- within Tax topic(s)

- within Tax topic(s)

- in European Union

- in European Union

- in European Union

- in European Union

- within Law Practice Management, Criminal Law, Litigation and Mediation & Arbitration topic(s)

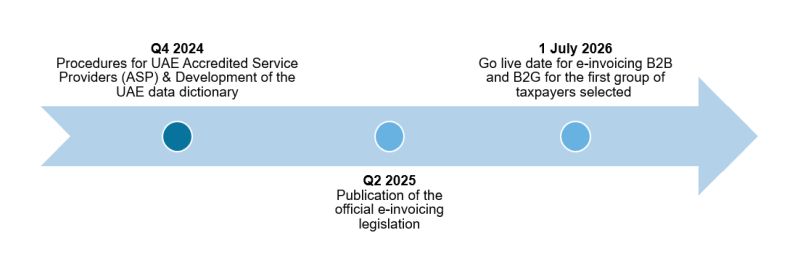

The United Arab Emirates (UAE) is about to witness yet another paradigm shift in its ever-evolving regulatory business landscape with the introduction of a mandatory e-invoicing regime starting on the 1st of July 2026 for both business-to-business (B2B) and business-to-government (B2G) transactions.

While an e-billing system was initially communicated in July 2023 as part the five transformational initiatives by the UAE Ministry of Finance (MoF) (The Ministry of Finance announces its Transformational Projects – Ministry of Finance – United Arab Emirates), an official webpage has now been published on the UAE MoF official website: EInvoicing – Ministry of Finance – United Arab Emirates

We have summarized some of the key highlights of this announcement below and offered commentary where we believe it is relevant or adds value:

1. The UAE E-Invoicing Timeline Confirmed: Key Dates and Expectations

The official timeline follows what was previously communicated:

At the time of this writing, business to consumer (B2C) transactions are excluded from the UAE e-invoicing regime. It is, however, our assumption that these will be included at a later stage, as we have seen in other e-invoicing mandated jurisdictions such as in Latin America.

While no details of the implementation roll out phases have been shared, we expect the largest UAE taxpayers to go live first as they will most likely be part of an e-invoicing pilot starting in December 2025. The rest of the UAE taxpayers, typically based on annual turnover, will most likely go live according to implementation waves afterwards.

2. The Definition of an e-Invoice in the UAE

The UAE has adopted the widely recognized definition of an e-invoice which is a structured, machine-readable invoice that is Extensible Markup Language (XML) based. This can be supplemented by a human-readable invoice, usually a pdf, something that most businesses are already using today.

In practice, it typically means both machine and human readable version of an invoice need to be produced by UAE based companies under the e-invoicing regime: the human readable version can be sent via email and the machine readable version need to be transmitted via the UAE e-invoicing system between the seller and buyer and reported to the UAE Federal Tax Authority (FTA) and UAE MoF.

Please note that only the machine-readable part, the XML and not the PDF, is considered an e-Invoice.

3. The UAE adopts the 5 Corner PEPPOL model for e-invoicing

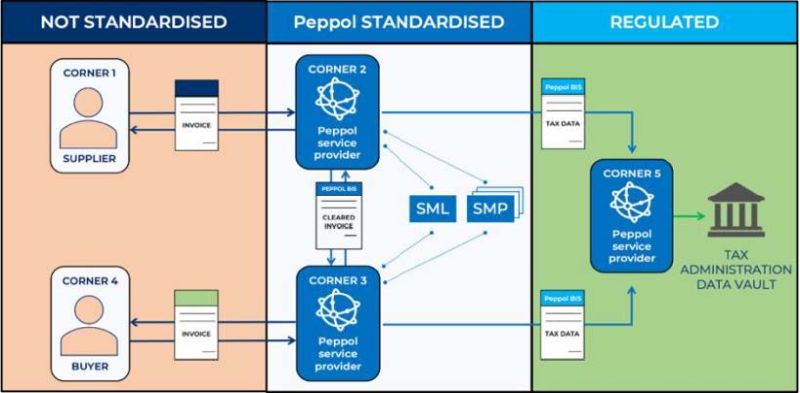

The UAE's e-Invoicing model follows the 5 corner Pan European Public Procurement On-line (PEPPOL) model, which is vastly different from that of its neighbouring country, the Kingdom of Saudi Arabia (KSA), has implemented since December 2021.

This is important to note because the UAE e-invoicing model will be decentralised as opposed to the pre-clearance system of KSA that many companies in the middle east are used to as a reference point.

The PEPPOL ideated in the European Union in 2008 as a pilot to facilitate B2G transactions. It has since evolved to support B2C and B2B transactions and has been adopted by nearly 20 countries around the world, outside its European Union birthplace. The core vision of PEPPOL is to standardize how electronic documents are shared, domestically and for cross-border transactions between economic actors.

The 5 corner PEPPOL model is the evolution of what was previously known as the 4 corner PEPPOL model, where the new 5th corner is the relevant tax authority, the FTA and MoF in the case of the UAE, getting transactions reported to them in near real-time.

As you can see below, the UAE is strictly implementing the best practices of a PEPPOL based e-invoicing regime.

|

|

|

Source: Peppol CTC Reference Document |

|

|

|

Source: UAE Ministry of Finance |

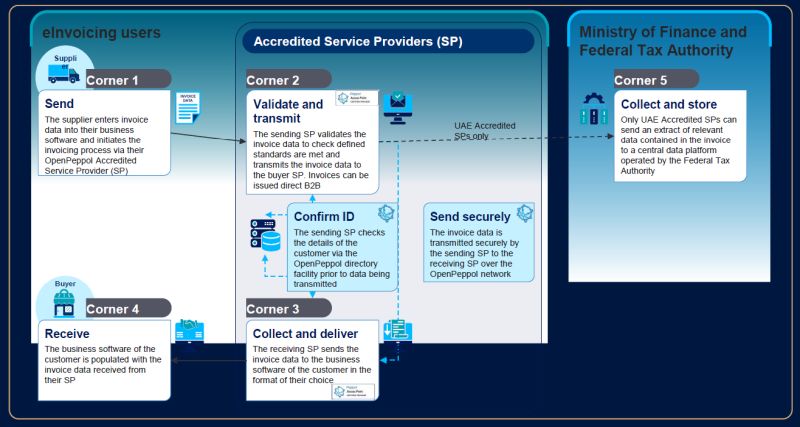

In the visuals above, the Accredited Service Providers (ASPs) are the Corner 2 and Corner 3 of the e-invoicing framework. The ASPs will be the only economic actors allowed to connect to the UAE government system. They will enable the submission and reception of e-invoices between companies in the UAE: sellers (Corner 1) and buyers (Corner 4).

In addition, ASPs will also report e-invoices directly to the UAE MoF and UAE FTA.

It is important to point out that companies will be mandated to contract commercially with an ASP i.e. a technology vendor officially accredited by the UAE MoF. There is no option for companies to connect directly to the UAE e-invoicing technology infrastructure without such an intermediary. The only alternative option would be to become an ASP, which would likely prove to be expensive and unnecessary for companies that do not have this as a core business activity.

This commercial mandate has obvious budgetary consequences for companies in the UAE, which they will need to consider in their 2025 budget.

With that in mind, it also raises the cost of compliance question for the 82% of all businesses in the UAE that have less than an AED 3 million turnover as ASPs can be complex software and therefore expensive.

It is our assumption that the UAE MoF, as part of the official accreditation process for ASPs, will force such technology vendors to provide a set number of transactions for free to help the micro and small businesses in the UAE enjoy the benefits of e-invoicing without suffering its potential financial strain.

Finally, there is no information yet on the frequency of reporting expected by the Ministry of Finance and the Federal Tax Authority but the mention of "near real-time" implies a very short timeframe.

4. VAT Groups

The UAE MoF has clarified that each member of a VAT group in the UAE should be connected to an ASP individually, while using the group Tax Registration Number (TRN), to ensure all transactions are captured within the e-invoicing regime.

There is no restriction for each member of the VAT group to use the same ASP and it is also what we would typically recommend for the group to be able to benefit from economies of scale and better commercial terms with an ASP.

5. Mandatory Registration

The UAE FTA and MoF are also enforcing mandatory registration of companies to be part of the UAE e-invoicing system by getting a Tax Identification Number (TIN), which is the first 10 digits of the Tax Registration Number (TRN). This confirms that all B2B and B2G transactions are part of the scope of UAE e-invoicing regime, regardless of the VAT or Corporate Tax registration status of the parties involved.

6. Exports

An overseas customer (buyer) is not mandated to register with a UAE ASP (subject to obligations to register under VAT and/or Corporate tax regimes) when transacting with a UAE business. If the overseas customer is part of the PEPPOL network in his/her domestic country, then its PEPPOL address will be used. If not, the UAE business will need to share the invoice over email, typically as a PDF, as it would be done today.

7. Self-Billing

In the spirit of the recent publication of the FTA's VAT executive regulations, UAE MoF has clarified that in case of an import (i.e. where the UAE business is a buyer), the company would need to create an e-invoice themselves, so called "self-billing" which is consistent with the current requirement to do so under the VAT framework and report the e-invoice to the FTA and MoF via its ASP.

8. Error Rectification

In line with the current VAT regulations, if an e-invoice needs to be rectified because of a change in the output tax or underlying value of supply for instance, a credit note, as an e-invoice, is mandatory.

Other clarifications have been provided on:

- Payment due date: wherein, if the payment is on the spot, the payment due date is the same day.

- The use of cloud technology: which must follow the guidelines set by the UAE National Cloud Security Policy

- Confirmation of data integrity and safety throughout the e-invoicing technology infrastructure in the UAE

The next milestone will most likely be the publication of the UAE data dictionary, which should lay out all the different data points the UAE will deem applicable for an e-invoice to be compliant under the UAE Peppol International Invoice (PINT).

The UAE MoF has the liberty to tailor the PINT to cater to the specifics of the UAE national business landscape such as the emirate level reporting or different free zones.

25 October 2024

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.