- with Senior Company Executives, HR and Finance and Tax Executives

- with readers working within the Accounting & Consultancy, Basic Industries and Business & Consumer Services industries

The Quebec Court decision in Kone Inc. v. QRA1 reiterates that economic substance has limited impact in the Canadian tax landscape, including for the purposes of the General Anti-Avoidance Rule ("GAAR"). Repo transactions cannot be recharacterized as a loan for Canadian tax purposes simply because such an arrangement presents similar features.2Kone represents a good preview to assess how the GAAR framework could be impacted should the Department of Finance decide to incorporate an economic substance element into the abuse analysis, as currently contemplated.

Facts

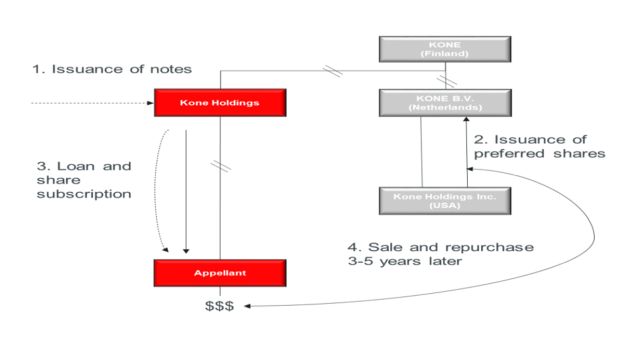

The taxation years in issue are 1999 to 2006. In order to finance upcoming acquisitions, a Canadian entity part of an international group issued $400,000,000 in notes.3 Pursuant to the group's financing strategy, those funds were ultimately made available to a foreign affiliate that would complete the acquisitions.4 For that purpose, instead of making further intra-group loans, repo transactions were entered into whereby newly issued preferred shares of another foreign affiliate in the group were purchased by an operating Canadian entity, subject to a repurchase agreement. The shares were in fact repurchased a few years later, for the same consideration plus all undeclared cumulative dividends accrued in respect of such shares.5 The resulting gain was deemed to be a dividend paid out of exempt surplus,6 such that there was no tax.

The QRA took offence with the fact that the repo transactions "were equivalent to loans", and were treated as such for US tax purposes. In the US, the payment of the cumulative dividends on the preferred shares gave rise to a deduction (they were treated as interest, based on the repo's economic substance). The transaction was challenged both on the basis of sham and GAAR.

The Decision

Sham requires an intent to deceive the tax authorities.7 For Canadian tax purposes, the absence of economic substance (other than obtaining a tax benefit) does not amount to a sham.8 In light thereof, the Court concluded that the repo transactions were designed and documented precisely to obtain the intended tax result.9 The fact that the transactions were intended to be recharacterized as a loan for US tax purposes pursuant to the US "substance over form" doctrine did not impact the Court's conclusion on sham, or determination of the legal effect of the transactions.10

In respect of the GAAR analysis, the Court concluded that there was no abuse of the Quebec equivalent to section 17 of the Income Tax Act11 (the only section allegedly abuse according to the QRA). Because that provision targets loans, the Court ruled that its abuse could not be based on the fact that the tax treatment of fundamentally different transactions (i.e. an acquisition and a disposition) was more beneficial.12 The fundamental purpose of the GAAR is not to recharacterize transactions,13 including based on their alleged economic substance.

What if the GAAR Included an Economic Substance Analysis?

As part of the ongoing GAAR consultation, the Department of Finance is currently considering whether an economic substance analysis should be built into the abuse test. If such a change were implemented, the Department of Finance recognizes that "it could significantly affect the body of case law that has developed on the misuse and abuse". 14 The present fact pattern represents a relevant example of a situation that could be decided differently, based on an economic substance analysis.

Footnotes

1. 2022 QCCQ 9892 ("Kone").

2. Such as the repurchase of the shares contemplated at the time of their sale (the "repayment of the capital"), guaranteed periodic return on the shares in the form of a fixed and cumulative dividend entitlement (similar to interest), restrictions on transfers, etc.

3. Kone, para. 8, Partial Agreed Statement of Fact ("PASF") para. 15 and 16.

4. Kone, para. 8, PASF para. 25.

5. Kone, para. 8, PASF para. 22 to 24.

6. Kone, para. 8, PASF para. 8.

7. Kone, para. 93.

8. Kone, para. 95. On this topic, see Stubart Investments Ltd. v. The Queen, [1984] 1 S.C.R. 536, p. 571 to 573; and Shell Canada Ltd. v. Canada, [1999] 3 R.C.S. 622, para. 39 and 46.

9. Kone, para. 107 and 108.

10. Kone, para. 123 to 125, and para. 132 to 134.

11. Section 17 of the Income Tax Act deems Canadian corporations to have received interest on loans made to non-residents when the interest rate agreed upon is less than a prescribed rate.

12. Kone, para. 199 and 200.

13. Kone, para. 201.

14. Modernizing and Strengthening the General Anti-Avoidance Rule, Consultation Paper, Department of Finance, p. 28.

To view the original article click here

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.