WEF CONFIRMS MALTA'S PLACING AS A TOP-20 FINANCIAL SERVICES JURISDICTION

Malta climbed six places in its Competitiveness levels according to the Global Competitiveness Report drawn up by the World Economic Forum, placing 41st out of 148 countries. It has also maintained its status of an innovation-driven economy.

The Global Competitiveness Report provides an in-depth analysis of the competitiveness levels of the world's economies, providing investors with a wide-range of data supporting their business decisions.

Focusing on the financial services sector, the World Economic Forum confirmed Malta's position as a leading financial jurisdiction. Indeed, the 2013-14 Report ranked Malta amongst the top 20 world nations, out of 148, with regards to issues related to soundness of its banking institutions (14th), the regulation of Securities Exchanges (17th) and the strength and reporting standards (13th).

Moreover, significant progress was made in general sectors which enhance the attractiveness of Malta as an investment location, with improvements in Health and Primary Education (up to 15th from 19th last year) and the quality of education, which now ranks 8th best in the world.

According to the World Economic Forum, the Report "assesses the ability of countries to provide high levels of prosperity to their citizens. This in turn depends on how productively a country uses available resources. Therefore, the Global Competitiveness Index measures the set of institutions, policies, and factors that set the sustainable current and medium-term levels of economic prosperity".

For the fifth consecutive year, Switzerland topped the table, followed by Singapore, Finland, Germany, and the United States.

The full Report can be found at: http://bit.ly/17CBUgY

CONSUMER AFFAIRS UNIT ANNUAL REPORT 2012

During the year 2012, the Consumer Affairs Unit handled no less than 708 formal complaints and 212 enquiries related to financial services products and services. A total of 884 cases were reviewed and concluded, which include a number of cases carried forward from previous years. These figures, accompanied by further information related to typical cases analysed, were disclosed in the Consumer Affairs Unit Annual Report 2012, published last month.

The year under review marks the tenth anniversary since the Consumer Complaints Manager had been appointed by the Authority to review complaints from private consumers against financial firms. Over the years, the Complaints Manager has reviewed various issues and practices which were detrimental to consumers of financial products and services.

Introducing the Report, MFSA Chairman Professor Joseph Bannister stated that "the financial sector has always thrived when the products and services brought to the market met the needs and expectations of the consumer. This is why it is important for the industry to always remain focused on consumers' legitimate needs and expectations. Consumers expect the industry to create products and services which bring real value to them, without necessarily shifting on to them undue risk."

Prof Bannister also announced that "in the coming months, the Authority will carry out detailed analysis of a number of issues which have been brought to light by the various complaints being reviewed by the Consumer Complaints Unit. The Authority needs to understand how consumers behave and will strive to address weaknesses in its regulatory framework, without stifling product innovation and weakening quality services levels.

The Authority is mindful that consumer confidence is key towards the development of a healthy financial sector. It is committed to address those risks which are detrimental to such confidence."

The Full Report is available on the MFSA Website: http://bit.ly/18Wk5Ot.

INVESTMENT SERVICES - WHY MALTA?

Introduction

Malta joined the European Union in 2004 and benefits from the harmonisation of EU financial services regulation, including the UCITS passport. It adopted the euro as its currency in 2008.

As Malta's single financial services regulator, the Malta Financial Services Authority ("MFSA") regulates banking, financial institutions, insurance companies, investment services companies, securities, recognised investment exchanges and admissibility to listing, trust management companies and pension schemes. It is an autonomous public institution and self-funded.

The MFSA is a very active member of EU regulatory committees, ESMS, EIOPA and EBA and is also a member of IOSCO and IAIS. Malta is very pro-active in the EU financial services sector particularly in the recent implementation of the AIFM Directive and UCITS IV Directive. Malta has continuously topped the scoreboard of Member States for the timely implementation of internal market rules for financial services.

The MFSA has signed a considerable number of MoUs with various non-EU jurisdictions, including Australia, South Africa and China. Negotiations are on going with various other countries. The MFSA has signed the IOSCO multilateral MoU and also exchanges information under this agreement.

Why Malta as an investment company and funds domicile?

Malta started developing as a financial centre in 1994. However, Malta came under the spotlight following EU accession in 2004. Since then it has gained a reputation for a robust regime (without being unduly prescriptive) with a highly approachable regulatory authority. It has been internationally recognised that the Maltese regulations provide a secure and stable frame-work for prudential supervision, consumer protection, market surveillance and prevention of money laundering.

Staff at MFSA have gained considerable experience through training with other regulators and financial institutions in the UK, Europe and the US. Regulators from BaFIN, FSA and the SEC visit Malta on a regular basis to train staff.

Maltese accountants are trained under IFRS, which Malta adopted in 1998. The World Economic Forum Report on Competitiveness (2013) places Malta in 13th position in the strength of auditing and reporting standards.

The Maltese legal profession is a long established profession and most professionals have had further training at major institutions overseas particularly in the UK.

The University of Malta and the financial training centres are producing sufficient graduates to meet the demand in training of lawyers, accountants, investment managers, fund managers, fund administrators and so forth. The MFSA has set up an Education Consultation Council composed of all finance industry training associations. There are over 10,000 employees in the financial services sector, which has expanded by around 25% in recent years and in direct intermediation contributes 8.5% to the GDP of Malta.

The Maltese regulatory framework is robust and adaptable, allowing managers and promoters to innovate and to develop new products to meet the changing needs of the fund industry. The MFSA works to fixed time lines agreed with each individual applicant. All regulators meet directly with operators to discuss their requirements. Malta's approach is based on:

- Emphasis on Disclosure

- Reliance on Fit and Proper Status of Directors, Senior Management and Service Providers

- Avoidance of Prescriptive Regulation to enable flexibility for promoters

- Licensing is very rapid compared to other jurisdictions

Malta has an imputation system of taxation whereby companies pay corporate tax at 35%. This tax is regarded as a prepayment for the tax due by the shareholder upon the eventual distribution of profits. On declaration of dividend the shareholders receive a refund of 6/7 of the corporate tax paid by the company. This means that the effective rate of tax in Malta is 5% and it is the lowest in the EU. This system of taxation is Malta's general system of taxation for all trading companies. It has been approved by the EU in 2007 under State Aid and Code of Conduct. Malta has a continuously expanding worldwide network of over 65 tax treaties (with all EU and most OECD members). New treaties are being negotiated with various Latin American countries.

Malta was one of a group of jurisdictions that was placed immediately on the OECD's 'white list' of countries and territories that had both embraced and substantially implemented the tax standards.

Funds domiciled in Malta pay no tax and non-resident investors are not subject to any withholding tax. Capital gains realised by investors who are not resident in Malta are not subject to tax in Malta. Transfers of shares in a licensed fund are exempt from stamp duty. There is no value added tax on fund management, fund administration as well as custody services.

The Investment Services and Funds Sector

The MFSA does not apply a "one-size fits all" to investment companies. A category of licences has been created depending on the type of investment services, a company intends to provide.

Category 1: Provide any investment service but do not hold or control clients' money/assets nor deal for their own account/underwrite (excludes fund management companies)

Category 2: Provide any investment service and hold or control clients' money or assets, but do not deal for their own account or underwrite (includes stockbrokers and fund management companies) [Fund Administrators who solely intended to provide administration services may only apply for Recognition]

Category 3: Provide any investment service, hold and control clients' money or assets and deal for their own account and underwrite

Category 4: Act as trustees or custodians of collective investment schemes

All Investment companies have to be MiFID compliant and can passport their services to other Member States.

Malta offers a range of fund vehicles (including investment companies, mutual funds, limited partnership, foundations and unit trusts), which can be tailored to suit investor requirements and investment policy. Different kinds of scheme structures can be established (schemes can also be established as Self Managed):

- Investment companies with fixed or variable share capital (INVCOs/ SICAVs)

- ICCs: SICAV Incorporated Cell Companies or Recognised Incorporated Cell Companies

- Unit trusts

- Common Funds; Possibility of setting up Special Investment Vehicles regulated as part of the same scheme

- Limited Partnerships: Capital may or may not be divided into shares Multi-fund & Multi-Class structures, with or without segregation of assets can also be set up.

In May 2004 before entry into the EU there were less than 30 funds/sub-funds licensed by the MFSA. Today there are around 900 funds/sub-funds domiciled in Malta ranging from pan-European retail funds (UCITS) to hedge funds (Alternative Investment Funds commonly known as Professional Investor Funds) and other forms of alternative investment vehicles that has been licensed by the MFSA. Fund promoters originate from various EU and non-EU countries including the USA. A number of promoters are Swiss based. Three types of Professional Investor Funds can be established. These are the Experienced, Qualifying And Extraordinary Investor Regimes. The MFSA has fully transposed the UCITS IV Directive during 2012 and is currently transposing of the AIF Directive.

Funds domiciled in Malta are distributed within the EU and outside the EU. UCITS funds domiciled in Malta are passported to various Member States. They are also distributed in Hong Kong and Singapore. UCITS is today a recognised worldwide brand. Alternative Investment Funds are distributed on a private placement basis.

INDUSTRY UPDATES

Investment Services Rulebooks

The MFSA has recently published a revised version of the Investment Services Rules for Retail Collective Investment Schemes and the Investment Services Rules for Professional Investor Funds (hereinafter referred to as 'Investment Services Rules').

The changes have been made to implement regulation 16 of the Companies Act (Investment Companies with Variable Share Capital) Regulations (hereinafter referred to as 'the Regulations'), according to which issues of fully paid up shares by a SICAV may be subject to full payment by a settlement date. Such settlement date must be disclosed in the prospectus or offering document of the SICAV and cannot exceed the number of days established in terms of Investment Services Rules.

The Regulations further stipulate that, where payment for the shares is not effected by the settlement date stated in the prospectus or offering document, the SICAV is required to cancel such shares retrospectively as from the date of issue, and the subscriber should be informed accordingly. Where the SICAV fails to comply with the above requirement, any member of the SICAV may apply to the court for an order that such shares are to be cancelled.

The revised Investment Services Rules now provide that the settlement date by which payment of the full subscription price is to be received by the SICAV cannot be later than five working days from the date of issue of those shares.

Investment Services Licence Holders and Collective Investment Schemes are to note that the Investment Services Rules are available for download from the MFSA website. The circular outlining the changes made to the Rules is also available for download, under the Circulars Section of the MFSA website.

Regulation of Funds in the EU

European Commission publishes a proposal on European Long-term Investment Funds

On 26 June 2013, the European Commission issued a proposal for a new investment fund framework designed for investors investing in European Long-Term Investment Funds (ELTIFs). The proposal covers the following areas: [i] the authorisation procedure and the interplay with the existing rules; [ii] the permissible investment policies and restrictions to be pursued by an ELTIF; [iii] the redemption, subscription and distribution policy; [iv] transparency requirements regarding the marketing of EL-TIFs; [v] the marketing rules applicable to an EU AIFM for marketing units or shares of an ELTIF to professional and retail investors; and [vi] the rules on supervision.

A copy of the European Commission's proposal can be obtained through the following web-link: http://bit.ly/19RYMO9

European Commission publishes a proposal for a Regulation on Money Market Funds

On 4 September 2013 the European Commission published a proposal on the regulation of Money Market Funds (MMFs) domiciled or marketed in the EU. The draft regulation covers the following: [i] a distinction between standard and short-term MMF's; [ii] liquidity management requirements; [iii] a 3% capital buffer requirement for MMFs which have a constant NAV; [iv] the eligible assets and investment restrictions; [v] the establishment of an internal credit rating mechanism; [vi] due diligence procedure to identify customer needs; and [vii] stress testing procedures.

A copy of the European Commission's proposal can be obtained through the following web-link: http://bit.ly/18phDfn

EMIR - Publication of Regulatory Technical Standards on Colleges for Central Counterparties

On the 13th September 2013, the Commission Delegated Regulation (EU) No 876/2013 of 28 May 2013 supplementing Regulation (EU) No 648/2012 of the European Parliament and of the Council with regard to Regulatory Technical Standards on Colleges for Central Counterparties was made public on the Official Journal of the European Union. This means that the aforementioned Technical Standards will enter into force on the 11th October 2013. A copy of these Technical Standards may be obtained from the Authority's website by following this link: http://bit.ly/16qovgr.

Reporting Obligation Commencement Date

ESMA's timeline for the implementation of EMIR, dated 5th July 2013 indicated that the earliest possible date for the commencement of the Reporting Obligation to Trade Repositories was the 1st January 2014.

Please note that ESMA has issued an updated timetable. The Reporting start date depends on the first registration of a Trade Repository. ESMA now envisages that this decision will not take effect prior to the 7th November 2013. Consequently, Counterparties' Reporting to Trade Repositories is not expected to start before the 12th February 2014.

A copy of the latest timeline for the implementation of EMIR may be obtained by following this link: http://bit.ly/ZZr6Km.

STATISTICAL ANALYSIS OF THE INSURANCE SECTOR

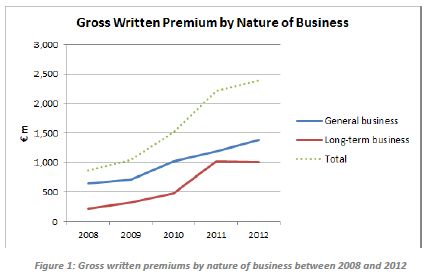

In 2012, the total gross written premiums have increased by 8.2% (€180m) in 2012, a statistical analysis in respect of the insurance industry in Malta has shown. Whilst the gross premiums written continue to grow steadily for the general business, for 2012 a decrease of 1.3% (€13m) in the volume of gross premiums written for the long-term business was observed.

The main highlights for 2012 are as follows:

The gross domestic product in real terms for 2012 was higher at €6.8bn (€6.6bn in 2011), an increase of 3.3% from 2011. The domestic market remains highly concentrated, especially in the long-term business sector.

The source of new business for general business continues to be generated directly. For the long-term business, new business is mainly sourced through tied insurance intermediaries.

The loss ratios have generally worsened for the general business due to the higher levels of claims incurred. For the long-term business, the amounts of claims paid have increased due to the higher maturity benefits paid out to policyholders and the higher death claims.

Further information is available on the MFSA Website: http://bit.ly/1fENUXj

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.