- within International Law, Immigration and Insurance topic(s)

As a dynamic hub for global commerce, investors now view the United Arab Emirates (UAE) as a key component in their worldwide operations. The UAE is well established as the prime destination for multinationals to set up their regional base and serve the high growth markets in the Middle East, Africa and South Asia. It is also the perfect location for new business set-ups across diverse sectors.

The main driving force behind this economic and commercial expansion has been the UAE's shift towards increasingly liberal economic policies, particularly the creation of economic and financial free zones, and diversification. Its success achieved international recognition with the decision to locate the World Expo in Dubai in 2020.

Historically Dubai has been the primary commercial hub of the UAE, but over the last few years Abu Dhabi, the federal capital and the largest of the seven emirates, has also been working hard to increase its global presence as a centre for all commercial activities, not just the oil and gas sector.

There are also over 40 Free Zones (FZs) operating in the UAE, where companies are governed by an independent Free Zone Authority (FZA), which is responsible for licensing and regulating the activities of companies. Each FZ is designed around one or more commercial categories and only offers licences to companies within those categories.

Until 1 June 2021, there was a requirement for at least 51% of the shares of a Mainland UAE company to be owned by a UAE national sponsor or partner. This requirement was removed via amendments to the Commercial Companies Law, subject to the activities being carried out by the company falling under relevant 'positive lists'. The amendments also removed the requirement for branches of foreign companies in the UAE to appoint a UAE national agent, for most activities.

The publication of these positive lists of approved activities and requirements for foreign shareholders by the respective Departments of Economic Development (DEDs) in individual Emirates has had a significant impact on the UAE's foreign ownership restrictions. The Abu Dhabi and Dubai DEDs have both listed over 1,000 activities, which are heavily focused on commercial and industrial activities.

Restrictions on foreign ownership still apply for companies carrying on activities with a 'strategic impact', which include:

- Security, defence and military activities;

- Banks, exchange houses, finance companies and insurance;

- Currency printing;

- Communications;

- Hajj and Umra services;

- Quran centres; and

- Services related to fish traps.

It is essential that our Polish clients have a complete understanding of their options before deciding how to establish a business presence in the UAE. The growth prospects of your business in the UAE can be damaged by making the wrong choice. Sovereign's teams in Dubai and Abu Dhabi are highly experienced and can provide expert advice and support on all aspects of company incorporation in the UAE and its free zones.

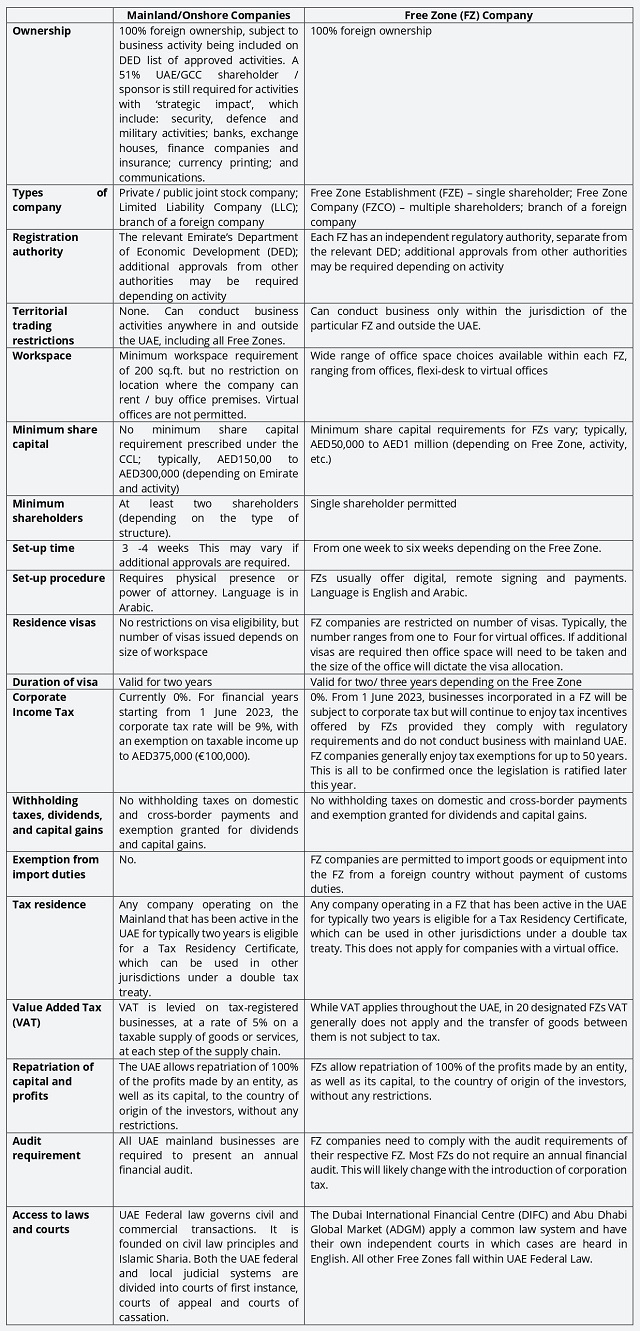

In the table below we set out the main characteristics and key differences to consider in respect of Mainland and Free Zone companies when deciding on the best structure in the UAE to meet your business requirements.

If you are a business owner looking to incorporate a company in the UAE with a Trading, Service or Industrial licence, Sovereign can help you to choose and set up the right structure, Mainland (DED) or Free Zone, depending on your activity and target market. Please get in touch with Ewelina Jakimowicz.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.