- with readers working within the Metals & Mining industries

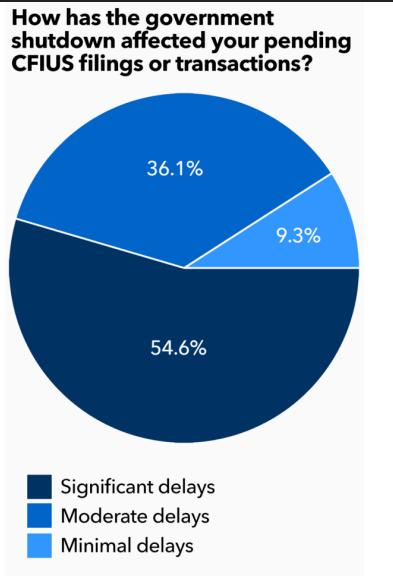

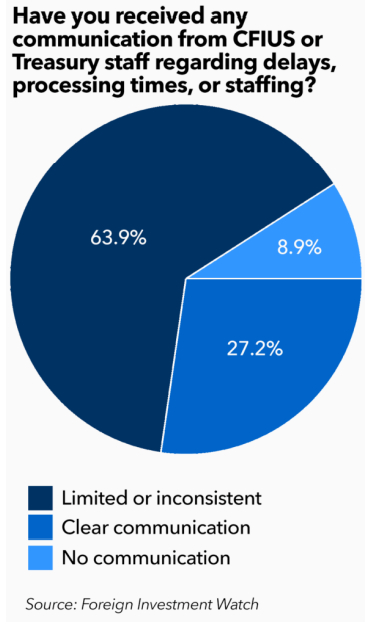

According to a survey conducted during the government shutdown, the vast majority of transaction parties (90.7%) experienced significant or moderate delays with CFIUS, and most respondents (72.8%) said they received no or limited communications from the Committee. With the shutdown now over, will the floodgates open?

WHAT HAPPENED

Foreign Investment Watch conducted a survey of readers during a two week period, spanning from Oct. 28 to Nov. 11. The survey closed twentyfour hours before the federal government shutdown ended.

The goal of the survey was to collect information regarding how filings and transactions were impacted by the shutdown, and to understand how companies were managing deal timing and transaction risks.

RESULTS

Perhaps not surprisingly, the vast majority of respondents said they had experienced delays. More than half (54.6%) called those delays "significant," while more than one-third (36.1%) described their delays as "moderate."

A plurality of those delays involved declarations (29.4%), with slightly less than one quarter impacting notices (23.5%) and mitigation negotiations (17.2%).

Interestingly, a number of respondents went out of their way to highlight the fact that the Committee was working through the shutdown, but simply wasn't clearing cases. "The delay has been driven by CFIUS not clearing any cases," said one respondent, "but processing activity has proceeded normally."

"They were definitely working," said one member of the CFIUS bar who asked to remain anonymous, "but clearance decisions were understandably put off, likely until the CFIUS agencies were back in action and could opine on transactions."

"Not only were they working," said another respondent, "but they were communicating with transaction parties." According to the survey, more than one-quarter of respondents (27.2%) said they received clear communications from CFIUS regarding the impacts of the shutdown.

However, most respondents (63.9%) said they received only "limited or inconsistent" updates from the Committee, with 8.9% of respondents saying they received no communication at all regarding delays, processing times or staffing issues.

IMPACT

According to experts, there may be pent-up communications in the coming days from the Committee. "I would expect any backlog to clear relatively quickly," said one former Treasury staffer. "This is happening at other agencies, like the DoD, which just published a massive list of new contracts that had been signed during the lockdown but not disclosed."

The same may occur with CFIUS, albeit via private communications, not public. "The DoD was working and delivering on its mission during the shutdown, but couldn't communicate through traditional channels," she said. "The same is likely the case at CFIUS: They were advancing cases, and will now get closure and communicate privately to transaction parties."

Hogan Lovells partner Brian Curran agrees that CFIUS immediately "picked up where it left off," but warns that there actually might be some short term disruptions as accumulated work gets cleared out. "In the short term," he says, "it's reasonable to expect that the pace at which CFIUS formally accepts some filings for review might slow, as CFIUS has to address the backlog of filings submitted during the shutdown, while simultaneously processing cases filed post-shutdown."

White and Case partner Laura Black, who previously served at CFIUS, says the Committee may "stagger acceptance in order to manage workflow and deadlines."

Olga Torres of Torres Trade Law agrees, noting the Committee is unlikely to rubber stamp transactions simply to clear out case load. "We expect communications with the Committee to move quicker now that the shutdown is over," she says, "but are not expecting CFIUS approvals or clearances to ramp up all of the sudden."

King & Spalding partner Phil Ludvigson adds that any spike in clearances may also be tempered by "a continuing void of political leadership at the Assistant Secretary level in some agencies."

Curran says transaction parties should understand that it might take CFIUS slightly longer to accept their filings, and if they file a declaration, depending on the facts of their case, "the likelihood of receiving a no-action letter or a request for a notice might be slightly higher."

Torres adds that, while some CFIUS member agencies may have maintained normal CFIUS-related operations during the shutdown, others may have fallen behind. As a result, she says, "it is possible that we see an increase in CFIUS inquiries and the issuance of follow-up questions in ongoing review cases within the coming weeks as the various agencies involved in CFIUS reviews normalize operations and tackle any internal review backlogs."

THE NEXT SHUTDOWN

The longer term impact of the shutdown is harder to calculate. Ludvigson of King & Spalding, who previously served as Acting Deputy Assistant Secretary for Investment Security at Treasury, doesn't expect any lingering impact from this particular shutdown, but warns additional shutdowns may have cumulative negative effects. "Additionally," he says, "there could be a depressed number of filings over the longer term if the economy proves to have been more heavily damaged than expected."

Morgan Lewis partner David Plotinsky agrees, noting that "parties and their counsel should give additional thought to the chance of a government shutdown when negotiating deal deadlines, so that deal deadlines allow time both for CFIUS review and also potential lapses in appropriations." Plotinsky adds that "it does seem that now there may be both an increased probability of future shutdowns and also the potential for longer shutdowns than previously."

Phil Ludvigson offers similar guidance. "Given that another shutdown currently seems very likely when the continuing resolution expires after the holidays," he says, "transaction parties need to time their deals with that in mind, including inserting appropriate provisions into the relevant agreements to account for that eventuality."

Plotinsky, who previously served as Acting Chief and Principal Deputy Chief of the DOJ's Foreign Investment Review Section, adds that, for CFIUS reviews that are timed to end in the fall or early winter, "I advise clients to factor potential government shutdowns into deal timing, and that planning can take various forms – such as negotiating a later deal deadline, or at least allowing extensions if needed to obtain regulatory approval."

Plotinsky also reminds transaction parties that although CFIUS deadlines may be tolled, clients' own deadlines are generally still in force, "such as deadlines to provide information to the Committee, or deadlines for compliance deliverables pursuant to mitigation agreements."

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.