- in Asia

- within Real Estate and Construction topic(s)

In recent years, U.S. renewable energy companies have experienced a period of substantial growth, driven in part by energy grants, reshaping the industry's future. Between August 2022 and December 2024, more than $550 billion in realized and planned investments flowed into the sector, according to American Clean Energy. While regulatory shifts in 2025 may have altered the landscape, our study of the sector highlights significant opportunities for those who plan appropriately and emphasize financial discipline.

Fortunately, the renewable energy sector is ripe with opportunities for growth using both organic and inorganic strategies. However, the complexity of the sector along with the uncertainty of the fiscal and regulatory environments requires successful companies to intentionally focus on building scalable operating models which deliver margin expansion from growth in both operating and SG&A costs. Too often, companies in growth mode focus on boosting revenues and footprint at the expense of managing the costs required to capitalize on economies of scale.

AlixPartners recently analyzed a select group of 17 solar, wind, and battery developers and operators, with annual U.S. market sales between $20 million and $1 billion. These companies have been firmly in growth mode over the past two years, and more than half have acquired companies and other assets in that time frame. Some also made major investments in upstream manufacturing.

Our study found that the focus on footprint growth often carries risks, some of which are not immediately visible. Growing companies focused project execution, expanding operations or integrating acquisitions often suffer from inefficient general and administrative (G&A) processes. The outcome is higher G&A cost per kilowatt (kW) compared with peers pursuing more discipline around profitability and their operating model.

Avoid growing pains

Companies that scale quickly to achieve growth aspirations exhibit some common tendencies that can strain the prospects for near-term profitability.

Efforts to expedite profitability by allowing for inconsistent processes across different geographies and technologies can lead to inefficiencies in areas such as financial reporting, procurement, legal and permitting. Multiple process owners can create excess management layers and make knowledge sharing more difficult.

Additionally, as the number of projects in a portfolio grows, support function cost can rise exponentially due to complex reporting and requirements for investor distributions in renewable financing. Companies with considerably varied financing structures and reporting requirements for each project often spend excessive time managing intercompany transactions, project level reporting, and distributions (i.e., tax equity).

Further, when companies are rapidly expanding or moving into new markets, their ability to contain costs tends to suffer because of their focus on speed. Pursuit of growth paired with weak spend governance creates risks that the company is investing in a low-quality project pipeline, often resulting in below par returns.

Finally, companies focused on growth through M&A that fail to focus on effectively integrating acquisitions can be left carrying excess costs from carrying multiple technologies and management layers, while also not leveraging distinctive technical expertise or capturing the benefits of critical mass around asset clusters.

In short, the most successful businesses will aggressively pursue growth opportunities while maintaining disciplined financial and operational principles, a truth that remains regardless of the regulations in play.

Principles for successfully scaling a renewable company

Investment for growth is important, but indiscriminately pouring capital into new assets is tricky - especially in a high interest-rate environment.

There is a clear roadmap however for renewable energy companies to build a scalable business model:

- Create scalable platforms including controls over SG&A cost

- Establish an effective origination and development engine

- Optimize operating models and operational processes

Companies that fail to follow these guidelines may find themselves the target of consolidation by more savvy developers.

SG&A discipline in a scaling business

Investors clearly value ROI, prompting operators to care about improving returns. A capital-intensive business also needs to prioritize SG&A efficiency.

Waiting until the end of the growth phase to address cost containment can leave money on the table, particularly operating expenses driven by factors such as headcount, transaction volume and the number of projects.

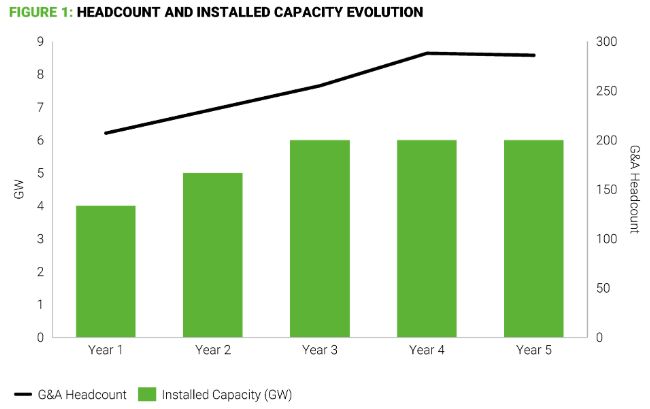

Figure 1 illustrates how the growth in G&A headcount may lag begind the growth in installed capacity. Companies should strive for improving economies of scale when pursuing revenue growth to avoid unwanted expansion of headcount and G&A-related third-party costs. Renegotiating supplier agreements earlier in the growth phase prevents over-spending throughout the company's expansion.

G&A functions typically show the highest degree of scalability. Their cost management requires a disciplined approach early in the growth phase that provides optimal resources, systems, and operating model for the post-growth environment.

Considerations include:

- Automating laborious and repetitive processes

- Implement transparent operating model with clear RACI (responsible, accountable, consulted, informed) matrices

- Performing a make versus buy analysis while considering insourcing of certain functions as the company gains economies of scale (especially around simpler technologies, i.e., solar, and in the areas of asset clusters)

- Moving supporting roles to low-cost locations

- Optimizing resource allocation through utilization and productivity tracking

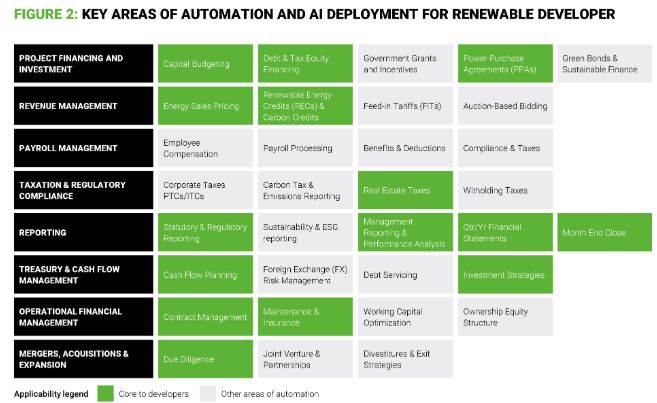

AlixPartners recently helped a renewable developer automate over 60% of its back-office processes, releasing significant resources to value-add tasks and reducing the overall SG&A overhang. Some areas of focus, which are also highlighted in Figure 2, included:

- Accounting–tools (e.g., Blackline) that automate financial close activities (e.g., manual journal entries, account reconciliation); Business Intelligence tools (e.g., Tableau) are used for management reporting, and in some cases natural language generation (NLG) can be used to draft financial reports

- Accounts payable –intelligent optical character recognition for invoice scanning; electronic data interchange (EDI) and OB10 that eliminates paper invoices and expedites vendor invoice processing, reduces non-value add work and eliminates errors

- Accounts receivable –robotic process automation (RPA) and workflows for customer setup, credit management, and billing; reduction of manual cash application through the use of automated lockboxes, intelligent matching of receipts; end user collection treatment routing and periodic push notifications (SMS texts, emails)

- Payroll–electronic time and attendance applications to collect and track time (e.g., Kronos); rules-based automation (e.g., RPA) for calculating payroll related payments/deductions

- Treasury– transportation management system (TMS) are used to manage cash and fin-tech solutions to facilitate payments (e.g., Venmo, PayPal)

- Tax equity –automation of monthly reporting and communication across various financial institutions

- Month-end close –support in consolidating data across various project SPV's for the benefit of monthly close and performance reporting to various stakeholders

Improvement opportunities for origination and development functions

While typically less scalable than G&A functions, origination and development functions may benefit from AI-enhanced processes and tools. Throwing more headcount in pursuit of footprint expansion and business development might boost pipeline, but it will almost certainly be at the expense of the quality. Key areas of opportunity in terms of automation include:

- Origination– automation of multi-source data gathering and identification of prospective locations, mailing solicitation campaigns, vetting responses, enhancing effectiveness of outreach campaigns based on prior performance and AI-powered communication with prospects

- Development– AI and machine learning enhanced models allowing for improved project prioritization based on Internal Rate of Return and probability of moving past notice to proceed (NTP)/ commercial operation date (COD)

- Operations– predictive maintenance models allowing for higher asset performance levels and reduced curtailment; automated operational performance reporting

These solutions are easily implementable with targeted 2-3-month-long projects overlying AI engines on the legacy technology. The speed and cost of implementation is much more favorable than on multi-year and multi-million dollar ERP projects, which yield uncertain results far in the future.

Automation and AI provide the best results if combined with traditional levers for efficiency, which may include:

- Tailored operating models -Models must be calibrated to support continued growth while serving as efficient value-creation engines. This entails streamlining processes, right-sizing resources and embedding flexibility to respond to volatility. We use a zero-based approach and an activity driver-based model to create a path to delivery.

- Disciplined sourcing and procurement -Contracts, unit prices, and commercial terms are ripe for opportunities during the growth phase. Terms with the suppliers must reflect the economies of scale and increased bargaining power of the growing organization. In addition to a rigorous sourcing process and active demand management, the developer shall ensure the least cost viable vendor is selected and waste is eliminated i.e., excessive design, lack of standardization, and over-engineering.

Process optimization

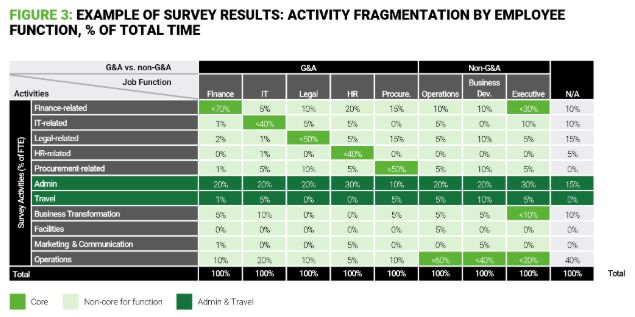

Clients find value in refining processes to eliminate confusing RACI matrices and streamlining decision making. A detailed activity survey, as shown in Figure 3, may help identify large pockets of inefficiencies such as high % of admin/unassigned time, process fragmentation (many participants with low level of involvement) or shadow organization (dispersed supporting functions).

AlixPartners' approach to process improvement is based on a basic stop-streamline-reduce principle which allows the organization to reflect on what they are doing, how frequently, and to stop or limit low value-add activities.

While we continue to monitor shifts in infrastructure funding, focus remains on the long-term outlook for renewable energy. Though momentum may have eased, renewables continue to rapidly grow as a share of overall energy production, and demonstrate strong resilience as the investment matures. Now is the time to refine strategic plans and reassess SG&A costs, before the next major surge in opportunity.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.