- within Employment and HR topic(s)

- with readers working within the Retail & Leisure industries

- with readers working within the Metals & Mining industries

For the German version, please read here >>

Working on a project abroad presents a variety of challenges that are often closely interlinked. One of the main hurdles is cultural differences, which are often underestimated. Different working styles, communication norms, and business practices can lead to misunderstandings and hinder the success of a project or, in the worst case, prevent it altogether if expectations are not clearly conveyed or communicated for these reasons. In addition, there are legal and regulatory requirements: local laws, taxes, work permits, insurance coverage, compliance requirements, and certifications must be carefully observed to avoid penalties or disadvantages. Language barriers often exacerbate this tension, as they can make communication, documentation, and internal processes more difficult.

In the following, we will look at the tax and social security aspects of a project assignment. The focus here is on the fact that the project assignment takes place in a country other than the one in which the employee has his or her employment relationship, and in which the employer has its registered office and the employee has his or her place of residence. The project assignment is therefore a type of assignment.

1. Social security

In the case of a temporary project assignment, social security coverage usually remains in the home country (this is usually the employee's country of residence or the country in which the employee was covered by social security prior to the assignment), provided this is legally possible.

The aim is also to avoid possible social security contributions in the country of destination and to obtain equivalent insurance coverage for the employee during the project assignment.

Double insurance can only be avoided if there is a corresponding agreement between the two countries and the insurance branches are specified in this agreement, and if the national law of the country of assignment provides for an exemption.

The various agreements would be:

- EU-Switzerland Agreement on the Free Movement of Persons

- EFTA Agreement

- Bilateral social security agreements

- Other multilateral agreements.

1a) Project assignment from an EU/EFTA country to Switzerland

In the case of a project assignment from Poland to Switzerland, for example, the following points would have to be taken into account:

- Verification of the employee's nationality to ensure the correct agreement is applied

- If the employee is an EU or Swiss citizen, the provisions of the Agreement on the Free Movement of Persons apply

- During the assignment, the employee remains covered by social security in their home country (in this case, Poland) in all insurance branches

- They can be exempted from social security contributions (in all insurance branches) in Switzerland

- An A1 certificate must be obtained from the competent social security institution in the home country for a period of, as a rule, a maximum of 24 months. If there is still a bilateral social security agreement between the two countries, the period can be extended to a maximum of 6 years under an exemption procedure.

In order for the employee to remain insured in their home country, the following conditions must be met:

- The employee is an EU or Swiss citizen

- The employee was subject to the social security system in Poland before working in Switzerland

- The employment relationship remains in Poland

- The assignment in Switzerland is temporary

- Social security contributions continue to be paid in Poland on the entire income from employment.

For project assignments from an EFTA country to Switzerland, the provisions of the EFTA Agreement apply, which are identical to the provisions of the Agreement on the Free Movement of Persons. The EFTA Agreement also contains a restriction regarding citizenship; it only applies to persons who are citizens of an EFTA member state or Switzerland.

1b) Project assignment from a non-EU/EFTA contracting state to Switzerland

As long as there is a social security agreement between the two countries involved, the aim is also for the employee to remain insured in their home country for the duration of the project assignment and to be exempted in the country of assignment.

However, the following must also be taken into account:

- The employee's nationality is irrelevant for the application of the social security agreement.

- The employee must have been insured under the social security system in their home country prior to the assignment (usually for at least 1 month beforehand).

- The project assignment in the other contracting state must be limited in time. As a rule, this applies for a maximum of 5 to 6 years.

- During the assignment, the employee usually remains insured in all branches of social security in their home country.

- They may be exempted from social security contributions in the country of assignment, but only for the types of insurance covered by the agreement. This may therefore lead to double insurance/double coverage

- Contributions must be calculated and paid on the entire earned income

- A certificate of secondment must be obtained in the home country, confirming social security coverage in the home country.

1c) Project assignments from a non-contracting state to Switzerland

If there is no social security agreement between the two countries, the employee is subject to social security contributions in the country of assignment in accordance with the national legal regulations.

As a rule, it is checked whether the employee can remain insured in their home country, which ultimately leads to double coverage.

In practice, this results in a number of additional challenges. For example, the employee must then actually pay social security contributions in both countries, or the question arises as to what happens if the employer pays these contributions. If the employer pays all contributions in the country of assignment and the employee has the option of having the contributions refunded, how can it be ensured that the employer will ultimately receive them?

2. Taxation

Another point to consider is the question of taxation during the project assignment, not only at the employee level, but also at the company level. Depending on the duration of the project assignment, different tax aspects must be taken into account if there is a double taxation agreement between the two countries involved:

- < 183 days in the calendar year/tax year/12-month period in the country of assignment: In most situations, tax liability remains in the home country and there is no tax liability in the country of assignment. If tax liability arises in the country of assignment, this is usually only a limited tax liability.

- ≥ 183 days in the calendar year/tax year/12-month period in the country of assignment: As a rule, the employee becomes subject to unlimited tax liability in the country of assignment.

2a) 183-day rule

All double taxation agreements (DTAs) contain a 183-day rule, which is always structured in the same way in principle. The only difference is how the 183 days are counted.

The 183-day rule contains the following three conditions, all of which must be met in order for there to be no tax liability in the country of assignment:

- Stay of less than 183 days in the country of assignment. The 183 days are counted either in a 12-month period, in a calendar year, or in a tax year.

- No salary payments from the country of assignment

- No costs are passed on to a permanent establishment or company in the country of assignment.

In addition to the 183-day rule described above, it must also be checked whether an additional regulation (economic or de facto employer) may apply in the country of assignment.

If one of these four conditions is not met, the country of assignment may tax the earned income. In Switzerland, this leads either to withholding tax or to taxation in the context of filing a tax return.

As soon as an employee registers in Switzerland, this automatically results in the person being entered in the tax register. This requires the submission of a tax return ( ), in which worldwide income and assets must be declared, but does not result in these being taxed in Switzerland. For worldwide income and assets to be taxed in Switzerland, the employee's center of life must also be relocated to Switzerland. This is usually not the case for short-term project assignments of up to 12 months.

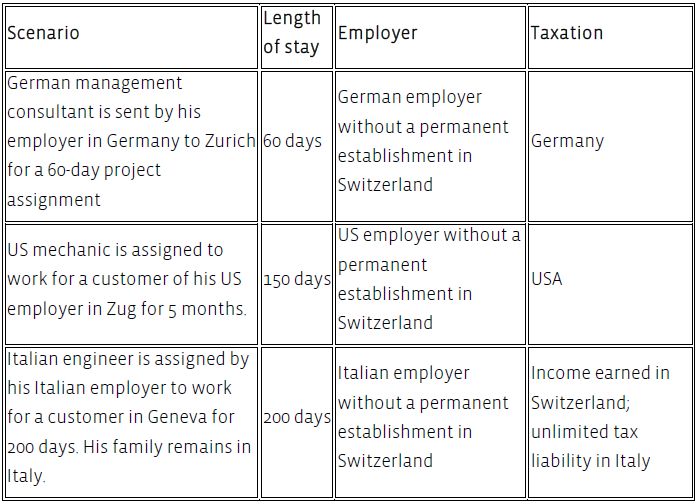

2b) Example scenarios

2c) Practical considerations for project assignments

Every cross-border project assignment should be reviewed from a tax perspective before it begins. The following points, among others, should be taken into account:

- Is there a double taxation agreement?

- For assignments lasting a maximum of 6 months: How are the 183 days counted, does the employee stay in the country of assignment for less than 183 days, are costs incurred in the country of assignment, is salary paid in the country of assignment, is there a regulation regarding economic or de facto employers?

- Tax rates can vary greatly depending on the location of the assignment (even within the same country).

- Expense regulations: Per diems and expenses are only partially tax-free

- Are there tax return obligations in the country of assignment?

- If tax liability arises in the country of assignment, what happens to tax liability in the home country?

- Does the assignment lead to additional tax costs that are reimbursed as part of a tax equalization procedure?

- Does the employee create a permanent establishment while performing their work during the project assignment?

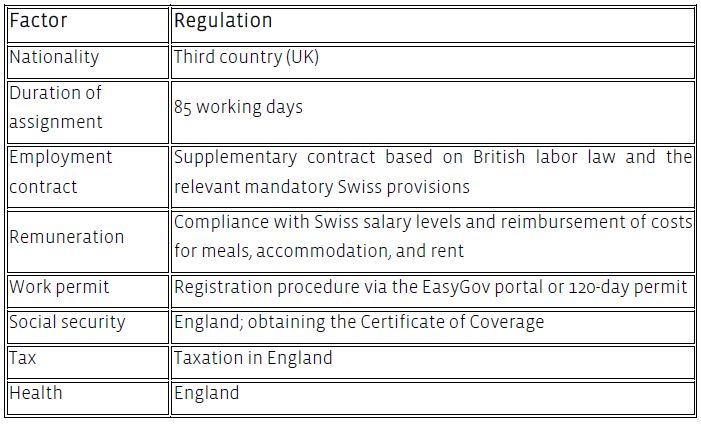

3. Example: Project manager from England with a project assignment in Zug

Initial situation

- Employer: Engineering company based in London (England)

- Employee: Senior project manager, British citizen

- Project: Management of a construction project for a new office building in Basel-Stadt

- Duration: 85 days

- Location: Basel-Stadt, Switzerland

Employment contract / labor law

The employee will receive a supplementary agreement to his current employment contract, which regulates all aspects of the project assignment. English labor law will continue to apply to him during the assignment, but with consideration given to the relevant legal regulations in Switzerland.

Work permit

Following Brexit, England is considered a third country in Switzerland and English citizens are considered third-country nationals. Transitional provisions are currently still in force, which will generally expire on December 31, 2026, meaning that the registration procedure can still be carried out at present.

For this assignment, either the registration procedure could be carried out for the employee or a 120-day permit could be obtained.

As part of the registration procedure, the days of employment must be reported individually, which involves a great deal of administrative effort. In addition, registration via the "EasyGov" registration portal must be completed at least 8 days before the first day of employment. To make matters more difficult, employers only have a quota of 90 calendar days in a calendar year for using the registration procedure.

The 120-day permit would certainly be the simpler option, as it would allow the employee to stay and work in Switzerland for a maximum of 120 days within a 12-month period. The employee can come to Switzerland on their own, without prior notification to the authorities. However, it usually takes between 3 and 4 weeks on average from the time of application to the receipt of this permit.

Since the duration of employment in this practical example is only a maximum of 85 days, the employee does not need to register in Switzerland, either when using the notification procedure or when using the 120-day permit.

Swiss Posted Workers Act

The provisions of the Posted Workers Act are decisive for the assignment. Among other things, this includes compliance with Swiss salary levels and the reimbursement of travel, accommodation, and meal expenses.

The national wage calculator is available for calculating the Swiss salary level, which can be calculated individually for each employee. If there is a difference between the wage in England and the comparable Swiss wage, this must be paid to the employee on a pro rata basis for the Swiss working days in accordance with the law.

The reimbursement of the remaining costs can be made either on an actual or a flat-rate basis.

Social security coverage

A bilateral social security agreement has been in place between the United Kingdom and Switzerland since 2021. Based on this social security agreement, the employee can remain subject to social security contributions in England and be exempt from social security contributions in Switzerland.

The employer must obtain a certificate of posting from the UK social security authority (HMRC) and provide a copy to the employee.

Even though the agreement does not cover all branches of social security, the social security exemption in Switzerland applies to all branches of insurance.

Taxation

There is a double taxation agreement between Switzerland and the United Kingdom. Since he has spent less than 183 days in Switzerland in the calendar year, does not receive any salary from Switzerland, and does not pass on any costs to a related company or permanent establishment, his earned income is taxable in England.

Summary

4. Practical tip for project assignments

Due to the multitude of challenges, it is advisable to analyze each assignment and also to consider the following points:

- Calculation of the relevant comparable wage in the country of assignment

- Check the relevant provisions of labor law

- Always apply for an A1 certificate or posting certificate before the start of the assignment – even for very short projects

- For longer-term assignments, check whether it is possible to extend the posting (maximum 24 months under the EU/EFTA–CH regulation).

- Check the 183-day rule and the tax regulations in the home country and the country of assignment.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.