- in United States

- with readers working within the Accounting & Consultancy and Banking & Credit industries

- within Law Department Performance, Antitrust/Competition Law and Family and Matrimonial topic(s)

Inflation – Monitor, Monitor, Monitor

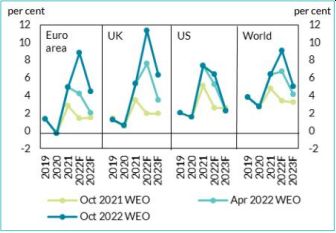

A prolonged period of double digit inflation has not been experienced in many countries for a generation. This change in the external environment has brought a new focus on inflation and ensuring that policyholders remain protected during the period ahead.

Allowing for the future inflationary outcomes requires a change in tack within risk management systems to analyse and monitor inflation at a more granular level across a diverse range of lines of business, segments and geographical areas, whilst also allowing for consideration of the potential secondary impacts. Development of risk management systems requires increased consideration of modelling methods and assumptions, and for a period of time, enhanced communication and monitoring of the evolving uncertainty and risks associated with inflation.

Granularity of Analysis

More granular monitoring and analysis of inflation risk by firms is required in response to the changing environment and the various drivers impacting inflation. This involves considering both the current and future range of inflation, incorporating both economic inflation1 and excess inflation2 , including social inflation3 . (Re)insurers should explicitly assess and understand the specific types of inflation which are relevant to their business and model them accordingly.

Where (re)insurers might have previously had a single overall assumption for inflation, an emerging trend is for (re)insurers to split inflation into its varying components. For non-life insurers this can for example involve splitting inflation into components such as general economic inflation and excess inflation. While the former may be strongly linked to common inflationary measures such as Consumer Price Index (CPI), excess inflation might encompass specific inflationary measures, such as legal and medical costs, as well as other factors such as societal attitudes towards claims and litigation. For life insurers, we see a trend of firms splitting inflation into components such as price inflation, and separating expense inflation for various costs such as salaries, rents and IT.

There may be several iterations of monitoring and analysis before key factors influencing the level of claims inflations are understood. Factors may vary depending on a range of variables including currency, geography mix, and additionally for non-life lines of business: heads of damage, class of business, time to settlement, claim size, judicial decisions, contract changes, policy terms and conditions. Given the differences in composition and risk profile between (re)insurers in Ireland, there is unlikely to be one approach that is appropriate for all. Rather, we expect (re)insurers to assess their own risk profile, identifying and managing the risks specific to them.

Methodology Changes

As historical data is unlikely to be representative of the future, and traditional reserving methods in particular do not address this, modelling methodologies have started to evolve. In addition to a shift in the likely impact of inflation on reserves, implications for reserve risk volatility should be considered in addition to the shift in correlation between risks within capital models and Own Solvency Needs Assessments.

Crude inflation modelling methods that were appropriate in the past may need to be revised, to ensure balance sheets provide appropriate policy- holder protection (Table 1 below includes some examples relating to methodology changes). When determining the appropriateness of methods, attention should be paid to the key assumptions e.g. use of explicit or implicit inflation assumptions, use and credibility of historical data relied on for modelling method. It is possible that different approaches will be need for prior years of account compared to the current and future years of account. Companies may need to consider if additional validation is warranted, and for firms in scope of the peer review of reserves, extra focus may be needed from the Reviewing Actuary in relation to inflation risk modelling.

Timely Communication of Risk

Head of Actuarial Function holders in particular should use governance frameworks within their firms to communicate appropriately and quantify inflation assumptions within the baseline scenario as well as the materiality of downside risks. The future level and path of inflation is uncertain and can materially impactthe adequacy of a firm's reserves. In such

- Shift from implicit assumption to explicit inflation adjustments in traditional reserving methods. For non-life business,this might entail use of methods such as inflation adjusted chain ladder.

- Uplifts applied to the projected expenses and/or claims cash flows analysed using various assumptions about the future level and path of inflation, such as high short term excess inflation and lower levels into the future, or constant percentages across the full duration of the liabilities.

- Overlaying the past data with expert judgement, to account for possible uncertainty regarding inflation that may be yet to emerge.

- Shift from a single inflation assumption to an inflation curve to measure the impact of inflation on future cash flows over the longer term.

- Explicit allowance within assumptions (for example, adjustments to frequency /severity assumptions and additionally for non-life or health business, changes to IELRs, IBNR loading).

- Explicit inflation provisions based on stress and scenario testing.

- Allowance for varying correlations: for non-life lines: between CPI or relevant inflation drivers and reserve inflation, by line of business, nature of claim and tail length, and for life business: between inflation and other assumptions such as interest rates, credit risk and lapse rates

circumstances, it is appropriate that (re)insurers explicitly consider this uncertainty. (Re)insurers may need to incorporate additional sensitivity testing to help communicate this uncertainty and the potential range of outcomes to key stakeholders such as the Board. Strong interlinks and regular communication between various aspects of the business functions will help ensure clarity, consistency and control of inflation risk. Table 2 below illustrates the wide ranging impact of inflation.

We have seen welcome improvements in the transparency of expert judgements, limitations and risks relating to adequacy of reserves over the last number of years; we expect firms to be transparent about the expert judgements, limitations and risks associated with inflation. Transparency regarding expert judgements, data limitations and forward looking inflationary assumptions and risks is the starting point for setting out paths to analyzing and taking timely action in response to the changing environment.

We expect undertakings and Boards to have clear visibility of the inflation assumptions embedded within their reserves, whilst also understanding the potential impact should the future level and path of inflation diverge from their assumptions.

Timeliness of communication, including communication of inflationary risks will facilitate decision making and avoid an unnecessary delay in response, for example not waiting to see inflationary impact come through in the data before taking action where there is a clear link between inflation drivers and risk exposure.

Conclusion

Ensuring that there is a central focus on inflation risk and bringing together various aspects of the business to assess, manage and monitor this risk, will no doubt ensure the clarity of action needed to protect policyholders during the period ahead.

To view the full article click here

Foornotes

1. Economic inflation relates to the changes in claims costs as captured through published economic indices relevant to a (re)insurer's mix of business, such as CPI, RPI or a wage index.

2. Excess inflation relates to changes in claims costs beyond what is captured in economic indices, including factors which are specific to a (re)insurers' business and including social inflation. Examples of this include changes in technologies and medicine, changes in legal environment, evolving social attitudes towards claiming and changes in political developments.

3. Social Inflation is a subset of excess inflation and more narrowly pertains to claims inflation as a result of societal trends. For example, this includes rising costs of claims resulting from increased litigation, larger compensatory jury awards and social movements.

Originally Published by Central Bank of Ireland

This article contains a general summary of developments and is not a complete or definitive statement of the law. Specific legal advice should be obtained where appropriate.