- within Tax topic(s)

- with Senior Company Executives, HR and Finance and Tax Executives

- with readers working within the Accounting & Consultancy, Insurance and Oil & Gas industries

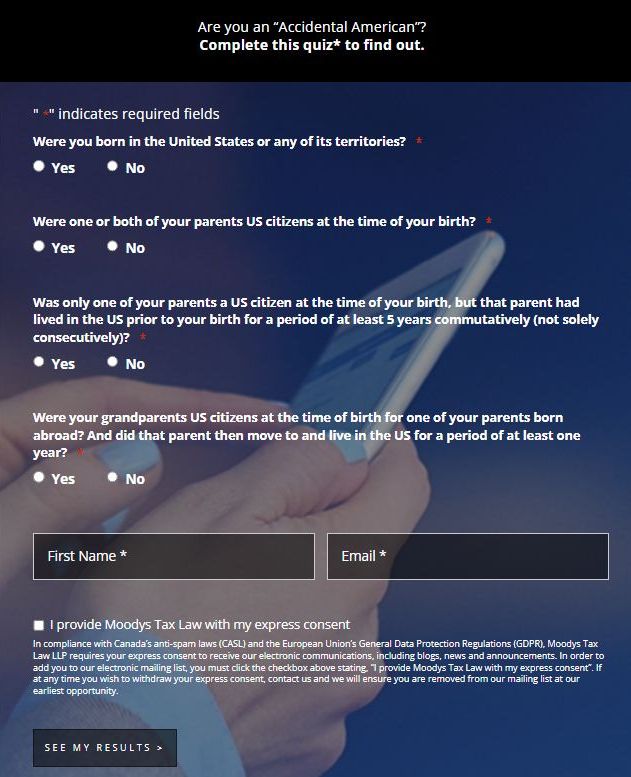

An alarming number of people living abroad don't realize they're US citizens who are subject to annual taxation and filing obligations to the IRS. They are commonly referred to as "Accidental Americans" and often discover they're US citizens later in life through other family members, or when their non-US banks reach out asking them to provide US ITINs (individual taxpayer identification numbers), fill out W-9s, or even look to close the account due to suspected US status.

The US is one of the few countries in the world (Eritrea is the other) that taxes one's worldwide assets and income based on citizenship - regardless of where that person lives in the world. This means that if you're a US citizen living in a country outside the United States, you are taxed on your worldwide income, have annual IRS reporting and filing obligations, and may even owe US tax to boot!

*This quiz is only intended to serve as a preliminary information tool and cannot be constituted as or substituted for legal advice issued by Moodys Tax. For a detailed personal evaluation, please book your consultation with Moodys Tax.

What does this mean for me?

US citizens have yearly IRS reporting and filing obligations, with their income being subject to taxation no matter where they live in the world, or how they acquired US citizenship. This applies even if the American has never set foot in the United States.

What should I do next?

The first step would be to seek legal advice to confirm your citizenship status. Once it is confirmed that you are a US citizen, you may wish to keep your US citizenship, which means you must become tax compliant with the IRS. There are amnesty programs that work very well for this situation and the requirement to back file US tax returns. If you do not wish to keep your US citizenship, you have the option to renounce your US citizenship, while again, needing to back file into an amnesty program to become US tax compliant.

Renunciation provides a safe and legal way out of your double taxation dilemma. Being taxed by your country of residency and the US can result in expensive annual tax filing legal fees, double taxation owed to the IRS, and issues in death via the US estate tax regime. Common situations where US expats living abroad may owe tax to the US, even when living in high-tax countries with tax treaties with the US (Canada, Australia, New Zealand, the UK, certain countries within Europe, etc.) include, but are not limited to, selling your principal residence with high gain, having an interest in a non-US privately held company, holding non-US mutual funds or ETFs, divorce settlements, the US estate tax (death tax), interests in non-US trusts/partnerships, gift tax, lottery winnings, and more. Being taxed by one country is always better than being taxed by two!

These stressful double-tax risks can be eliminated if one successfully renounces their US citizenship. The US has a gauntlet of tricks and traps to avoid when renouncing properly (exit tax, inheritance tax, disbarment from the US for life, travel issues, keeping social security, etc.). Our firm handles more renunciation clients than any firm in the world and ensures that none of these potential problems happen. We specialize in making sure you renounce the right way to avoid all the potential land mines while still being able to enjoy the US using your fallback passport.

To learn more, we encourage you to visit our dedicated US Citizenship Renunciation webpage for more information. This page contains links to register for our upcoming renunciation webinars. You can find one tailored to your geographic location in our events listings.

These webinars thoroughly review everything you need to know about the US citizenship renunciation process and available options should you decide to take the next steps.

Click here to view our upcoming Renunciation Webinars and register

Moodys Tax Law is only about tax. It is not an add-on service, it is our singular focus. Our Canadian and US lawyers and Chartered Accountants work together to develop effective tax strategies that get results, for individuals and corporate clients with interests in Canada, the US or both. Our strengths lie in Canadian and US cross-border tax advisory services, estateplanning, and tax litigation/dispute resolution. We identify areas of risk and opportunity, and create plans that yield the right balance of protection, optimization and compliance for each of our clients' special circumstances.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.