- within Media, Telecoms, IT and Entertainment topic(s)

- within Antitrust/Competition Law, Intellectual Property and Real Estate and Construction topic(s)

- with readers working within the Retail & Leisure industries

The PayTV business is facing strong headwinds globally. Customers are spending less time watching traditional TV in their living rooms, engaging more with their mobile phones and social media instead. Over-the-top (OTT) services have also been substantially chipping away at PayTV subscribers and revenues.

2022 marked a watershed moment when video streaming subscriptions surpassed PayTV subscriptions for the first time At that point, global PayTV subscribers were just over 1.4 billion, while video streaming had crossed 1.5 billion. Fast forward to 2025, and global PayTV subscriptions have fallen to about 1 billion (GlobalData).

At the same time, content production costs have risen, and the content provider market is consolidating. Media companies such as Disney, Warner Bros., and Paramount are "going direct" to customers with their own apps. In-country advertisers are shifting their spending to digital media, where they can better measure ROI, gain actionable insights on viewers, and use richer UI/UX to create sales and engagement loops directly through advertisements.

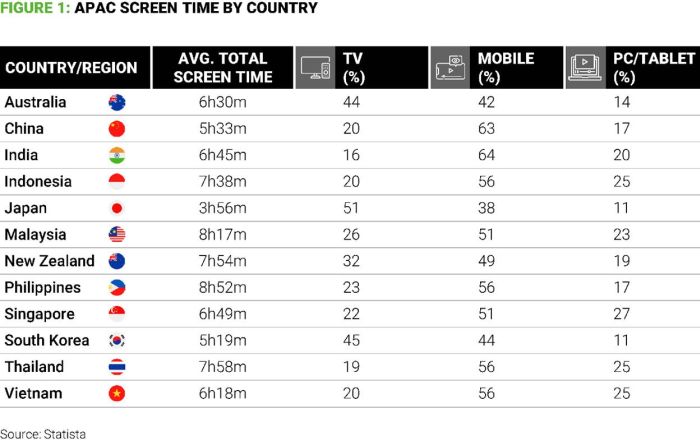

These challenges resonate with APAC PayTV operators. In some ways, the difficulties are even more severe in our region. For example, Figure 1 captures the dwindling share of time subscribers spend on TV by APAC country. The US subscriber, on average, still spends 54% of their screen time on TV – higher than any market in Asia.

Operators in the APAC region face markets fragmented by language and content preferences, making it challenging to gain scale. Additionally, piracy is rampant due to local regulations and enforcement lacking teeth. A lack of broadband infrastructure and customer credit risks also pose limitations on reach and revenue generation.

On the brighter side, the OTTs in APAC are just beginning to invest in local content and scale up their in-country teams. This creates a short window of opportunity for PayTV operators to get their act together.

We see a few urgent interventions and changes to the operating model that PayTV operators must prioritize:

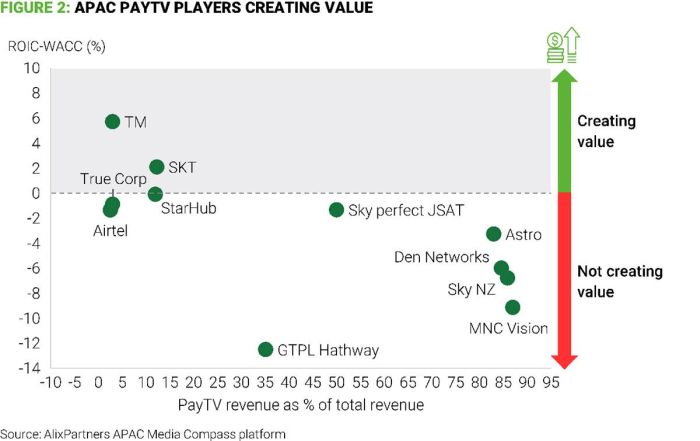

1. Drive clarity on investor value creation: PayTV operators need to focus singularly on the value created by the organization, which is the net of Return on Invested Capital (ROIC) and Weighted Average Cost of Capital (WACC). In Figure 2, we leverage insights from our proprietary APAC Media Compass platform to compare the organization's value-add (ROIC minus WACC) for different operators against the percentage share of PayTV revenues (subscription, content, and ad) to total revenues. Pure-play PayTV operators are clearly struggling, and almost all are losing money for their investors.

Ensuring sustained value creation for investors will require significant, needle-moving structural changes and tough decisions on trade-offs. The path to creating investor value is market-specific, based on the competitive landscape, regulatory positioning, and available options.

2. Follow the customers and don't fight gravity: PayTV operators must embrace streaming and understand the underlying, market-specific motivations for customers cutting the cord. The reasons for Asian customers will differ from their North American and European counterparts. Are customers canceling subscriptions due to a lack of convenient or customizable bundle, a lack of content variety, the UI/UX experience, or because they feel PayTV is too expensive for the time they spend on it? Following and understanding departing customers to gain data-driven insights is key. While many PayTV operators now offer hybrid STBs that carry OTT apps, more needs to be done. PayTV operators need to be paranoid and avoid the "Kodak moment".

3. Go local: A clear differentiation strategy PayTV operators can adopt against OTTs is local content, as some Asia Pacific markets are still underserved in this dimension. The key is to figure what local content can be monetized and how to produce and market it effectively. Channels carrying local news, sports, music, movies, and events can be a viable bulwark in most markets. In the near term, rather than venturing into their own local productions and own channels, PayTV operators might seek gain-sharing mechanisms and local media partnerships.

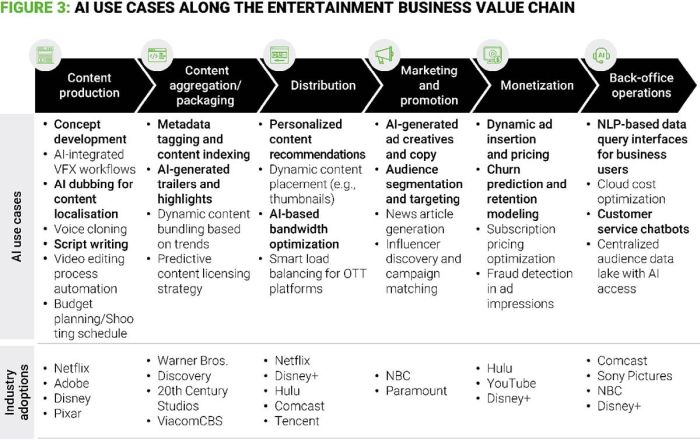

4. Innovate and use AI/ML: PayTV operators need to innovate across the value chain, from how viewers engage with the platform to how technology can streamline operations. Next-generation STBs can provide more effective content discovery and search, intuitive controls, interactive programming and ads (with QR codes for mobile engagement), and social or gamified experiences (like loyalty points for watching certain content or ads).

Furthermore, AI and ML have vast potential to transform operations. While OTTs lead with their deep pockets for R&D, PayTV operators can be fast followers, picking and choosing what matters most for their market and customer base. A selection of emerging use cases is captured below.

5. Focus on cost efficiencies and fiscal discipline: With rapidly dwindling revenues, aligning the cost structure and ensuring healthy operating margins is paramount. For many PayTV operators, content is over 40% of the cost base. Therefore, institutionalizing the right content monetization metrics and rationalizing licensed content is key. A long list of channels for bragging rights in the market may not pay off, as customers seek content quality over quantity. Secondly, content rights sharing should be explored within the market. There have been cases where the sporting rights were shared based on media (e.g., for IPL streaming, Jio Cinema took the digital rights while Disney took the TV rights), days of the week (e.g., rights are distributed across channels for the NFL in the U.S., or for Bundesliga and the Champions League in Germany), or packaging (live vs. replay vs. sporting highlights). Substantial savings are also viable with the right framing of trade-offs across other cost categories beyond content.

How PayTV operators can get execution right

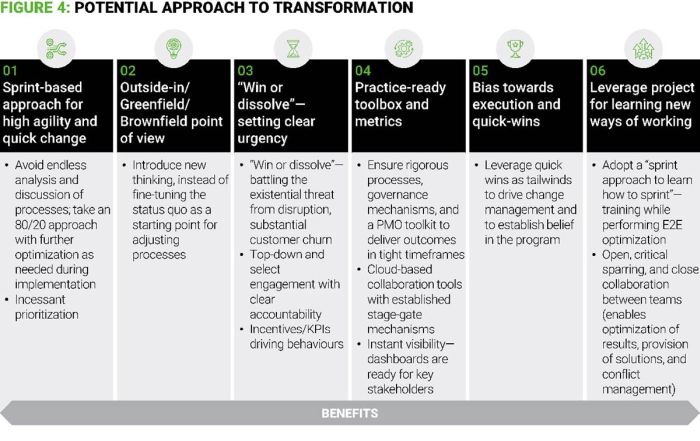

APAC PayTV operators are just now building their transformation muscle. Having seen tremendous growth in subscribers and content through the 2010s and the COVID-19 pandemic, they are now facing the rampant "cord-cutting" phenomenon. Establishing the urgency to transform and driving alignment among the Board and CXOs on the target impact is paramount before developing initiatives. This sequence helps foster the right mindsets and culture for making trade-offs. We believe a few elements of the transformation also need to be different.

Conclusion

PayTV operators in the APAC region have a narrow window of opportunity. While customer preferences might eventually swing back—perhaps when the market is flooded with too many OTT apps or content distribution becomes too fragmented—PayTV operators have no choice in the near term but to mitigate the worst-case scenario of 5-15% revenue erosion every year.

About AlixPartners Media and Entertainment Practice

AlixPartners has extensive client experience in the Media and Entertainment segment. Globally, we have served over 100 clients, including those here in APAC, on performance turnarounds, growth and monetization, M&A, external spend optimization, operating models, organization design, headcount optimization, and other areas. With assets and digital platforms such as our Media Compass, Radial, and Elevate, we help clients drive complex transformations and accelerate outcomes.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.