In 1987, a Plain Dealer delivery boy received a $10,000 Christmas "tip" from an elderly customer. When approached by the delivery boy's parents to ensure it was not a mistake, the customer confirmed her intent and that she had consulted with her accountant before making the gift. In such a generous gift situation, are there also favorable tax consequences for the donor?

Each year, a person may gift thousands of dollars to as many different persons as that person desires, without triggering U.S. Gift Tax or using one's lifetime exemption. In 2025, the annual Gift Tax exclusion amount is $19,000.

This simple, and often overlooked gifting strategy offers enormous benefits for receivers and transfer tax savings for high-net-worth givers. Leveraging this basic annual exclusion tax strategy should not be overlooked when considering complex planning techniques. Navigating Estate and Gift Tax rules can be daunting, and if a plan is not executed correctly, it can potentially diminish the value of a donor's generosity through unnecessary taxation.

Assisting client-donors to establish a gifting strategy while they are still living can be illuminating for them to be able to see the outcome of their generosity.

Lifetime Gift and Estate Tax Exemption

Each individual has a lifetime Gift and Estate Tax exemption, which represents the amount a taxpayer may leave to beneficiaries at death without incurring a tax liability. We'll call this simply the "Lifetime Exemption" in this article (and we'll put aside here complexities of the related Generation-Skipping Transfer Tax Exemption). It is the combined total value of the taxable gifts made during ones lifetime plus what is left in his taxable estate at death. In 1987, the year of the opening story, the Lifetime Exemption was $600,000.

In 2017, the Tax Cuts and Jobs Act ("TCJA") significantly increased the Lifetime Exemption amount. The amount was doubled from $5.49 million per individual (adjusted for inflation) to $11.18 million per individual for estates of decedents dying in 2018. In 2025, the Lifetime Exemption amount is $13,990,000 ($27,980,000 for married couples). This means that estates valued below this amount will not be subject to the Estate Tax. However, this change, as enacted, is temporary. The increased exemption amount is set to expire at the end of 2025. Starting in 2026, the exemption amount will revert to its pre-TCJA level (adjusted for inflation). This is expected to bring the Lifetime Exemption back down to around $7 million per individual (with inflation adjustments). Given the recent election results, there is a likelihood that new legislation could change this trajectory and extend the high Lifetime Exemption amounts, though whether the extension is temporary or permanent and the shape of potential legislation remains to be seen.

Annual Gift Tax Exclusion

However, not all gifts will reduce the Lifetime Exemption amount. Each individual has an annual Gift Tax exclusion, which is the amount a taxpayer may gift each year without resulting in reduction of their lifetime exemption amount. We'll call that simply the "Annual Exclusion" in this article. Unlike the Lifetime Exemption, which is reduced by the total gifts made by a donor regardless of the recipient, the Annual Exclusion may be used on each individual recipient. Other gifts, such as direct payment of medical or tuition expenses, as well as gifts made to charitable organizations, also do not reduce an individual's Lifetime Exemption amount. While the Lifetime Exemption amount may continue its rollercoaster ride of ups and downs, the Annual Exclusion does not appear to be going anywhere.

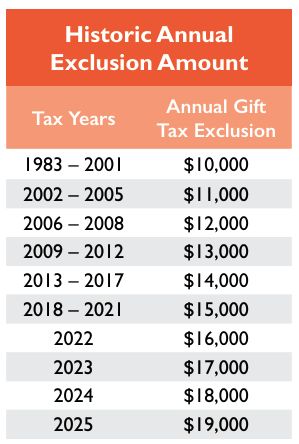

The Annual Exclusion amount is adjusted annually for inflation. As the table above shows, the amount has grown from $10,000 in 1983 to $19,000 in 2025.

Spouses can "split" gifts to the same recipient, effectively doubling their annual gifting amount per recipient ($38,000 in 2025). If gifts exceed the Annual Exclusion, or in certain other cases, a U.S. Gift Tax Return must be filed.

Variety of Annual Exclusion Gifting Strategies

Annual Exclusion gifting can be made directly to adult recipients, into custodial accounts for minors, contributed to special irrevocable gifting trusts, and paired with more sophisticated tax planning strategies.

A great tactic to implement as part of an Annual Exclusion gifting strategy is using the Annual Exclusion gifts as contributions to a 529 savings plan. The IRS allows for five years' worth of contributions in a lump sum to a recipient's 529 account. This means that in 2025, a donor could make a contribution of $95,000 ($190,000 for a married couple if gift splitting) without any of it reducing the Lifetime Exemption of the donor(s). This is particularly advantageous for those looking to quickly lower their taxable estate and jump start tax-deferred growth. There are other rules that may come into play here, including Estate Tax inclusion, on a pro rata basis, of any gifted amount if the donor passes away before the end of five years.

One important consideration to keep in mind when gifting property is that the donee receives a carryover basis from a gift, meaning the property's original cost basis transfers, rather than receiving a potential step-up in basis if the property is held by the donor until death.

Example 1: Single Donor, Two Donees, 15 Years, Net Worth Below Lifetime Exemption

As a quick and simple example, let's assume that in 2025, Sarah, single, begins making gifts equal to the Annual Exclusion amount to two nieces every year for 15 years. Additionally, let's assume that the annual rate of return on the gifted property is 5% (after tax), and the Annual Exclusion amount is adjusted for inflation annually at 3%. The chart below shows how advantageous regular gifts of the Annual Exclusion amount can be, Estate Tax savings put aside.

In such scenario, the Annual Exclusion amount would be $28,000 in 2039. The total amount Sarah gifted would be $694,000, but the combined cumulative value of that gifting in 2039 for both recipients would be $972,339. And as explained above, the donor would have used $0 of donor's Lifetime Exemption.

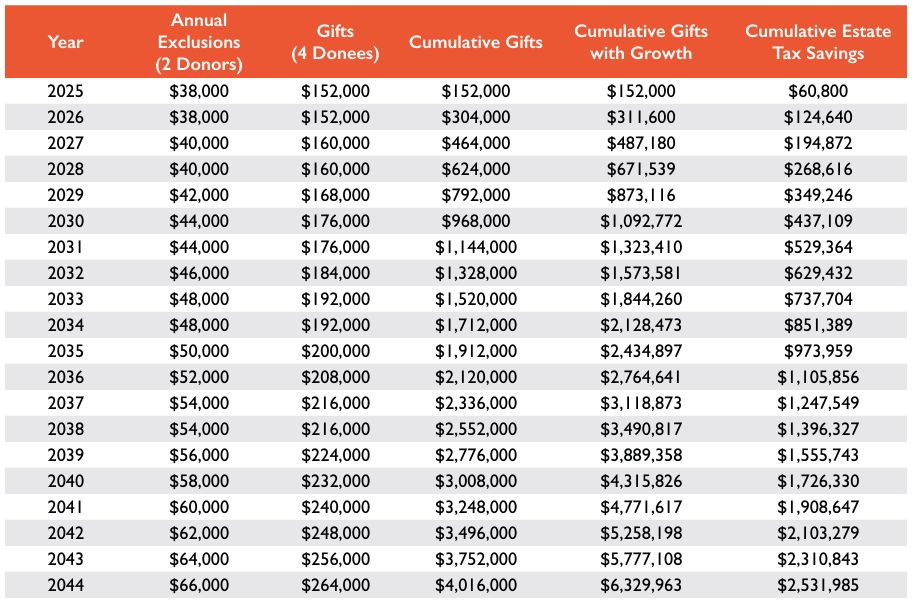

Example 2: Married Donors, Four Donees, 20 Years of Gifts, Net Worth Subject to Estate Tax

Now assume Martha and Max, married, make Annual Exclusion gifts to their two married children, Charlie and Claire, and to their spouses for the next 20 years, electing to split gifts. Martha and Max have significant wealth such that their assets exceed their Lifetime Exemptions, and will be subject to Estate Tax at their deaths, at a 40% rate. Using the same assumptions in Example 1, this chart illustrates the total amount gifted ($4,016,000), the cumulative value of all gifting in 2044 ($6,329,963), and the basic cumulative potential Estate Tax savings based on the value at the time of the gift ($1,606,400). If the annual gifts are invested by Charlie, Claire, and their spouses at compounded interest, the potential Estate Tax savings could reasonably be understood to be $2,531,985.

Example 3: Same as Example Two but with Eight Donees

As a variation of Example 2, assume instead that Martha and Max also made gifts to grandchildren, Grant, Ginger, George, and Grace, so that there were eight recipients (instead of four) each year for 20 years. In that scenario, the total amount gifted would be $8,032,000, the cumulative value of all gifting in 2044 would be $12,659,927, and the basic cumulative potential Estate Tax savings would be $3,212,800, but would be $5,063,971 when factoring in growth of the gifts.

Perhaps the most important thing to remember when considering implementing an Annual Exclusion gifting strategy is that it represents just one piece of the estate planning puzzle, and it is a strategy that works best when integrated into a comprehensive estate plan.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.