- within Consumer Protection topic(s)

- in European Union

- within Energy and Natural Resources topic(s)

Buried within the more than 800 pages of the One Big Beautiful Bill Act ("OBBB") are several significant provisions affecting institutions of higher education and the broader higher education sector. Over the next few weeks, Thompson Coburn's Higher Education Practice, in conjunction with our Lobbying & Policy team, will break down some of the most important changes through blog posts, webinars, and videos. First up is our review of the changes impacting the Borrower Defense to Repayment regulations.

BDR Overview

As regular REGucation readers know, under the Higher Education Act ("HEA") and its implementing regulations, students may seek discharge of their federal Direct Loans (or Direct Consolidation Loans) by filing a claim with the U.S. Department of Education (the "Department") and asserting that their institution engaged in certain misconduct related to the origination of their loans or the provision of educational services. This process is referred to as a "Borrower Defense to Repayment" or "BDR" claim.

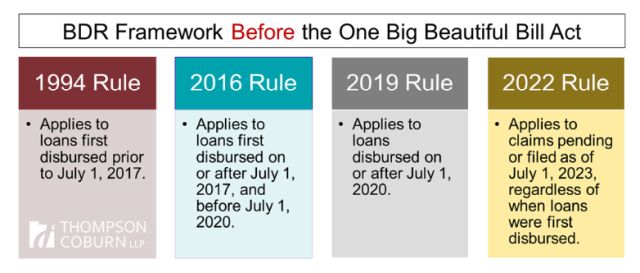

Over the years, the Department has issued four distinct regulatory frameworks implementing the statute. These rules were issued in 1994, 2016, 2019, and 2022. We stress here that each time a new version of the rule came along, it did not entirely cancel out the prior rules. Rather, each version of the rule added to the overall, and increasingly complex, BDR framework. To determine which version of the BDR rule applied to a particular claim, the Department had to consider both the date the underlying loan was first originated or disbursed and the date the claim was made, as follows.

The Legislative Reset

Section 85001 of the OBBB makes two key legislative changes to the Department's BDR framework.

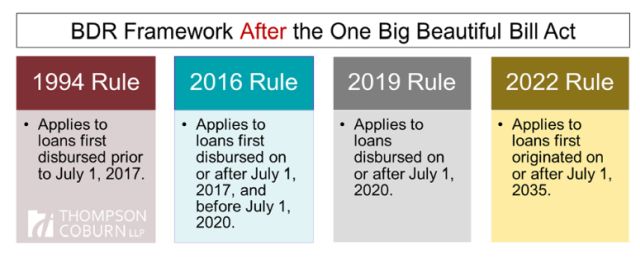

First, Section 85001(a) expressly states that the Biden administration's 2022 BDR regulations are not in effect "for loans that first originate before July 1, 2035." Although some lawmakers sought to repeal the 2022 BDR rule outright, the Senate Parliamentarian ruled that a complete repeal was not permissible under the budget reconciliation process used to pass the OBBB. Nonetheless, while not formally repealed, the 2022 BDR rule can never be applied to loans first disbursed over the next decade, even if the rule is still on the books in 2035.

Second, Section 85001(b) of the OBBB expressly states that the Trump administration's 2019 BDR rule is "restored and revived as such regulations were in effect on such date." Of course, as noted above, each time a new version of the BDR rule came along, it did not entirely cancel out the prior versions of the rule. Thus, while the 2019 BDR rule has been officially "restored and revived," it still exists alongside the 1994 and 2016 versions of the rule. The graphic below illustrates the new state of play.

We have seen some suggest that the OBBB "delayed" the entire "BDR rule" for 10 years. As the graphics above demonstrate, this is not an accurate assessment. In fact, Congress expressly affirmed the continuing existence and application of the 2019 BDR Rule, which works in concert with the 1994 and 2016 versions. To be clear, borrowers may still file claims. And there is still a complex framework pursuant to which those claims are to be assessed and adjudicated.

Institutions also should remain aware that each of the three BDR rules that remains in effect differs significantly in terms of standards for claims, evidentiary burdens, time limits, procedural requirements, and discharge and recovery mechanisms.

Looking Ahead

While the changes to the BDR regulations in the OBBB are significant, institutions can take some comfort in the fact that the bill largely codifies and clarifies the existing status quo.

As readers may recall, the 2022 BDR rule has been enjoined by the U.S. Court of Appeals for the Fifth Circuit since shortly after its promulgation, preventing the Department from enforcing it. As a result, institutions already have been operating under the 1994, 2016, and 2019 frameworks in their review and defense of BDR claims.

The OBBB does, however, eliminate some uncertainty in the regulations by formally reinstating the 2019 BDR Rule as the governing standard for loans disbursed on or after July 1, 2020, and before July 1, 2035. Prior to this legislation, the regulatory framework applicable to loans disbursed after July 1, 2023, was unclear due to the ongoing litigation and regulatory changes. On July 18, 2025, the Department published a Dear Colleague Letter (GEN-25-04) ("DCL") providing information about changes made by the OBBB that affect the administration of Title IV, HEA programs. The DCL states that the changes to the BDR regulations took effect upon enactment of the OBBB and that "the Department will publish a Federal Register notice shortly that restores the regulations that were in effect on July 1, 2020."

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.