Intangible assets such as brands now contribute by far the greatest shareholder value in most sectors and many organisations consider their brand to be one of their most important assets. Yet only comparatively recently have organisations tried seriously to put a value on intangible assets – especially in the solar/PV arena. Maurice Alphandary, Principal Consultant, and and Jackie Maguire, CEO, Coller IP speak to Power and Energy Solutions Magazine

Valuing Intellectual Property (IP) accurately and putting a monetary value on it can be a contentious issue but it can be, and in fact is being done. Indeed, understanding not just how much a company's IP is worth but also exactly where the IP resides is fundamental to future business planning, from the very smallest company right up to multinationals. The process is, however, made more complex by the fact that a great deal of the value often lies not just in the IP (that is, patents, trademarks, copyright, designs, trade secrets) but in other intellectual assets (skills, policies, "knowhow", processes), and intellectual capital (reputation, branding, relationships, contracts).

If key employees leave, perhaps because they are unhappy about a possible change in the company's structure, their knowledge may leave with them. Written materials, customer contact lists and bespoke materials can all form part of the intangible assets. Ideas and inventions may be fundamental to the company but the wider intellectual capital is often the key to driving growth, profitability and access to markets. IP is now becoming a prominent asset class but is still under-represented on balance sheets. Just like other assets, IP can be valued, and bought, sold or leased.

However, even if the assets have been included on a balance sheet, IP is often not valued accurately, and the information provided may not be detailed enough to be very useful. One of the issues is that identifying the intangible assets held by the business is not always straightforward. For example, if a company co-owns IP rights with another organisation, there can be tricky issues to resolve even with expert help.

Some products, including those in the solar sector, are also likely to involve a combination of different assets, where the finished product may be more valuable than individual assets. Valuation of Intellectual Property needs to rely upon good, accurate information which is not always easy to obtain. Project Via (Valuing Intellectual Assets) was an initiative from the Intellectual Assets Centre (IA Centre) in Scotland which asked organisations specialising in IP, including Coller IP, to help companies operating in the renewable energy sector in Scotland identify and realise value from their intangible assets.

One of the companies participating in the first Phase of first phase of Project VIA was Synergie Scotland, a privately owned company based in Inverness which comprised three main divisions, each offering a range of services including energy management, building energy performance and remote metering.

Recognising that this growth would be determined to a greater or lesser degree by how well aligned its Intellectual Assets (IA) were, Synergie-Scotland took the opportunity to engage with Project VIA. One of the directors, Uisdean Fraser, was particularly keen to understand how and why a business's IA can best be aligned and leveraged in support of creating a strong and growing business.

The starting point was to understand the relative strength of its IA, which was achieved through the use of the IA Centre's Benchmark Tool. The next step was to identify the actions needed to provide more adequate protection of and realise greater value from the company's IA. A key consideration was whether the company structure and the brand that it was projecting were consistent with the largely independent nature of the products and services associated with each of its operating divisions and its Mirspot subsidiary. Although the IA underpinning each operating division was largely independent of the others, there was the possibility of brand confusion. It was decided that more effective use could be made of each division's discrete IA for its client facing activities and that the best interests of each of the operating divisions would result from the creation of new companies each of which would be aligned to the products and services of the operating divisions.

Two new companies were formed: Synergie Environ and Synergie Training. Early implementation of the lessons learnt during the course of the project has led to the company being awarded some important contracts and developing new relationships that will underpin major growth opportunities for the new company.

Another example of how understanding intellectual assets can be used to underpin business thinking is Currie Brothers, a privately owned business that was established on Orkney over 30 years ago, who also participated in Project Via. Today the company manages and delivers construction engineering projects, encompassing not only civil but also mechanical engineering and has been involved in supplying a range of services in support of the testing of marine energy technologies at the European Marine Energy Centre (EMEC) in Stromness.

When Currie Brothers initially joined Project VIA in 2009 there had been little focus on the Intellectual Assets (IA) in the company. A benchmarking exercise helped Currie Brothers to focus on the key actions that were needed to capture and protect Currie Brothers' IA. Particular focus was given to the need to align the IA that underpinned each of its services in a manner that was more market and client focused. In addition, the company understood the need to develop a marketing and communication strategy based on the target markets for each of its services.

In common with the other companies that were involved in the second phase of Project VIA, the benchmark indicated a need for strengthening the company's relationship capital.

As Currie Brother continues to build its brand in the marine renewables sector it is focusing on raising its profile through greater presence at exhibitions and conferences. In parallel with the redevelopment and re-launch of the company's website there was a strong desire to strengthen and protect the corporate brand and image.

Near the end of the first phase of Project VIA, Currie Brothers were awarded two important new projects on Shetland which together with an improvement in the market for marine works, led to a 30% increase in turnover for 2010, improved profitability and a net creation of five new jobs, which had grown to 20 upon completion of the second phase. Currie Brothers Director Susan Learmonth attributed much of this success to having developed a clear understanding of how the company could make better use of and leverage its IA in support of the tender process.

Identify, defend and assert

Identification of all the valuable intangible assets in a company can be done internally or by calling in outside specialists as with Project Via. These specialists will undertake an audit, and then, often using specifically designed software tools, will undertake a landscaping exercise in order to understand the intangible assets that are of value. This includes assessing the company's unique position relative to existing or potential competitors, while at the same time identifying possible opportunities for exploiting any IP further. Once this has been done, the specialist can then put a value on the assets assessed.

Once an organisation understands its intangible assets and their value, it then needs to ensure that they are fully protected. This does of course include ensuring that the correct patents and trademarks are in place, but other aspects also need to be considered. If an organisation is planning to merge with or acquire another, does the other company have employment contracts that prevent their employees taking ideas to a competitor?

Clearly it is better, if possible, to take steps to try to avoid getting into IP disputes. A good IP firm will try to ensure that if litigation does occur, the company it is working for is on as firm a ground as possible. The example this year in China of the wrangle etween US wind turbine component maker AMSC and China's Sinovel Wind Group involving a multi-phase and multi-million dollar legal fight over the Chinese company's alleged breach of contract and theft of Intellectual Property (IP) from AMSC is of course the stuff of nightmares for those trying to manage IP issues in this sector. Most companies will not be involved in IP issues of this complexity, but it is essential to be prepared.

The best IP specialists will undertake a range of activities, including checking that patents are enforceable and that an organisation can maintain and defend them. They will also advise on commercialisation including how to avoid potential pitfalls. The process can identify gaps in an IP portfolio that need to be filled by development, partnering or acquisition.

One of the areas that it is important to look at is how well differentiated the technology and patent applications are from the 'prior art' – that is, previously published third party patent documents in the same technology space. This involves searching international patent databases, to analyse prior publications and to establish whether third-party patents are still live. This enables an understanding of the differentiation of the patents in question and to understand and articulate the commercial risks associated with third party IP.

Patenting issues and solar

Any organisation involved in creating new inventions – products or processes – in the renewables sector should ask themselves the following questions:

- Who are the major patent holders and what are their activities?

- Is this a growing or shrinking field of technical activity?

- Are their core technologies common to the product offerings of the patent holders?

- Will my activities result in infringement of third party patents?

- How valuable is my IP?

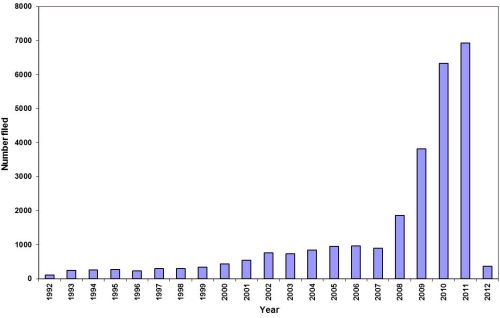

According to the Clean Energy Patent Growth Index (CEPGI), US patents for clean energy technologies in 2011 were at an all time high of 2331, jumping 450 patents, or 24 percent, over 2010, which is the second largest year-to-year jump, lagging only the previous year-to-year jump of 756 patents. Patents in wind energy were up over 85 percent followed by solar patents at almost 50 per cent. * Patent searches on renewable energy (geothermal, tidal, wind and solar) show nearly 28,000 patent families that have been filed over the past 20 years. A breakdown of the patent filing dates shows that the renewable energy area is one of considerable expanding activity – see Figure 1: Filing rates in renewable energy (output from Thomson Innovation).

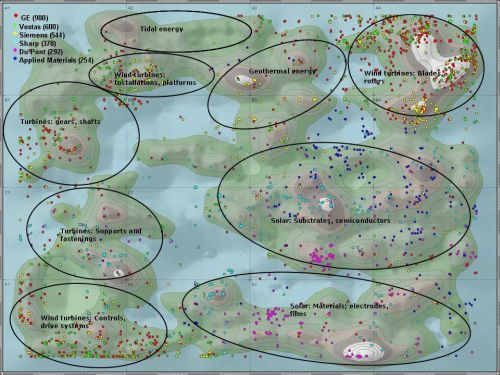

The landscape diagram below represents major (that is those with high patent holdings) technology-based companies developing IP in the renewables area. There are many companies with a few patents but the technical barrier to enter the renewable field precludes a large number of major patent holders.

For the renewables field (here tidal, geothermal, wind, solar) the landscape highlights the main patent holders who have the technical skills across disciplines to develop products from scratch. For example in solar, input from chemistry, materials, electronics, semiconductors are required. Smaller companies usually buy solar units and assemble them into large units. For wind, input from civil engineering, electrical engineering and physics are required.

Studies of the patent landscape indicate many active players and the major patent holders (with numbers of patent families in brackets) are:

- GE (980)

- Vestas Wind Systems (600)

- Siemens (544)

- Mitsubishi (509)

- Sharp (378)

- Canon (292)

- Du Pont (292)

- Sanyo Electric (292)

- Applied Materials (254)

- LG Electronics (250)

- Sumitomo (205)

- Robert Bosch GmbH (150)

- Enercon/Wobben (143)

In a crowded patent landscape there is always a possibility of a new entrant infringing third-party patents and professional advisors can help avoid problems here. Some of the patents on this landscape will be of significant value, and understanding the relative position of the new development to the existing patents is important for business decisions relating to investment in an enterprise, development of a product or sale of a business.

Where the sun shines

Anyone with business interests in renewable energy will want to know who their nearest competitors are and what patents they hold. One way of homing in on nearest competitors is through generation of a patent landscape which can help a company in the process of evaluating their IP. In simple terms a landscape for say the set of nearly 28,000 patent families used for Figure 1 is generated through an analysis of the most frequent words and phrases, referred to as themes, in the set of documents and allows us to see who is active in a specific area of development.

Such a landscape is shown for our analysis of the renewable energy area – see Figure 2: Patent landscape for approximately 28,000 families on renewable energy (output from Thomson Innovation). In general, documents that lie close together on a landscape can be considered to be related technically and the snow covered peaks are around subject areas of high patenting activity.

We have represented the activity of some major patent holders on the landscape. In the wind turbine area there is considerable clustering of patents between major players in the field, for example between GE, Siemens and Vestas. In this analysis, Sharp and Du Pont have activities restricted mainly to the solar area.

In addition there do not appear to be major players in tidal energy which was represented by around 130 patent families in total. Similarly there does not appear to be a dominant patent holder in the area of geothermal energy, here represented by around 500 patent families.

So, finally, to commercialisation and exploitation – a step some companies forget but which can add significant value. Coller IP has developed a Commercialisation and Management Process that allows clients to understand the value of their intangible assets and to assess and track the commercial potential of their products and services at different stages of development. In addition, the process prompts decisions on how and whether to protect the underlying assets.

In summary, effective use of intangible assets can be used strategically to underpin business planning for companies of all sizes. Placing a value on the IP and understanding the competition is also important in determining whether and how innovation can be protected, to underpin prospects for commercialisation. All these steps need to be taken and interwoven in the highly competitive world of renewables.

For a pdf of Renewing your company through strategic intellectual property download a copy here from Power and Energy Solutions Magazine and see Page 106

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.