Introduction

This document comprises the Programme of Activity for ACME AIF ICAV (the "ICAV") setting out the ICAV’s structure, its activities and the processes and controls which it has adopted to comply with its obligations under the provisions of the European Union (Alternative Investment Fund Managers) Regulations 2013 (the “Regulations”) and Commission Delegated Regulation (EU) 231/2013 of 19 December 2012 supplementing Directive 2011/611 EU of European Parliament and of the Council with regard to exemptions, general operating conditions, depositaries, leverage, transparency and supervision (referred to generally as the “Level 2 Regulation”).

This document should be read in conjunction with the ICAV’s Policies and Procedures document which sets out the policies adopted by the ICAV covering various operating and organisational obligations of the ICAV.

The ICAV shall keep this Programme of Activity up-to-date and shall submit updates to the Central Bank of Ireland (“Central Bank”), if necessary. Material amendments to this Programme of Activity shall be notified to the Central Bank as they arise.

It is intended that this document will also assist the ICAV in complying with the Corporate Governance Code for Collective Investment Schemes and Management Companies issued by the Irish Funds Industry Association (the “Code”).

General ICAV Information

ACME AIF ICAV

|

Date of Incorporation: [ ] |

Registered No.: 123456 |

|

Registered Office 33 Sir John Rogerson’s Quay Dublin 2 Ireland |

Directors Mr. A. Smith Mrs. B. Murphy Mr. C. Jones Ms. D. Kelly |

|

Investment Manager ACME Asset Management LLC (the “Investment Manager”) |

Distributor ACME Asset Management LLC (the “Distributor”) |

|

Administrator Irish Administration Company Limited (the “Administrator”) |

Depositary Irish Depositary Limited (the “Depositary”) |

|

MLRO Ms. A. Walsh (the “MLRO”) |

Secretary Tudor Trust Limited (the “Secretary”) |

|

Legal Advisors (Ireland) Dillon Eustace (the “Legal Advisors”) |

Auditors Irish Audit Firm (the “Auditors”) |

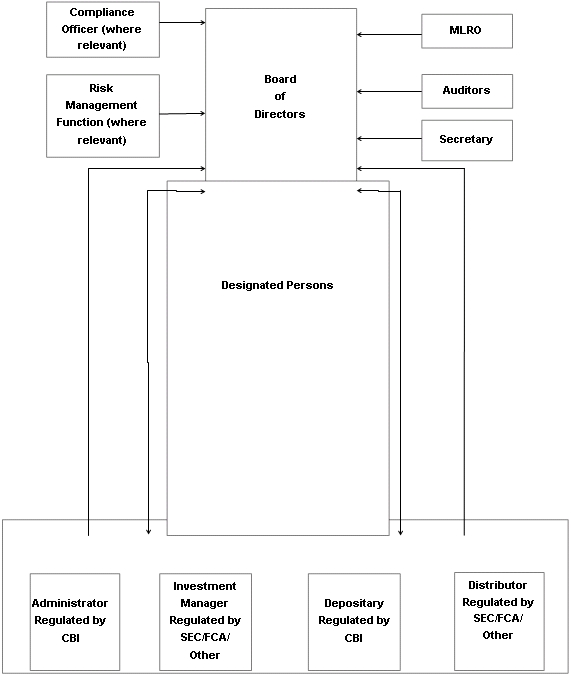

Organisational Chart & Reporting Lines

ICAV Overview

ACME AIF ICAV (the "ICAV") was registered in Ireland on [ ]as an Irish collective asset-management vehicle (“ICAV”) and with segregated liability between sub-funds under the Irish Collective Asset-Management Vehicle Act 2015, and is authorised by the Central Bank of Ireland (the "Central Bank") as an internally managed retail investor alternative investment fund (“RIAIF”) and as an internally managed AIF pursuant to the European Union (Alternative Investment Fund Managers) Regulations, 2013 (the “Regulations”).

Proposed Activities

It is proposed that the ICAV will, subject to Central Bank authorisation, undertake the following activities provided for in Schedule 1 to the Regulations:

|

AIFMD - SCHEDULE I Services |

(✓) |

|

|

1. |

Investment management functions which an AIFM shall at least perform when managing an AIF: (a) portfolio management; (b) risk management. |

✓ |

|

2. |

Other functions that an AIFM may additionally perform in the course of the collective management of an AIF:

|

✓ |

|

✓ |

|

|

N/A |

The Funds

The ICAV offers the following sub-funds (each a “Fund”) for investment:

ACME Fund A;

ACME Fund B; and

ACME Fund C. (the “Funds”)

pursuant to a Prospectus dated [ ] (the "Prospectus").

Each Fund is a collective investment undertaking, investing monies subscribed by investors into a separate pool of investment assets.

The investment objectives, policies and restrictions, the extent to which each Fund will employ leverage and the types of investments which each Fund may make as well as dealing arrangements and applicable fees and charges can be found in the Prospectus and relevant Fund Supplement.

Dillon Eustace Drafting Note

The Programme of Activity will then need to, inter alia, disclose the following matters in detail:

- Organisational Structure

An overview of the role and responsibilities of the Board of Directors and Chairman should be described. Details in respect of Board Meetings and the process for Board appointments and resignations should also be documented.

- Delegation

Details on each of the various delegates and service providers should be outlined. A clear rationale for the delegation/appointment must be disclosed together with the control of the Board maintains over the delegates and service providers.

- Portfolio Management Procedures

The ICAV’s portfolio management framework, including the activities of the ICAV and of the Investment Manager, needs to be disclosed. The monitoring and oversight of the investment policy, strategy and performance for each Fund should also be documented.

- Risk Management Procedures

The risk management framework, including the risk management activities and controls of the ICAV and of the Investment Manager, need to be adequately disclosed. Detail in respect of the leverage risks, liquidity risks and operational risks relevant to the ICAV should also, in particular, be described.

- Operating Conditions and Organisational Requirements

AIFMD imposes numerous operating conditions and organisational requirements for AIFMs. For example, there are specific requirements for matters such as Personal Transactions and Best Execution. The Programme of Activity should describe how the ICAV complies with these requirements.

- Exercise of Management Functions.

The Central Bank has prescribed 16 key management functions in respect of the operation and oversight of the ICAV. The 16 management functions are as follows:

- Decision making

- Monitoring of investment policy, investment strategy and performance

- Monitoring compliance

- Risk management

- Liquidity management

- Operational risks

- Conflicts of interest

- Supervision of delegates

- Financial control

- Monitoring of capital

- Internal audit

- Complaints handling

- Accounting policies and procedures

- Recordkeeping

- Remuneration

- AIFMD reporting process

The Programme of Activity is required to include detail in respect of each function and to identify the relevant Board members or other individual (“designated person”) who will, on a day to day basis, monitor and control each of the individual functions.

- Reporting

The Programme of Activity is required to provide for the following requirements in relation to the reports to be reviewed by the designated person and the action required in the context of each function:

(a) the types of reports received;

(b) the frequency of reports;

(c) any action carried out pursuant to the reports received; and

(d) exceptional reporting.

The Central Bank typically requires the above detail to be included in chart format as an appendix to the Programme of Activity.

- Charges

The Programme of Activity should detail the nature of any charges, guarantees, indemnities or other security commitments given by the AIFM to third parties in effect at the date of application.

- Financial Projection

The Programme of Activity should include financial projections covering a period of three years.