- within Consumer Protection and Antitrust/Competition Law topic(s)

- with Senior Company Executives, HR and Inhouse Counsel

- with readers working within the Transport and Law Firm industries

Steven Pettigrove and Luke Higgins of the Piper Alderman Blockchain Group bring you the latest legal, regulatory and project updates in Blockchain and Digital Law.

Binance Founder CZ Pardoned, is SBF next?

The Trump Administration has been unashamedly pro-crypto, seeking to craft innovation supporting rules and changing the leadership at the previously anti-crypto Securities & Exchange Commission.

This approach has dialed up further with news that Binance founder Changpeng "CZ" Zhao has been pardoned today for his conviction in connection with a prosecution of Binance for breaching sanctions and anti-money laundering laws.

After the Department of Justice commenced that prosecution, CZ voluntarily travelled to the United States, where a plea deal was agreed, CZ stood down as CEO and was sentenced to 4 months imprisonment. The sentence was very unusual in that, as his lawyers pointed out in relation to banking anti-money laundering breaches:

no defendant in a remotely similar ... case has ever been sentenced to incarceration

Binance paid a US $4.3B fine in connection with the plea deal. The Wall Street Journal reported that Binance had been campaigning for a pardon for CZ for much of the last year.

The White House Press Secretary reportedly said:

President Trump exercised his constitutional authority by issuing a pardon for Mr. Zhao, who was prosecuted by the Biden Administration in their war on cryptocurrency...[i]n their desire to punish the cryptocurrency industry, the Biden Administration pursued Mr. Zhao despite no allegations of fraud or identifiable victims

Earlier this year the founders of BitMex were also the subject of a pardon, and recently news broke concerning allies of Sam Bankman-Fried ("SBF") agitating for a pardon, with the publication of a piece titled:

FTX Was Never Insolvent: My Prison Interview with Sam Bankman-Fried

It seems SBF would face a far higher hurdle to a pardon, having pled not-guilty to accusations of fraud over the collapse of FTX and having been convicted, versus CZ striking a plea deal over allegations not involving loss of funds or fraud.

British Columbia Places Permanent Ban on New Crypto Mining Projects

In an update to a temporary moratorium in place since 2022, and cutting against the global thaw on crypto engagement and policy of the USA to promote more cryptocurrency business, British Columbia has announced a permanent ban on new cryptocurrency mining projects from accessing the provincial electricity grid. This decision is said to arise from concerns over the environmental effects of cryptocurrency mining and its hefty electricity demands, but this is curious given there has been a temporary ban in effect for 3 years already. AI datacenters will see their access to the BC grid limited as well under this new approach.

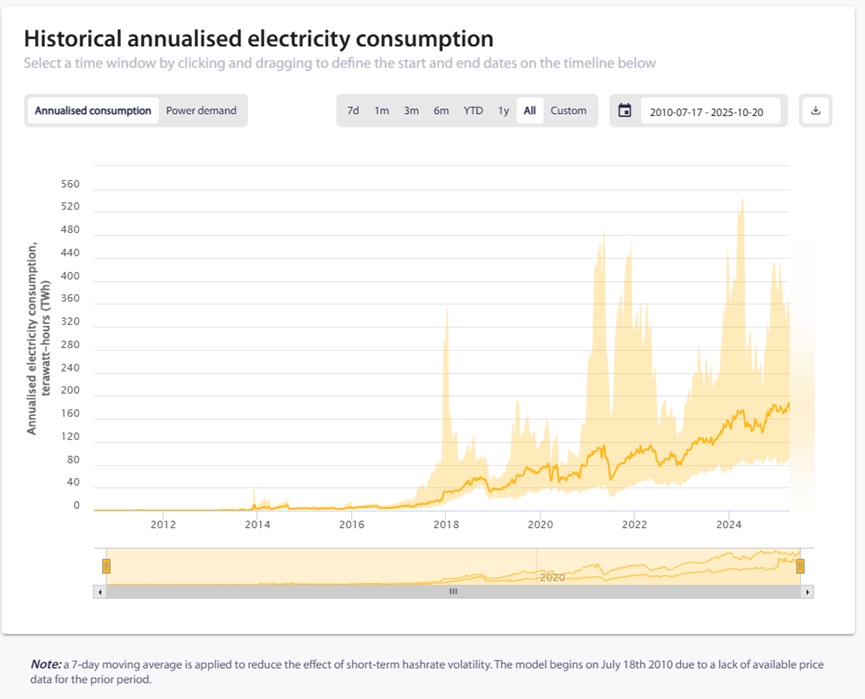

Reports from the Cambridge Centre for Alternative Finance indicate that cryptocurrency mining consumes a large quantity of electricity in absolute terms. In 2021, Bitcoin mining alone was responsible for about 0.5% of the world's total electricity use. This statistic has been used to assert that Bitcoin is environmentally damaging, but critiques have been made, noting that electricity demand for "stranded assets" using Bitcoin mining can help fund and support new renewable energy projects and reduce emissions from gas flaring as well.

The decision to make permanent the temporary ban on new mining projects aims to proactively diminish the environmental impact of crypto mining and ensure that the province's energy resources are used efficiently. However, it also provokes questions about the proper allocation of electricity and the future of the cryptocurrency sector in British Columbia, as well as the economic consequences that might emerge from this ban and whether this might continue to push Bitcoin mining from green hydroelectricity to dirtier sources of power.

The Cambridge Centre for Alternative Finance has regularly published statistics on the electricity usage of cryptocurrency mining. Their reports underscore the major energy demands of mining, particularly for Bitcoin, which relies on an energy-intensive proof-of-work mechanism. The Centre has had to update their methodologies and revise downwards past estimates of electricity usage. The range of theoretical lower and upper bounds means these estimates are just that, but they reveal an upward trend.

Since British Columbia first introduced a temporary ban on new crypto mining connections to the grid in 2022, which was extended in 2024 the immediate impact is not likely to be great. Existing mining operations now have certainty that they still cannot obtain new power connections and continue to look elsewhere for new sites and plan knowing there is no possibility of a new connection. There seems little innovation on the horizon which could help mining projects setup their own power sources in BC and while the winter in Canada provides a very useful heat sink for mining projects, helping reduce costs, a frosty regulatory reception is not conducive to greater investment.

With Canada generally maintaining a very conservative approach to cryptocurrency businesses in the face of rising demand, this move by British Columbia will continue to push more innovation and talent abroad and away from the great white north.

Australia publishes draft stablecoin and payments legislation

The Australian Government has released exposure draft legislation which will regulate stablecoins as a standalone financial product and make significant amendments to Australia's payments legislation. The proposed laws will apply financial services licensing obligations to stablecoin issuers and introduce bespoke reporting and compliance obligations carrying hefty civil and criminal penalties for non-compliance.

Assistant Treasurer and Minister for Financial Services, Daniel Mulino, stated in a press release on 9 October 2025 that the draft legislation delivers:

A core licensing regime that will set clearer obligations on payment service providers that perform specific functions.

A graduated regulatory framework for stored value facilities like prepaid accounts, stablecoin issuers, or wallets that hold customer funds.

Explanatory material released with the draft legislation states that the objective of the new laws is to create a more comprehensive and effective regulatory system for payment services which reflects the nature of modern payment products and services.

What do the changes look like?

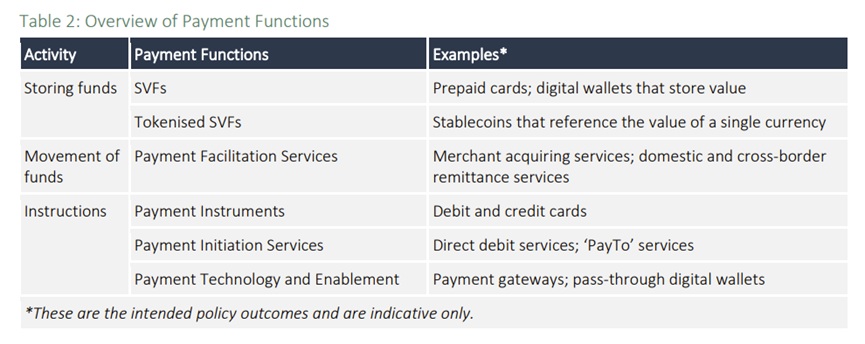

The draft legislation introduces stablecoins to the regulatory framework by defining tokenised SVFs and tokenised SVF providers (curiously the term "payment stablecoin" has been dropped after previous consultations).

A tokenised SVF is defined as a stored value facility where:

- Each right to redeem a particular amount in respect of the amount standing to the credit of the facility is exercisable only by the person who possesses the digital token attached to that right; and

- The amount that may be redeemed in exercising that right is fixed and denominated in a single currency (whether Australian or foreign currency).

A tokenised stored value facility provider is defined as a person who:

- Carries on a financial services business in this jurisdiction that consists wholly or partly of issuing tokenised stored value facilities; and

- Is a constitutionally-covered corporation.

This definition would appear to include foreign stablecoin issuers depending upon whether they are caught by the broad definition of carrying on a business under financial services laws.

The draft legislation also introduces ongoing disclosure obligations for tokenised SVF providers, requiring them to publish online:

- Any material change or significant event that may reasonably be expected to affect the value of the assets backing their tokens.

- Any material change or significant event that may reasonably be expected to affect their ability to meet those obligations.

- A monthly statement detailing their reserve assets and outstanding liabilities.

Under the draft legislation, offences carrying civil and criminal penalties of up to 5 years imprisonment will also be created, punishing SVF providers who:

- Fail to comply with their ongoing disclosure obligations; or

- Disclose misleading or deceptive information.

While the legislation would impose criminal penalties in the form of imprisonment, given only a constitutional corporation can act as a tokenised SVF provider, one would expect that the risk to directors of imprisonment for failing to meet monthly reserve reporting requirements is limited save perhaps in the most egregious circumstances.

Statutory defences will be available where the information required to be published was not disclosed because it could not be obtained or where reasonable steps were taken to ensure that the information would not be misleading or deceptive.

Further payment reforms

The draft exposure legislation contains a number of other significant changes to the way in which payments services are regulated in Australia. Importantly, those changes are expected to extend to providers dealing in money and tokenised SVFs only, whilst seeking to coexist alongside the digital asset reforms which are currently also the subject of consultation.

The reforms will see the abolishment of the concept of a non-cash payment facility and purchased payment facility, and its replacement by a number of more prescriptive payment products and services.

In totality, these changes broaden the scope of existing payments licensing obligations in a number of respects. They will, for example, provide for express coverage of pass through digital wallets and remittance.

We are told that a second draft exposure bill will be circulated early next year which will specify important exemptions to the regime including carve-outs for "purely back-end services" from technology and enablement services (presumably software developers). The two exposure draft bills are expected to be introduced to Parliament as a single legislative package.

Have your say

If you offer payment products (including hitherto unregulated services such as stablecoin issuance, remittance and digital wallet providers), the proposed reforms will affect you. The draft legislation is currently open for consultation and the Government has invited interested parties to make written submissions on the new laws before 6 November 2025.

The Government is aiming to implement the legislation in 2026. Consultations on subordinate legislation will follow.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.