- in European Union

- in European Union

- in European Union

- in European Union

- in European Union

- with readers working within the Accounting & Consultancy, Banking & Credit and Media & Information industries

- within Insolvency/Bankruptcy/Re-Structuring topic(s)

Budget Proposal

The Finance Bill 2023 has proposed changes in the new tax regime applicable to individuals and HUFs as provided under section 115BAC of the IT Act.

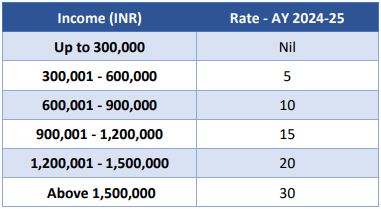

Revised tax rates applicable from AY 2024-25 and onwards is as follows:

In respect of resident individuals opting for new tax regime, the Finance Bill 2023 proposes to extend the availability of rebate under Section 87A of the IT Act upto income of INR 700,000 (as against INR 500,000 available earlier).

Further maximum rate of surcharge of 37% is proposed to be capped to 25% for income exceeding INR 20 million.

Finance Bill proposes that the new tax regime would be the default regime, and the taxpayers would have to specifically exercise an option to opt for old tax regime.

Impact

Resident individuals opting for the new tax regime who have total income up to INR 700,000 would now be saving tax outgo of INR 25,000 on a yearly basis.

Considering the fact that, the basic exemption limit would be increased to INR 300,000 and the rebate would be available to resident individuals having total income up to INR 700,000, the new tax regime would be favourable for resident individuals over the old tax regime even after forgoing the benefit of section 80C and 80D.

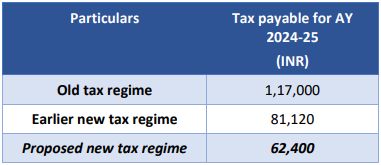

Comparison of the tax payable assuming gross total income of INR 1,000,000 excluding deduction under section 80C, 80CCD, 80D, etc earned by the resident individual is as follows:

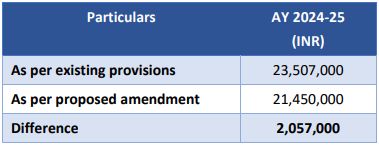

Further reduction of surcharge from 37% to 25% under new tax regime, results in reduction of highest tax rate from 42.74% to 39%. Comparison assuming total income of INR 55 million:

ELP's Insights

Given that rebate is available only to resident individuals, the proposed amendments by Finance Bill 2023 may not result in any substantial benefits for HUFs and non-resident individuals.

Recently, the Supreme Court in Janhit Abhiyan, Writ Petition (Civil) No. 55 of 2019, upheld the validity of the 103rd Constitutional Amendment which provides 10% reservation for the Economically Weaker Sections (EWS). EWS in India is a subcategory of people with a family income less than INR 800,000 and who do not belong to any special category such as SC/ST/OBC. A Public interest writ petition has been filed before the Madras HC seeking exemption from tax for income less than INR 800,000. The proposed amendment is a welcome move which has largely dealt with the issue discussed above and removed the tax burden for resident individuals having total income of up to INR 800,000

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.