- within Antitrust/Competition Law topic(s)

Amendment in Import Policy Condition of ATS-8 covered under Chapter 29 of ITC HS, 2022 (18 Sep)

The import of ATS-8 that comprises of the following chemicals under Chapter 29 of ITC HS, 2022, having a CIF value of less than US$111 per kg, is 'Restricted' till 30th September 2026 with immediate effect. However, the inputs imported by Advance Authorization holders, EOUs, and SEZ shall be exempted from the MIP condition.

- (4R-Cis)-1,

- 1-Dimethylethyl-6- cyanomethyl-2,

- 2-dimethyl-1-3-dioxane-4-acetate

Additional Export Policy Condition for Second Generation (2G) Ethanol notified (24 Sep)

The Directorate General of Foreign Trade has notified the Additional Export Policy Condition for Second Generation (2G) Ethanol. As per the notification, the export of Second Generation (2G) Ethanol is permitted for fuel and non-fuel purposes, subject to a valid Export Authorisation and feedstock certification from the relevant competent authority. The exports permitted for fuel, industrial, or other permissible uses subject to the conditions, which may include:

- BIS 15464 compliance and subsequent amendments.

- Valid export authorization from DGFT.

- Relevant certificates (feedstock origin, quality tests from accredited laboratories, safety documentation) as applicable.

- Compliance with destination country requirements.

Second Generation (2G) Ethanol is produced through cellulosic material such as bagasse, wood waste, other renewable resources, industrial wastage, lignocellulosic feedstocks, non-food crops (e.g. grasses, algae) and residue streams having low COz emissions or high G H reduction, and which do not compete with food crops for land use and meets IS 15464 specifications.

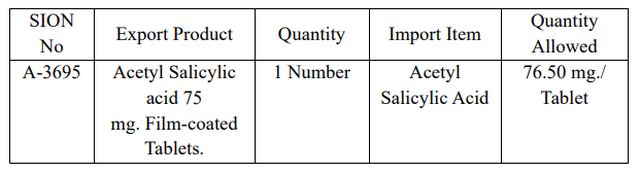

Fixation of new Standard Input Output Norm under 'Chemical and Allied Products' (03 Sep)

The Directorate General of Foreign Trade has notified the following three new Standard Input Output Norms under 'Chemical and Allied Products'.

Clarification regarding applicability of Minimum Import Price (MIP) on Virgin Multi- layer Paper Board (VPB) (03 Sep)

Vide Notification dated 22nd August 2025, the Directorate General of Foreign Trade had imposed Minimum Import Price on import of Virgin Multi-layer Paper Board till 31st March 2026. The Directorate has clarified the applicability of the provisions of the MIP as follows:

- Imports of Virgin Multi-layer Paper Board by 100% Export Oriented Units and units located in Special Economic Zones shall not be subject to the Minimum Import Price, provided that such imported goods are not sold into the Domestic Tariff Area.

- Imports of Virgin Multi-layer Paper Board under Advance Authorization or Duty-Free Import Authorization schemes shall also be exempted from the Minimum Import Price.

Extension of RoDTEP Scheme (30 Sep)

The Directorate General of Foreign Trade has notified that the RoDTEP Scheme will remain in force and will be applicable to exports made from Domestic Tariff Area (DTA) units, Advance Authorisation holders, SEZ units and EOU Units till 31st March 2026.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.

[View Source]