- within Antitrust/Competition Law, Food, Drugs, Healthcare, Life Sciences and Wealth Management topic(s)

1. Investment structures for French real estate funds

French real estate funds have been quite active in our home markets recently. In this contribution, we comment the investment structures we have seen the most, highlighting possible pitfalls and attention points. Note that this contribution does not comment on French regulatory and tax aspects, and only focuses on SCPI and SIIC (or corporation benefitting from a SIIC regime).

1.1 Investment structures for French SCPI

We start from the assumption that French SCPI are translucid from a French tax standpoint, meaning that they have legal personality and title to the asset, but the

taxation is established in the hands of the unit holders, and not of the SCPI. In addition, we understand that SCPIs are subject to regulatory constraints with respect to the assets they can invest in and therefore we have assumed that the SCPI shall either invest directly in the real estate asset or via an AIF (or another translucid entity).

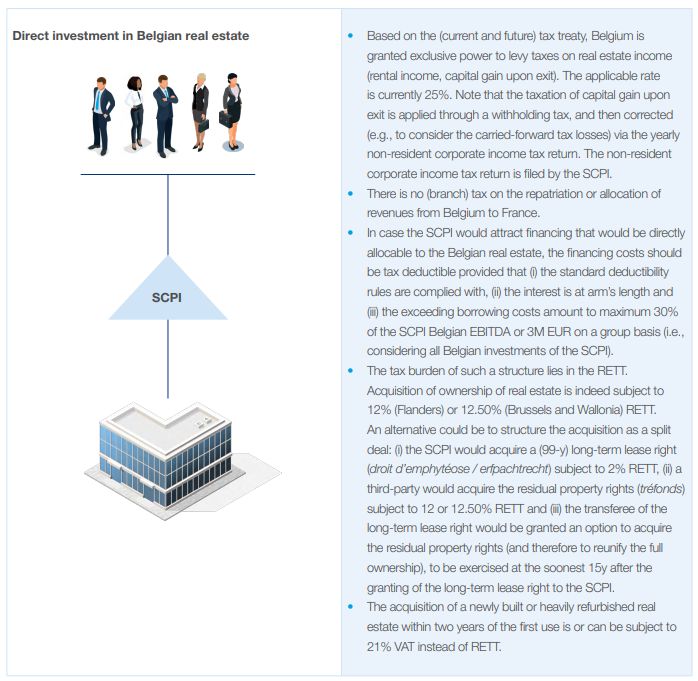

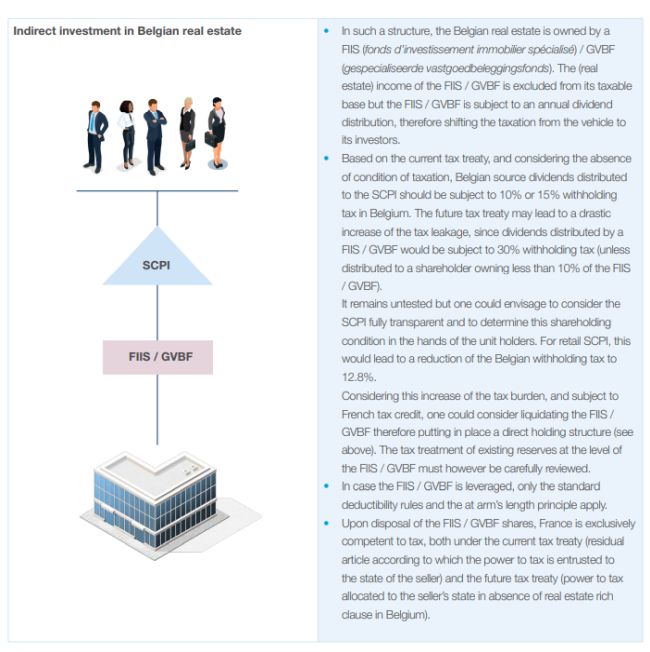

1.1.1 Investment in Belgian real estate

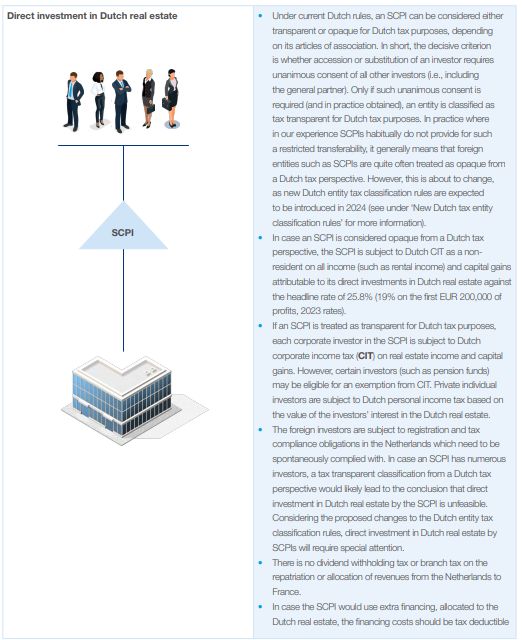

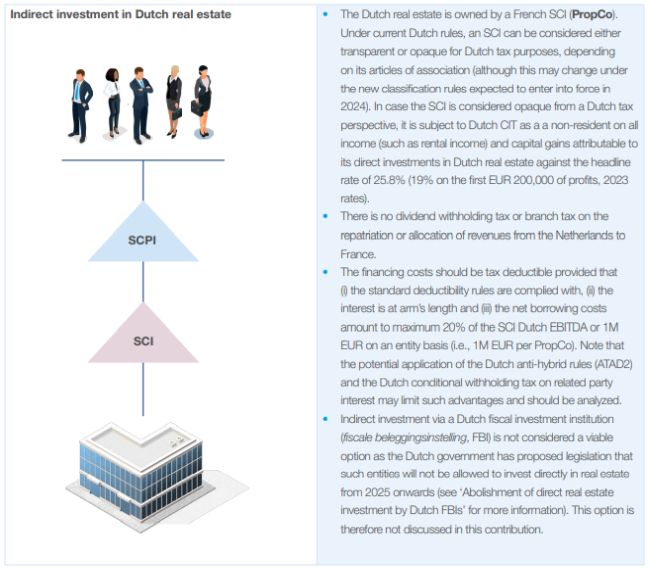

1.1.2 Investment in Dutch real estate

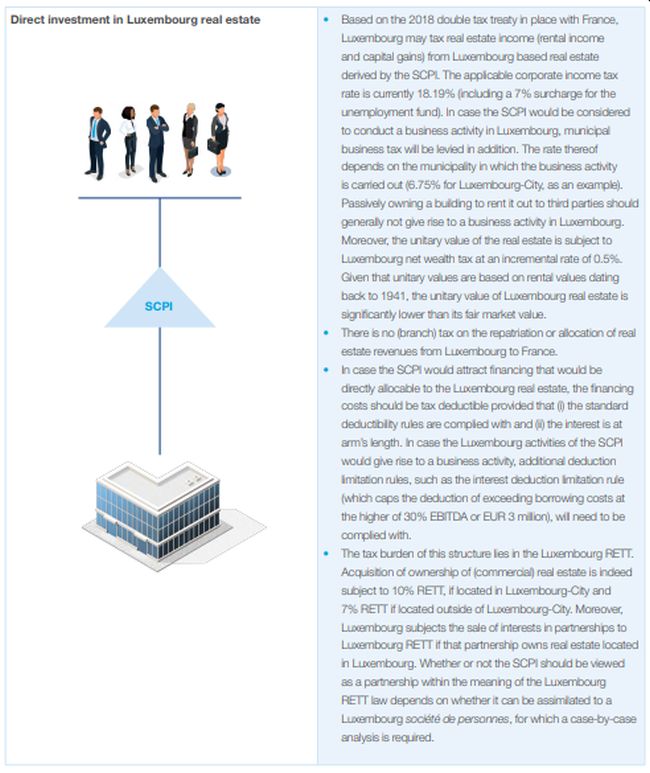

1.1.3 Investment in Luxembourg real estate

1.1.4 Investment in Swiss real estate

- Switzerland applies two different sets of taxation for real estate investments.

- For federal income tax purposes, income from real estate for private tax resident individuals is fully taxable but capital gains are tax-free (only taxed at cantonal level). Corporate investors are taxed both on income and capital gains.

- For cantonal income tax purposes, capital gains realized by a private tax-resident individual are subject to real estate capital gains tax. The tax rate varies between cantons and takes into account the holding period of the investment (short term capital gains are taxed at a higher rate, e.g., 40-50%). Some cantons also levy real estate capital gains tax for corporate investors (monistic system; levied only on the difference between acquisition costs and the sale price; difference between book value and acquisition costs are subject to regular corporate income tax) whereas the majority of cantons levy capital gains from real estate with regular corporate income tax (dualistic system; tax rates vary from approx. 12% to 20%).

- Foreign real estate investors would be subject to tax in Switzerland under domestic law pursuant to the above system.

- Based on the Swiss-French double tax treaty, both income and capital gains resulting from immovable property can be taxed in the state of the property. The same applies for wealth taxation. Accordingly, Switzerland would be free to levy real estate taxation in accordance with the above rules (depending on the location of the respective investment).

1.2 Investment structures for French SIIC

We start from the assumption that French SIIC are corporations with separate legal personality and subject to corporate tax, although benefitting from a deviating regime for (certain) real estate investments. This regime provides from an exemption from corporate income tax subject to a distribution obligation.

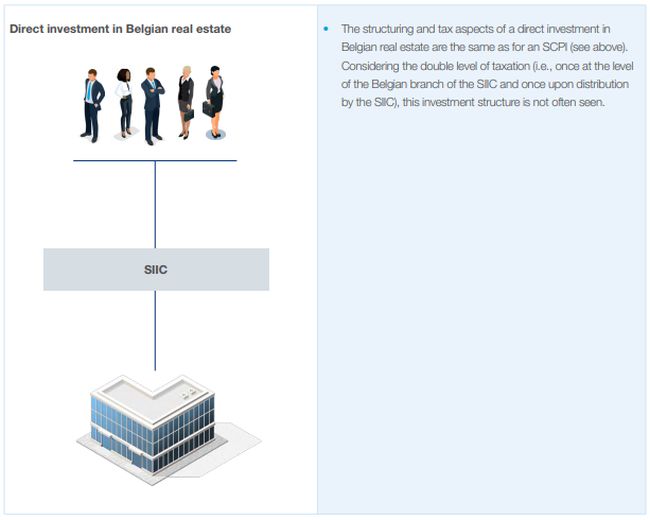

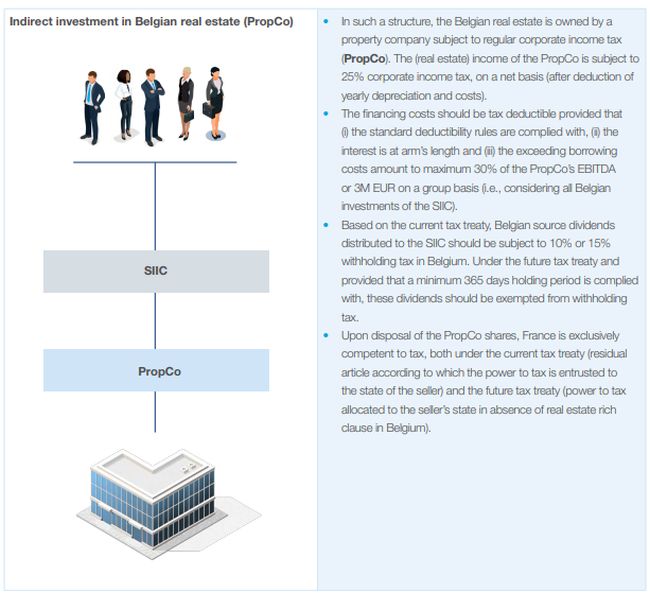

1.2.1 Investment in Belgian real estate

1.2.2 Investment in Dutch real estate

1.2.3 Investment in Luxembourg real estate

1.2.4 Investment in Swiss real estate

- We refer to the above developments.

- In cantons with a monistic system, the sale of shares in a legal entity which predominantly holds Swiss real estate (50%) is deemed to be an alienation of the property itself triggering real estate capital gains tax. Some cantons will allow for a tax neutral step-up in basis if the investment vehicle is a Swiss legal entity.

- Cantons with a dualistic system generally do not levy tax on the sale of a real estate investment company, i.e., share deals pertaining to a Swiss or foreign vehicle should be more favorable in these cantons. Note that some cantons (e.g., Geneva) may apply a different tax treatment if the Swiss real estate is directly held by a non-Swiss legal entity.

1.3 Conclusions

The appetite of French funds for non-French real estate remains high but such investments sometimes lead to a higher burden in terms of structuring. The past modifications to the French-Luxembourg tax treaty and the announced modifications to the Belgian-French tax treaty, as well as new classification rules under Dutch tax law, may lead to a review of the classic investment structures, for the past and for the future.

To view the full article click here

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.

[View Source]