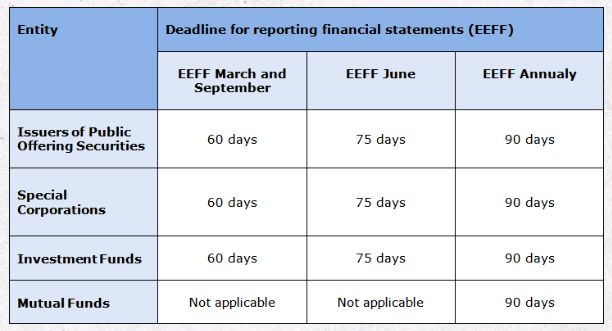

On February 12, 2019, the Chilean Commission for the Financial Market ("Comisión para el Mercado Financiero" o "CMF") issued General Rule No. 431 ("NCG 431), regarding the deadlines for reporting of quarterly and annual reports and financial statements for the following entities:

- Issuers of Public Offering Securities;

- Special Corporations or those subject to obtaining a resolution authorizing their existence by the CMF; and

- Mutual Funds and Investment Funds under the CMF's supervision.

NCG 431 establishes definitively the deadlines for reporting of financial statements to the aforementioned entities, which were previously set forth annually by the CMF, in accordance with the former provisions of General Rule No. 30.

In regard to terms, NCG 431 maintains those that are currently in force, except for mutual funds and investment funds, which are subject to the CMF's supervision. The terms for mutual funds and investment funds were increased in order to make them similar to those that are already established for other issuers of securities.

The terms are of consecutive days and are counted as of the closing date of the relevant calendar quarter.

In the case of special corporations or those subject to obtaining a resolution authorizing their existence by the CMF, NCG 431 sets forth that they will be subject to these reporting obligations, unless:

- They are registered in the Securities Registry of the CMF, in which case the reporting obligations as issuers of public offering securities will be applicable.

- The CMF has established for them a shorter period for submitting the financial information, in which case they must comply with these special instructions.

- They are not under the CMF's supervision.

Regarding other entities supervised by the CMF, NCG 431 does not make any modifications, therefore the relevant terms remain in force.

For further information, you may review the CMF's Deadline Calendar for Supervised Entities (in Spanish).

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.