Mintz EnergyTech Update: New Hydrogen Patents Data Released

The European Patent Office (EPO) and International Energy Agency (IEA) have now released "Hydrogen Patents for a Clean Energy Future" – a comprehensive report on innovation in clean-energy hydrogen technologies over the past two decades according to global patent filings. Patents remain strong indicators of innovation activity and the state and direction of science. The report provides a unique look at where green hydrogen investment has been focused and where it are heading based on international patent families ("IPFs"). According to the report, IPFs are reliable proxies for inventive activity as each represents an invention having value sufficient for seeking protection across multiple patent offices.

-

Hydrogen Innovation Around the Globe: EU and Japan Lead the Way

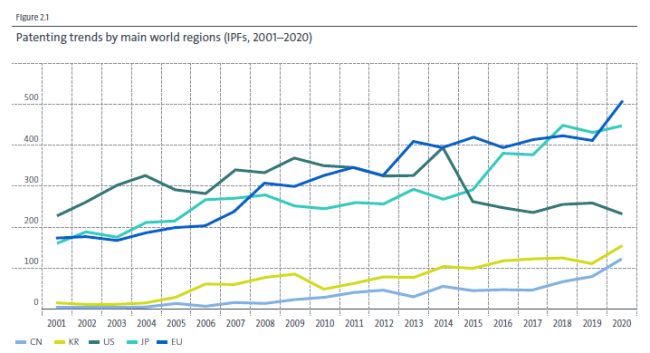

The world's five largest hydrogen innovation regions have been and continue to be the EU countries (considered as a block), Japan, the United States, China and the Republic of Korea, as shown below in Figure 2.1 depicting the number of hydrogen-related IPFs initiated in each region since 2001:

Source: EPO/IEA Full Report, p. 27, Figure 2.1

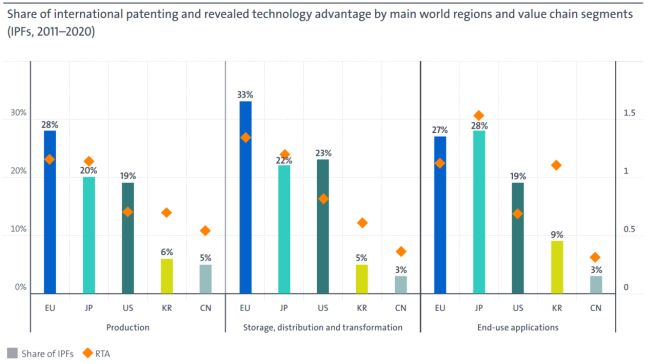

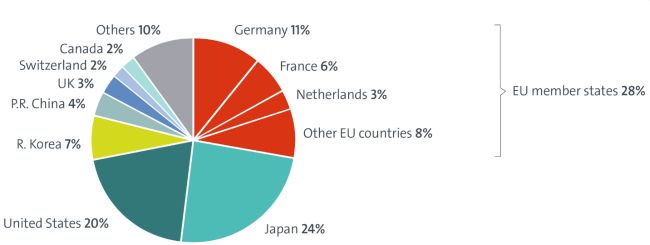

Across the three value chains—(i) production, (ii) storage, distribution and transformation and (iii) end-user applications—the Report shows in Figure E1 that the EU and Japan lead the world in hydrogen-related IPFs with 28% and 24%, respectively, across these three chains since 2011.

Source: EPO/IEA Full Report, p. 27, Figure E1

Source: https://www.epo.org/news-events/news/2023/20230110.html

-

Modernizing Hydrogen Production is a Top Priority

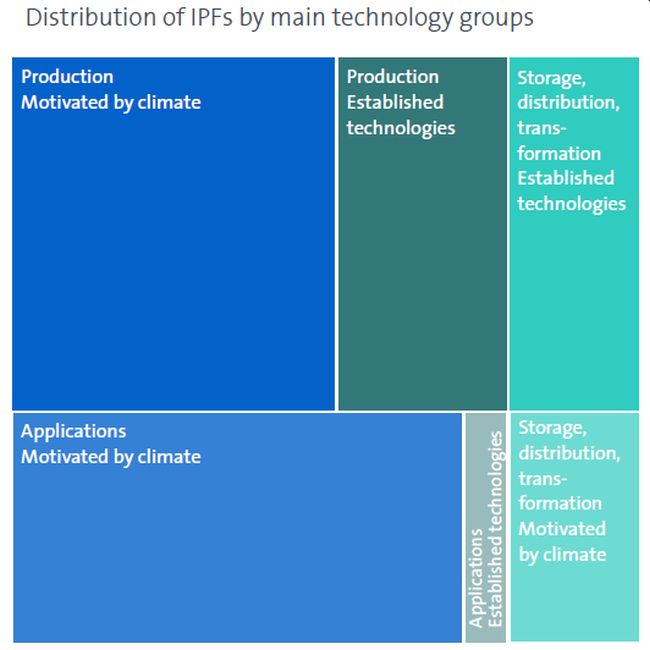

Over 50% of hydrogen-related IPFs since 2001 have focused on innovation in production technologies, with the balance being split evenly between innovations in end-use applications and in storage, distribution and transformation technologies, as shown in Figure 2.3:

Source: EPO/IEA Full Report, p. 32, Figure 2.3

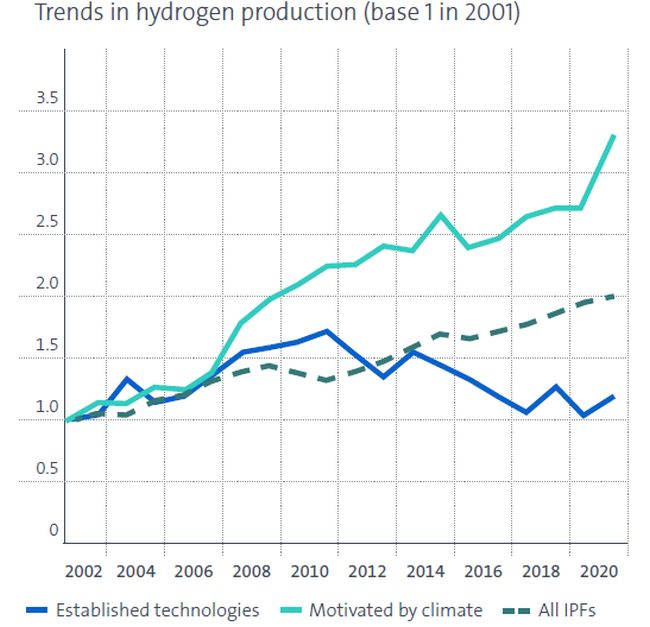

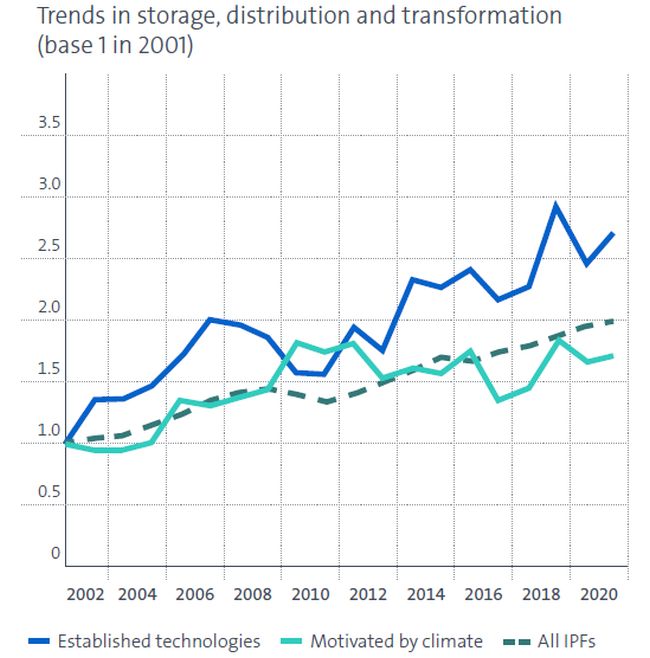

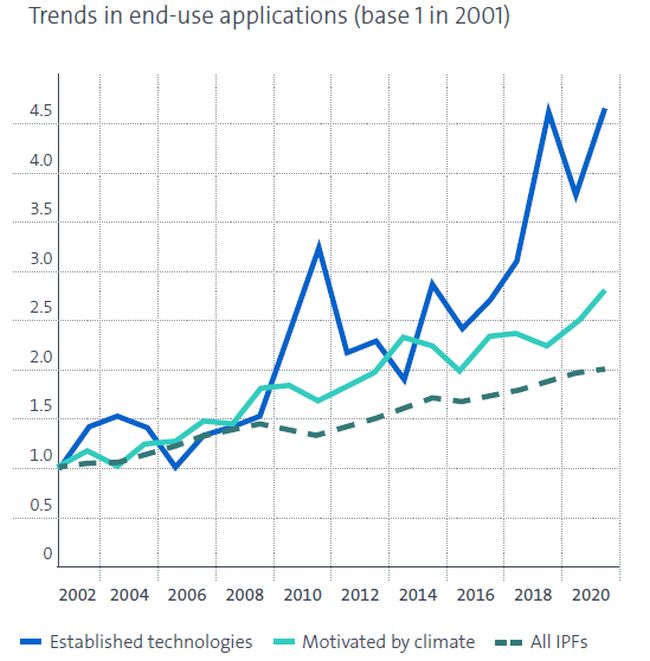

Production technologies have shifted over the past 10 years from carbon-intensive methods to technologies focused on decarbonizing hydrogen production. The Report suggests that 80% of IPFs in hydrogen production since 2011 have been driven by climate change, with a specific focus on electrolysis, including polymer electrolyte membrane (PEM) electrolysis technologies, solid oxide electrolysis cell (SOEC) technologies and alkaline water electrolysis technologies. Figure 2.3 shows these trends across the value chains.

Source: EPO/IEA Full Report, p. 32, Fig. 2.3

-

Industry Trends: Chemicals and Automotive Sectors are Driving Innovation

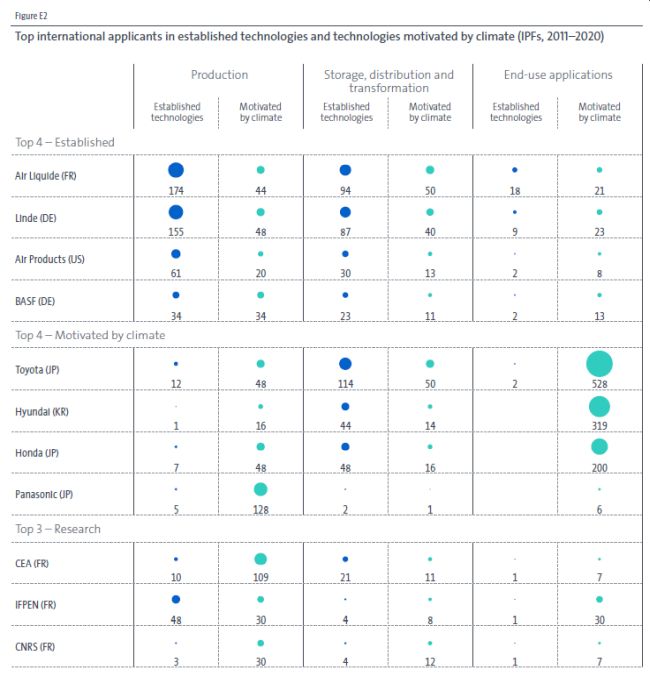

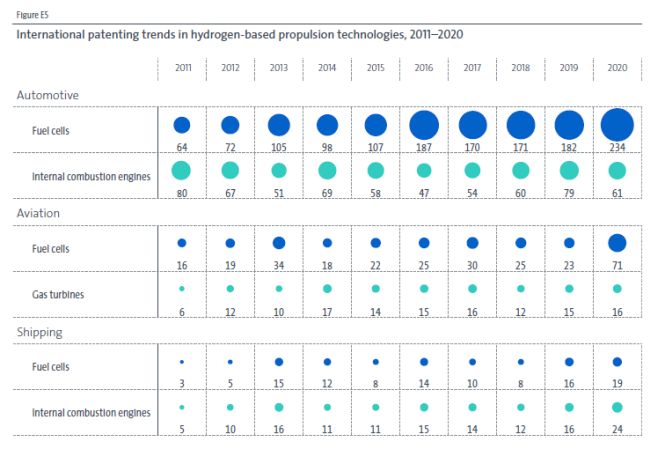

Patenting activity in hydrogen technologies is largely attributable to a handful of industries. Companies already specialized in hydrogen commodities, like large chemical producers, continued supporting innovation in hydrogen production and storage technologies. But significant IPF growth in hydrogen transportation and distribution technologies is being driven more recently by the automotive sector and demand for on-board hydrogen storage and the development of hydrogen-powered vehicles, as seen in Figures E2 and E5 below.

Source: EPO/IEA Full Report, p. 12, Fig. E2

Source: EPO/IEA Full Report, p. 16, Fig. E5

-

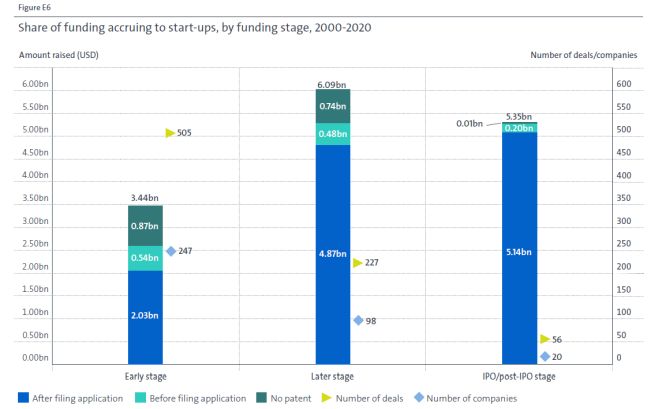

Patenting Underpins Fundraising by Hydrogen-Focused Businesses

The report highlights a strong correlation between patents and capital procurement for hydrogen-tech pioneers. While less than 30% of start-up companies with activities related to hydrogen technology filed one or more IPFs during the 2011-2020 period, this group of companies received 55% of initial funding in the space. This figure increases dramatically to nearly 80% when moving on to later funding rounds, especially for those businesses pursuing low-emissions technologies – emphasizing the importance of patenting for young companies in this area. That is, while only 117 of the 391 start-up companies filed hydrogen-related IPFs during 2011–2020, those 117 companies attracted 55% of the venture capital funding provided for early, late and IPO/post-IPO stages, as illustrated in Figure E6.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.