- within Environment topic(s)

Malta Enterprise has launched new guidelines for the Start-up Finance Scheme, providing funding in the form of a repayable advance in the range of €500,000 to €1,500,000 to support viable start-up undertakings.

Are you eligible?

To be eligible for support under this Scheme, the applicant must meet the definition of a "Small Start-up Undertaking". "Small Start-up Undertakings" are defined in the Scheme Guidelines as:

- Unlisted small enterprises up to five years following registration, which meet a set of cumulative conditions laid out in the Scheme guidelines; and which

- At time of application, must employ less than 50 full time equivalent employees, and have an annual turnover or annual balance sheet total which does not exceed Eur10 million.

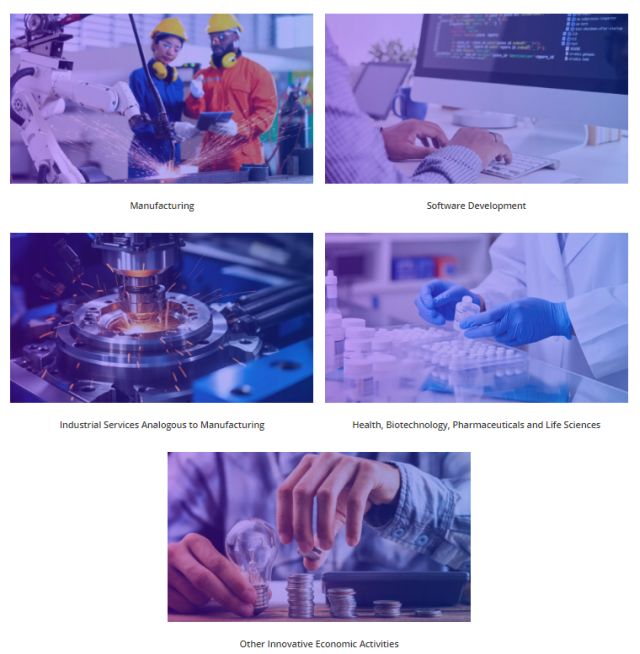

Amongst other conditions set out in the Scheme Guidelines, only "Small Start-up Undertakings" engaged in the following business activities may be considered eligible to benefit from the Scheme:

What is eligible expenditure under the Scheme?

The Scheme supports the following eligible expenditure:

- Payroll costs;

- Procurement of assets;

- Procurement of materials, and of specialised and technical services; and

- Costs incurred towards establishing an operation in Malta.

Support varies according to whether the "Small Start Up Undertaking" is an "Innovative Small Start Up Undertaking" or otherwise, and also depends on the physical location of the business of the applicant, to the extent that:

- Applicants which are "Small Start Up Undertakings", the support varies to a maximum of €500,000, and if operating from assisted areas as set out in the Scheme guidelines, the support increases further up to a maximum of €750,000; and

- Applicants which are "Innovative Small Start Up Undertakings", the support varies to a maximum of €1,000,000, and if operating from assisted areas as set out in the Scheme guidelines, the support increases further up to a maximum of €1,500,000.

Application deadline

Applications for assistance under this Scheme may be submitted by 30 September 2026.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.