- within Tax topic(s)

- in European Union

As the global economy is rebuilt, the public and policy makers alike are demanding a course correction and are looking to the United Nation's Sustainable Development Goals (SDGs) as a template for redevelopment. Resting at the heart of the SDGs, is the concept of 'agency', the ability of all citizens to act independently, contribute to society and affect their destiny. However, without financial inclusion, the very concept of agency may not be achieved.

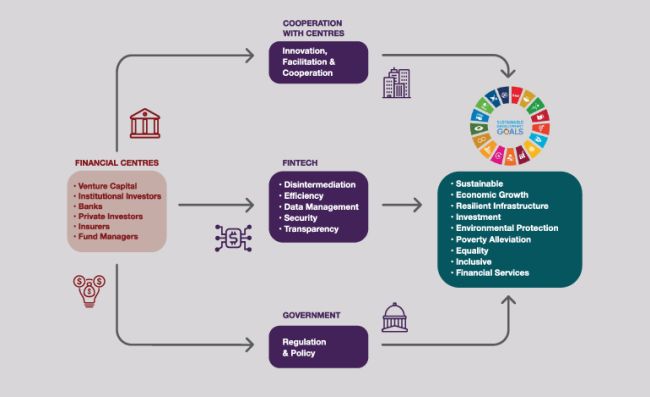

In a research paper jointly produced by Labuan IBFC and Z/YEN Group, which will soon be launched, the role that International Financial Centres (IFCs) can play in the delivery of the SDGs is explored. These concepts include:

- how IFCs can facilitate financial inclusion using new and emerging digital technologies;

- how IFCs should collectively take the mantle as the crucible for positive innovation; and

- how IFCs should foster collaboration with policy makers and Governments on how sustainable and equitable development should be a shared vision.

IFCs, Fintech and the Delivery of the SDGs

IFCs as wholesale financial intermediation centres, have always had a pivotal role to play in the global financial "plumbing", and as such has been the key enabler of globalisation and economic growth. It only stands to reason that IFCs, have now to embrace their role in the curation of an inclusive financial system to support the goals of SDGs. However, they cannot act in isolation.

Cooperation and partnership, between centres, between centres and policy makers, and between centres and the enterprises they host is essential if they are to reach their full potential as leaders and change agents.

Financial inclusion is the fulcrum of equality and critical to the delivery of the SDGs. Thus, to ensure this global objective is met, fresh innovations in financial products and services such as sustainable and responsible finance and fintech, hold promise towards the attainment of the SDGs. This is where the role of IFCs is crucial.

Society has set and tested ways of addressing development problems - from command-and-control, through policy focus, to enacting legislation and ensuring a fair as well as equitable taxation system. However, in order to truly achieve a fair and inclusive future, a change of mindset is required.

A future where global financial centres cooperate as well as compete, 'co-opetition' is needed to ensure inclusion is achieved. Afterall, like everything else that holds true, balance is always achieved in the middle.

Such a proposed collaboration requires policymakers, financial services providers, and financial centres to discuss and be aware of future needs of the industry in order to best support inclusive goals.

Without a doubt, IFCs are key enablers in ensuring the successful holistic adoption of inclusive finance, and a key natural facilitator of this enabler is the adoption of digital technology as well as protocols that reduce the cost of business generally, but offer transparency via distributed ledger technology - providing a clear and indisputable 'audit trail' in the roll out of SDG related initiatives.

Labuan IBFC and Z/Yen Group are jointly organising a webinar to share our research findings from the report "International Financial Centres: Facilitating Financial Inclusion via Digitalisation". This webinar will also share research findings, discuss opportunities and challenges for IFCs towards playing its role in creating a financially inclusive global system.

Register here and join us for this webinar on Thursday, 15 July at 4.00PM (GMT +8).

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.