- within Government and Public Sector topic(s)

- in United States

- within Real Estate and Construction, Environment and Corporate/Commercial Law topic(s)

- with Senior Company Executives, HR and Finance and Tax Executives

- in United States

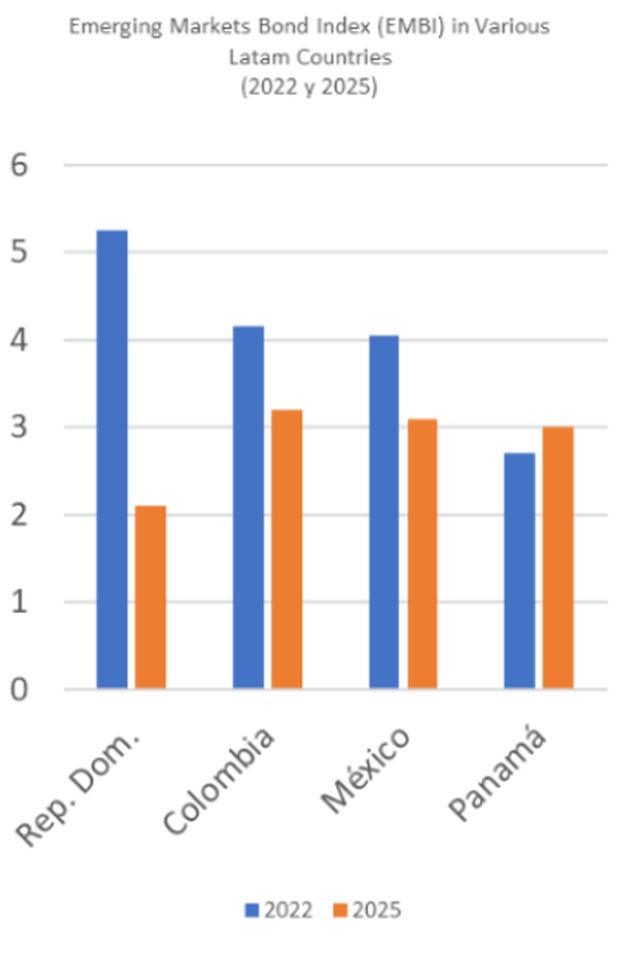

In a global context of high volatility and liquidity restrictions, the Dominican Republic has maintained the lowest country risk indicator in Latin America, standing out as a safe investment destination. According to JP Morgan's EMBI indicator, the Dominican Republic's country risk improved from 530 basis points in March 2022 to 200 basis points in February 2025, its lowest historical level. This reflects the recognition of the country's strong macroeconomic fundamentals.

Emerging Markets Bond Index (EMBI) in Various Latam Countries (2022 – 2025)

JPMorgan Chase

Additionally, the Dominican Republic is the only Central American country with a positive risk rating outlook according to Fitch Ratings. Foreign direct investment has exceeded 4 billion dollars in the last three years, with expectations to reach 4.7 billion dollars by the end of 2025. Economic dynamism is also seen in remittances, tourism, and exports, which totaled more than 43 billion dollars in 2024.

Despite the appreciation of the dollar and high interest rates in the United States, the Dominican economy grew by 5.0% in 2024, with an inflation rate of 3.35% and an unemployment rate of 4.8%. The nominal GDP reached 124.5 billion dollars, positioning the country as the seventh largest economy in the region. Growth projections for 2025 are 4.5%, surpassing the Latin American average.

The Dominican financial sector is healthy and well-capitalized, with no evidence of significant macro-financial risks in the short term. There are opportunities to expand nearshoring and diversify exports, which would contribute to exchange rate stability.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.