- with Finance and Tax Executives and Inhouse Counsel

- with readers working within the Healthcare and Retail & Leisure industries

Reforms to Australia's AML/CTF regime have been passed and are set to commence in 2026. In this article, we discuss the changes to the definition of "designated services" introduced and which types of businesses will be required to comply with AML/CTF requirements from 2026. These businesses are commonly known as 'Tranche 2' entities (given a Tranche 1 of entities went live with AML/CTF requirements in 2007).

Background

Currently, a wide range of financial services businesses (such as financial services providers, banks, casinos and gambling services providers, bullion dealers, remittance service providers, and digital currency exchange providers) are already regulated under the AML/CTF regime. This is because these businesses provide a "designated service" as defined in the AML/CTF Act.

Under the reforms, the list of designated services has expanded to include additional high-risk services, which often provided by gatekeeper professions – non-financial businesses which facilitate transactions and activities that can be used for money laundering or terrorism financing.

Note: A business is not regulated under the AML/CTF regime just because it belongs to one of the above industries. The business must provide one or more "designated services" as defined in the AML/CTF Act in the course of carrying on a business (i.e. the designated service is a regular part of the business' operations and not an incidental event).

New Designated Services

Buying and selling precious metals, stones and products

A business provides a designated service if it buys or sells precious metals, precious stones and/or precious products, where:

- the purchase involves the use of cash and/or virtual assets; and

- the total value (whether in a single transaction or via instalments) is A$10,000 or more (or foreign equivalent).

If a business that deals with precious metals, stones and products decides not to accept cash or virtual asset payments for any transaction above the $10,000 threshold, the business does not provide a designated service. The business must make this a business rule and ensure that its employees adhere to this rule.

If a business deals with bullion, the business provides a designated service and is regulated under the AML/CTF regime, regardless of the payment methods accepted and the value of the transaction.

| Category | Definition | Examples |

|---|---|---|

| Precious metal |

|

N/A |

| Precious stone |

|

Beryl, chrysoberyl, corundum (including rubies and sapphires), crystallin and cryptocrystalline quartz, diamond, feldspar, garnet, jadeite jade, lapis lazuli, nephrite jade, opal, olivine peridot, pearl, spinel, spodumene, tanzanite, topaz, tourmaline, and zircon |

| Precious product |

|

|

| Bullion |

|

Note: Numismatic coins made of gold / silver / platinum / palladium are considered precious metals instead of bullion. However, if the numismatic coins are traded at their bullion value (e.g. Gold Sovereign coins, Krugerrands), they are treated as bullion even if they do not bear an explicit mark indicating fineness. |

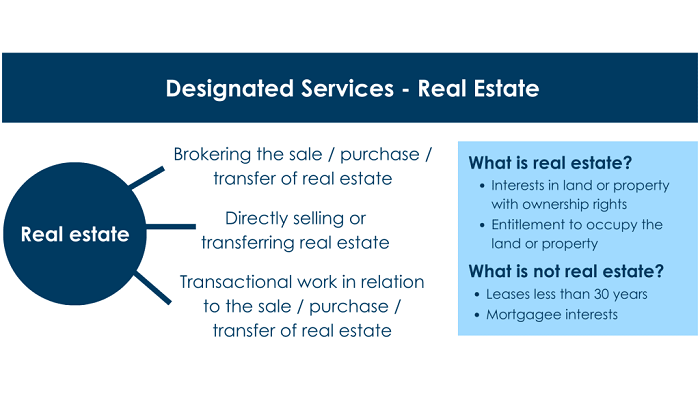

Real estate services

A business provides a designated service if it does any of the following:

- brokers the sale/purchase/transfer of real estate on behalf of a customer. This designated service would capture real estate agencies which represent sellers and buyers of real estate.

- sells/transfers real estate, where the sale/transfer is not brokered by an independent real estate agent. This designated service would capture property developers and other businesses which sell real estate with their own in-house real estate agents or employees.

- assists a person to plan or execute a transaction to sell/buy/transfer real estate. This designated service would capture lawyers and conveyancers who engage in work that gives effect to the transfer of ownership of real estate from one person to another (except where the transfer is pursuant to a court order). Such work involves the planning steps before the actual conduct of the sale/purchase, for example researching property titles, preparing contracts and transfer instruments, coordinating mortgage payments, and preparing for settlement.

What is "real estate"?

- Interests in land (including subdivided / strata land) in Australia or overseas that confers ownership rights (e.g. fee simple interest, leasehold interest) or an entitlement to occupy the land (e.g. conferred through an ownership of shares in a company or units in a unit trust scheme, together with a lease or licence).

- Does not include:

- Leases of 30 years or less (e.g. most rental tenancies)

- Incorporeal hereditaments (e.g. easements)

- Interests in land that do not reflect ownership (e.g. mortgages, covenants)

Note: Real estate professionals may also be providing other designated services (see 'Professional Services' below).

Professional Services

A business provides a designated service if it:

- assists a person with a transaction to sell/buy/transfer a company or other legal arrangement (except where the transfer is pursuant to a court order), where the person is or will be a beneficial owner (at least 25% ownership of or control over the company).

- directly sells or transfers a shelf company (a company that has had no business activity).

- assists a person with the creation or restructuring of a body corporate or other legal arrangement. This designated service would capture for example, reviewing corporate agreements and trust deeds, lodging forms with ASIC to register a company or business name, and conducting due diligence on transactions. A business does not provide this designated service if it performs only advisory work without any proposed transaction.

- provides another company or other legal arrangement with a registered office address or principal place of business address for use in lieu of a genuine office address that the company operates their business from. This designated service would capture those businesses who provide business addresses to companies which do not have physical presence in Australia or do not use/occupy the premises.

- acts as, or arranges for another person to act as, an alternate/nominee/resident director of a company (or similar roles in other legal arrangements), on behalf of a nominator. This designated service would capture those businesses which assist with identifying and engaging a person to be an acting director who will act only on the wishes and instructions of the nominator, but not businesses which assist with genuine appointments where the person nominated will be fulfilling their duties with independent decision-making authority.

- acts as, or arranges for another person to act as, a nominee shareholder of a company or other legal arrangement, on behalf of a nominator. A nominee shareholder is someone who holds shares in a company on behalf of another person, exercises voting rights according to the instructions of that person and/or receives dividends on behalf of that person.

- receives/holds/controls/disburses/manages a person's

money/accounts/securities/virtual assets/property that forms or

will form part of a transaction. This designated service would

capture for example, the holding of monies on trust that would be

applied towards a transaction on settlement, but not money/property

that is:

- deposit or pre-payment for goods/services that the business will provide;

- to be payable under a court order; or

- to be payable to/from a government body, court/tribunal, public international organisation, licensed insurance provider.

Note: A business may operate a trust account without providing any designated services (e.g. a law firm that operates a trust account but does not engage in any transactional work).

- assists a person in equity capital raising or debt financing relating to a (proposed) body corporate or other legal arrangement. This designated service would capture for example, preparing transactional documents, providing advice on the process for equity or debt financing.

Virtual asset services

Currently, only the exchange of virtual assets for money (and vice versa) is a designated service under the AML/CTF Act. Virtual asset service providers who provide this designated service are required to enrol and register with AUSTRAC.

The Reforms have expanded the list of designated services that would apply to virtual asset service providers to include the following:

- Exchanging a virtual asset for another virtual asset of the same or different kind – this includes mixing and tumbling activities.

- Transferring virtual assets from payer to payee (the payer and payee can be the same person).

- Providing a virtual asset safekeeping service (i.e. ability to hold/trade/transfer/spend the virtual asset per the user's instructions) – this designated service captures those who administer digital wallets, but does not capture those who provide ancillary infrastructure to support the safekeeping services.

- Participating in and providing financial services related to an issuer's offer and/or sale of a virtual asset (e.g. initial coin offerings).

Next Steps

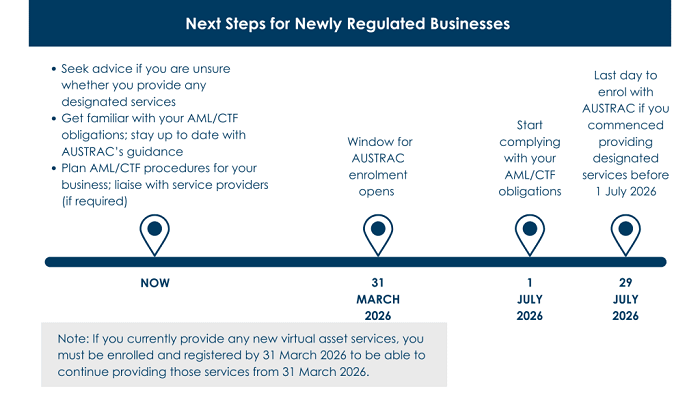

If your business will be newly regulated under the reforms the following timeframes apply:

| Comply with AML/CTF Act and Rules | Enrol with AUSTRAC | Register with AUSTRAC | |

|---|---|---|---|

| Buyer/seller of precious metals, stones, products | 1 July 2026 | Between 31 March and 29 July 2026 (if providing services before 1 July 2026) | N/A |

| Real estate services | 1 July 2026 | Between 31 March and 29 July 2026 (if providing services before 1 July 2026) | N/A |

| Professional Services | 1 July 2026 | Between 31 March and 29 July 2026 (if providing services before 1 July 2026) | N/A |

| Virtual Asset Service Providers | 31 March 2026 | Submit application before 31 March 2026 | Submit application before 31 March 2026 |

Further Reading

Businesses which provide a "designated service" under the AML/CTF Act and have a geographical link to Australia are known as reporting entities. Reporting entities are regulated by AUSTRAC and have a variety of obligations under the AML/CTF Act, including the requirement to implement an AML/CTF Program and conduct customer due diligence. For further information about what these obligations are, please refer to this page.

More details can be found in the AML/CTF Amendment Act 2024, as well as the upcoming new AML/CTF Rules and AUSTRAC's core guidance – to be released in the second half of 2025.

- AUSTRAC's AML/CTF Reform Hub

- AML/CTF Amendment Act 2024

- Explanatory Memorandum and Supplementary Explanatory Memorandum

- Future Law Compilation of the AML/CTF Act

- Draft AML/CTF Rules 2025

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.