third countries ("non-EU AIFM" or "non-EU Manager") who (i) manage EU-based AIF and/or (ii) market, i.e. distribute, in the EU, EU-based and non-EU based AIF they manage in the EU.

This section aims at analysing in a practical manner the most frequently used structures to provide solutions on how to address the impact of the AIFMD. It is not a detailed analysis of the case studies described hereafter but it highlights the most relevant implications for each of the case studies described.

- Case 1: non-EU Manager managing a Luxembourg AIF with marketing in the EU;

- Case 2: non-EU Manager managing a Cayman AIF with marketing in the EU;

- Case 3: non-EU Manager managing a Luxembourg AIF with no marketing in the EU;

- Case 4: Lux AIFM managing a Lux AIF and delegating investment management to a non-EU Manager with marketing in the EU; and

- Case 5: Lux AIFM managing a Lux AIF and delegating investment management to a non-EU Manager with no marketing in the EU.

For the purpose of this analysis, it is assumed in each case study that (1) the investment fund involved qualifies as an AIF and falls within the scope of the AIFMD and (2) that its appointed AIFM does not benefit from or take benefit from the small manager exemption, all as described in the second part of this brochure "AIFMD Key Features".

Also, for the purpose of these analyses, the term "marketing" as referred to in these introductory paragraphs and the aforementioned case studies, is to be understood as meaning a direct or indirect offering or placement on the initiative of the AIFM or on behalf of the AIFM of units or shares of an AIF it manages to or with investors in the EU. So-called "reverse solicitation" would not be considered as marketing for the purpose of the AIFMD. It is expected that the concept of marketing will be clarified further by additional EU regulations or guidelines.

A table (the "Table") is inserted at the end of this section, which illustrates the different situations where the third country regime applies and also the scope of application of the AIFMD provisions to third country AIFM and AIF.

1. CASE 1: NON-EU MANAGER MANAGING A LUX AIF WITH MARKETING IN THE EU

The EU nationality of the AIF and the marketing in the EU both entail that the AIFMD will be applicable.

As shown in the Table, the scope of application of AIFMD provisions will evolve over the coming years.

Three periods of time can be identified during which different options will be available to managers:

- 2013-2015: Option A and Option B

- 2015-2018: Option A, Option B and Option C

- 2018-onwards: Option B and Option C

1.1 From July 2013 up to 2015:

Option A and Option B:

Option A:

In July 2013, when the implementation period will end and when the Directive will be applicable, a non-EU Manager will be entitled to continue its management activities and market a Lux AIF in the EU using the national private placement rules ("NPPR") if the following AIFMD requirements1 are complied with:

- publication of an annual report by each AIF2, disclosure to investors3, reporting by the non-EU Manager to competent authorities in each of the EU Member States where the marketing takes place on the markets and instruments it trades on behalf of the AIF4, and notification and disclosure requirements when the AIF is taking controlling interests of certain issuers5;

- the third country in which the non-EU Manager is established is not listed as a Non-Cooperative Country and Territory by the Financial Action Task Force ("FATF Compliance"); and

- cooperation arrangements are entered into between (i) the supervisory authority of the non-EU Manager, (ii) the supervisory authorities in each of the EU Member States where marketing takes place and (iii) the home state authority of the AIF (i.e. in Luxembourg, the CSSF) ("Cooperation Arrangements").

Member States may, however, impose stricter rules on the non-EU Manager in respect of the marketing of the AIF to the investors on their territory.

Conclusion:

If specific requirements set forth in the Directive are met, a Lux AIF managed by a non-EU Manager can be marketed in the EU on the basis of and under the conditions set forth by the locally applicable private placement rules, without the non-EU Manager being required to become an authorised AIFM under the Directive.

Option B:

If NPPR are considered too restrictive6, the structure could be changed by interposing a Lux manager which will act as AIFM7 of the Lux AIF and benefit from the EU passport for the marketing of the Lux AIF in the EU to professional investors. The portfolio management could be delegated by the Lux AIFM to the non-EU Manager (see Case 4 for more information and requirements on that possibility).

Conclusion:

A Lux AIF ultimately managed by a non-EU Manager, through delegation from an authorised Luxembourg AIFM, can be marketed to professional investors in the EU on the basis of a European passport.

1.2 2015-2018: Option A, Option B and Option C

Options A and B

Both options are described in the foregoing paragraph 1.1.

Option C:

As from 2015, a non-EU Manager will have the possibility, subject to a decision from the EU authorities, to benefit from the EU passport.

In order to benefit from this EU passport, the non-EU Manager will have to become authorised under the AIFMD as a non-EU AIFM. To that effect, it will have to comply with the all the AIFMD obligations applying to an EU AIFM managing an EU AIF8.

In addition, the following requirements apply:

- The non-EU Manager will have to appoint an EU Member State of reference ("Member State of Reference") and the financial authorities of that Member State of Reference will act as its regulator9. Specific rules are provided for the designation of the Member State of Reference depending essentially on the EU Member States where the AIF is established or where it is intended to be distributed10. In addition, a legal representative established in the Member State of Reference will need to be appointed11. The legal representative will be the contact point of the non-EU AIFM in the European Union and it must be sufficiently equipped to perform the compliance function relating to the management and marketing activities performed by the AIFM, together with the AIFM12;

- Appropriate cooperation arrangements need to be in place between the authorities of the Member State of Reference, the authorities of the home Member State of the EU AIF concerned and the supervisory authorities of the third country where the non-EU AIFM is established in order to ensure at least an efficient exchange of information that allows the competent authorities to carry out their respective duties in accordance with the Directive13;

- The third country where the non-EU AIFM is established must not be listed as a Non-Cooperative Country and Territory by FATF14;

- The third country where the non-EU AIFM is established has signed an agreement with the Member State of Reference, which fully complies with the standards laid down in Article 26 of the OECD Model Tax Convention on Income and on Capital and ensures an effective exchange of information in tax matters, including any multilateral tax agreements15;

- The effective exercise by the authorities of their supervisory functions must not be prevented by the laws, regulations or administrative provisions of the third country governing the AIFM16.

Once the Member State of Reference is appointed and the international requirements mentioned above ("International Requirements") duly fulfilled, the authorisation procedure may start: an authorisation file can be introduced by the non- EU AIFM to the competent authorities of its Member State of Reference.

Once authorised, the non-EU authorised AIFM will be entitled to market the Lux AIF it manages to professional investors in the EU on the basis of and subsequent to a regulator-to- regulator notification procedure.

Conclusion:

A Lux AIF managed by a non-EU Manager authorised as AIFM through the relevant authorisation procedure in the Member State of Reference (Luxembourg or another EU Member State) can be marketed to professional investors in the EU on the basis of a European passport.

1.3 In 2018: Option B and Option C

In July 2018, the EU authorities may decide on the termination of the NPPR. If that decision is made, non-EU Managers developing management and/or marketing activities of Lux AIF in the EU will be subject to the full AIFMD rules and thus Option A will no longer be available.

Conclusion:

Upon the termination of national private placement rules, only Options B and C, i.e. duly authorised AIFM, compliance with AIFMD and marketing on the basis of a European passport, will remain available for a non-EU Manager managing a Lux AIF.

2. CASE 2: NON-EU MANAGER MANAGING A CAYMAN AIF WITH MARKETING IN THE EU

The marketing of a Cayman AIF in the EU entails that the AIFMD will be applicable.

Case 2 is to a certain extent very similar to the situation examined in Case 1: only the EU nationality of the AIF has changed.

The scope of AIFMD application is exactly the same as in Case 1: EU AIF and non-EU AIF managed by a non-EU Manager are treated in the same manner.

The AIFMD rules applying to the marketing of an AIF in the EU are those mentioned in paragraphs 1.1, 1.2, and 1.3.

Conclusion:

There is a level playing field between EU AIF and non-EU AIF managed by a non-EU Manager.

However:

Differences may arise due to the different legal and regulatory environment in Luxembourg on one hand and outside the EU on the other hand enabling or facilitating the meeting of the AIFMD conditions described in Options A, B and C in Case 1. above, among others:

- the compliance of the AIF with the annual report, disclosure and reporting requirements;

- the FATC Compliance of the two jurisdictions concerned;

- existence of Cooperation Arrangements between the relevant supervisory authorities and necessary OECD tax model agreements.

As regards Luxembourg, a part of these conditions has already been met due to the regulated nature of Luxembourg AIF and the cooperation arrangements in place between the Luxembourg supervisory authorities and supervisory authorities in other countries including, without limitation, Swiss, American, or Asian). Luxembourg is aiming at ensuring that by the time the AIFMD becomes applicable (July 2013), all such conditions will be met (subject to the necessary consent of supervisory authorities from relevant third countries).

3. CASE 3: NON-EU MANAGER MANAGING A LUX AIF WITH NO MARKETING IN THE EU

The EU nationality of the AIF entails that the AIFMD will be applicable.

As shown in the Table, the full AIFMD will apply but not before 2015.

A Member State of Reference will need to be appointed and the financial authorities of that Member State of Reference will act as EU competent authorities for the authorisation and supervision of the non-EU Manager.

The International Requirements will also need to be fulfilled.

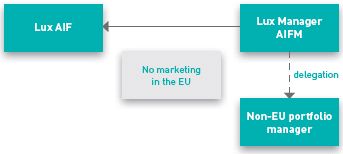

4. CASE 4: LUX AIFM MANAGING A LUX AIF AND DELEGAT ING INVESTMENT MANAGE MENT TO A NON-EU MANAGER , WITH MARKETING IN THE EU

This situation reflects a case where the passport will be immediately available (i.e. as from July 2013) to the authorised AIFM for the marketing of the AIF to professional investors in the EU.

It corresponds to Option B described in Case 1. above.

4.1. Delegation of portfolio management by a Lux AIFM to a non-EU portfolio manager

A Lux AIFM may delegate the portfolio management to a non-EU Manager. The following conditions need to be fulfilled:

- the delegation must be notified to the Luxembourg supervisory authority before the delegation can take effect;

- the Lux AIFM must be able to justify objectively the entire delegation structure;

- the non-EU Manager must have sufficient resources to carry out the respective tasks and those who effectively conduct the delegated activities must be of good repute and have sufficient experience;

- the non-EU Manager must be authorised or registered for the purpose of asset management and subject to supervision17 and the cooperation between the competent authority of the Lux AIFM and the supervisory authority of the non-EU Manager must be ensured;

- the delegation must not impede the effective supervision of the Lux AIFM and, in particular, it must not prevent the Lux AIFM from acting, or the Lux AIF from being managed, in the best interests of investors;

- the Lux AIFM must be able to prove that the non-EU Manager is qualified and capable of performing the tasks in question, that due diligence has been implemented in its selection and that the Lux AIFM is able to monitor the delegated tasks effectively and at any time, to give further instructions at any time to the non-EU Manager and to withdraw the delegation with immediate effect when this is in the investors' interests.

A Lux AIFM remains responsible vis-à-vis a Lux AIF and its investors; its responsibility is not affected by the delegation.

The Directive also provides that an AIFM may not delegate its functions to the extent that it can no longer be considered as the manager of an AIF and to the extent that it becomes a letter-box entity. The EU Commission has been mandated to specify the notion of "letter-box entity" in the AIFMD level II measures. Although no official draft of the level II measures has yet been published, it cannot be excluded that the delegation by an AIFM of a substantial part of its functions will be restricted or subject to additional conditions and criteria.

4.2. An advisory agreement can be entered into between a Lux AIFM and a non-EU portfolio manager

Instead of a delegation of portfolio management functions, an advisory agreement may be entered into whereby a Lux AIFM would receive investment advice from the non-EU Manager.

Under the advisory agreement, the Lux AIFM holds responsibility for making the final investment decision. It is free to choose wether or not to follow the advice received from the non-EU Manager.

The point has not yet been formally confirmed by the EU authorities but one may reasonably believe that as long as the terms of the agreement are clear and do not create any confusion with a delegation agreement, the entry into an investment advisory agreement would not entail application of any of the AIFMD provisions referred to in 4.1. above.

5. CASE 5: LUX AIFM MANAGING A LUX AIF AND DELEGATI NG INVESTMENT MANAGE MENT TO NON-EU MANAGER, WITH NO MARKETING IN THE EU

A Lux AIFM will need to be authorised under the AIFMD and all AIFMD requirements will need to be fulfilled.

As for Case 4, the delegation of the portfolio management or any other management function and/or the entry into an advisory agreement can be envisaged.

To read this article and it's footnotes in full, please click here.

Footnotes

1 Article 42.1 a), b) and c) of the AIFMD.

2 Article 22 of the AIFMD.

3 Article 23 of the AIFMD.

4 Article 24 of the AIFMD.

5 Articles 26 to 30 of the AIFMD.

6 NPPR are at the discretion of each EU Member State and therefore vary from country to country. Also, as indicated above, Member States may impose stricter rules on a non- EU AIFM in respect of the marketing of units or shares of AIFs to investors in their territory (Article 42.2 of the AIFMD).

7 The AIFM will need to be authorised as AIFM and all the conditions provided for by the AIFMD will need to be fulfilled.

8 In the case, however, where compliance with a provision of the AIFMD would be incompatible with compliance with the law to which the non-EU AIFM and or non-EU AIF is subject, there shall be no obligation to comply with the provision of the AIFMD provided that specific conditions are fulfilled (Article 37.2 of the AIFMD).

9 Article 37.1 of the AIFMD.

10 Article 37.4 of the AIFMD.

11 Article 37.3 of the AIFMD.

12 Article 37.7 c) of the AIFMD.

13 Article 37.7 d) of the AIFMD.

14 Article 37.7 e) of the AIFMD.

15 Article 37.7 f) of the AIFMD.

16 Article 37.7 g) of the AIFMD.

17 If the condition relating to the local authorisation and supervision cannot be met, the competent authorities of the AIFM (i.e. the Luxembourg authorities) are still entitled to approve the non-EU portfolio manager under certain conditions.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.