- with readers working within the Banking & Credit industries

- within Antitrust/Competition Law, Intellectual Property, Media, Telecoms, IT and Entertainment topic(s)

I. Introduction

Employees are generally vital for the success of a business operation. Merger & acquisition (M&A) transactions («Transactions») regularly affect the employees of a target business in some way or the other – or create a fear of the employees of a (negative) impact if not handled well by the parties. In particular, a Transaction may affect an employee's pension situation – which in practice is often overlooked or identified only at a rather late point in time in the Transaction process, potentially causing disruption, uncertainties, delays or even a loss of talents, workforce and resources. The employees' pension schemes should thus be addressed with high priority in the planning, structuring and implementation of a Transaction.

To ensure a smooth Transaction, it is essential to suitably address potential pension topics, including, e.g., information and consultation obligations, required amendments to the employment agreements and affiliation with a pension scheme, and to consider timing requirements at an early stage.

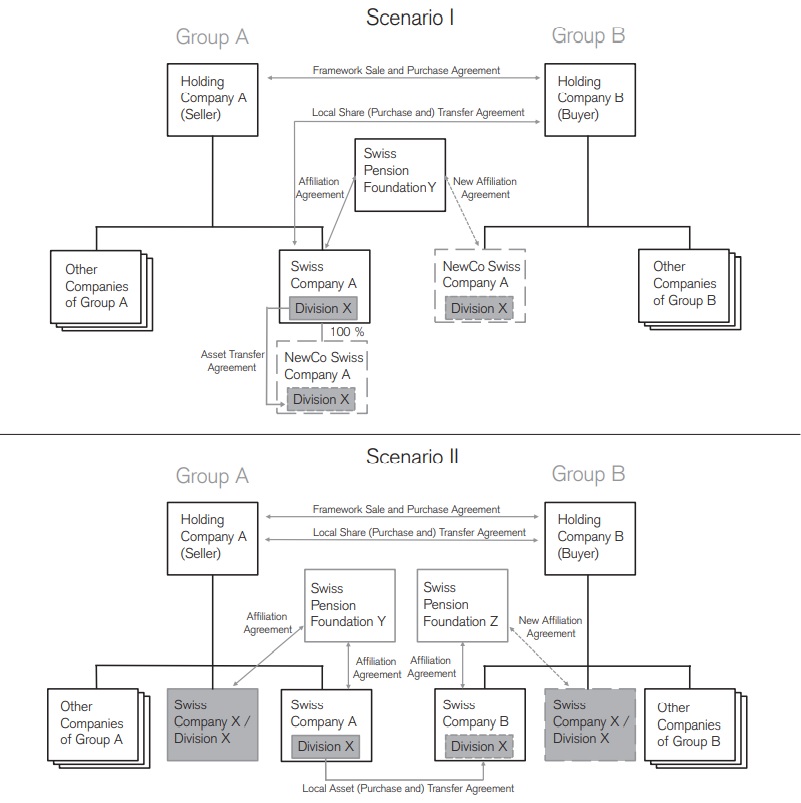

The following simple example illustrates a typical scenario of the pension situation in a Transaction («Example Case»):

Company group A («Group A») intends to sell its business division X. In Scenario I (see chart 1 below), a part of the business operation of Swiss company A refers to business division X («Swiss Company A»). In Scenario II (see chart 2 below), a part of the business operation of Swiss Company A and the business operations of Swiss company X refer to business division X («Swiss Company X») . Both Swiss Company A and Swiss Company X are affiliated with the pension foundation Y to include their employees in the mandatory pension plan scheme of pension foundation Y.

Company group B («Group B») intends to purchase the business division X from Group A. The top holding companies of Group A and of Group B enter into a framework sale and purchase agreement for the sale of the business division X (that might refer to several group affiliate companies in their entirety or in part) to Group B. In Scenario I, Group B has no Swiss group affiliate company. In Scenario II, Group B holds a Swiss group affiliate company B («Swiss Company B») that is affiliated with the mandatory pension plan scheme of pension foundation Z.

The implementing elements of the overall Transaction are the following:

- Scenario I: The transfer of the part of the business of Swiss Company A that refers to the business division X; and

- Scenario II: The transfer of the part of the business of Swiss Company A that refers to the business division X and the Swiss Company X from Group A to Group B.

There are various structuring alternatives to implement such transfer. In order to determine the preferred alternative, various aspects must be considered from a business perspective, but also legal aspects need to be taken into consideration. These include: pension, employment,contractual, corporate law perspective, and tax considerations.

In Scenario I, the operational business in Swiss Company A referring to the business division X could in a first step be carved-out, e.g. by way of an asset transfer under the Swiss Merger Act («Merger Act») into a newly incorporated NewCo Swiss Company A (or which is less seen in practice be spun-off from the Swiss Company A in a spin-off under the Merger Act) and in a second step, Holding Company B could acquire the shares in NewCo Swiss Company A by way of a share transfer under an implementing local share (purchase and) transfer agreement. The below chart illustrates this transaction alternative.

In Scenario II, the Swiss Company A could e.g. carveout and transfer the business of division X in Swiss Company A directly by way of a local asset (purchase and) transfer agreement under Merger Act to the Swiss Company B.1 . In a separate step Holding Company A could transfer the shares in Swiss Company X to Holding Company B by way of an implementing local share (purchase and) transfer agreement. The below chart illustrates the transaction structure in Scenario II.

Footnotes

1 In contrast to Scenario I usually no two-step approach consisting of an asset transfer and subsequent share transfer applies or is required because of the already existing Swiss company of Group B (i.e. Swiss Company B).

To read the full article click here

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.

[View Source]