- within Corporate/Commercial Law topic(s)

This edition of the Bermuda Public Companies Update summarises significant transactions involving Bermuda companies listed on the New York Stock Exchange and Nasdaq in the second half of 2024.

Global Market Update

In the second half of 2024 global capital markets witnessed a gradual recovery, with IPO activity slowly rebounding from the restrained levels of early in the year. Despite this progress, deal volumes remain well below historical norms, reflecting ongoing macroeconomic uncertainties and political pressures.

Global IPO activity declined by 14% in the third quarter of 2024, with proceeds falling 35% to US$24.9 billion from 310 IPOs. While this performance outpaced the first two quarters of the year, volatility peaked in August with market uncertainty levels reaching an all-time high since March 2020.

Many companies opted to delay public listings, prioritising stronger financial positioning and awaiting more favourable conditions. This suggests that we can expect an uptick in IPO activity in 2025.

Regionally, the Asia-Pacific market stabilised, contributing positively to global figures, while the Americas and EMEA regions demonstrated resilience with notable growth in deal numbers and values. A standout debut in the US was the US$18 billion IPO of Lineage Inc (Nasdaq:LINE), the largest public offering since the Arm Holdings (Nasdaq: ARM) US$4.8 billion IPO in 2023.

The global M&A market showed modest growth, with a deal volume of US $3.17 trillion – almost 10% greater than in 2023. This can be attributed in part to greater stability in the US economy and decreased inflation. Factors such as increased regulation, geopolitical tensions and the US presidential election dampened large deal-making activity, with only four deals over US$25 billion announced. But optimism remains for an even stronger M&A landscape in 2025, driven by expectations of deregulation, further improved economic conditions and strategic consolidation opportunities.

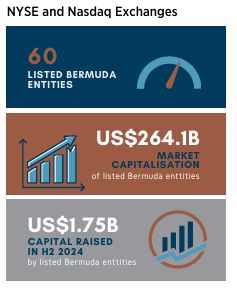

Bermuda Companies Update

Deal-making for US listed Bermuda public companies in the second half of 2024 was largely centred on share buyback programs and secondary offerings, reflecting proactive efforts to attract investment, strengthen market positions and drive future growth.

Insurance companies Fidelis Insurance Holdings Limited (NYSE:FIHL), Hamilton Insurance Group, Ltd. (NYSE:HG), RenaissanceRe Holdings Ltd. (NYSE:RNR) and SiriusPoint Ltd (NYSE:SPNT) each announced significant share buybacks totalling US$1.25 billion. Among these, RenaissanceRe stands out with its US$750 million buyback program, representing a 50% increase from its previous share repurchase authorisation of US$500 million. Under the program, RenaissanceRe may repurchase shares through both open market transactions and privately negotiated agreements.

Tiziana Life Sciences Ltd (NasdaqCM:TLSA) announced multiple offerings to raise capital for its ongoing research and development initiatives. Viking Holdings Ltd (NYSE:VIK) also launched a secondary public offering of 30,000,000 ordinary shares as a follow-on to its landmark IPO in May. Viking Holdings Ltd (NYSE:VIK) and Norwegian Cruise Line Holdings Ltd (NYSE:NCLH) emerged among the top five best performing shipping stocks on the exchange in 2024, with share price increases of 63.72% and 46.57%, respectively.

M&A activity among Bermuda public companies followed the slow-moving global trend. Of note is Sixth Street's acquisition of Enstar Group Limited ("Enstar") (Nasdaq: ESGR). Enstar is to be acquired by investment company Sixth Street, along with Liberty Strategic Capital, J.C. Flowers & Co. LLC and other institutional investors. The US$5.1 billion definitive merger agreement is anticipated to close in mid-2025.

Finally, the Teekay's Group's decision to redomicile two NYSE listed companies to Bermuda from the Marshall Islands is a strong indicator of Bermuda's continued attractiveness. We discuss this development in greater detail on this page.

Teekay Corporation Ltd. (NYSE: TK) and Teekay Tankers Ltd. (NYSE: TNK) Redomicile to Bermuda

On 1 October 2024, Teekay Corporation Ltd. (NYSE: TK) and Teekay Tankers Ltd. (NYSE: TNK) announced their redomiciliation from the Marshall Islands to Bermuda. Conyers served as special Bermuda legal counsel to the Teekay Group during the redomiciliation.

Teekay's decision to redomicile to Bermuda underscores the island's reputation as a leading jurisdiction for global business. The redomiciliation comes as part of a broader initiative to position the NYSE-listed companies for long-term success by leveraging Bermuda's established reputation in the international market.

Teekay Corporation Ltd. (NYSE: TK) and Teekay Tankers Ltd. (NYSE: TNK) are two of the world's leading marine energy transportation companies. Teekay Corporation Ltd. (NYSE:TK) is a leading provider of international crude oil marine transportation and other marine services, which it provides directly and through its controlling ownership interest in Teekay Tankers Ltd. (NYSE: TNK), one of the world's largest owners and operators of mid-size crude tankers. Teekay Tankers Ltd. (NYSE: TNK) has a fleet of 42 double-hull tankers (including 24 Suez max tankers and 18 Aframax / LR2 tankers) and has six time chartered-in tankers.

Corporate Income Tax Agency CEO Named

Mervyn Skeet, the former Director of General Insurance Policy at the Association of British Insurers, has been appointed as CEO of Bermuda's Corporate Income Tax Agency ("CIT Agency"). As CEO, Mr. Skeet will oversee the CIT Agency's day to-day operations, manage staff and consultants, and establish the necessary systems to administer and collect Bermuda's 15% corporate income tax on multinational groups. The tax, implemented under the Corporate Income Tax Act (CIT Act) was passed in 2023 and was implemented on 1 January 2025. The CIT Agency is tasked with administering tax receipts, supporting liable companies, ensuring compliance, auditing returns and enforcing penalties where necessary.

Highlighted Transactions | NYSE

- SFL Corporation Ltd. (NYSE:SFL) completed a public offering of 8,000,000 of the company's common shares, valued at US$12.50 per share. The company granted the underwriters a 30-day option to purchase up to 1,200,000 additional common shares. (July)

- SiriusPoint Ltd. (NYSE:SPNT) completed a share repurchase program completed the repurchase of9,077,705 shares for US$125 million. (August)

- Hamilton Insurance Group, Ltd. (NYSE:HG) announced a share repurchase program under which the company would repurchase up to US$150 million of its shares. (August)

- RenaissanceRe Holdings Ltd. (NYSE:RNR) announced a share repurchase program under which the company would repurchase up to US$500 million of its common shares. (July)

- Fidelis Insurance Holdings Limited (NYSE:FIHL) announced a share repurchase program under which the company would repurchase up to US$200 million in value of its shares. (August)

- Brookfield Business Partners L.P. (NYSE:BBU ) announced a share repurchase program. Under the program the company would repurchase up to3,714,088 units, representing 5% of its issued and outstanding units. (August)

- Teekay Corporation Ltd. (NYSE:TK) announced a share repurchase program under which the company would repurchase up to US$40 million worth of its outstanding common shares. (September)

- Teekay Corporation Ltd. (NYSE:TK) completed a share repurchase program under which the company repurchased US$25 million worth of its common shares. (September)

- Viking Holdings Ltd (NYSE:VIK) completed a secondary public offering of 30,000,000 ordinary shares by selling shareholders of the company. (September)

- Aspen Insurance Holdings Limited (NYSE: AHL.PRC) completed a public offering of 8,000,000 depositary shares, each of which represents a 1/1,000th interest in a share of the Company's newly designated 7.00% Perpetual Non-Cumulative Preference Shares. (November)

- Brookfield Infrastructure Partners L.P. (NYSE:BIP) announced a share repurchase program under which the company would repurchase up to 23,088,572 limited partnership units, representing 5% of its issued share capital. (November)

- SiriusPoint Ltd. (NYSE:SPNT) announced an agreement to repurchase all common shares and warrants held by CM Bermuda for US$733 million. The transaction involves purchasing 45.7 million common shares at US$14.25 per share and 21 million warrants at US$3.56 per warrant. (December)

- The Bank of N.T. Butterfield & Son Limited (NYSE:NTB) announced a share repurchase program under which the company would repurchase up to 2,700,000 ordinary shares for US$100 million. (December)

- Telecom Armenia OJSC acquired an unknown majority stake in Imagine Communications Group Ltd. from Brookfield Business Partners L.P. (NYSE:BBU) and its institutional partners. (December)

Highlighted Transactions | NASDAQ

- Enstar Group Limited (NasdaqGS:ESGR) announced a definitive merger agreement under which Sixth Street would acquire the company with Liberty Strategic Capital, J.C. Flowers & Co. LLC, and other institutional investors. Enstar shareholders will receive a total of US$338.00 in cash per ordinary share of Enstar payable upon closing of the transaction, representing a total equity value of US$5.1 billion. (July)

- Altamira Therapeutics Ltd. (NasdaqCM:CYTO) completed a public offering of an aggregate of 5,555,556 common shares accompanied by Series A-1 and Series A-2 warrants to purchase the common shares. (August)

- Helen of Troy Limited (NasdaqGS:HELE) announced a share repurchase program under which the company would repurchase up to US$500 million its shares. The program will be valid for 3 years. (September)

- Golar LNG Limited (NasdaqGS:GLNG) completed a public offering of its US$300 million 7.75% unsecured bonds in the Nordic bond market. The bonds will mature in September 2029. (September)

- Tiziana Life Sciences Ltd (NasdaqCM:TLSA) completed a follow on equity offering of 5,263,158 common shares at US$0.95 per share, raising approximately US$5 million in gross proceeds. (October)

- Tiziana Life Sciences Ltd (NasdaqCM:TLSA) announced an agreement to sell its common shares on the open market through Jefferies LLC, with a minimum price set at US$1.00 per share. (October)

- Helen of Troy Limited (NasdaqGS:HELE) agreed to acquire Olive & June, LLC from Essential Investment Partners, LLC, Alpha Edison, Sugar Capital, Jackalope Ventures, LLC, Short List Capital and others for US$240 million. (November)

- James River Group Holdings, Ltd. (NasdaqGS:JRVR) completed a private placement of 1,953,125 common shares at a price of US$6.40 per share for the gross proceeds of US$12,500,000. (December)

- Arch Capital Group (NasdaqGS:ACGL) announced a share repurchase program under which the company would repurchase US$1 billion common shares. (December)

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.