- within Law Department Performance, Family and Matrimonial and Antitrust/Competition Law topic(s)

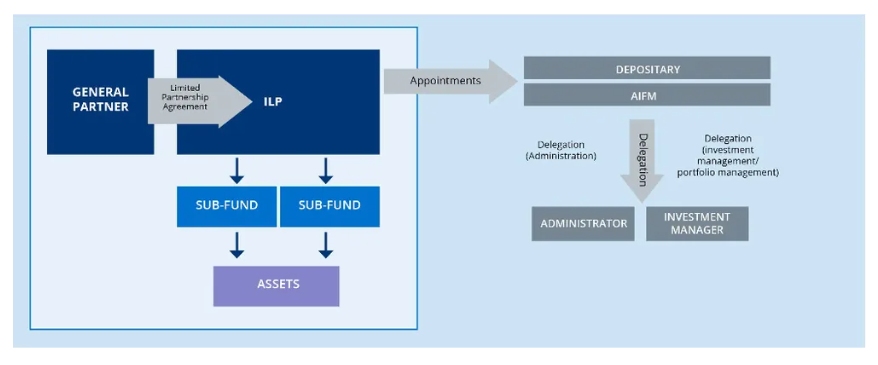

INVESTMENT LIMITED PARTNERTSHIP (ILP)

ILP: the ILP is a regulated limited partnership structure used as a structuring solution for private equity strategies and an alternative to the Luxembourg SCSp.

Regulated Structure: 24 hour authorisation process. No review of fund documents by Central Bank of Ireland (pre-submission required for funds investing in Irish property and crypto assets).

Broad Flexibility: flexibility in relation to investment strategy & policy and not subject to any borrowing or leverage limits. All the typical mechanisms and features of a private equity fund can be accommodated in the ILP (e.g. waterfalls, carried interest plans, excuse/exclusion).

Marketing Passport: ILPs with an EU AIFM can avail of the EU marketing passport.

Tax: ILPs are entirely transparent and therefore the tax analysis will depend on the domicile of the investor and tax advice will be required on a case by case basis.

This article contains a general summary of developments and is not a complete or definitive statement of the law. Specific legal advice should be obtained where appropriate.