- within Real Estate and Construction and Law Practice Management topic(s)

- with Finance and Tax Executives and Inhouse Counsel

- in Australia

- with readers working within the Insurance, Property and Construction & Engineering industries

On 4 July 2024, Downes J of the Federal Court of Australia provided a decision in favour of the ATO that contradicts how Bankruptcy Trustees have traditionally treated Capital Gains Tax (CGT) prior to June 2021 in Robson as trustee for the bankrupt estate of Lanning v Commissioner of Taxation [2024] FCA 720

Outcome

- Section 254 of the Income Tax Assessment Act 1936 (Cth) applies to Trustees in Bankruptcy

- Trustees are required to lodge an income tax return if they have derived income, profits or gains in their capacity as agent of the taxpayer. This includes Bankruptcy Trustees.

- Trustees are personally liable for the payment of tax upon the issuance of a Notice of Assessment by the ATO for any income, profits or gains to the extent they have been retained by the Trustee

- However, Trustees will not be personally liable for payment of the tax liability if they fail to retain monies prior to the issuance of the Notice of Assessment

Practical Reality

This decision confirms that the Commissioner may in certain circumstances be entitled to priority over the ordinary unsecured creditors of a bankrupt estate from assets vested in the Trustee as at the date of bankruptcy.

Care will need to be taken when considering options available to insolvent debtors as to what assets are available for distribution to unsecured creditors. This is important when considering alternatives to bankruptcy such as Personal Insolvency Agreements and proposals under s73 of the Bankruptcy Act.

There are also implications on debtors once they go bankrupt. This may best be illustrated by the following example.

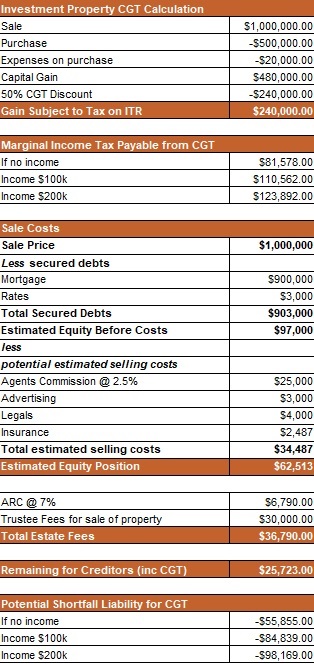

Assume a bankrupt purchased an investment property for $500k in 2020. Over the years they leveraged that property and the mortgage increased with the property value for business purposes. Upon bankruptcy in 2024, the property was worth $1m and the mortgage due to leveraging or cross collateralisation was at $900k.

The property is subsequently sold by the Trustee, a tax return is lodged and a Notice of Assessment is issued in 2026.

As we can see in the example above, the funds required to be retained by the Trustee may be insufficient to discharge the post-bankruptcy liability of the taxpayer.

Depending on the extent of this shortfall, the bankrupt may not be in a position to discharge that CGT liability shortfall which will continue to be a debt due to the ATO and cause further financial stress and potentially the requirement to go bankrupt again restarting the 3-year bankruptcy period.

Where to next?

This decision doesn't change the law but rather clarifies the Tax Office's position.

When considering bankruptcy and options that may be available,

care needs to be taken to ensure that all factors are taken into

account, in particular any potential post-bankruptcy liabilities of

an insolvent debtor.

If you have any clients who are considering bankruptcy, please

reach out to us early so that we may assist them navigate the

complexities above.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.